The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

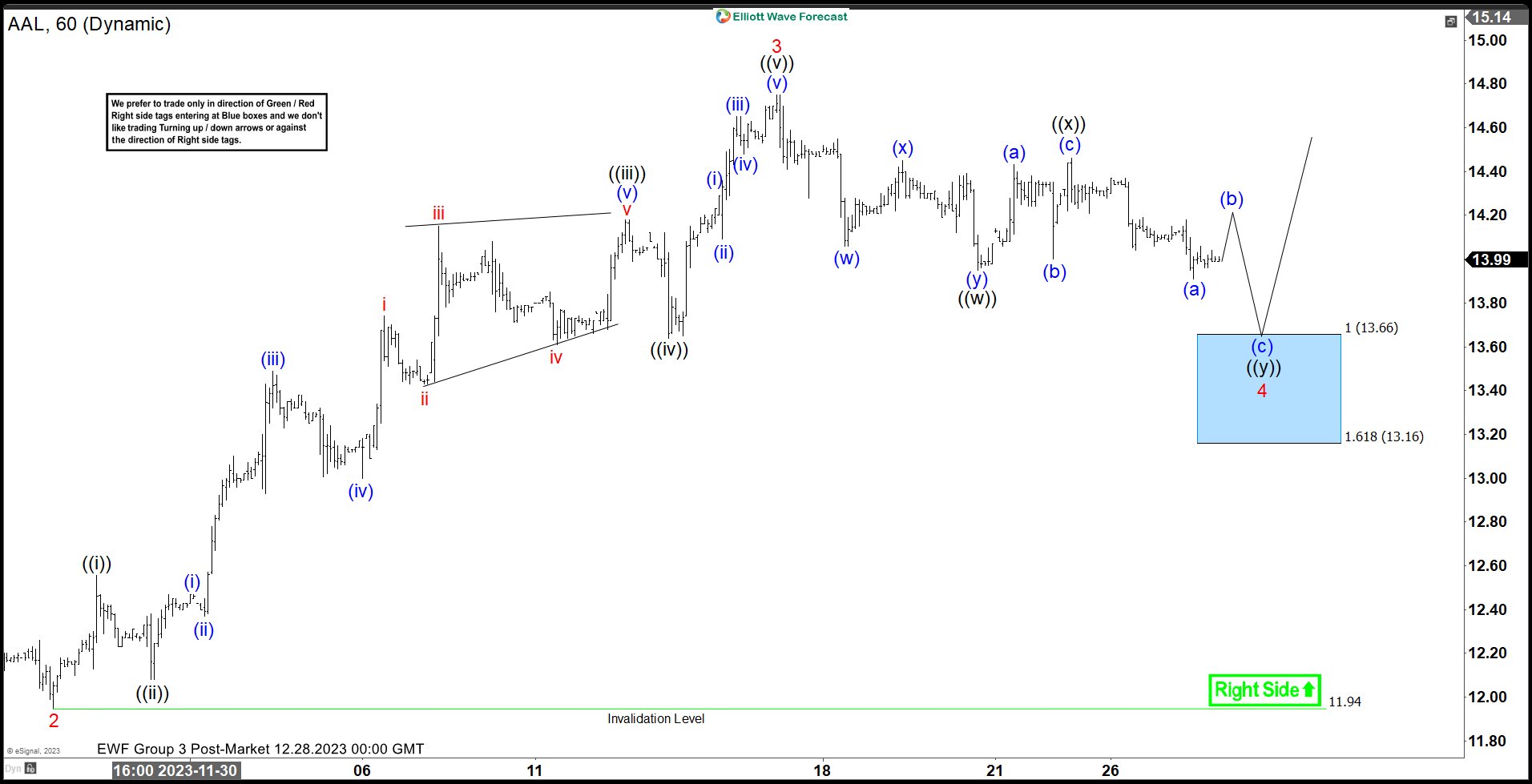

America Airlines (AAL) Buyers at the Blue Box

Read MoreAmerica Airlines (AAL) is looking to correct in a double three structure before it resumes higher. This article and video look at the Elliott Wave path.

-

Eurostoxx Reacting Higher From The Blue Box Area

Read MoreIn this blog, we take a look at the past performance of Eurostoxx charts. The index produced a strong reaction higher from blue box area.

-

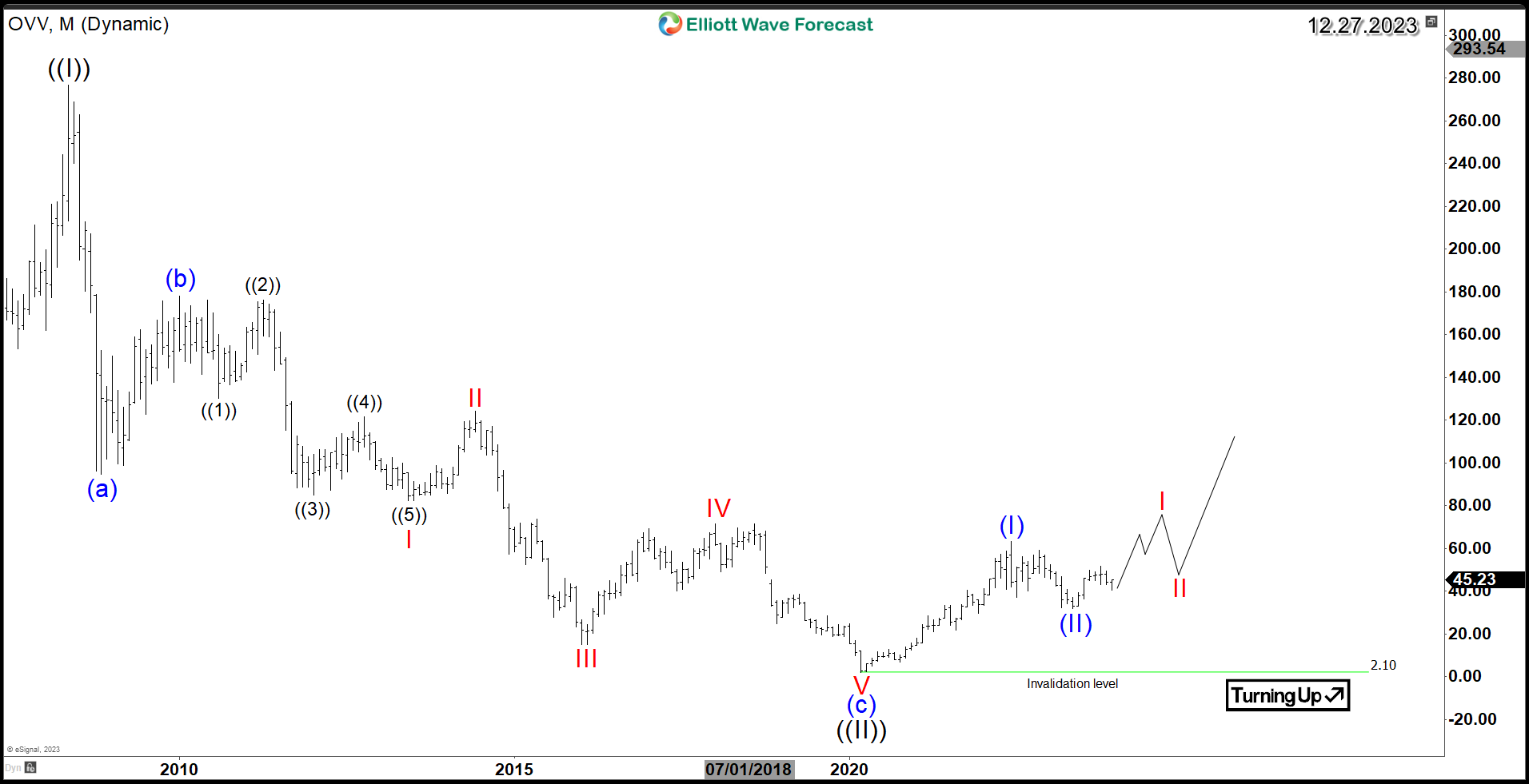

Ovintiv Inc (NYSE: OVV) Long Term Bullish Reversal

Read MoreOvintiv Inc. (NYSE: OVV) is a leading North American exploration and production company. It is an oil and gas producer that explores, develops, produces, and markets natural gas, oil, and natural gas liquids. In this article, we delve into OVV’s technical structure based on Elliott Wave Theory and highlight its potential for further growth. Since It’s […]

-

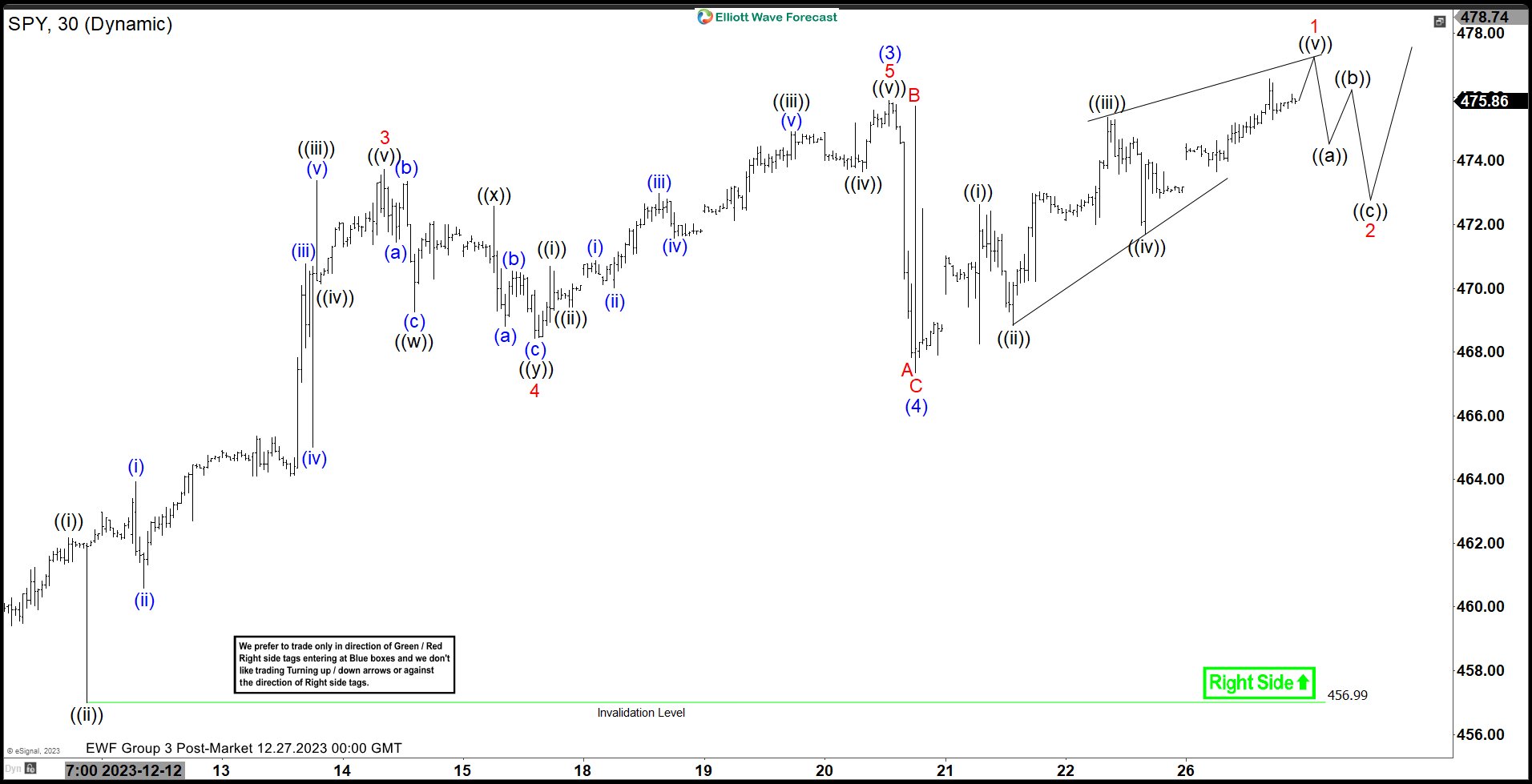

S&P 500 ETF (SPY) Looking to End Impulsive Rally

Read MoreS&P 500 (SPY) is looking to end impulsive rally from October 28, 2023 low. This article and video look at the Elliott Wave path.

-

SPDR Consumer Staples ETF ($XLP) Reacting Higher from Extreme Area.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4H Hour Elliott Wave chart of SPDR Consumer Staples ETF ($XLP). The rally from 10.06.2023 low at $65.16 unfolded as 5 waves. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the structure […]

-

West Pharmaceutical Services WST Bullish Daily Cycle

Read MoreWest Pharmaceutical Services, Inc. (NYSE:WST) is a designer and manufacturer of injectable pharmaceutical packaging and delivery systems. The Elliott Wave structure based on the 2023 daily cycle will be explored in this article. Since the 55% decline from its 2021 peak, WST found a major low in October 2022 before reversing to the upside. Since then, […]