The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$FSR : Weekly Buying Opportunity in EV Stock Fisker

Read MoreFisker Inc. is an US American automotive company. It is producing electric sport utility vehicles (SUVs) like Fisker Ocean, Pear, Ronin and Alaska. Founded 2016, headquartered in Los Angeles, California, US, it is a component of the Russel3000 index. Investors and traders can trade it under the ticker $FSR at NYSE, Fisker Weekly Elliott Wave Analysis […]

-

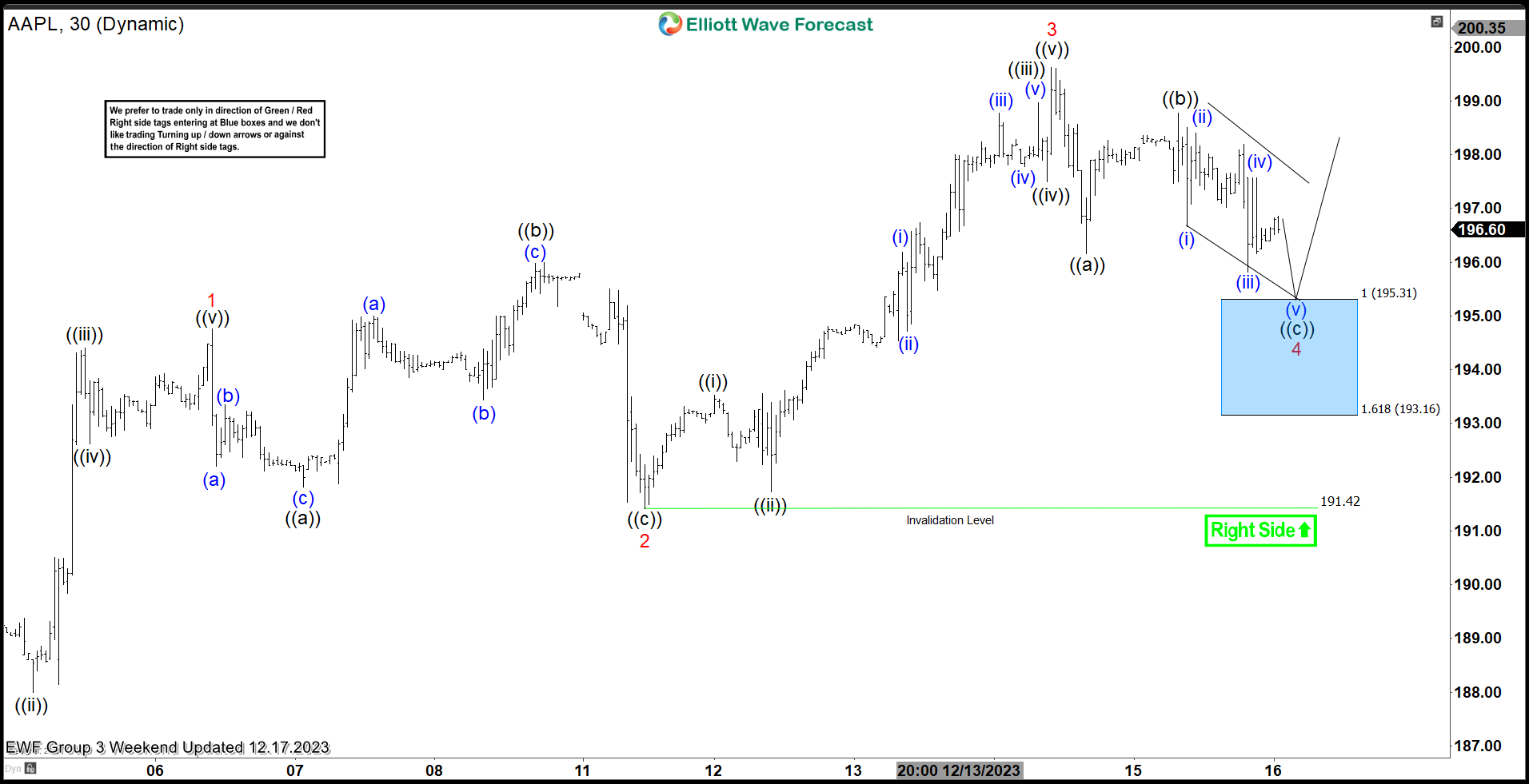

Apple Inc. ($AAPL) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of Apple Inc ($AAPL). The rally from 12.11.2023 low at $191.42 unfolded as 5 waves. So, we expected the pullback to unfold in 3 swings and find buyers at 195.31 – 193.16. We will explain the […]

-

XPO INC (XPO) Looking To End Impulsive Rally

Read MoreXPO INC., (XPO) provides freight transportation services in United States, rest of North America, Europe, UK & internationally. It operates in two segments, North American LTL & European Transportation & offers services to different industries. It is based in Greenwich, CT, comes under “Industrials” sector & trades as “XPO” ticker at NYSE, which having 10.1 […]

-

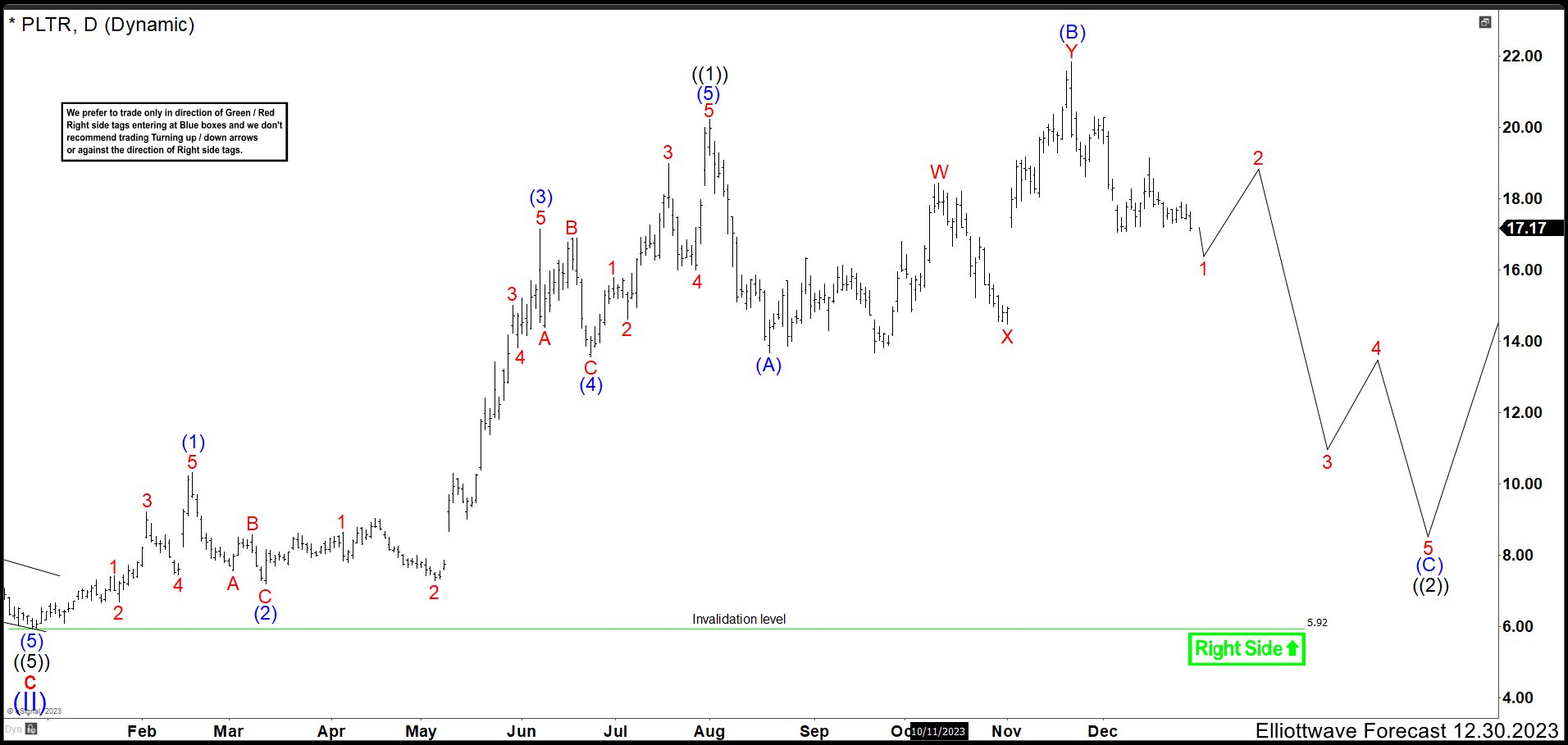

Palantir (PLTR) Rally Is Not Ready To Show Up Again

Read MorePalantir Technologies (PLTR), Inc. is a holding company, which engages in the development of data integration and software solutions. It operates through the Commercial and Government segments. The firm offers automotive, financial compliance, legal intelligence, mergers and acquisitions solutions. PALANTIR (PLTR) Daily Chart Alternative September 2023 Let’s remember Palantir alternative chart, where wave (II) end […]

-

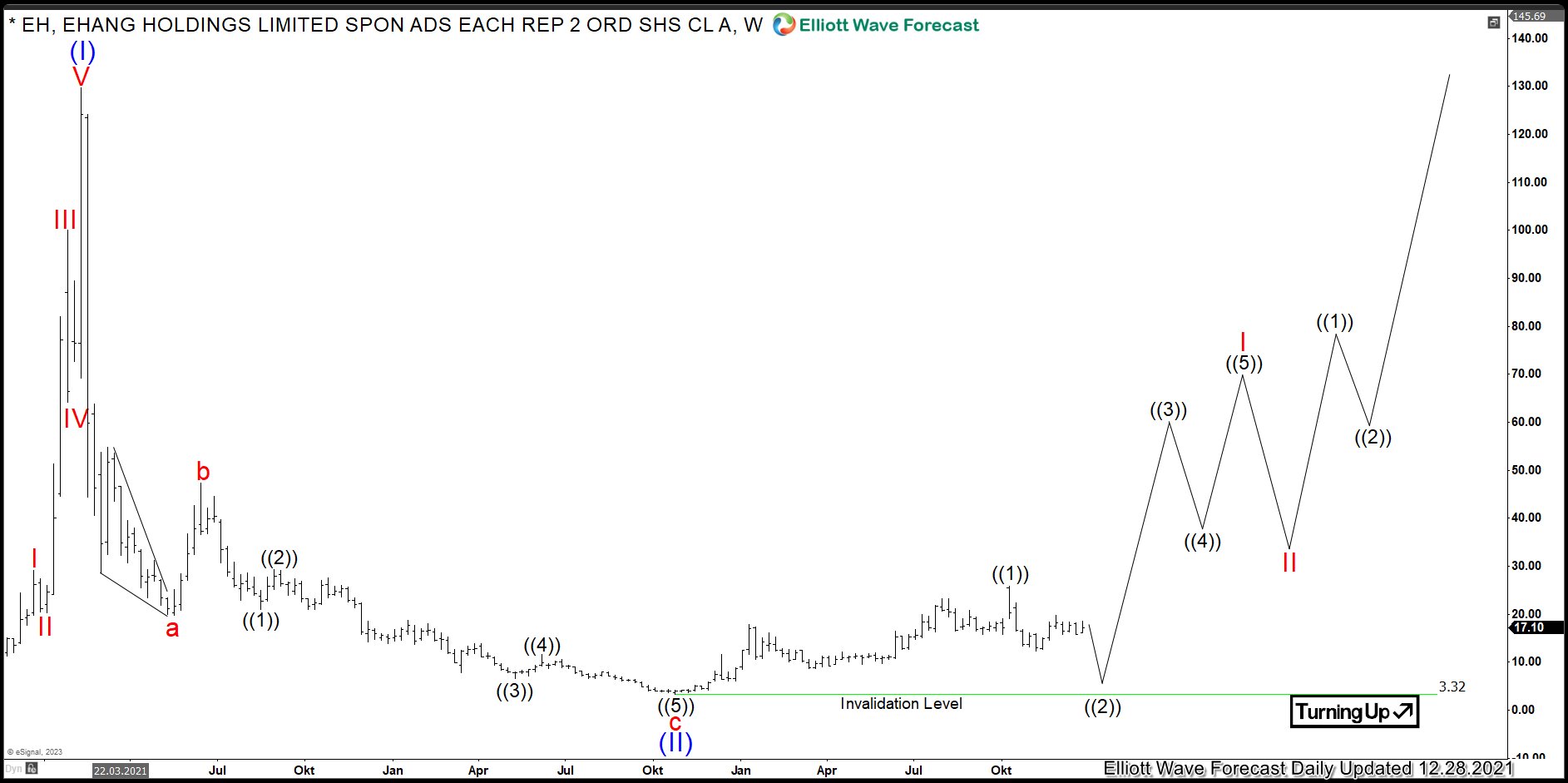

$EH: Buying Guangzhou EHang Stock in a Zigzag Pullback

Read MoreGuangzhou EHang Intelligent Technology Co. Ltd. is a Chinese designer and manufacturer of autonomous aerial vehicles (AAVs) and passenger AAVs. These products have entered service in China for aerial cinematography, photography, emergency response and survey missions. Founded 2014, EHang is headquartered in Guangzhou, China. One can trade it under the ticker $EH at NASDAQ. EHang […]

-

Boeing (BA) Pullback Structure Looks Corrective

Read MoreBoeing (BA) pullback structure from 12.21.2023 high looks corrective, suggesting market is bullish. This article and video look at the Elliott Wave path.