The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

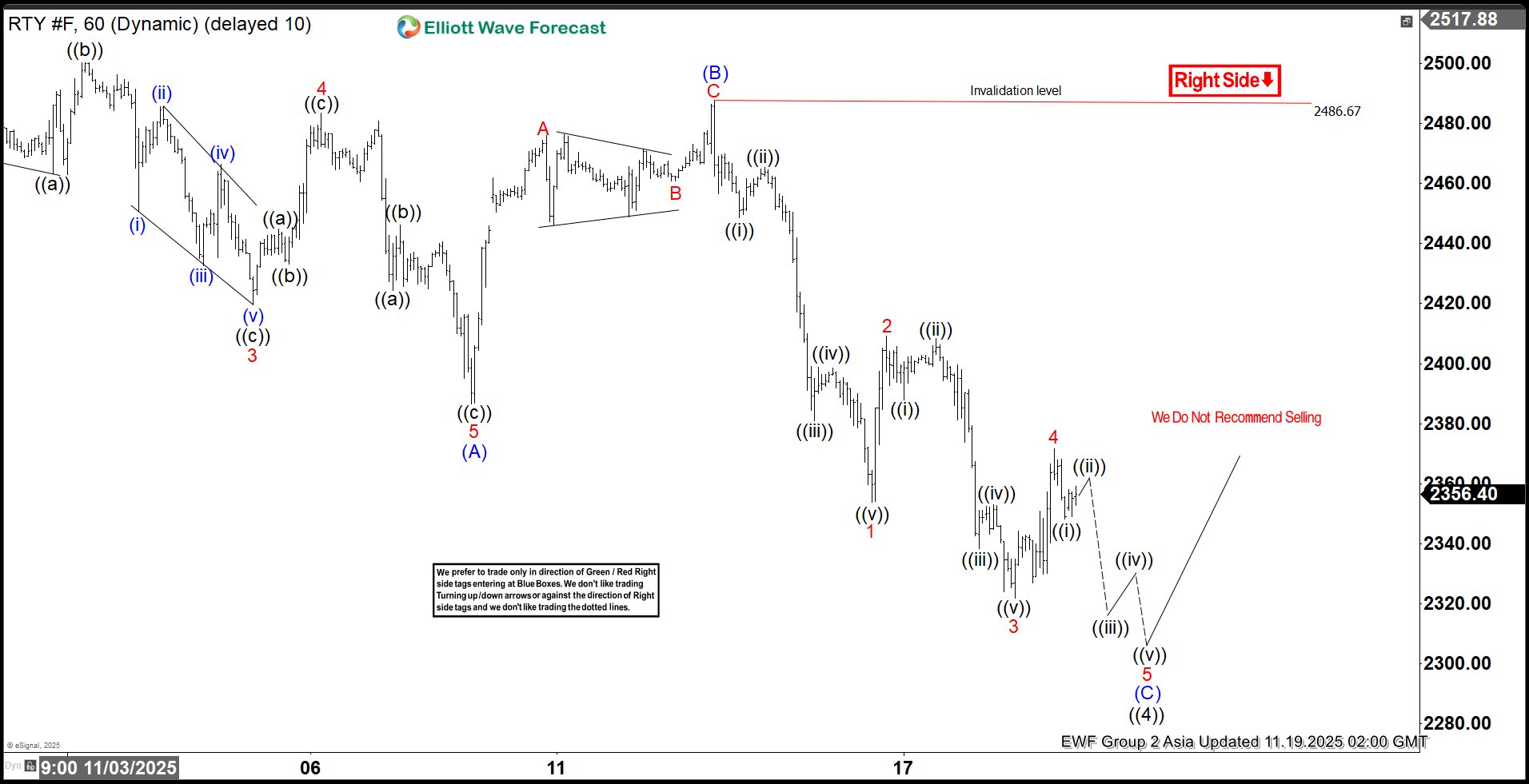

Zigzag Structure in Russell Futures (RTY) Nears Resolution Around 2300

Read MoreRussell 2000 (RTY) is correcting in a zigzag structure and should soon see support at 2300 area. This article and video look at the Elliott Wave path.

-

Bitfarms Ltd. $BITF Update: Zig-Zag Correction Offers a Blue Box Area

Read MoreHello Traders! In today’s update, we’ll revisit the Elliott Wave structure of Bitfarms Ltd. ($BITF) and provide insights into the next phase of its price action. You can check the last article here. As anticipated, a Zig-Zag (ABC) pattern is unfolding, approaching a critical support zone where buyers have historically stepped in. Let’s break down the key developments. 5 Wave Impulse Structure + […]

-

Volatility Before Opportunity: AT&T (T) Correction Sets Up Rally

Read MoreAnalysts still maintain a Moderate Buy consensus with an average price target of about $30.6, implying nearly 20% upside from current levels. However, forecasts suggest short‑term weakness: AT&T (T) could dip toward $23.4 by the end of November and $22.1 in December, reflecting a potential 10% decline. This near‑term pressure stems from market fatigue and […]

-

DexCom (DXCM) Eyes Deeper Correction Toward $44.11–$20.95 Zone

Read MoreDexCom Inc., (DXCM) is a medical device company, that focuses on the design, development & commercialization of glucose monitoring systems globally. It comes under Healthcare sector & trades as “DXCM” ticker at Nasdaq. The DXCM favors double correction in weekly from November-2021 high discussed in last article few months ago. It favors weakness started from 2.17.2025 […]

-

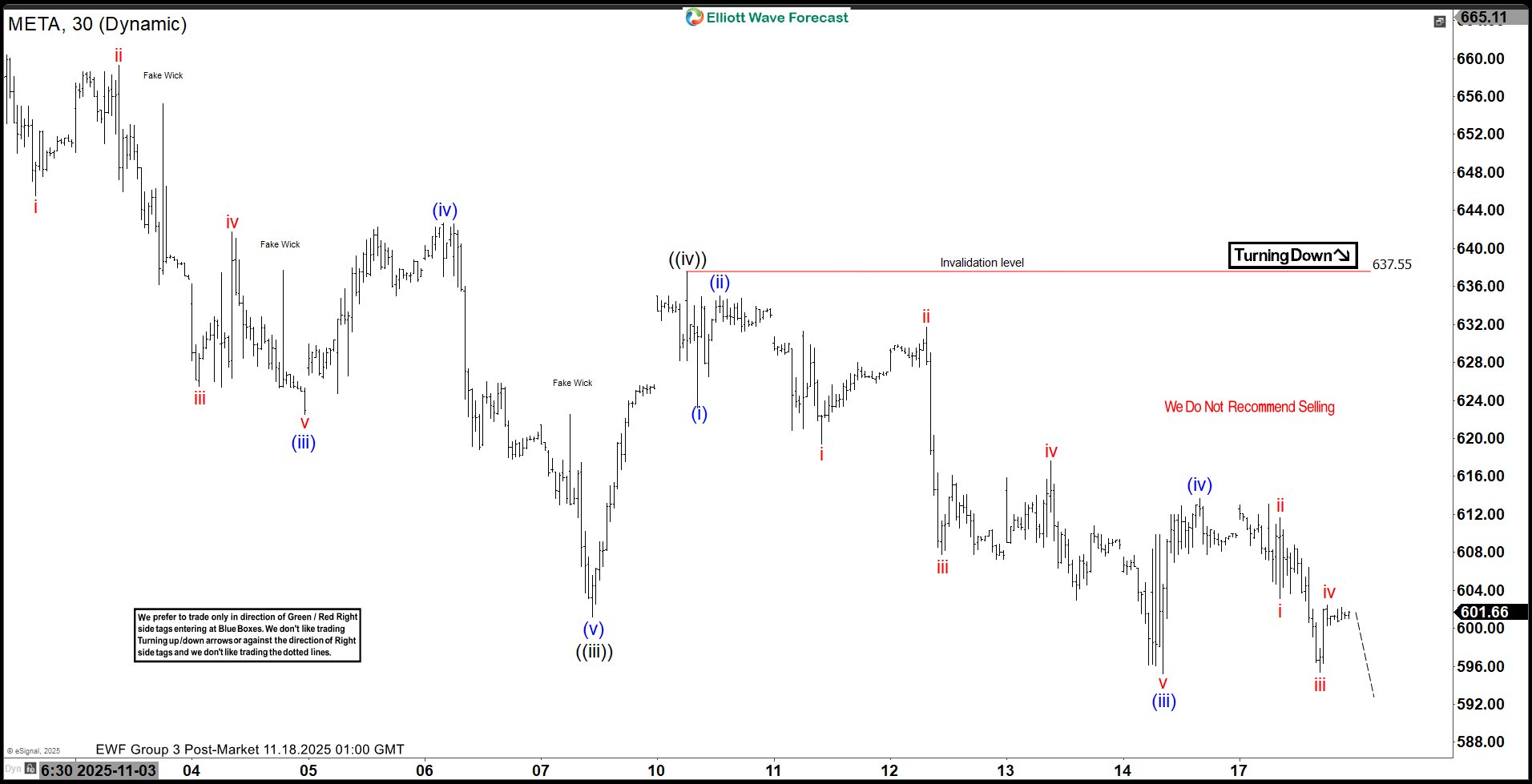

META Eyes Support Base with Corrective Rally Potential

Read MoreMETA is looking for a base after ending 5 waves impulse down from October 29 high. This article and video look at the Elliott Wave path.

-

TMUS Bullish Outlook: Wave ((4)) Low Holds, Eyes $300 Target

Read MoreTMUS remains in an all-time bullish sequence. The recent dip appears to have found support in the blue box. The resultant bounce could advance to $300 thus, keeping the buyers in control. T-Mobile US (NASDAQ: TMUS) is a leading U.S. wireless carrier, known for its aggressive pricing and nationwide 5G network. Headquartered in Bellevue, Washington, […]