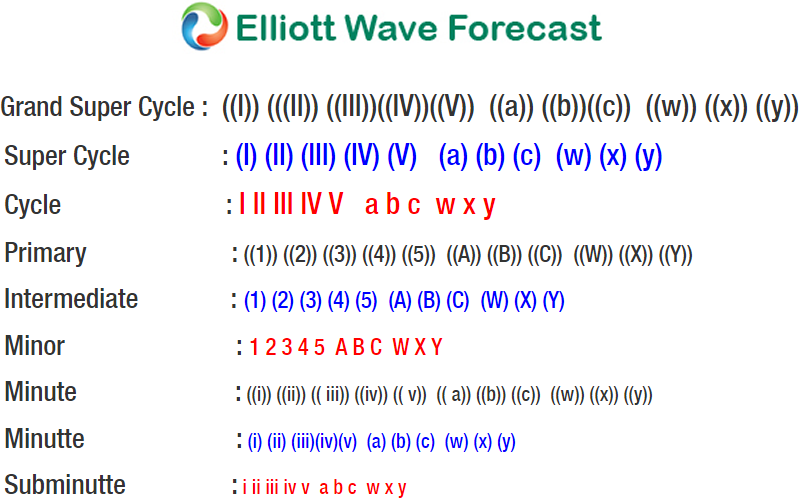

Amazon ticker symbol: $AMZN short-term Elliott wave view suggests that a decline to $1685.99 low ended primary wave ((W)). The internals of that decline unfolded as Elliott wave Flat structure. Up from there, a bounce to $1856.92 high ended primary wave ((X)) as Elliott wave zigzag correction. Where intermediate wave (A) ended in lesser degree 5 waves at $1809.88 high. A pullback to $1734.23 low in 3 swings ended intermediate wave (B). And finally, a push higher towards $1856.92 high ended intermediate wave (C) of ((X)) in another 5 waves.

Down from there, Amazon has made new lows already confirming the next extension lower in primary wave ((Y)), thus favoring more downside. The initial decline to $1714 low ended Minor wave W as a zigzag structure where Minute wave ((a)) ended in 5 waves at $1753. Minute wave ((b)) bounce ended at $1809.50 and Minute wave ((c)) of W ended at $1714 low. Then a 3 wave bounce to $1784 high ended Minor wave X. Near-term, while bounces fail below there and more importantly below $1856.92 expect stock to extend lower for more downside towards $1488.28-$1401.41 100%-123.6% Fibonacci extension area of primary wave ((W))-((X)) before upside renew or stock produces a 3 wave bounce at least. We don’t like buying it.