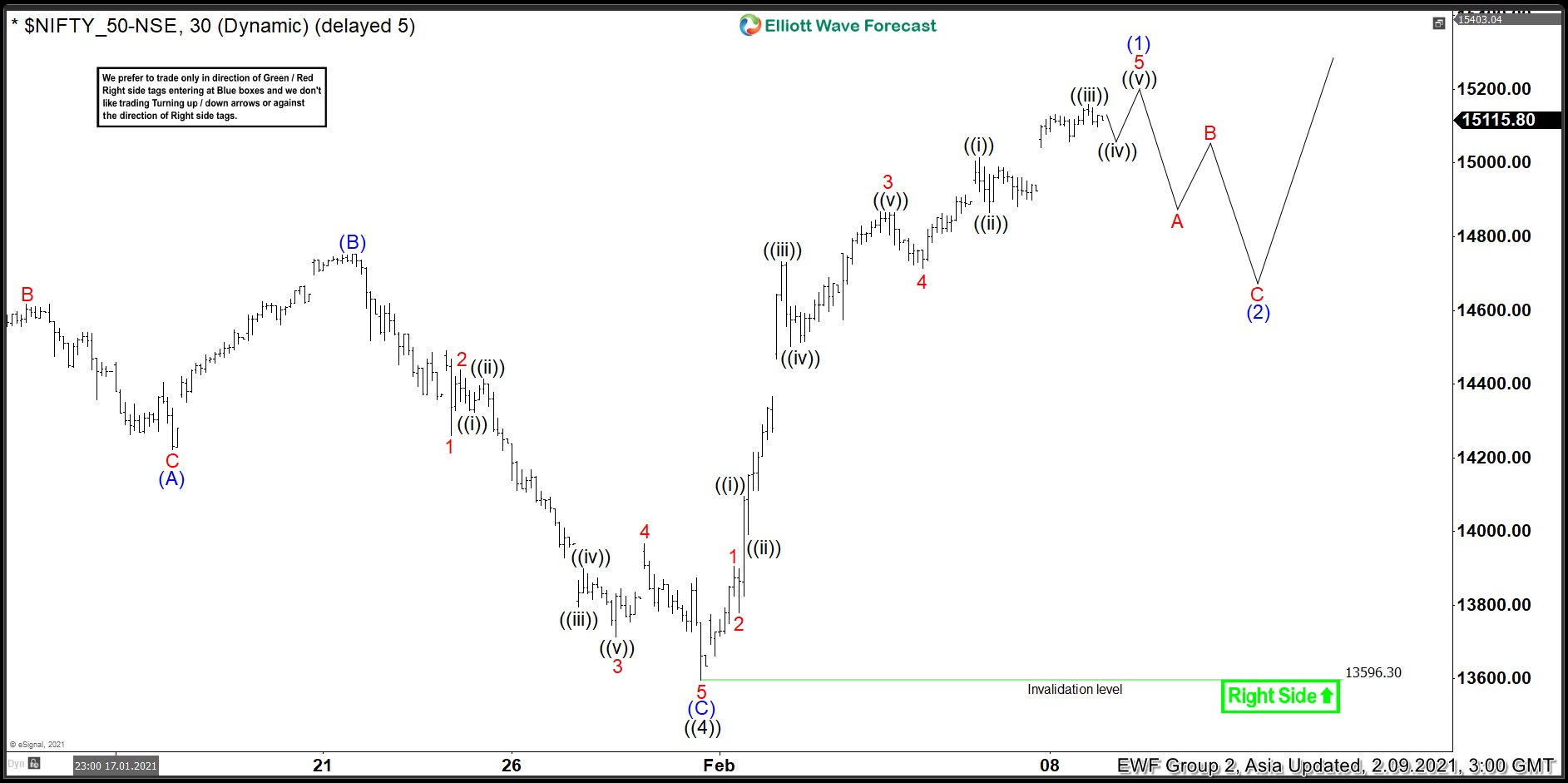

Cycle from March 2020 low in Nifty remains in play as a 5 waves impulse Elliott Wave structure. In the chart below, we can see wave ((3)) of the impulse ended at 14653.35. Wave ((4)) pullback has also ended at 13597.81. The internal subdivision of wave ((4)) unfolded as an Expanded Flat structure. Down from wave ((3)), wave (A) ended at 14222.80, wave (B) ended at 14752.80, and wave (C) of ((4)) ended at 13597.81.

The Index has resumed to new high above wave ((3)) suggesting the next leg higher in wave ((5)) has started. Up from wave ((4)), wave 1 ended at 13906.1 and pullback in wave 2 ended at 13778.30. Index then resumed higher in wave 3 towards 15014.65 and pullback in wave 4 ended at 14864.75. Expect Index to end wave 5 soon and this should complete wave (1) of ((5)) in higher degree. Index then should pullback in wave (2) to correct cycle from January 29, 20201 low before the rally resumes. As far as wave ((4)) low pivot at 13597.81 stays intact, expect dips to find support in 3, 7, or 11 swing for further upside.