In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

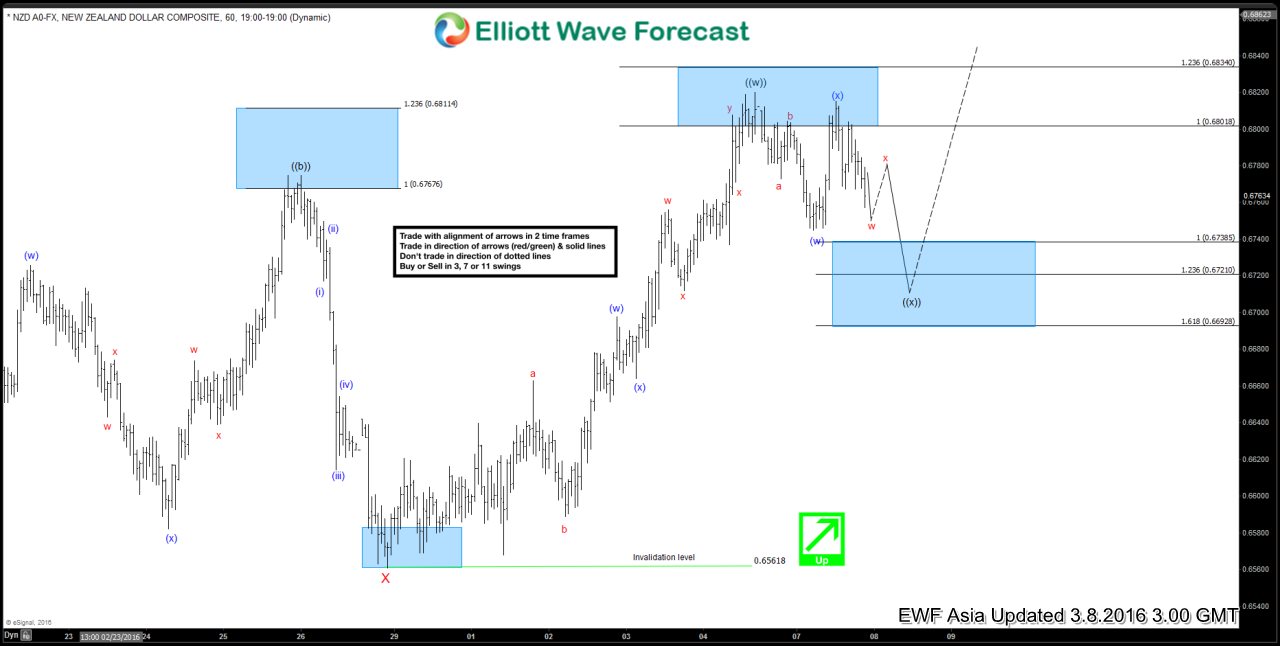

NZDUSD Short-term Elliott Wave Analysis 3.8.2016

Read MoreShort term Elliottwave structure suggests cycle from 2/29 low ended with wave ((w)) at 0.682 and pair is in wave ((x)) pullback. Internal structure of wave ((x)) is unfolding as a double three where wave (w) ended at 0.6745, wave (x) ended at 0.6815, and wave (y) of ((x)) is in progress towards 0.669 – 0.6738 […]

-

How we traded the BOJ this January $USDJPY

Read MoreHow we traded the BOJ this January USDJPY did took the 08.24.2015 lows (116.07) fractionally on the move down from November last year’s secondary peak on 1.20.2016 later, as the lows formed that day was (115.96), which was also the 5th swing target area 0.618-0.764% extension (117.68-116.23) and completed the 5 swing structure from June […]

-

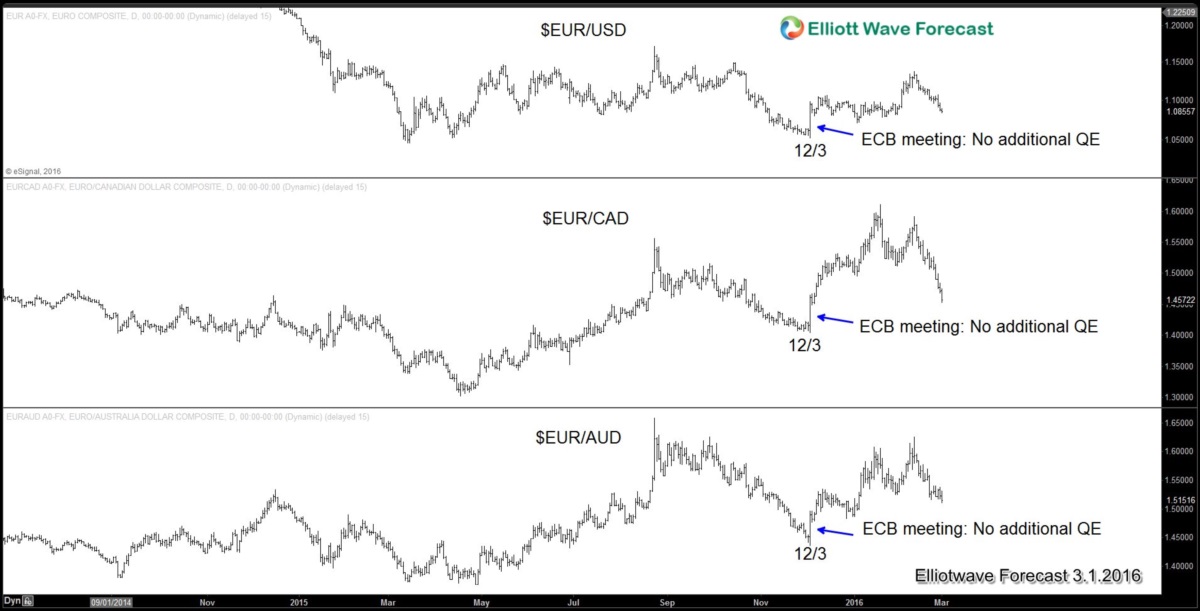

Euro going into ECB meeting on March 10

Read MoreIn our previous Jan 19 article “Where is Euro going next“, we explain the negative correlation between asset volatility and the Euro. When stock market declines, the Euro dollar goes up, and vice versa. The table below from Morgan Stanley confirms this inverse relationship. We can see that other than the period between 2007 – 2009 and the period in […]

-

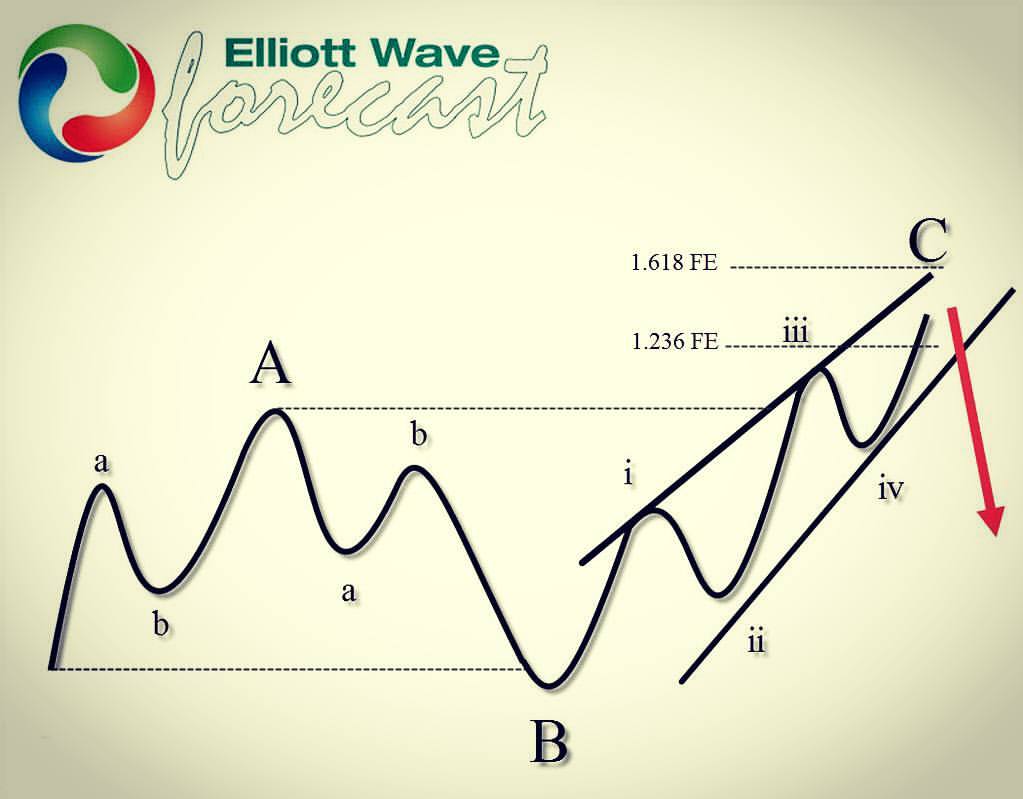

$AUDUSD Expanded Flat Pattern

Read MoreThe $AUDUSD chart below shows forecast from February 19 2016. It suggests the cycle from the 0.69693 short term low has not done to the upside yet, calling for further extension above the previous W high : 0.7242. The pair ended first leg wave ((w)) of Y red at 0.7171 and now it’s showing very […]

-

Weak NZ Inflation in 4Q 2015 may force RBNZ to cut rate

Read MoreIn December 9, 2015, the Reserve Bank of New Zealand (RBNZ) delivered a cut to the Official Cash Rate (OCR) by 25 bps to 2.5% but surprisingly $NZD/USD rallied on that same day from 0.6565 to 0.6759 (2.9% daily range) before closing at 0.6713 (2.3% increase). In subsequent weeks, $NZD/USD continued to rally further to 0.688 before finally turning lower […]

-

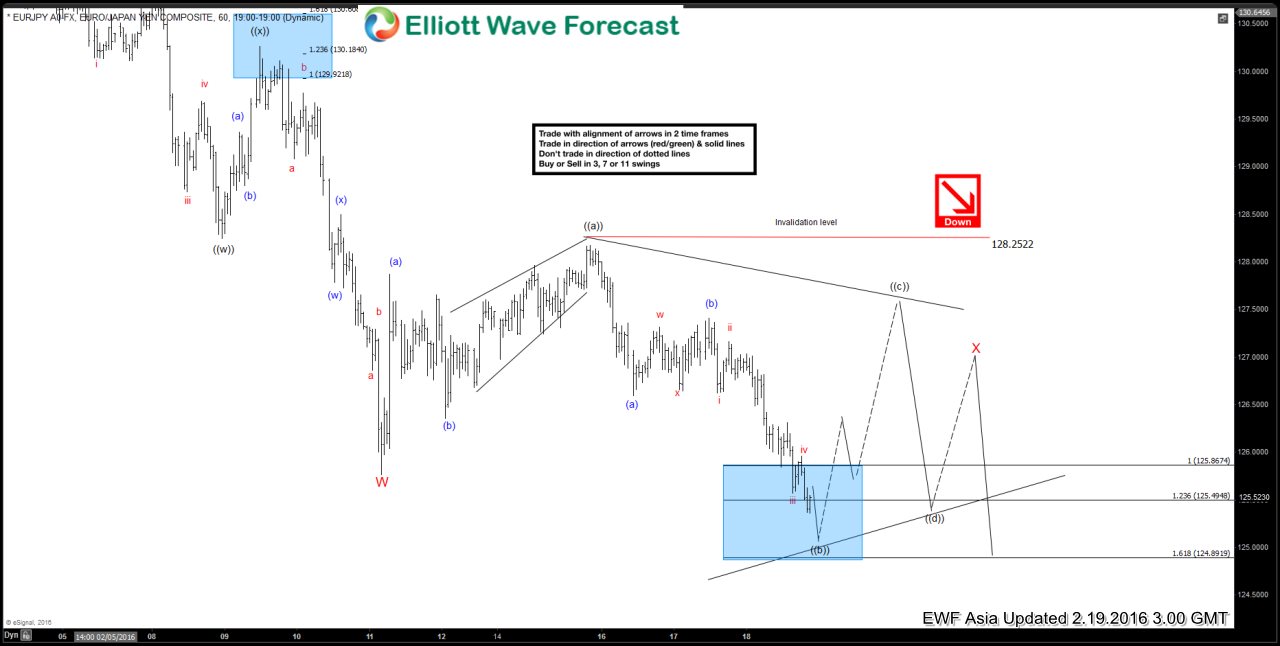

EURJPY Short-term Elliott Wave Analysis 2.19.2016

Read MoreRevised short term Elliottwave structure suggests decline to 125.74 ended wave W. Wave X bounce is unfolding as a triangle where wave ((a)) ended at 128.25, and wave ((b)) is in progress and expected to complete at 124.9 – 125.5 area before turning higher in wave ((c)). We don’t like buying the proposed wave ((c)) bounce. […]