In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

CHFJPY Elliott Wave Forecasting The Path

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of CHFJPY published in members area of the website. As our members know CHFJPY has ended 5 waves down from the 112.212 peak. Now, the pair is giving us recovery against the mentioned high and we can see […]

-

Elliott Wave View: Further Strength in EURUSD

Read MoreEURUSD shows a 5 waves rally from May 23 low suggesting that more upside while pullback stays above there. This article & video show the Elliott Wave path.

-

USDTRY Mid-Term Elliott Wave View

Read MoreIn this blog, we revisit Turkish Lira Elliott wave analysis presented back in August 2018 and present the latest USDTRY Elliott Wave Analysis. We were looking for a bounce to fail below August 2018 peak for another leg lower to complete a larger 3 waves correction down from August 2018 peak before buyers entered the […]

-

Reserve Bank Australia Will Consider Rate Cut

Read MoreIn a speech to the Economic Society of Australia today, Reserve Bank of Australia (RBA) governor Phillip Lowe gave the strongest indication that the bank will cut cash rate in the next meeting. Dr. Lowe said that without interest rate cut, unemployment is not likely to fall much further and inflation remains low. The Australian Dollar […]

-

AUDUSD Elliott Wave Analysis: Calling The Reaction From Inflection Area

Read MoreI want to share with you some Elliott Wave charts of AUDUSD which we presented this month. You see the 1-hour updated chart presented to our clients on the 5/16/19. AUDUSD had a 1-hour right side tag against 0.6951 peak suggesting more downside. AUDUSD ended the cycle from 05/10/19 peak in black wave ((iii)) at 05/16/19 low (0.6892). […]

-

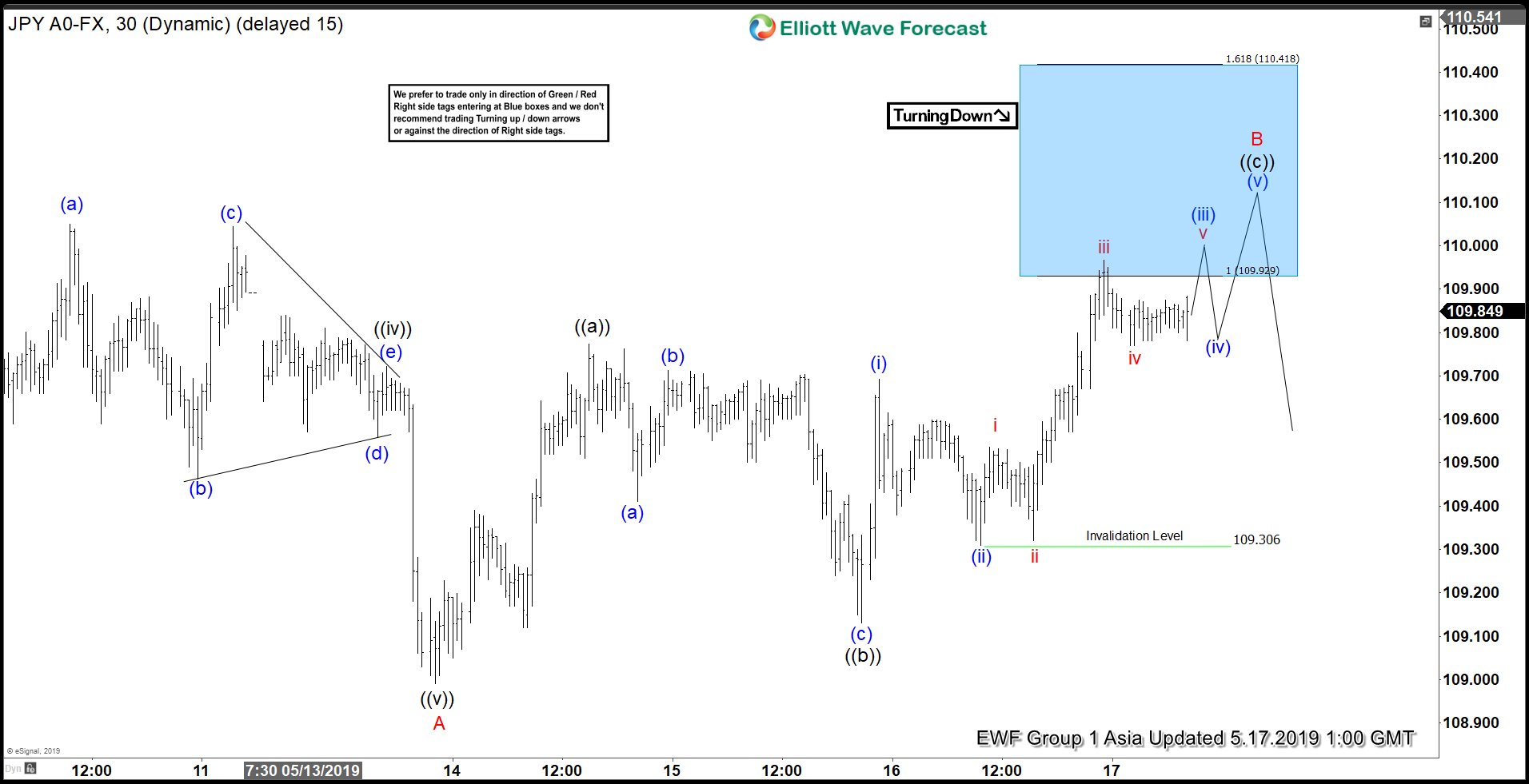

Elliott Wave View Calling for Pullback in USDJPY

Read More$USDJPY shows impulsive move from 4.25.2019. Bounce is expected to fail for further downside.This article & video shows the short term Elliott Wave path.