In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

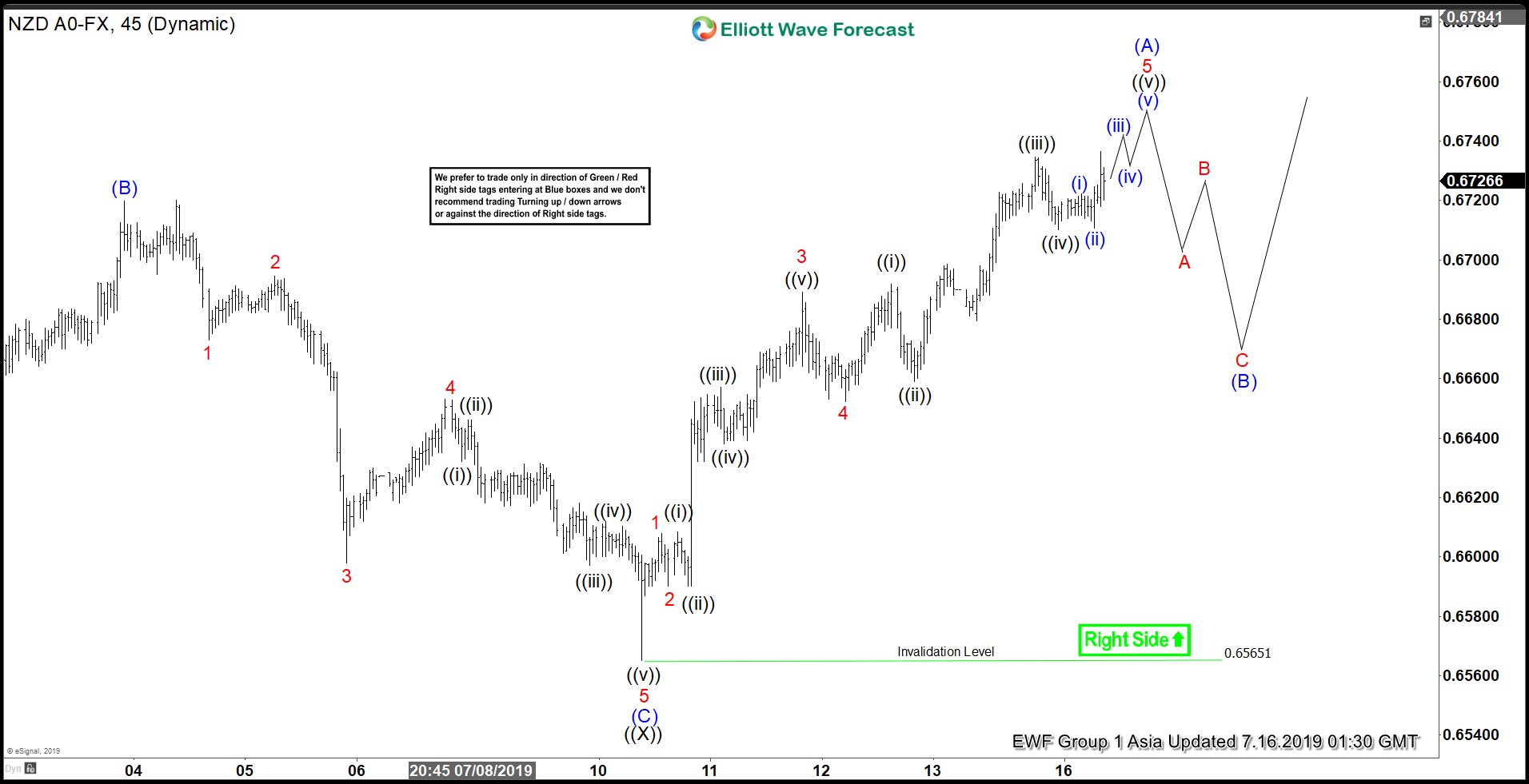

Elliott Wave View: NZDUSD Showing Incomplete Sequence

Read MoreNZDUSD has an incomplete 5 swing sequence from May 23, 2019 low favoring further upside. Short term Elliott Wave view suggests the pullback to 0.6565 on July 10, 2019 low ended wave ((X)). Pair then rallies from there as a zigzag Elliott Wave structure where wave (A) of this zigzag is in progress as an impulse. Up […]

-

EUR and GBP Should Remain Weak Against Canadian Dollar

Read MoreEUR and GBP have seen a strong sell off against Canadian Dollar in the last few weeks and in this article we will take a look at the swing sequences in EURCAD and GBPCAD to present the path of least resistance and also look at the future targets. EURCAD Cycle from 3.2018 Peak is Incomplete […]

-

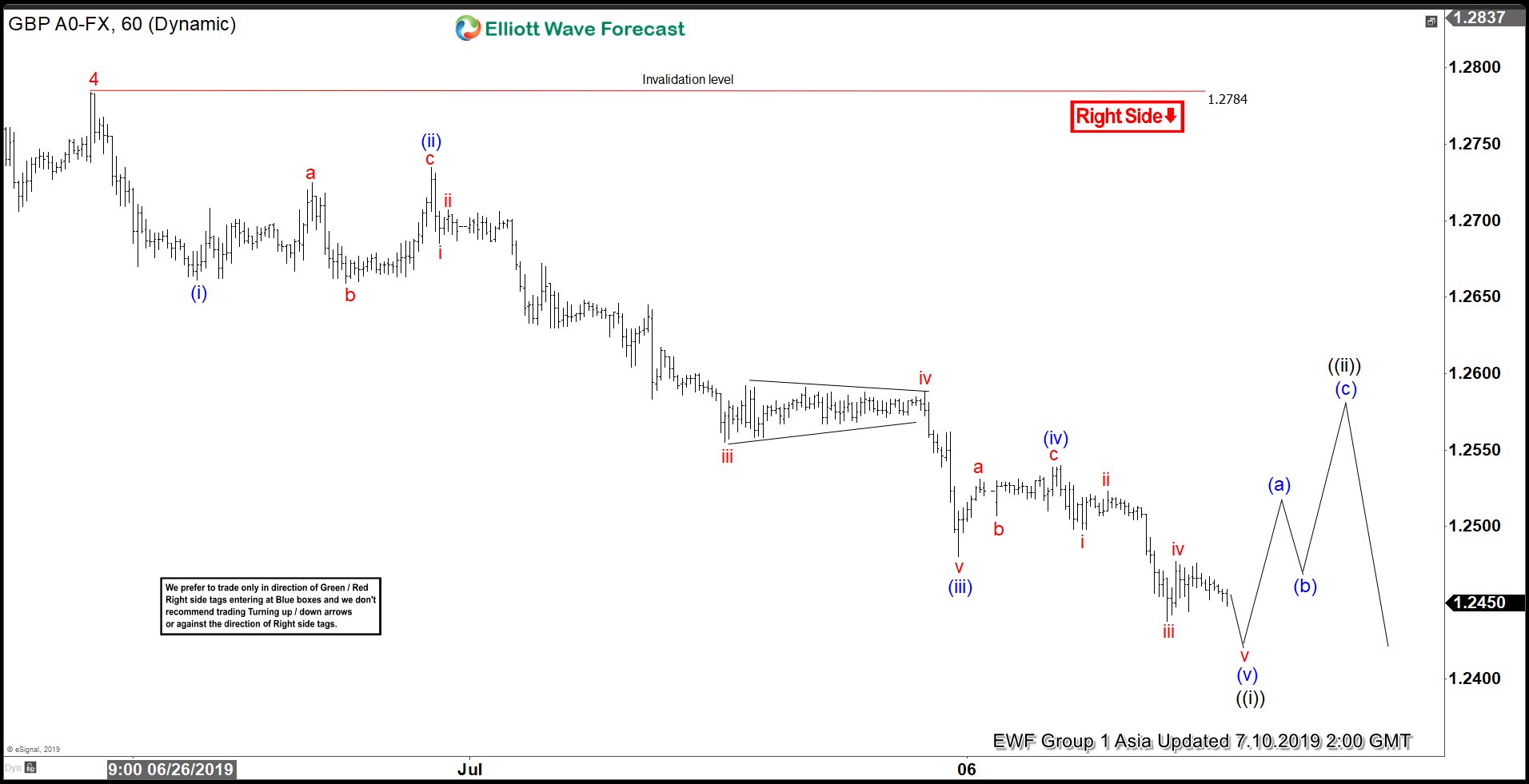

Elliott Wave View: GBPUSD Ending 5 Waves Move

Read MoreElliott Wave View suggests the move lower from March 13, 2019 high (1.3381) is unfolding as an impulse Elliott Wave structure. In the short term chart below, the bounce to 1.2784 ended wave 4 as part of the impulse move from March 13 high. Pair is currently within wave 5 and the internal also unfolds […]

-

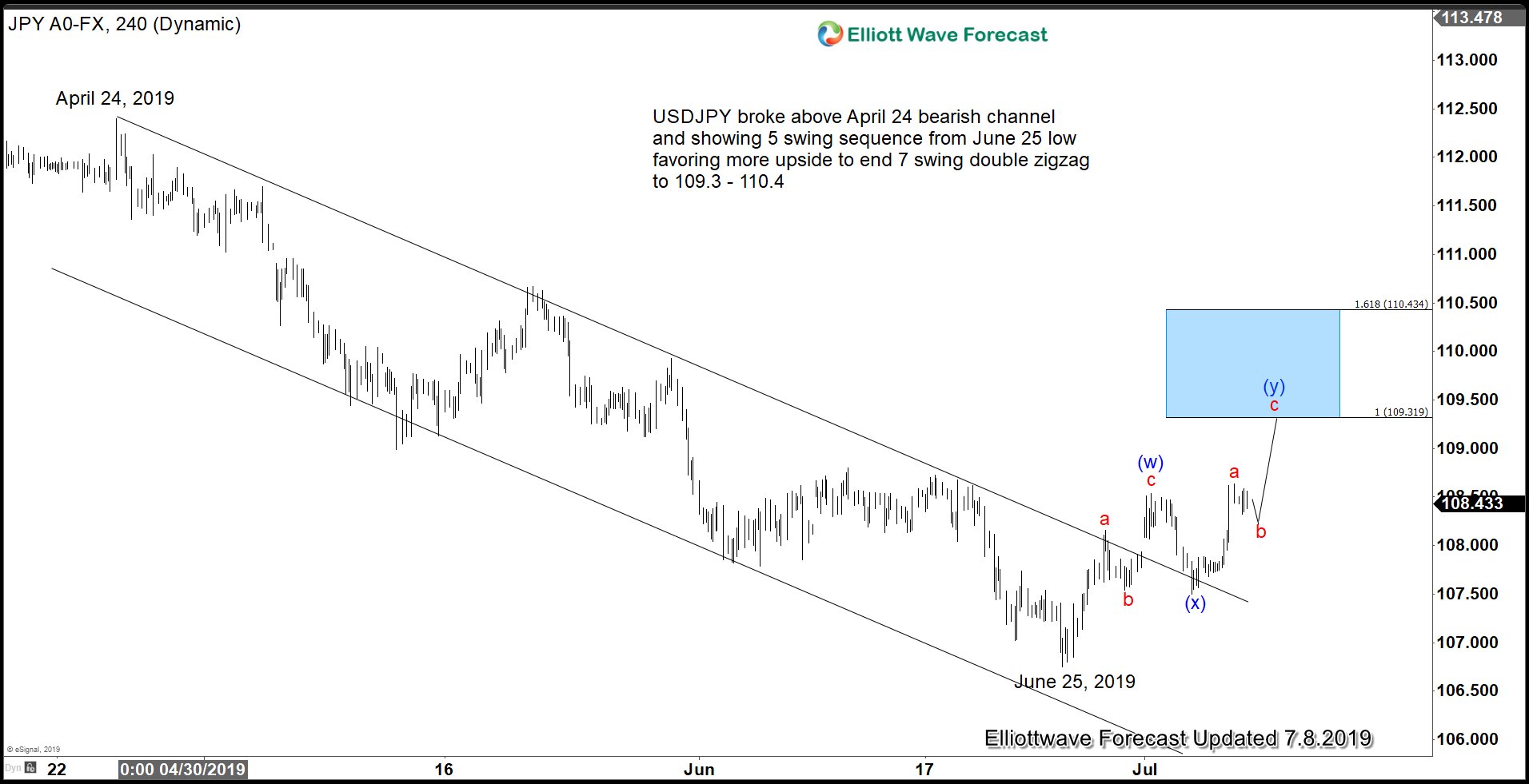

Strong NFP Report Tempers Fed’s Rate Cut Expectation and Boosts US Dollar

Read MoreJobs report for the month of June came above the expectation, tempering the hope of a Fed’s rate cut. June NFP (Nonfarm Payroll) rebounded to 224,000 after a disappointing 72,000 May figure. Unemployment rate increased to 3.7% while average wage gains increased less than expected at 3.1%. The gain however might not be enough to […]

-

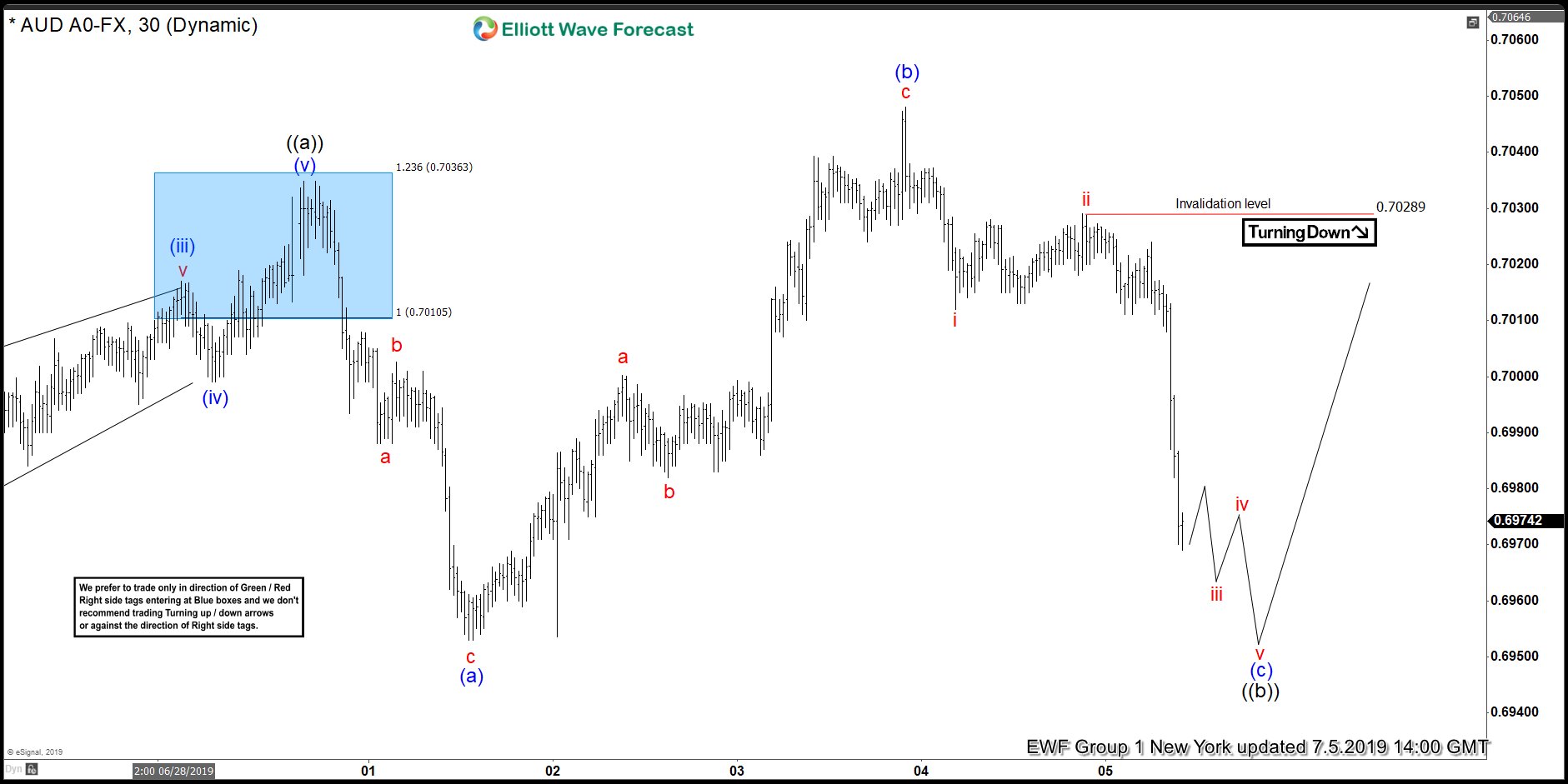

Elliott Wave View: AUDUSD Strength Should Resume

Read MoreAUDUSD is correcting the rally from June 18, 2019 low in a Flat structure. This article and video show the Elliott Wave path.

-

Elliott Wave View: AUDJPY Should Remain Supported

Read MoreAUDJPY shows a 5 waves impulsive rally from June 18 low favoring more upside. This article and video shows the Elliott Wave path.