In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

Elliott Wave Update: Dollar Index (DXY) Bearish Trend Intact

Read MoreDollar Index (DXY) cycle remains bearish and short term rally should fail for further downside. This article and video look at the Elliott Wave path.

-

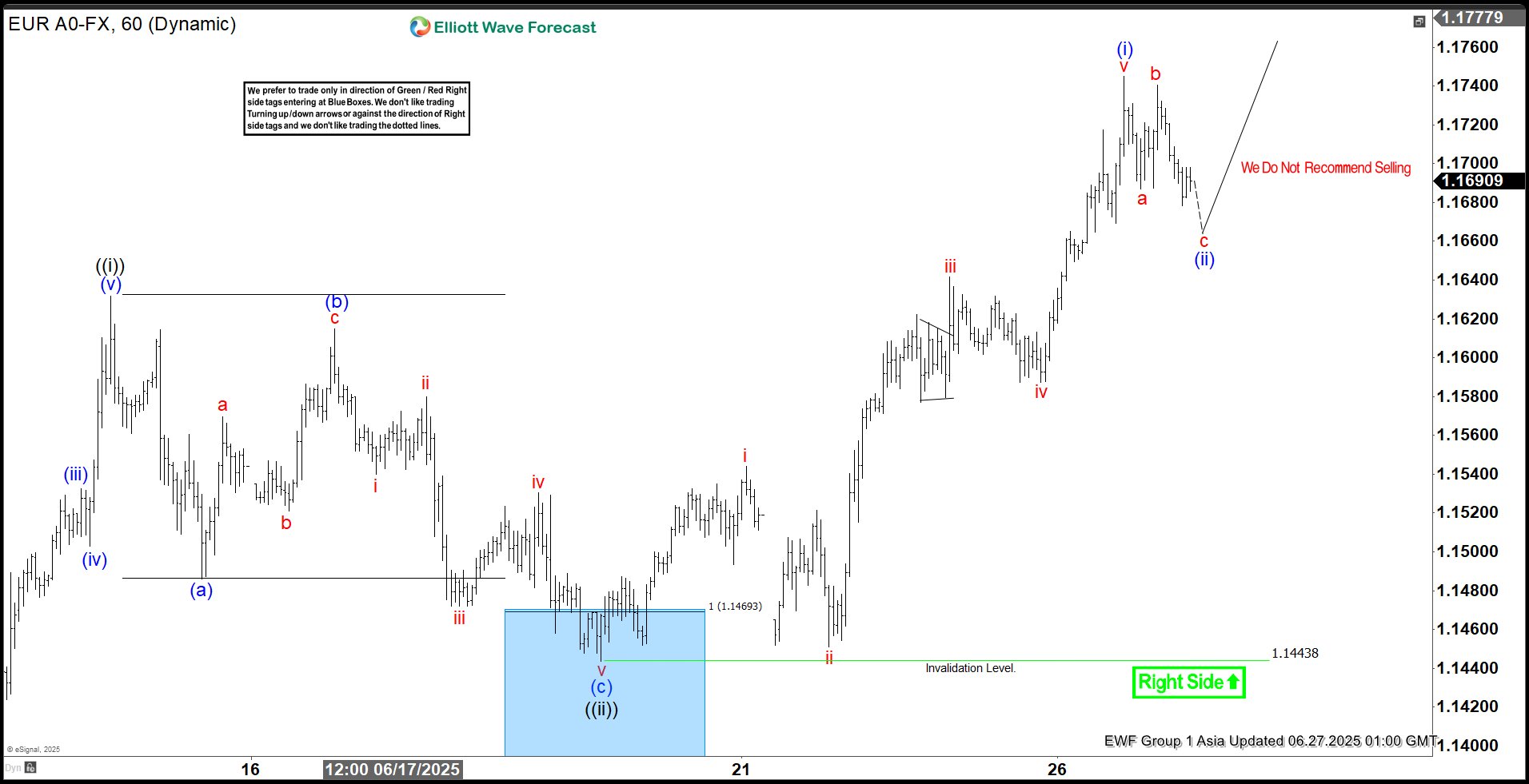

EURUSD Elliott Wave Update: Upward Momentum Resumes

Read MoreEURUSD shows incomplete bullish sequence from September 2022 low favoring more upside. This article and video look at the Elliott Wave path.

-

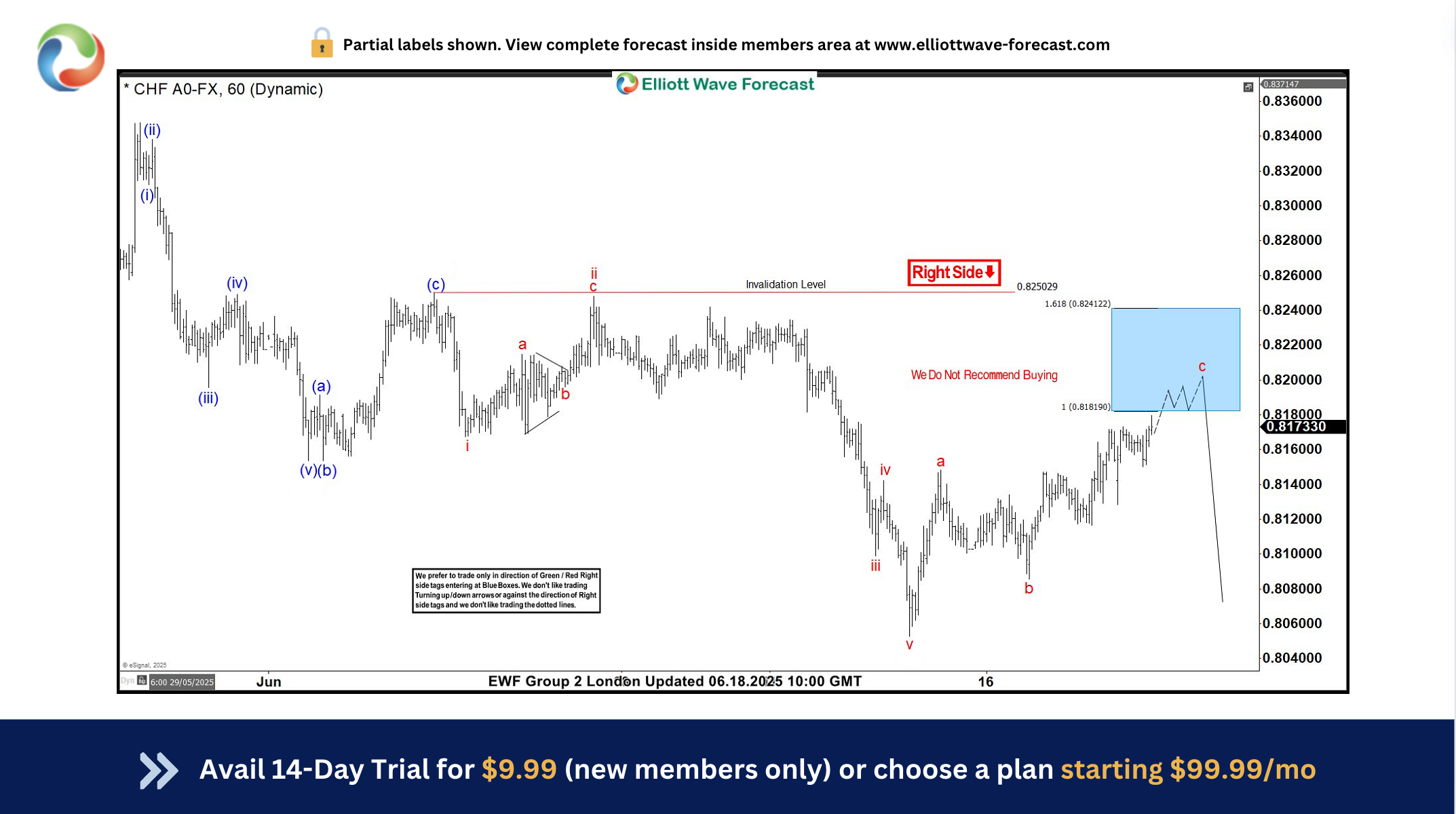

USDCHF Reaches New Lows: A Perfect Reaction from the Blue Box Zone

Read MoreIn this technical blog, we have looked at the past performance of USDCHF charts, in which the pair reaches new lows from the blue box zone.

-

EURUSD Trade Setup Explained: Buying the Dips at the Blue Box Zone

Read MoreHello fellow traders. In this technical article, we are going to talk about another Elliott Wave trading setup we got in EURUSD . The pair has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this article, we’ll break down the Elliott Wave Forecast and explain the […]

-

GBPJPY Elliott Wave Outlook: Impulse Pattern Approaching End

Read MoreGBPJPY is looking to end impulsive rally from April 9, 2025 low. This article and video look at the Elliott Wave path of the pair.

-

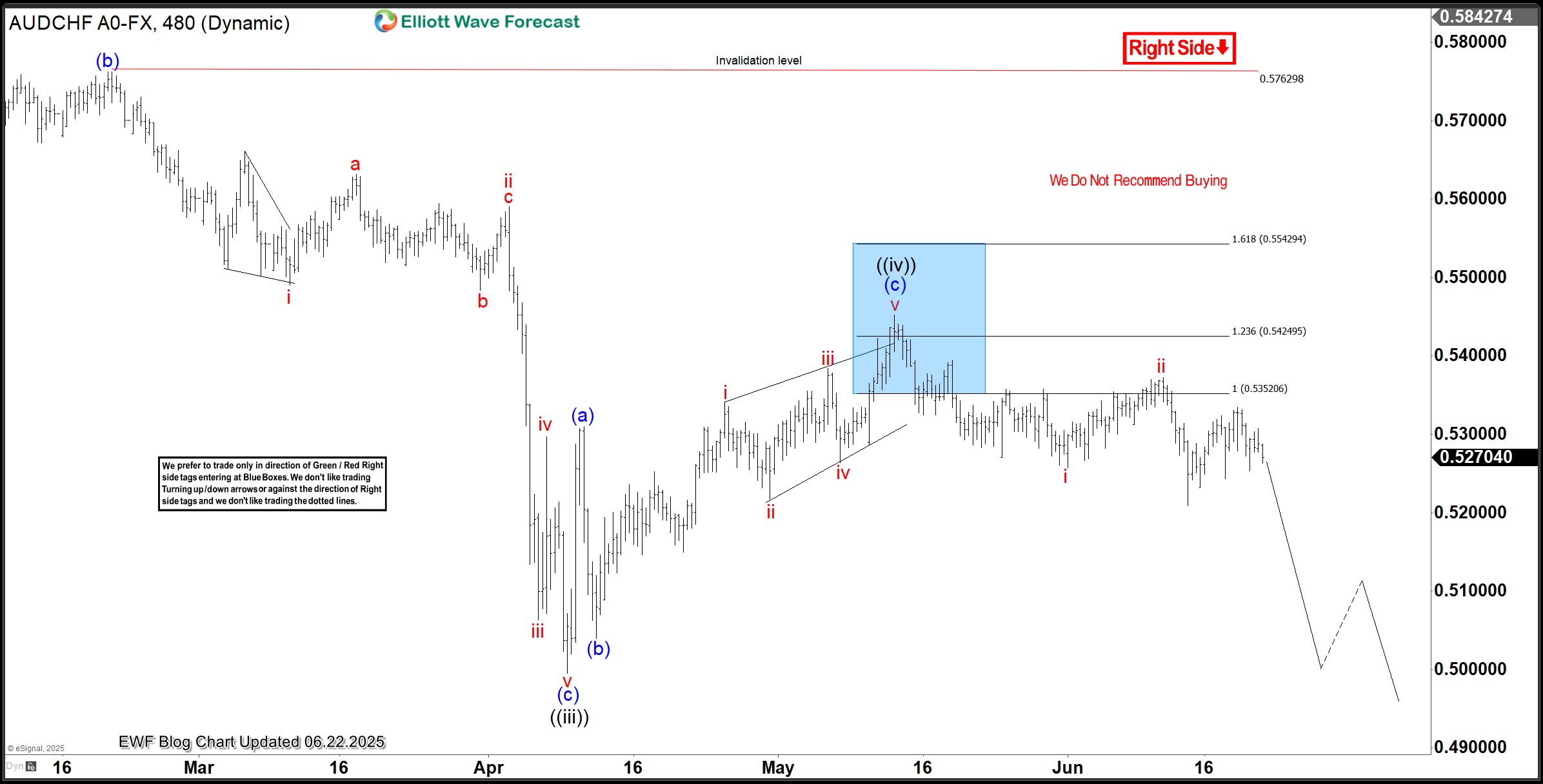

AUDCHF Sells From Blue Box, Aligning With Long-Term Bearish Sequence

Read MoreAUDCHF is on the verge of completing a multi-decade bearish cycle from April 1992. However, it appears sellers will continue to push in the shorter cycles. Thus, the pair should attract short-term sellers, while long-term sellers should watch out. AUDCHF has been in a long-term bearish cycle from April 1992 in a somewhat corrective sequence. […]