Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

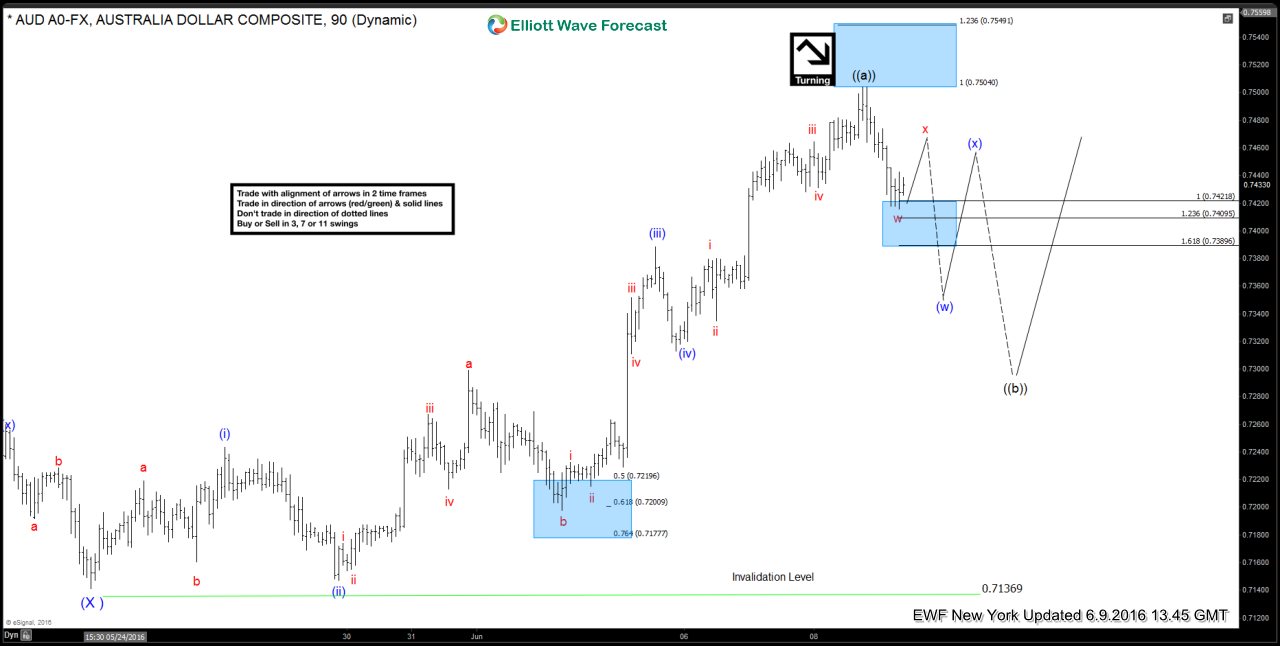

$AUDUSD Live Trading Room – Trade Recap

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 8:00 AM EST , join Dan there for more insight into these proven methods of trading. Trading is […]

-

NFP Number: Good or Bad. EURUSD doesn’t care

Read MoreThe surprisingly weak employment report takes a walk of June rate table and the chances of a motion at the next meeting July also fell sharply. The USA created only 38,000 new jobs in May, well below the forecast of an increase of 155,000. Is the smallest number of jobs added monthly work in almost […]

-

Weekly Market Report June 8

Read MoreU. S. Dollar – Biased lower Last Friday, Non Farm Payroll number came out very weak with job growth increased only by +38K in May, far below the consensus of +160K. This is one of the largest misses since 2011 and cooling off the expectation of rate hikes. Further adding to the woe, April’s job gains was also […]

-

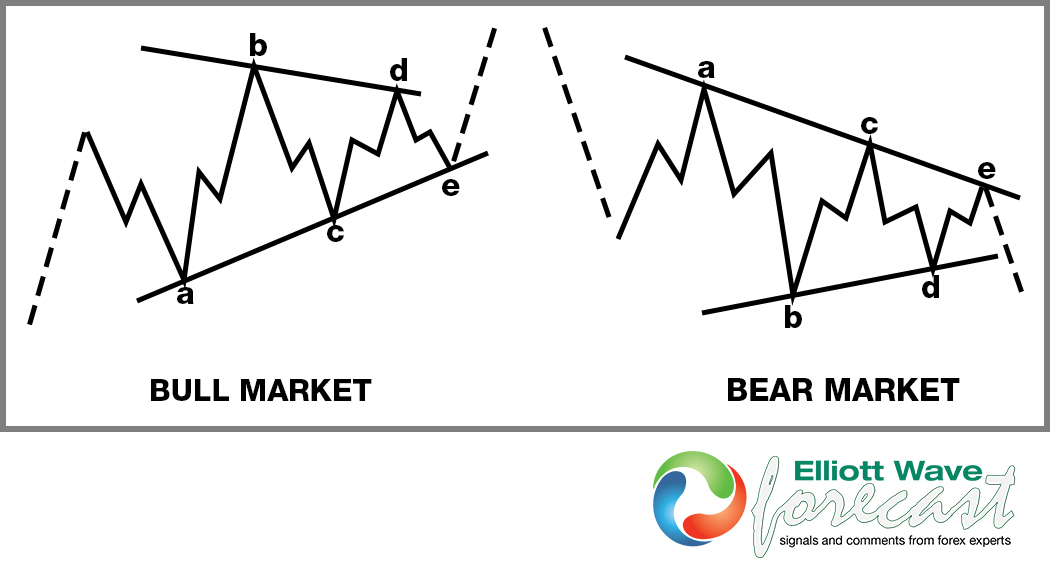

Elliott Wave Theory Structure : A Running Triangle

Read MoreElliott Wave Theory Structure : A Running Triangle Triangles are overlapping five wave structures. They subdivide into five, three swing moves as 3-3-3-3-3 that give pause to a trend. This consolidates the progress made during a trending move that can be either bullish or bearish. These will only show up in the fourth waves of […]

-

$GBPAUD $GBPUSD and $AUDUSD Live Trading Room – Trade Recap

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 8:00 AM EST , join Dan there for more insight into these proven methods of trading. Inflection zones […]

-

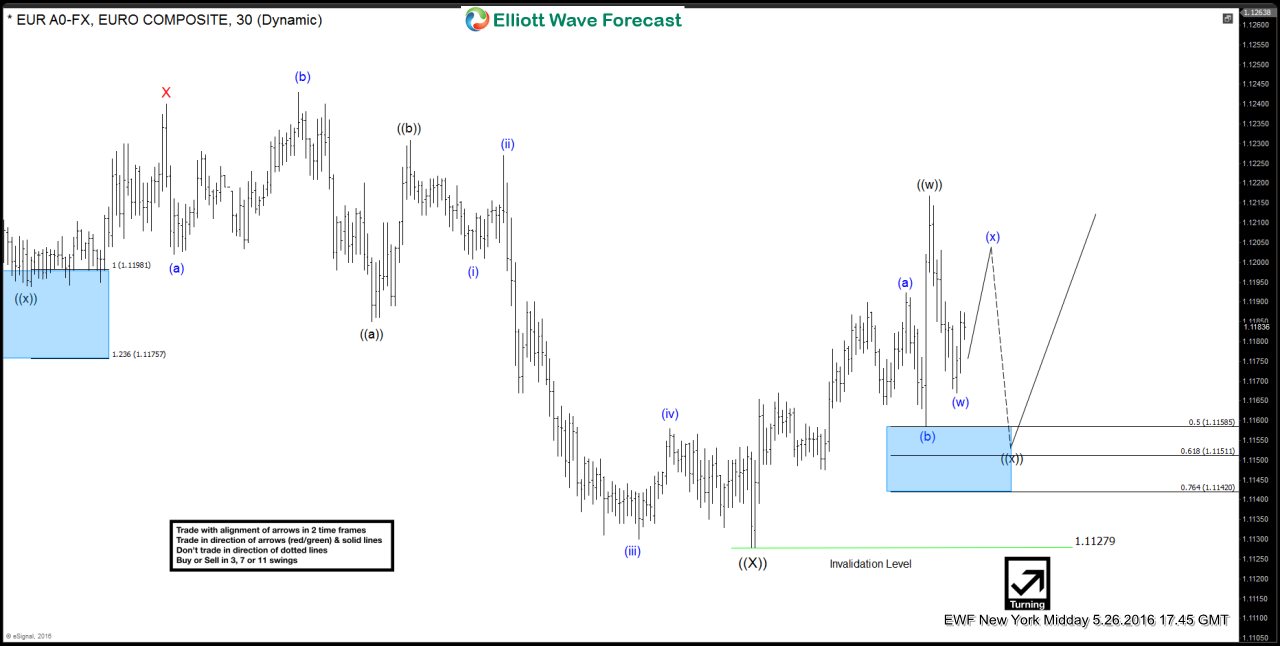

$EURUSD Live Trading Room – US Unemployment Live Trading

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 8:00 AM EST , join Dan there for more insight into these proven methods of trading. Inflection zones […]