Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

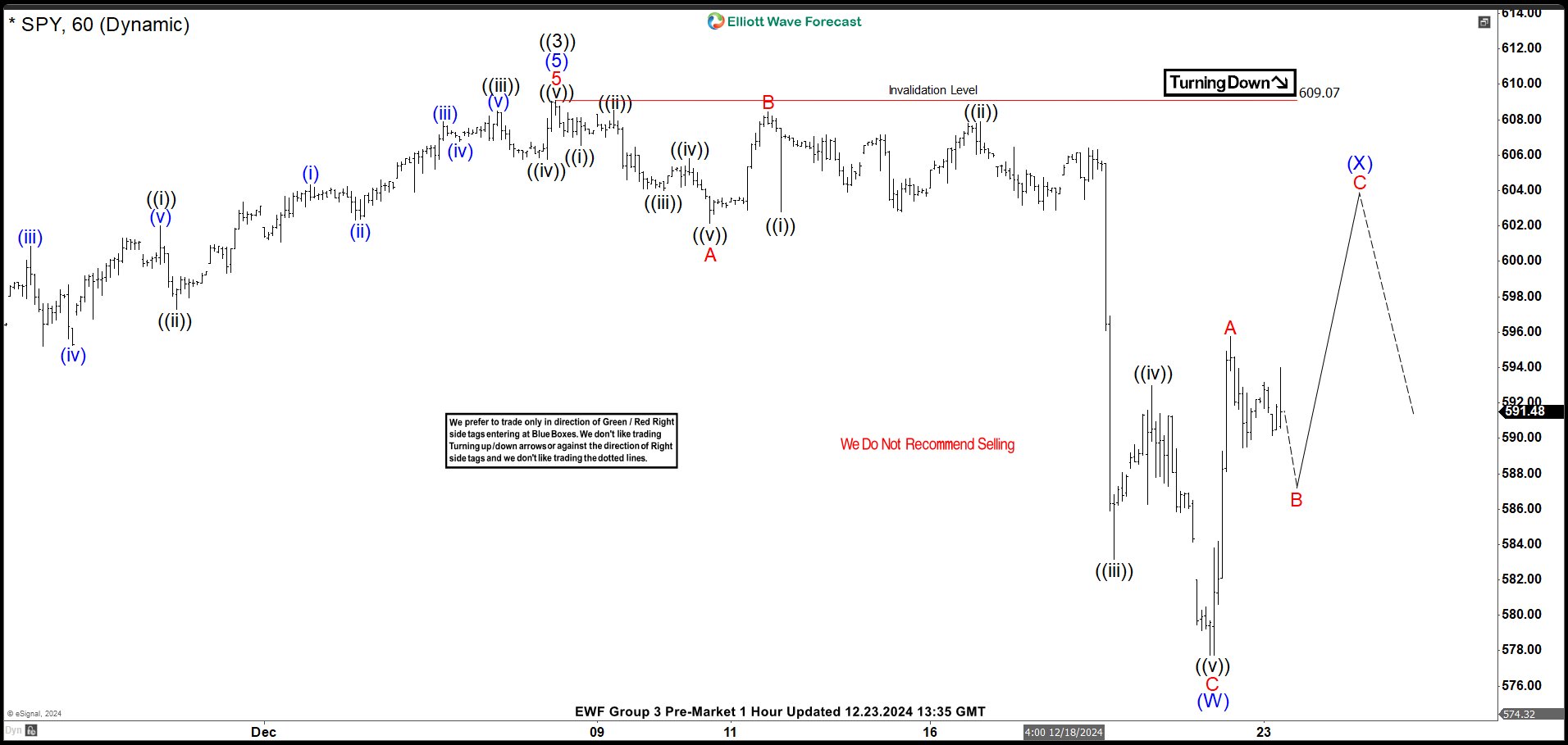

S&P 500 ETF (SPY) Elliott Wave: Forecasting the Future Path

Read MoreHello fellow traders ! In this technical article, we’re going to take a quick look at the Elliott Wave charts of the SPY ETF , published in the members area of the website. As our members know, SPY remains overall bullish. However, currently it’s correcting the cycle from the August 504.84 low. In this article, […]

-

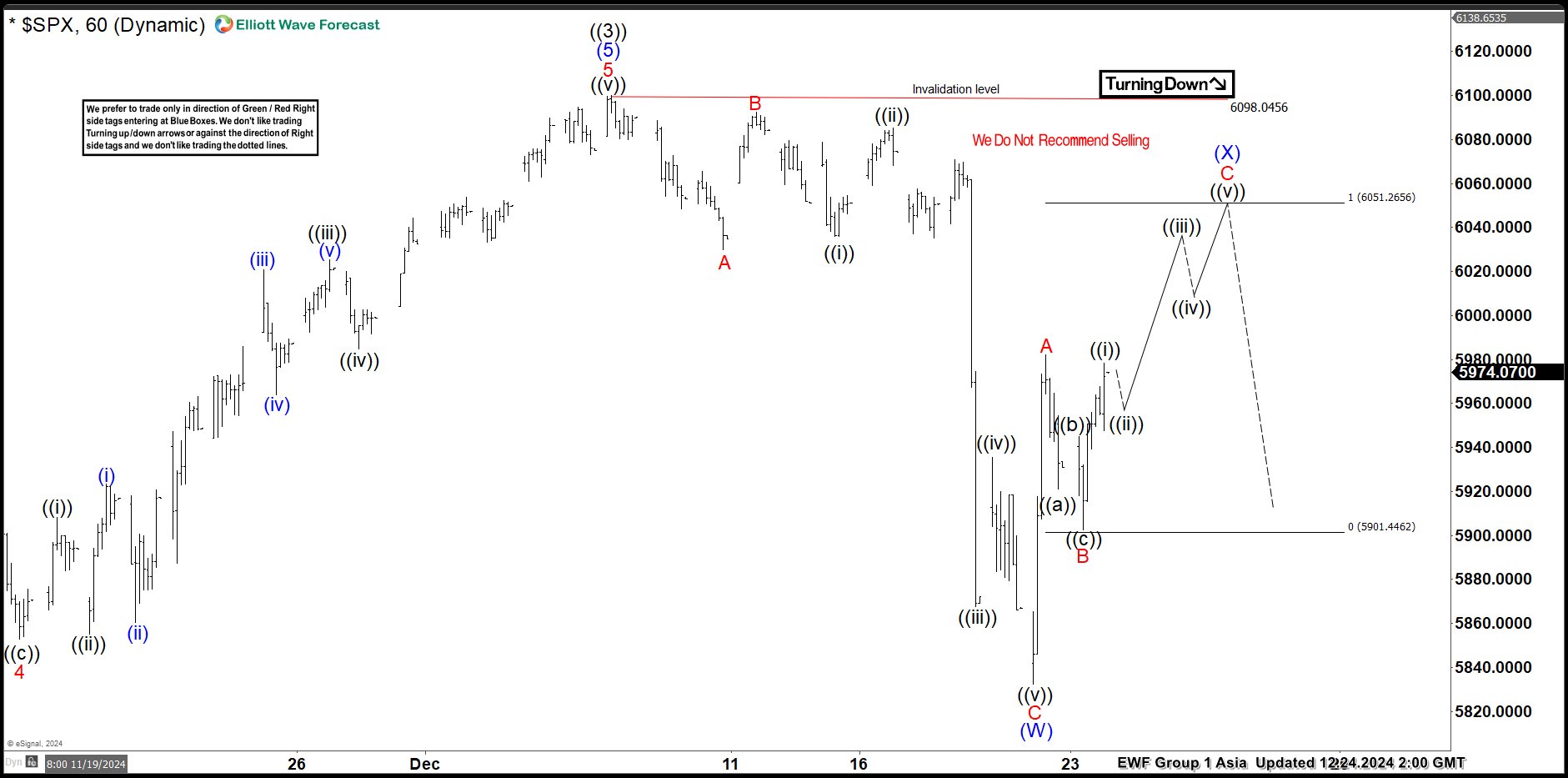

SPX : Elliott Wave Forecasting the Future Path

Read MoreHello traders ! In this technical article, we’re going to take a quick look at the Elliott Wave charts of the SPX index, published in the members area of the website. As our members know, SPX remains overall bullish, currently correcting the cycle from the August 5118.95 low. In this article, we will explain the […]

-

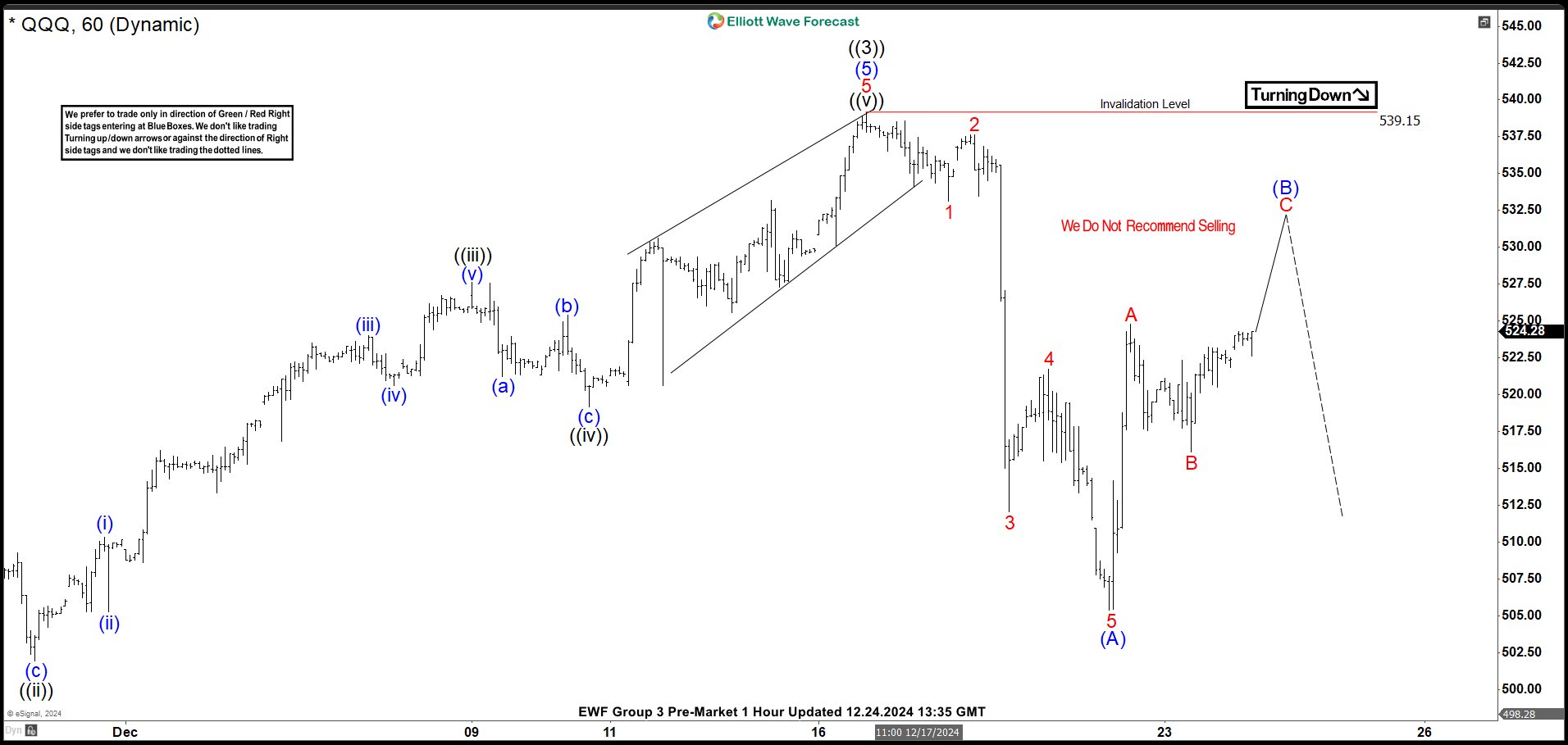

Nasdaq ETF (QQQ): Elliott Wave Forecasting the Future Path

Read MoreHello traders and investors! In this technical article, we’re going to take a quick look at the Elliott Wave charts of the Nasdaq ETF QQQ, published in the members area of the website. As our members know, QQQ is showing impulsive bullish sequences in the cycle from the August 420.16 low. As a result, we […]

-

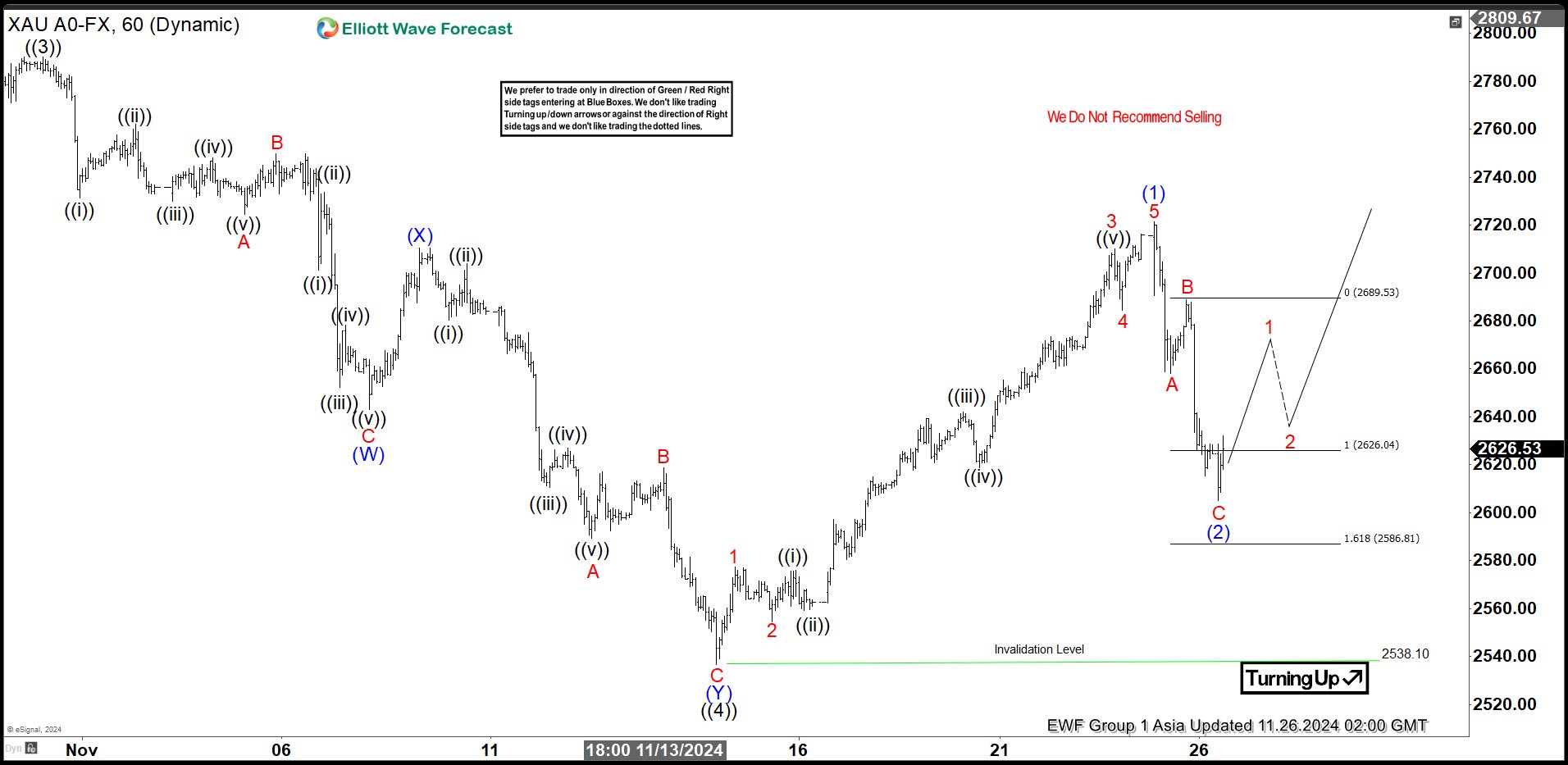

GOLD (XAUUSD) Found Buyers After Elliott Wave Zig Zag Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GOLD (XAUUSD), published in members area of the website. As our members know the pair is showing impulsive bullish sequences in the cycle from the 2537.3 low. Consequently , we were calling for the further […]

-

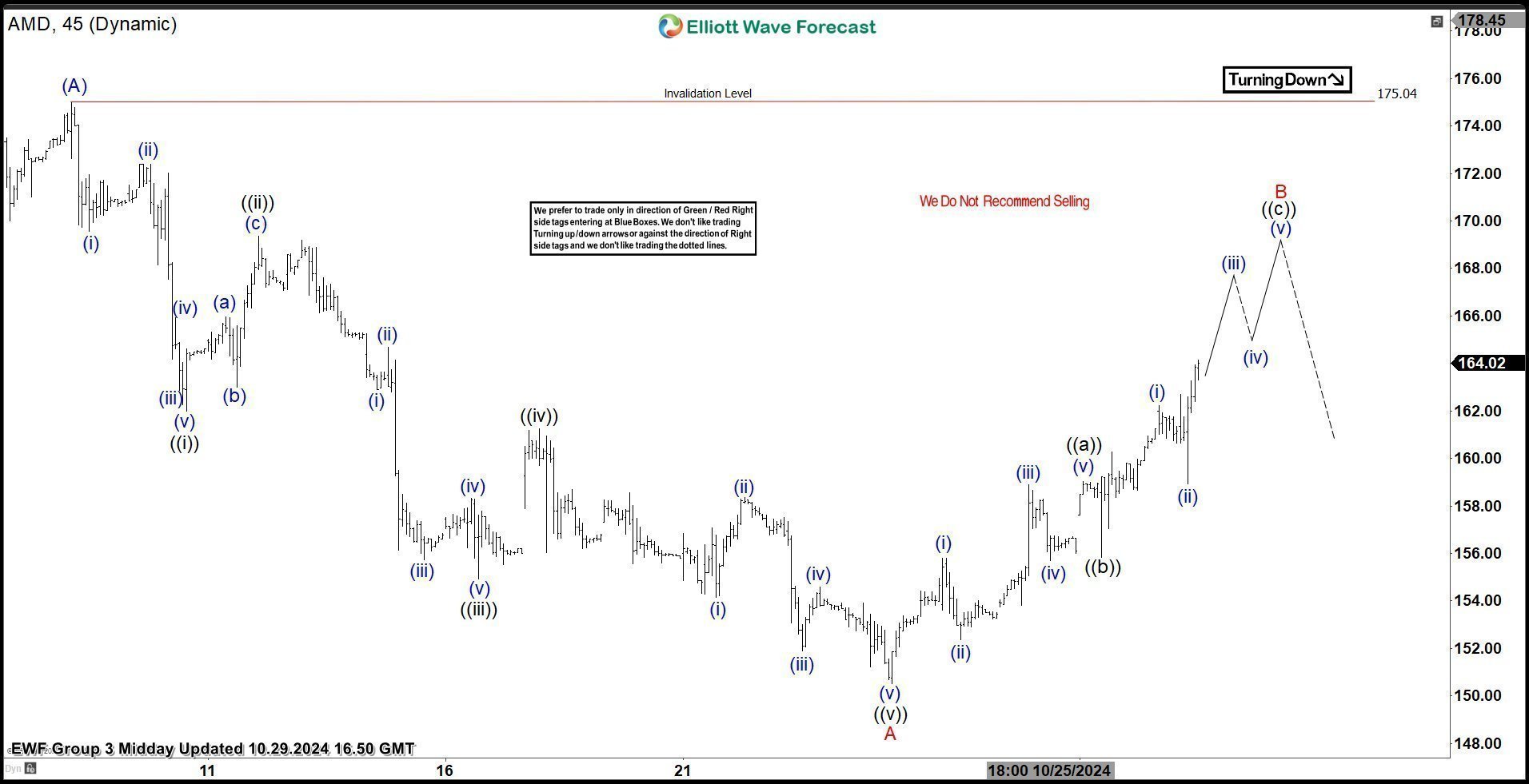

AMD Elliott Wave Calling the Decline After Zig Zag Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of AMD stock published in members area of the website. As our members know, AMD recently gave us a correction from the 241.58 peak, after which we called the drop in the stock. Recovery formed Elliott […]

-

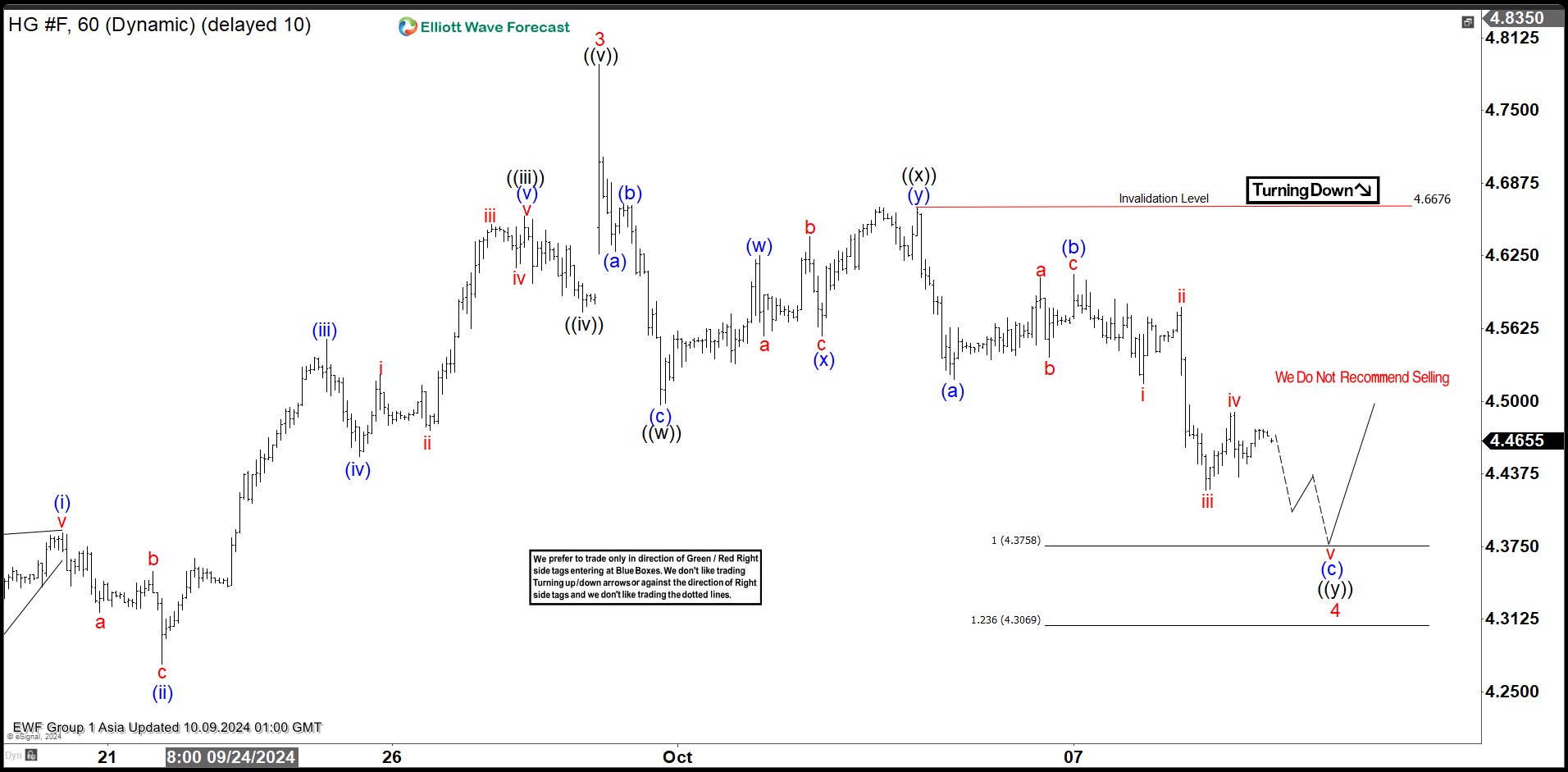

Copper Futures (HG_F) Elliott Wave Forecasting the Path

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of Copper Futures HG_F, published in members area of the website. As our members know, Copper is showing impulsive sequences in the cycle from the 3.9230 low. Consequently we are favoring the long positions at this stage. The commodity […]