Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

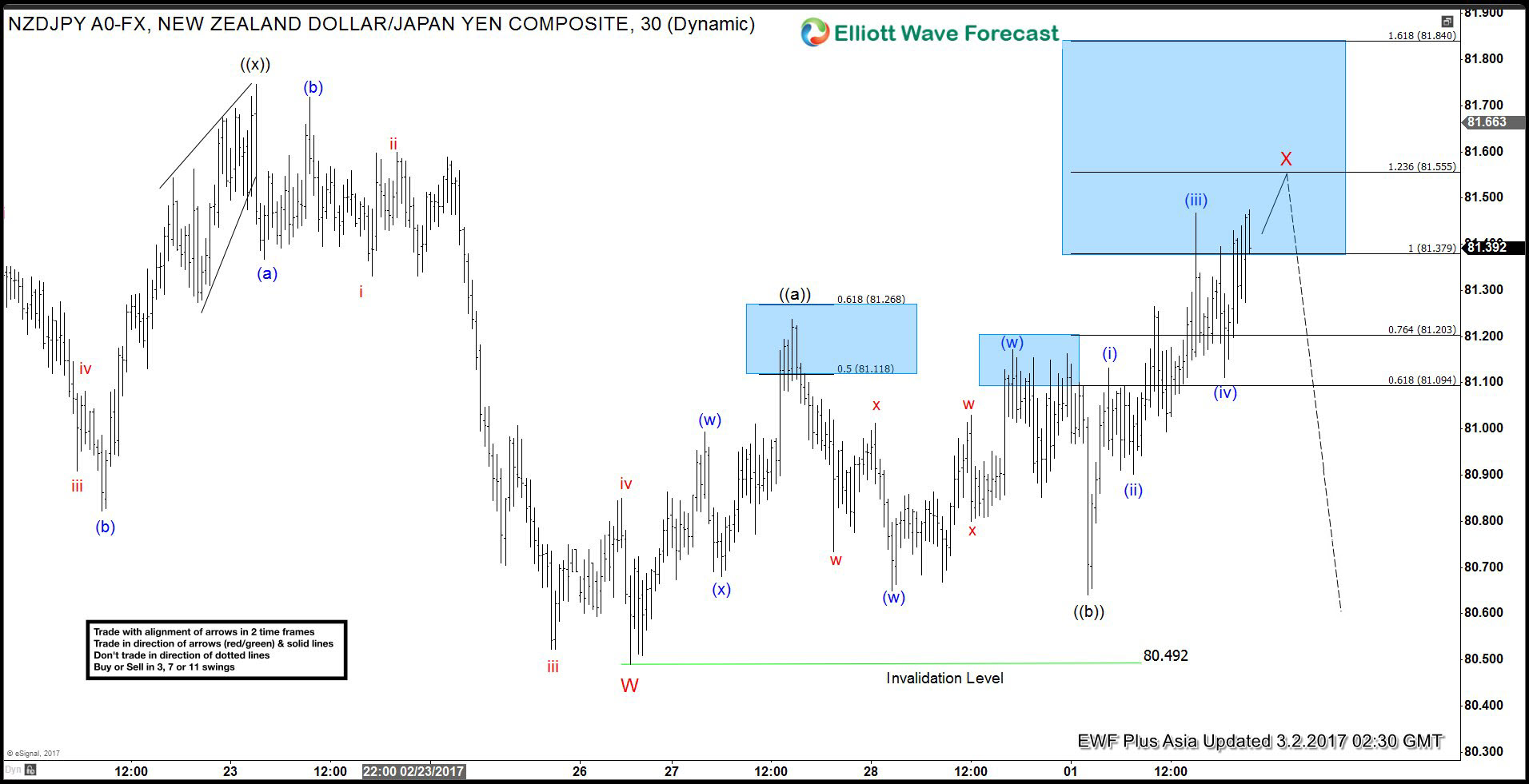

Check your Elliott Wave knowledge

Read MoreHello fellow traders. As you may have noticed, we were doing a lot of free educational blogs, explaining various Elliott Wave Patterns through real Market examples. Now we challenge you to Take this short test and check your Elliott Wave knowledge. Test your Elliott Wave knowledge Chart below is our Elliott Wave forecast of NZDJPY […]

-

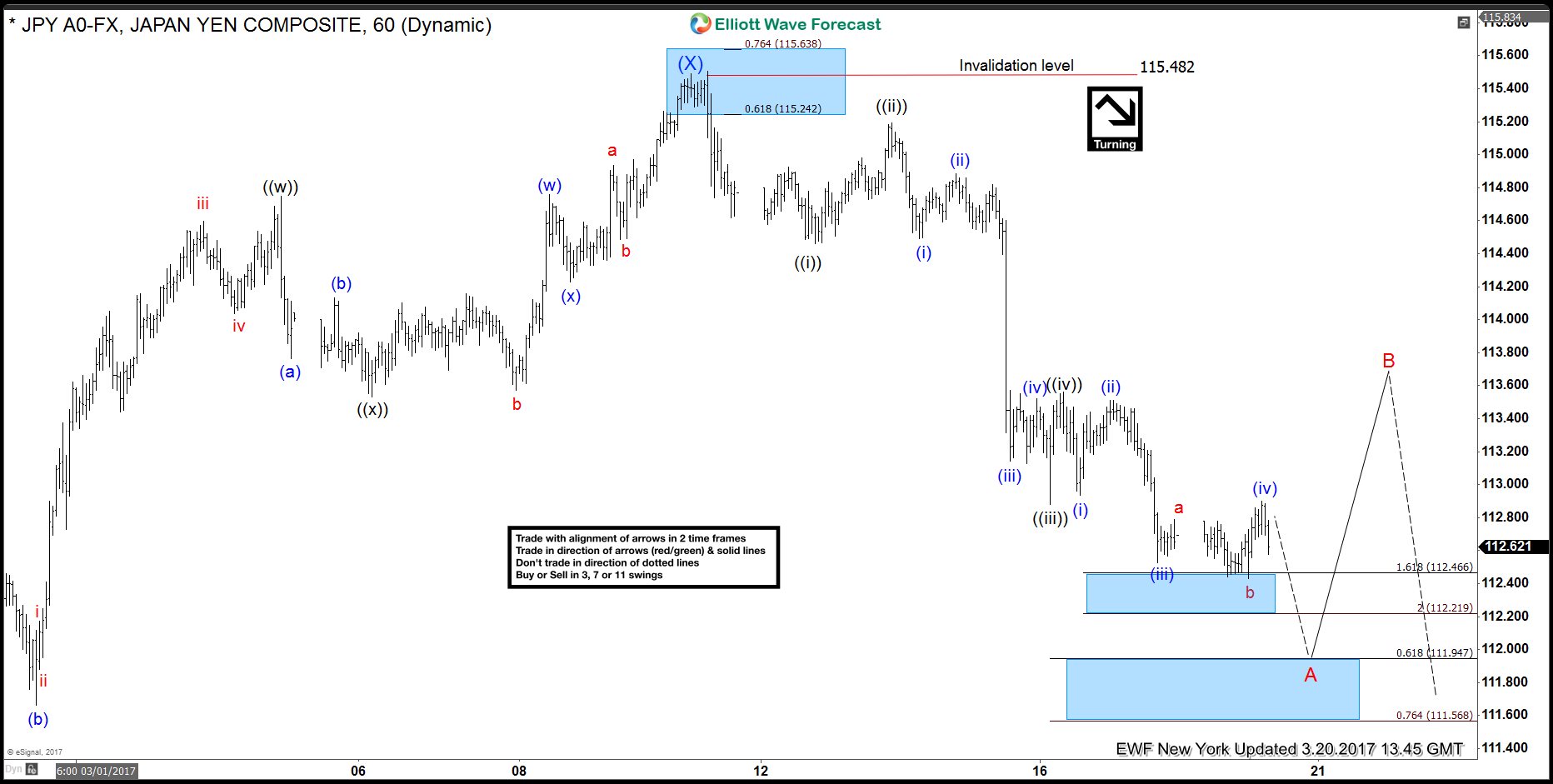

5th Wave Target Area in the $USDJPY move Lower from 3/10

Read More5th Wave Target Area in the $USDJPY move Lower from 3/10 The $USDJPY pair from the 3/10 highs at 115.50 is showing a 5 wave impulse lower that is beginning to look mature. How to get the target area to end the wave ((v)) of A is as follows. I will reference the 3 different […]

-

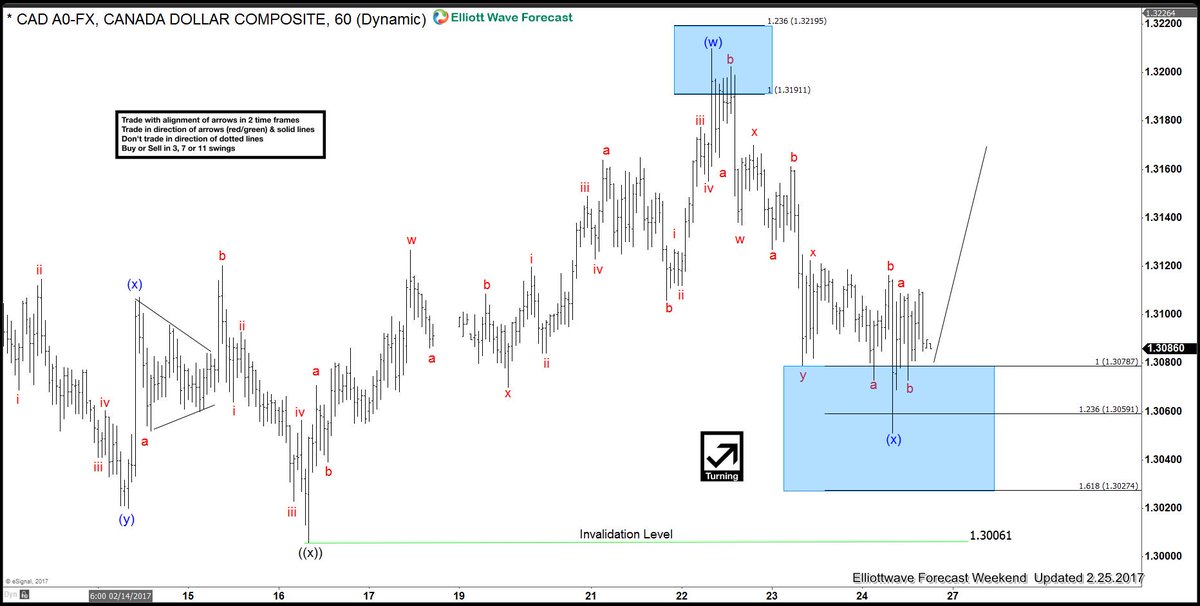

CAD (USDCAD) Elliott Wave Forecasting the rally

Read MoreIn this technical blog we are going to take a quick look at the USD CAD Elliott wave structure from January 31 cycle (1.2967), in which the pair was expected to do a double three Elliott wave, where wave Minute wave ((w)) ended at 1.3209 & Minute wave ((x)) at 1.3006, up from there Minutte wave (w) […]

-

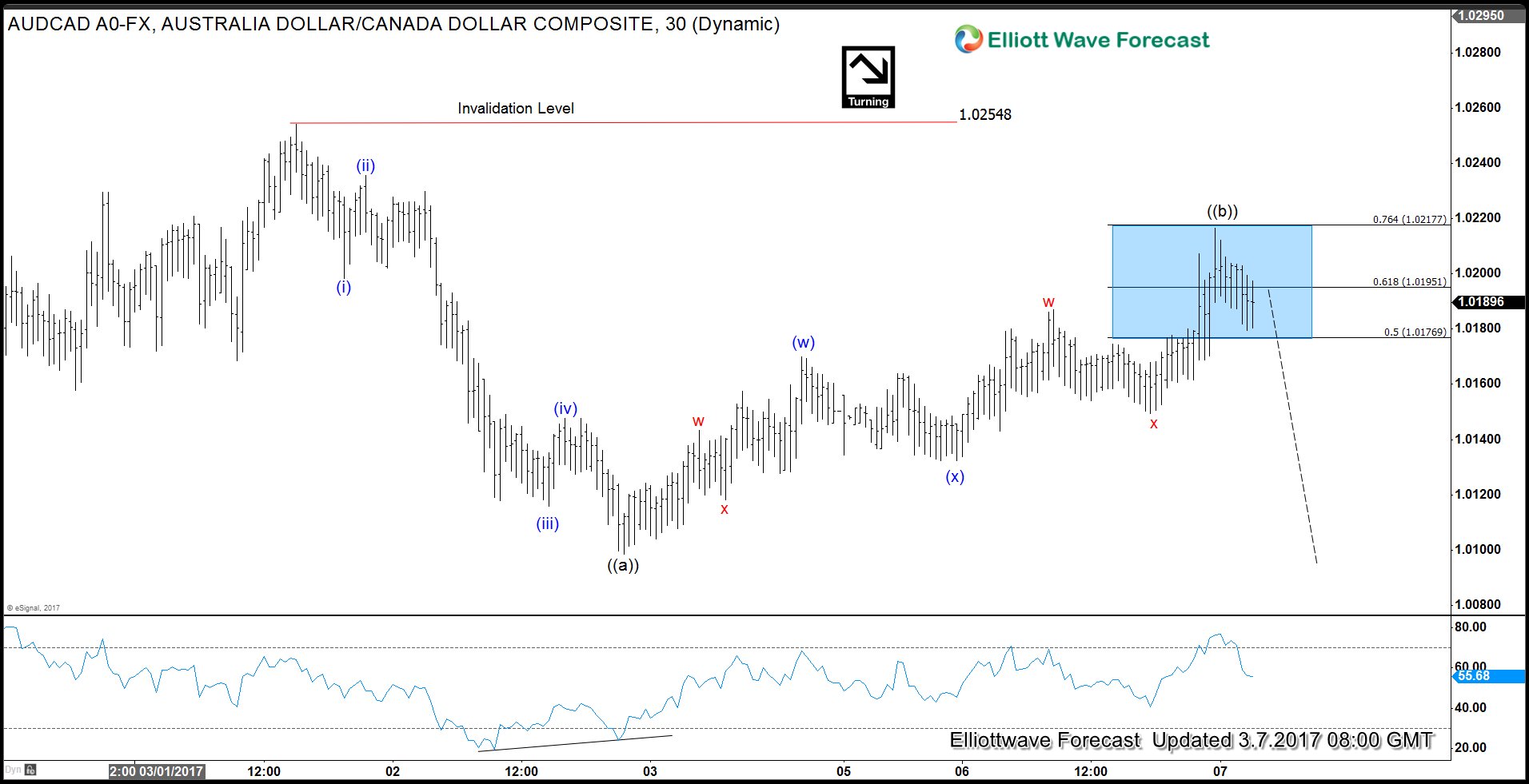

AUDCAD Elliottwave Intraday View

Read MoreShort term Elliottwave structure of AUDCAD from 3/1 peak (1.025) looks to be showing an impulse structure with a nice 5 waves subdivision where Minuette wave (i) ended at 1.0198, Minuette wave (ii) ended at 1.0235, Minuette wave (iii) ended at 1.0115, Minuette wave (iv) ended at 1.0147, and Minuette wave (v) ended at 1.0098. We […]

-

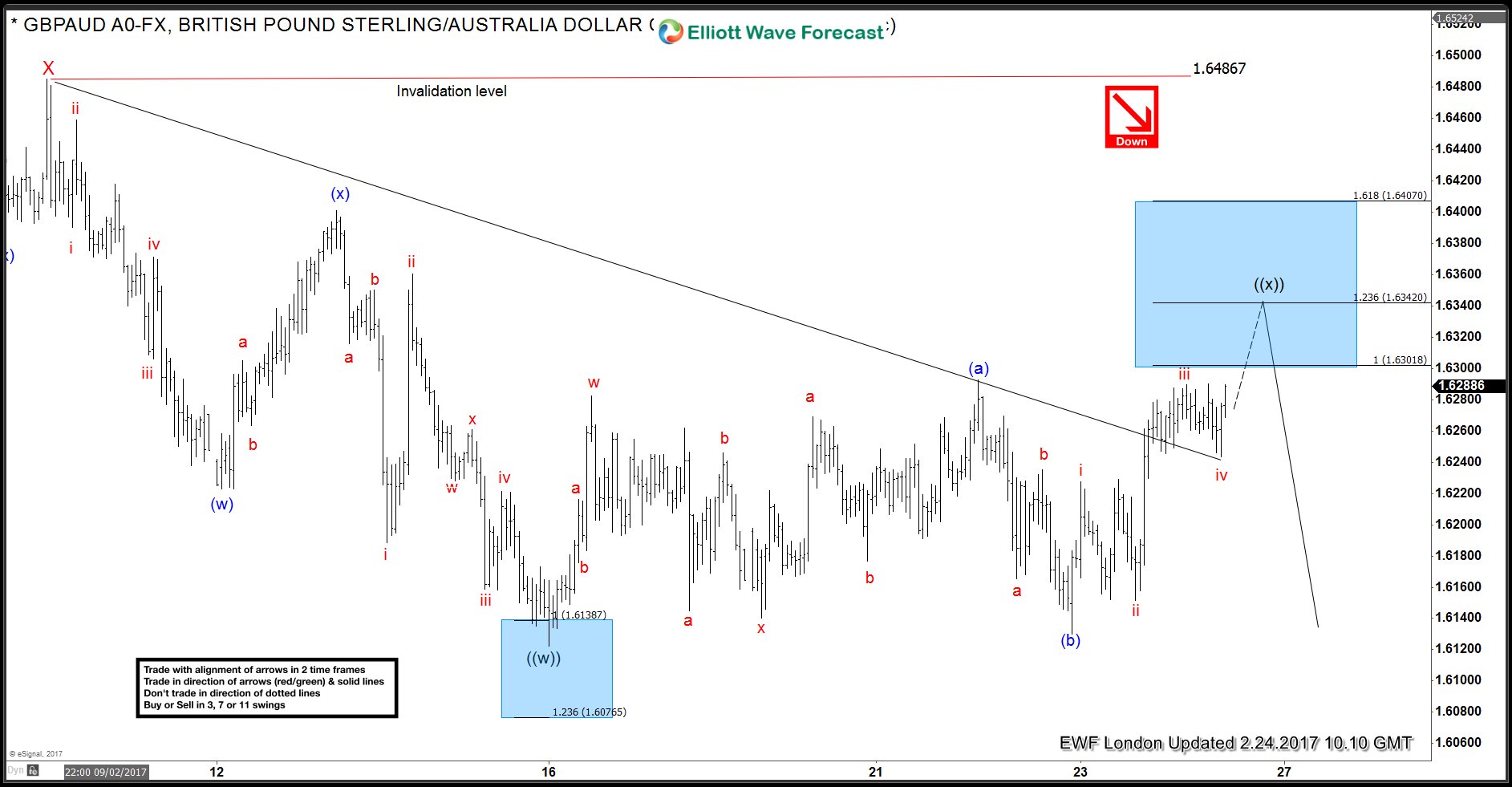

GBPAUD: Elliott waves calling the move lower

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of GBPAUD published in members area of www.elliottwave-forecast.com. We’re going to explain the structure and see how we were forecasting decline. GBPAUD 4 Hour update 01.23.2017 Elliott Wave structure is showing incomplete bearish sequences in […]

-

Wheat Futures (ZW #F) forecasting the rally

Read MoreThe chart below is ZW #F h4 update from 2.6.2017. Price structure is showing incomplete bullish sequences in the cycle from the 01/12 ( red 2) low. As of right now we can count 5 swings from the mentioned level. Fifth swing ended at 437’4 high and 6th swing is about to complete. It’s Marked […]