Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

USDJPY: Forecasting the Rally Based on Elliott Wave Structure

Read MoreUSDJPY extended the rally this week and exceeded the peak seen on 20th May 2020. In this article, we would look at the forecast from start of the week and how we called it higher. We will show some charts presented to clients this week and explain the reason for calling the extension higher and […]

-

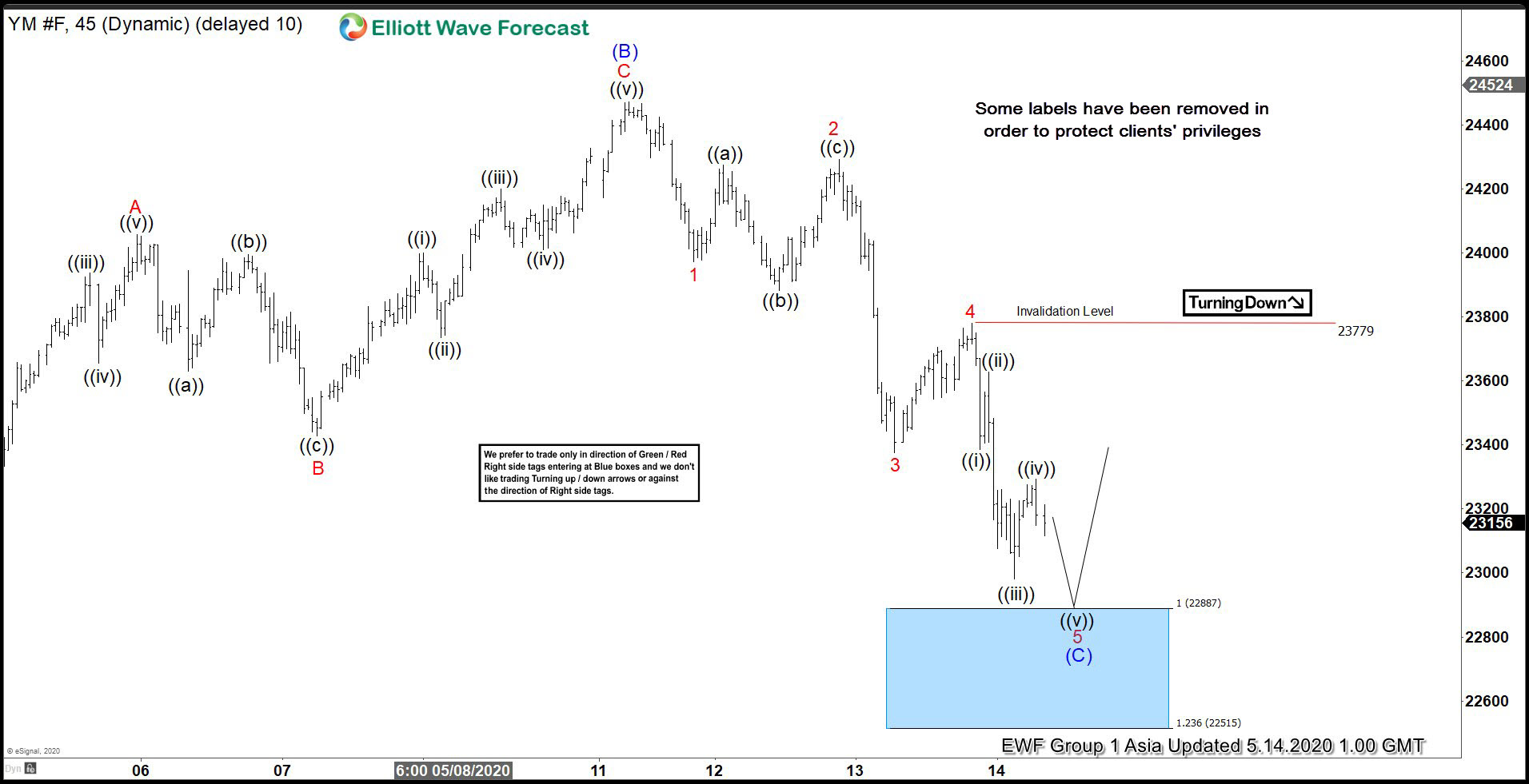

INDU ( $YM_F ) Found Buyers After Elliott Wave Zig Zag Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of INDU. As our members know INDU has recently given us pull back against the March 18058 low. Pull back unfolded as Elliott Wave Zig Zag Pattern. We expected buyers to show at the Blue Box […]

-

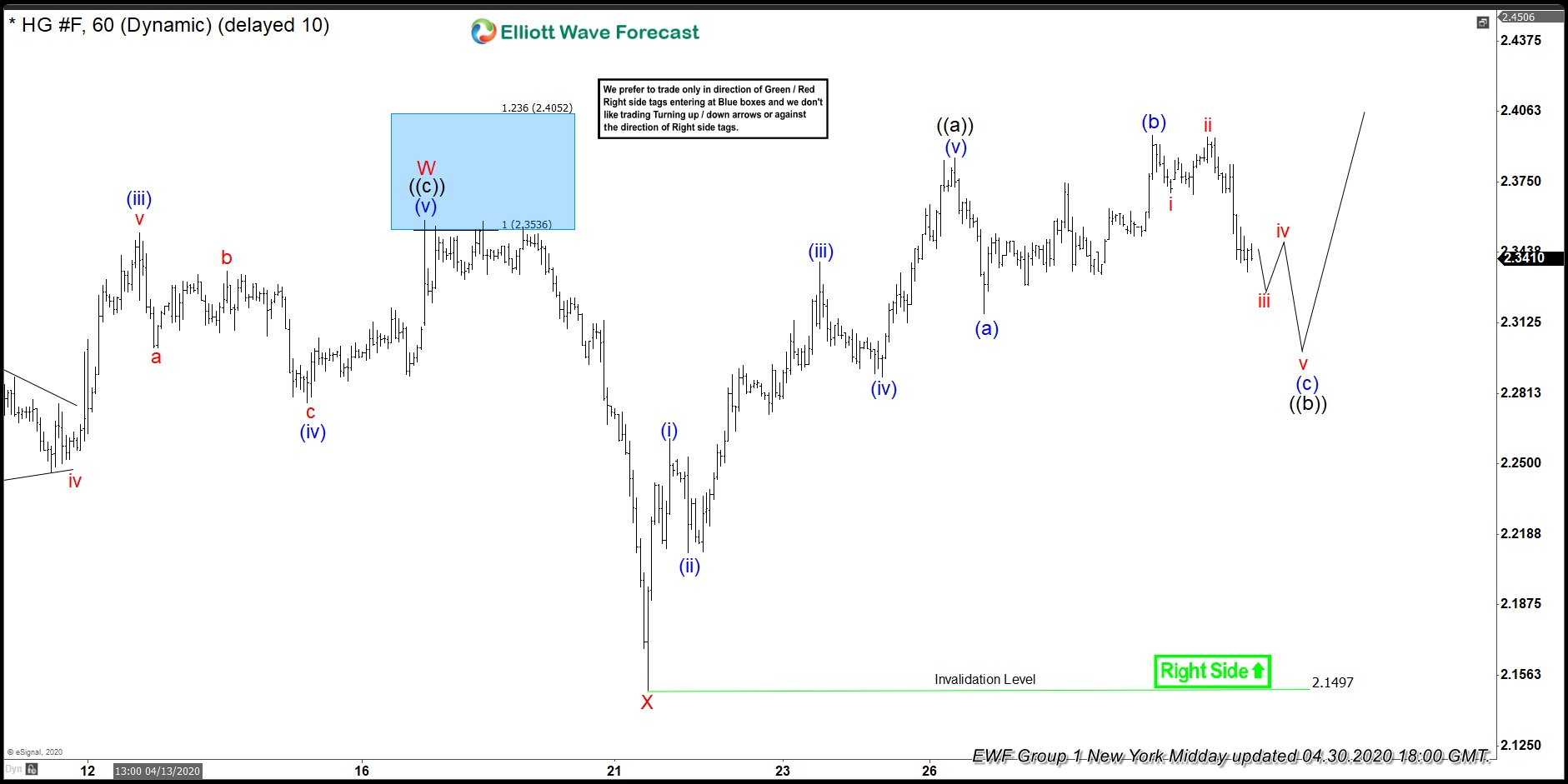

Copper ( $HG_F ) Forecasting The Rally After Elliott Wave Flat

Read MoreHello fellow traders. In this technical blog we’re going to talk about Copper. As our members know, Copper has incomplete bullish sequences in the cycle from the March 19th low. Break of 04/16 peak made cycle from the March (1.9715) low incomplete to the upside. The commodity is now bullish against the 2.1475 low. Consequently, […]

-

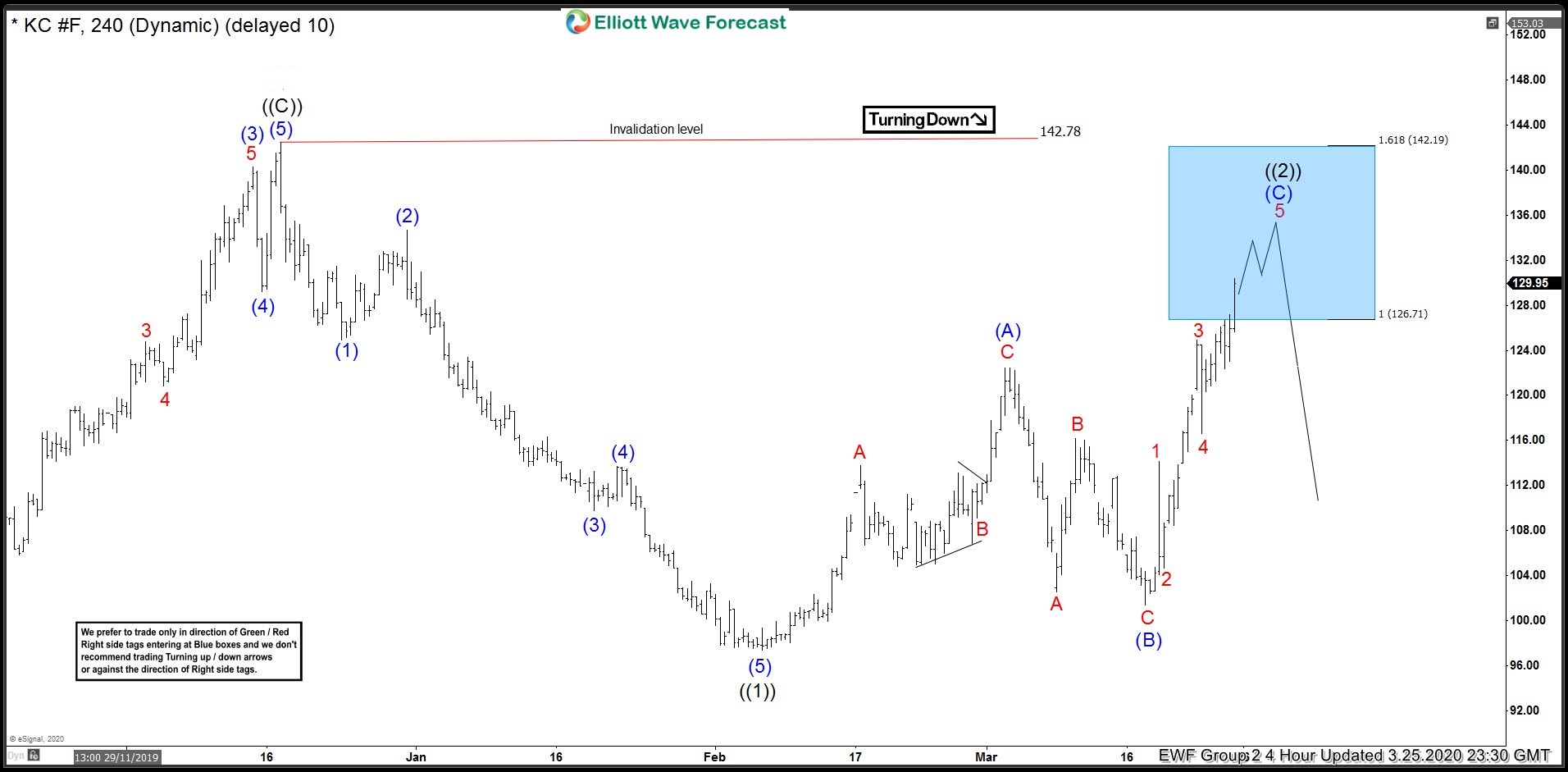

COFFEE ( $KC_F ) Found Sellers After Elliott Wave Flat Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a look at the Elliott Wave charts of COFFEE Futures ( $KC_F ) published in members area of the website. The Commodity corrected the cycle from the 142.78 peak recently, when recovery unfolded as Regular Elliott Wave Flat structure. In further text we’re going […]

-

Elliott Wave View: Ten Year Notes Remain Supported

Read MoreElliott Wave view in Ten Year Notes (ZN_F) suggests that it has a bullish sequence from October 2018 low, favoring more upside. Near term, rally to 140.24 ended wave I and pullback to 133.2 ended wave II. Internal of wave II unfolded as a double three Elliott Wave structure. Down from 140.24, wave ((W)) ended […]

-

10-Year Treasury (ZN) Drops Below 0.5% As Fear Grips Market

Read MoreOver the weekend, a series of events has rocked the market. Investors continue to brace for economic fallout as coronavirus continues to spread around the world. Outside Mainland China, Italy now has the highest infection rate and death toll. It has imposed draconian measure similar to China by locking down Lombardy region and 14 other […]