It’s Just Hard for Us to Be Still.

The very essence of trading is assertive actions to create alpha. Sometimes, though, the hardest thing to do as a trader is nothing at all. I can definitely speak from personal experience during my trading career that I felt like there were times that I had to trade. Whether it was the urgency to make a certain % or nominal $ gain for a specific measured amount of time in hopes of attracting outside capital or simply to pay the bills back when I first started putting my own small amount of capital at high risk, most of those periods of self-forced highly active trading led to less than desirable results. Trading just to trade with no sound system or methodology is a recipe for disaster in the world of the markets. I read a lot about successful traders and I’m always comparing their beginnings to where they are now or where they were at the pinnacle of their success. Most will tell you one of the worst things that happened to them was they made a lot of money right out the gates and really couldn’t explain how, why, or what attributed to such success.

Can Winning in the Beginning Be a Bad Thing?

You may be scratching your head right now asking, “Why would being so successful at the beginning be such a detriment?” Well it’s not, in itself, a detriment. In fact I believe it’s great and what America was truly founded upon. Taking risks in hopes of a better life. Putting your money where your mouth is, so to speak. So this blog isn’t to bash success, capitalism, etc. as I’m no hater to any form of success as long as it’s legal or doesn’t impose restrictions on anyone else’s freedoms. Most traders that are highly successful early on end up giving most, if not all, of their gains right back to market because they had no system that was replicable. They seemed to approach every trading session going on unsubstantiated tips, the opinion of the financial media talking heads, or just because they felt a certain way about any particular instrument. I get it, I’ve been there too. In the beginning everything seemed to work and hardly any trade was a loser. But, I really couldn’t explain why I did what I did with any degree of intelligence be it technical or fundamental reasoning. So, of course, over time I ended up losing a decent amount of money. Looking back now some 15 years later I can honestly state that was probably the most valuable education (including college) that I’ve ever had to go through with regards to not only trading, but life in general.

What I Learned From Some of My Failures and Times of Inconsistent Profitability.

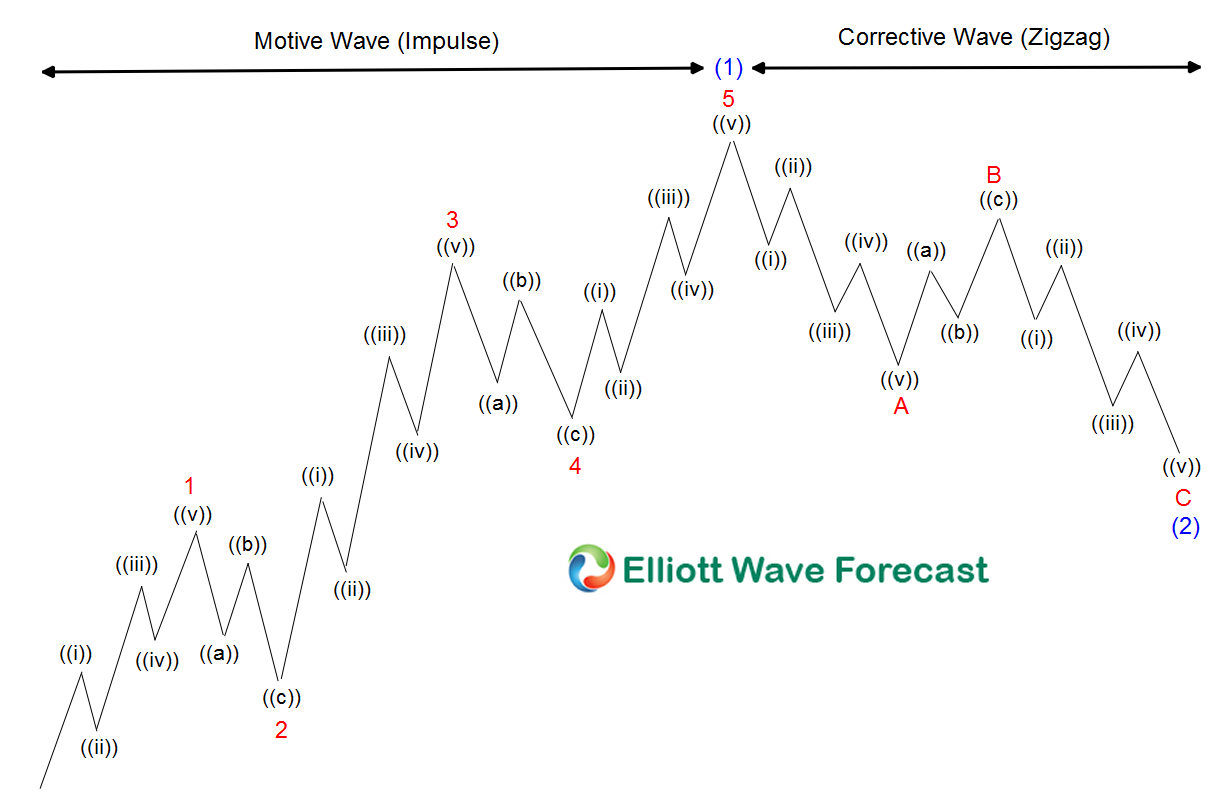

I learned that you have to put the time into anything if you truly want to be successful. And just like we all would just love to hit the next Billion (with a B!) dollar MegaMillions jackpot and call it a wrap, we want it to be easy. Entering the world of trading basically means you’re in the fortune telling business. Think about that…predicting the future. I’m not trying to talk you out of trading so let’s get back to how I fixed my trading self. Luckily, one of my first trading partners introduced me to the principle of the Elliott wave. So, long story very short, I learned all the ins and outs to the last degree by reading/watching/listening to everything I could get my hands on about the wave principle. I spent money on subscriptions to various professional services, videos, and the sort and then went on to live trading practical application. And, that’s where the story ends. My life was forever changed and I went on to be the most successful trader in history…Well, that’s what I thought would happen. While all the resources I investigated taught me something, they didn’t teach me how to apply the wave principle properly basically due to the highly subjective nature of counting Elliott waves.

Why We Need More Than Pure Elliott Wave.

Back in my beginnings as an Elliott wave trader there were always the elusive alternate (or multiple alternate) count(s) that seemed to confuse rather than provide any actionable analysis. Now, I’m not blaming them (the educational providers) for my inconsistencies with profitability using the wave principle as the sole reason to enter, exit, or not trade at all. Back in the day we simply traded the 3 waves back after 5 waves up or vice-versa no matter the direction because we knew (read “thought” here) our wave count was unshakeable. And, we won some and lost some here and there. The bottom line is it just wasn’t consistent enough to solely rely on the interpretation of any wave count be it a primary count or its alternative. What I’m truly saying is none of these services provided a solid mentality of using cycles and sequences to put money at risk with consistent documented results, so we developed one. Now don’t get me wrong I love the Elliott Wave Principle. I believe there are no other market analytical languages out there that compare and here at Elliottwave-Forecast.com (EWF) we use Elliott analysis no doubt, but it isn’t the end all be all.

What Helps Your Elliott Wave Based Trading?

If your trading is struggling I sincerely believe what could really change your trading are our methods of sequence and cycle determination coupled with the new applications we use within the Elliott wave analysis. I can tell you from personal application that it has dramatically decreased the frequency of my trading yet increased the profitability of my trading. Otherwise stated the service EWF provides gives a set methodology of parameters of when to trade, how much to risk, where you are wrong, where to take profit, and a thorough description of why we see what we see and why we’re doing what we’re doing with no after-the-fact cherry-picked analysis to try and “sell” something that isn’t real. Our service was started to help traders make better decisions and be confident when placing hard-earned money as risk, even when that means learning when to NOT take a trade. To take a test drive of our service click here and I hope to see you in the live sessions we provide every trading day.

To your success,

James

Back