In this technical blog, we are going to take a look at the past performance of Palladium ticker symbol $PA_F, 1-Hour Elliott wave Charts that we presented to our members. In which, the cycle from 8/02/2019 low showed a higher high sequence in an impulse structure with the right side up called for more upside to take place. Therefore, our members knew that buying the dips in 3, 7 or 11 swings remain the preferable trade. We will explain the Elliott wave structure & buying opportunity our members took below:

Palladium 1 Hour Elliott Wave Chart

Palladium 1 Hour Elliott Wave Chart from 9/18/2019 London update. In which the metal showed an impulse rally where wave ((iii)) ended $1619.8 high. Down from there, the metal made a wave ((iv)) pullback which was expected to offer buying opportunity in 3, 7 or 11 swings looking for more upside. The internals of that pullback unfolded as a zigzag structure where wave (a) ended at $1577.4 low. Wave (b) bounce ended at $1607.4 high. Wave (c) was expected to reach 100%-161.8% Fibonacci extension area of (a)-(b) at $1565.9-$1539.8 equal legs area. For a potential long side looking for more upside or for 3 wave reaction higher at least.

Palladium Latest 1 Hour Elliott Wave Chart

Here’s Palladium 1 Hour Chart from 9/20/2019 New York update. Showing reaction higher taking place from the blue box area. Allowing members to create a risk-free position shortly after taking the long position from the blue box area. Now as far as it remains above $1563.36 low metal looked to extend higher towards initial target area i.e inverse 123.6%-161.8% Fibonacci extension area of ((iv)) at $1633.2-$1655 area before profit-taking can be seen.

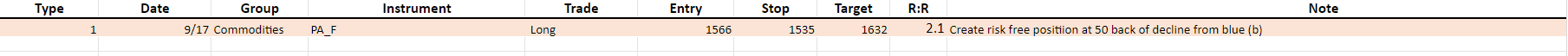

Below is our trade setup presented in the trading journal:

The trade has 2.1 Risk to Reward Ratio. Upon hitting the target, we have $66 points in profit, but in terms of percentage, members profit 1.8% to 3.6%, depending on the risk taken (we recommend between 1% to 2% risk/trade).

Palladium Trade Video Clip from 17 September 2018 Live Trading Room

Keep in mind that the market is dynamic and the view could change in the meantime. Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry. Stop loss and take profit levels with high accuracy and allows you to take a risk-free position, shortly after taking it by protecting your wallet. If you want to learn all about it and become a professional trader. Then join our services with Special 50% discount offer by using this code: 864AA98028.

Back