Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Charting the Decline in Raw Sugar (SB_F)

Read MoreThe sentiment for Raw Sugar (SB_F) has turned sour recently. After bottoming at 10.16 cents in 2015, Raw sugar futures have rallied strongly until it peaked at 24 cents last Fall. In fact, Raw Sugar was one of the best performing commodities in 2016, rising around 30% (see table below as of November last year) […]

-

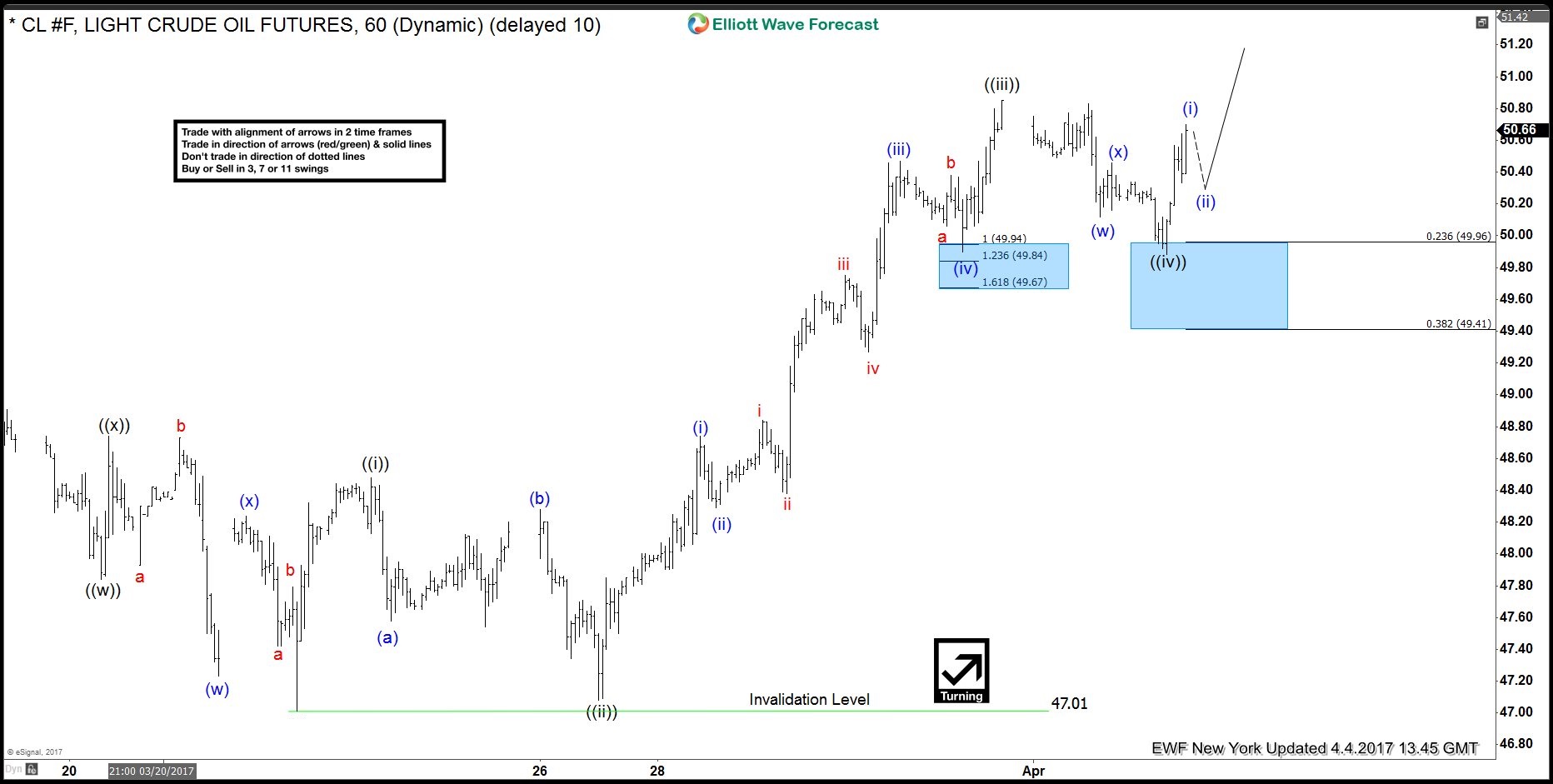

Crude Oil (CL_F) Elliott Wave View: 5 Wave Impulse

Read MoreCrude Oil (CL_F) started rallying from 03/22 low in a bullish structure which still needs another leg higher to become 5 impulsive waves. The instrument ended the minute wave (( iv )) at the 23.6% Fibonacci retracement area 49.96 from which it managed to bounce higher to resume the move to the upside looking to reach the […]

-

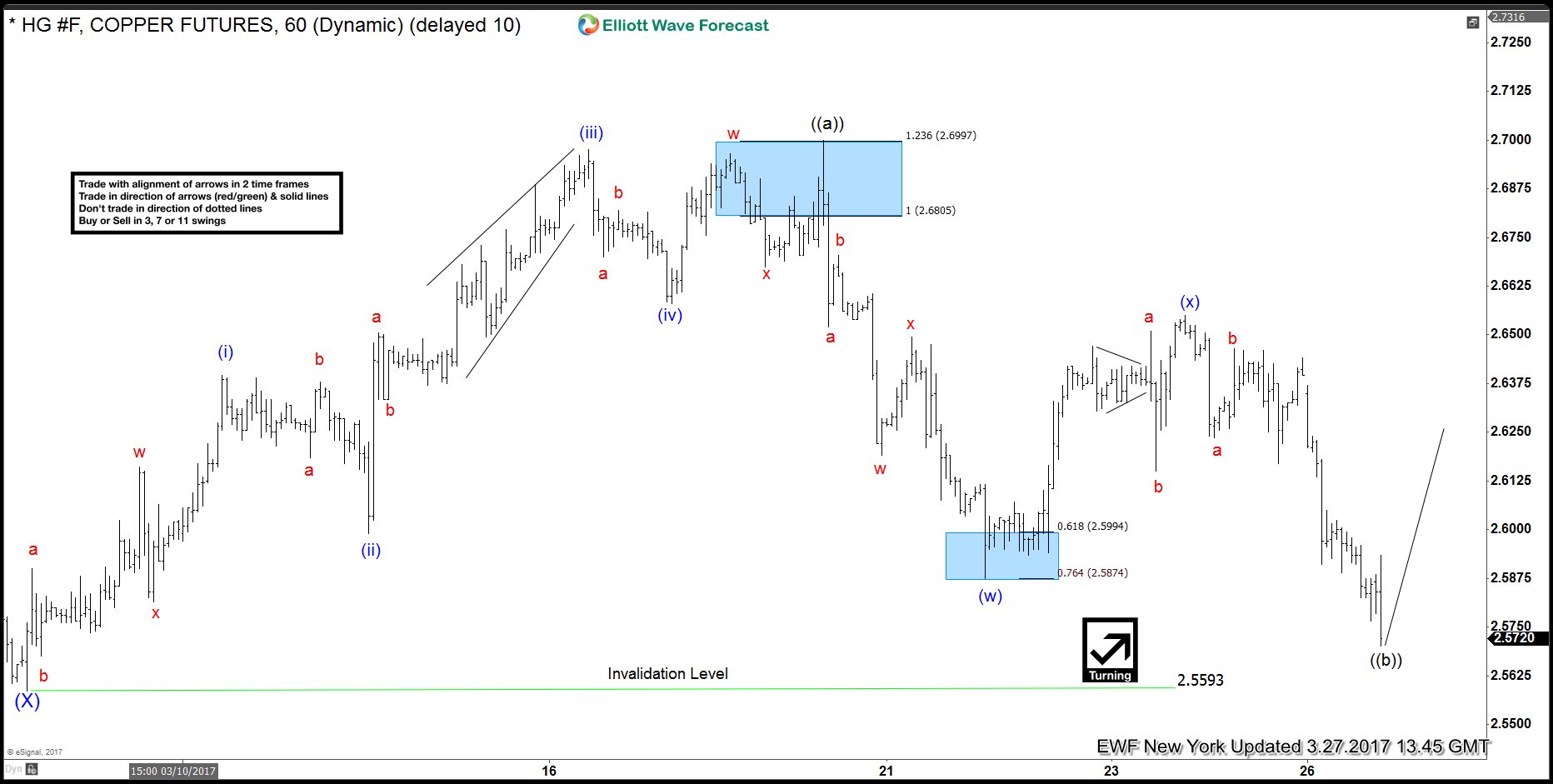

Copper Elliott wave view: 5 waves calling higher

Read MoreIn this technical blog, lets take a quick look at the 1 hour Copper Elliott wave view from March 09 lows. In which the the metal was showing 5 waves bounce from March 09 (2.5593) low & the bounce was impulsive rather then corrective sequence. Thus suggesting the cycle from (2.5593) low could be following the […]

-

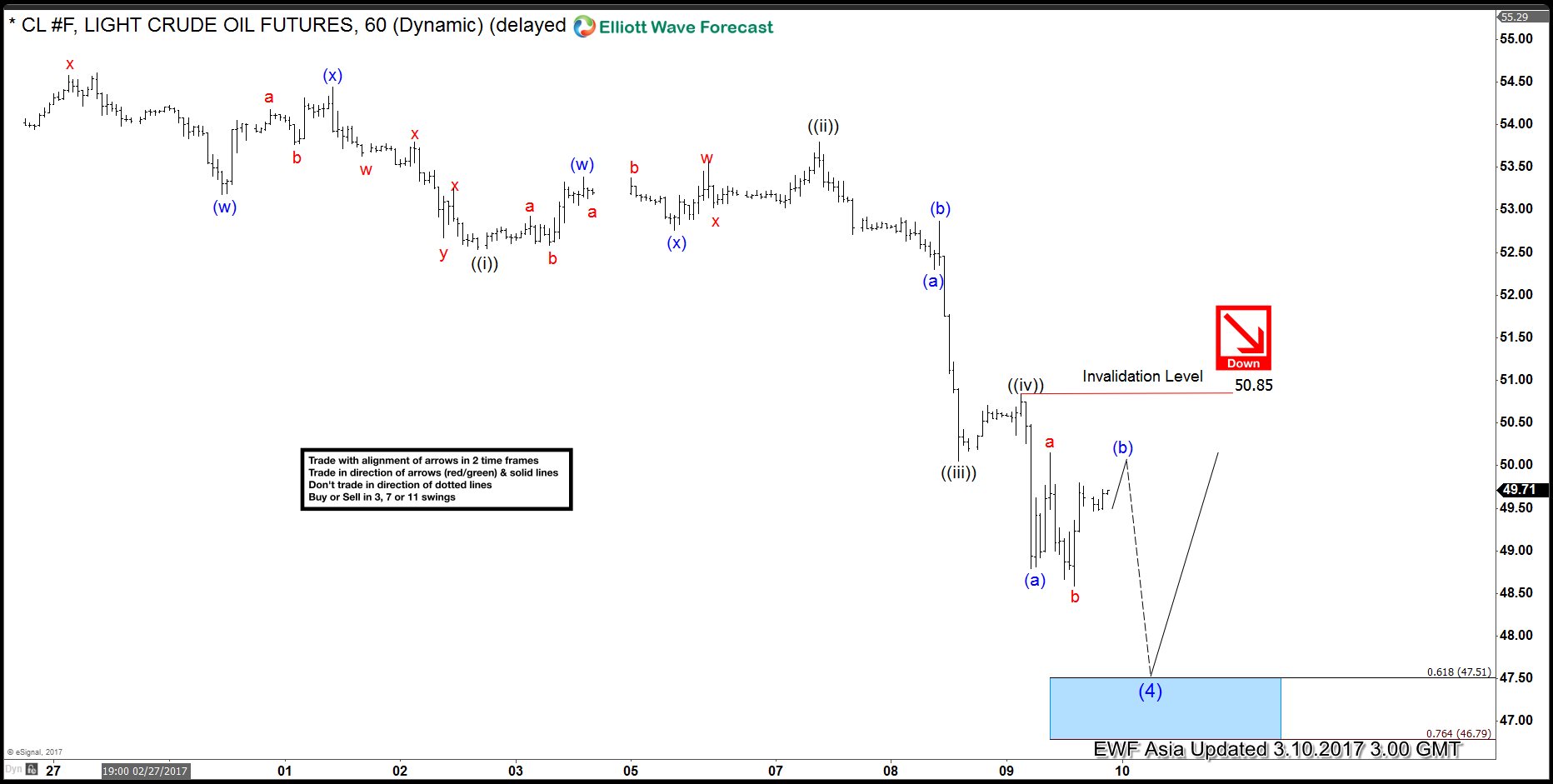

CL_F Elliott Wave View: Bounce expected soon

Read MoreShort term Elliottwave view in Crude Oil (CL_F) suggests that the instrument is currently correcting cycle from 11/14/2016 low (42.21) in 3, 7, or 11 swing before the next leg higher. Revised view suggests the decline starting from 1/3 high (55.24) is unfolding as a flat Elliottwave structure where Minor wave A ended at 50.71 and Minor wave B […]

-

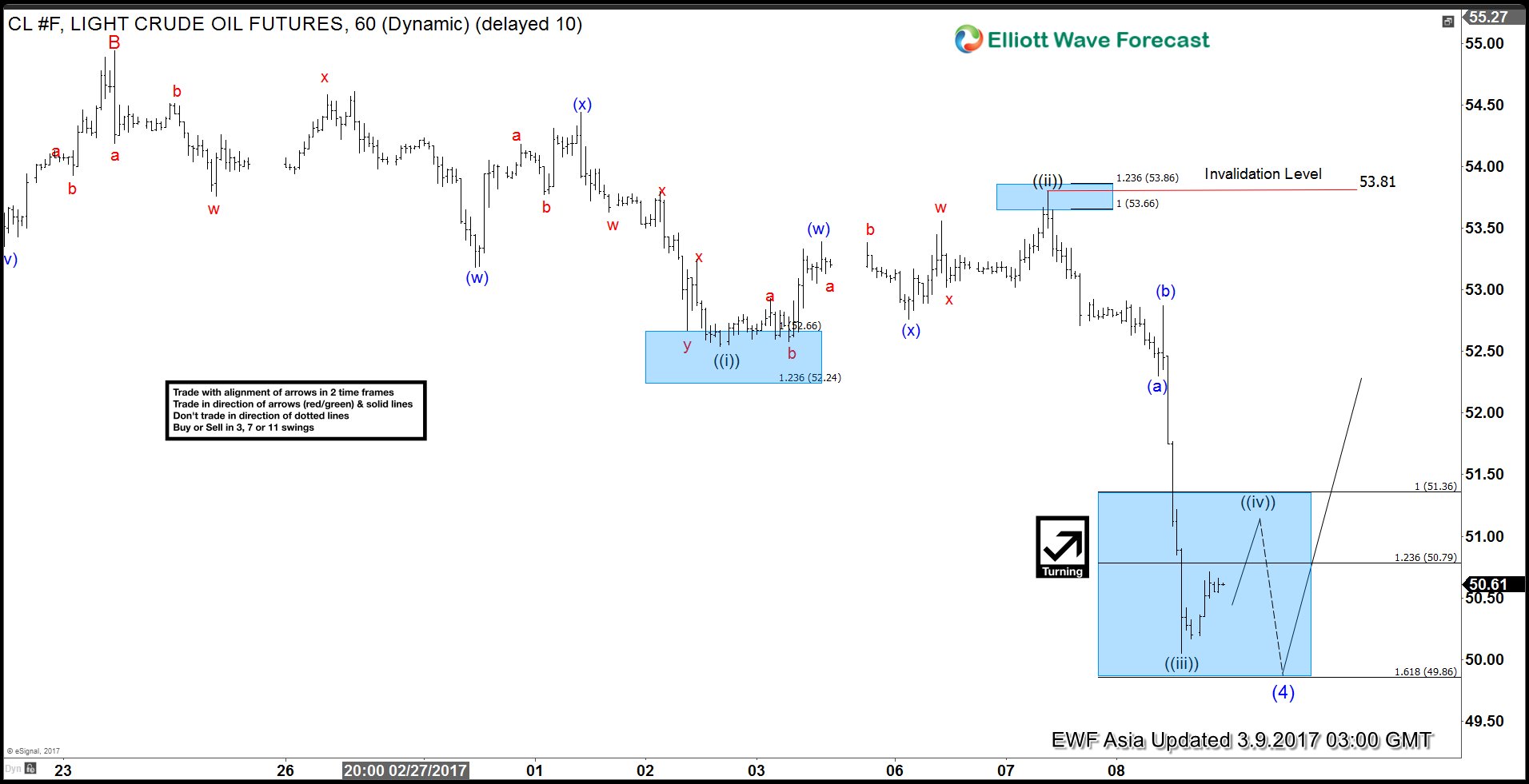

CL_F Elliott Wave View: Ending a Flat Correction

Read MoreShort term Elliottwave view in Crude Oil (CL_F) suggests that the instrument is currently correcting cycle from 11/14/2016 low (42.21) in 3, 7, or 11 swing before the next leg higher. Revised view suggests the decline starting from 1/3 high (55.24) is unfolding as a flat Elliottwave structure where Minor wave A ended at 50.71 and Minor wave B […]

-

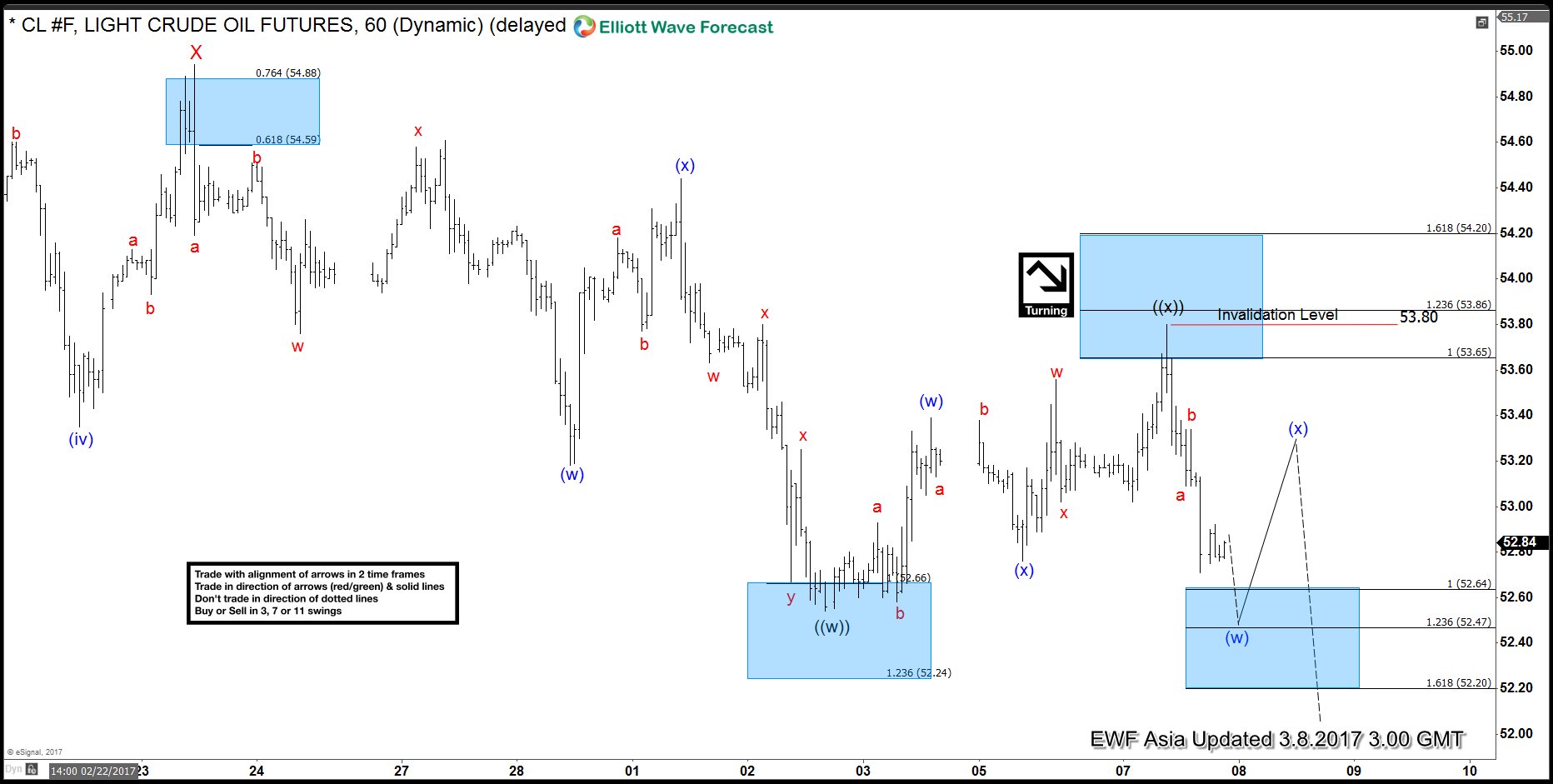

Crude Oil (CL_F) Short-term Elliott Wave View

Read MoreShort term Elliottwave view in Crude Oil (CL_F) suggests that the instrument is currently correcting cycle from 11/14/2016 low (42.21) in 3, 7, or 11 swing before the next leg higher. The decline starting from 2/23 high (54.94) is unfolding as a double three Elliottwave structure where wave ((w)) ended at 52.54 and wave ((x)) ended […]