Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

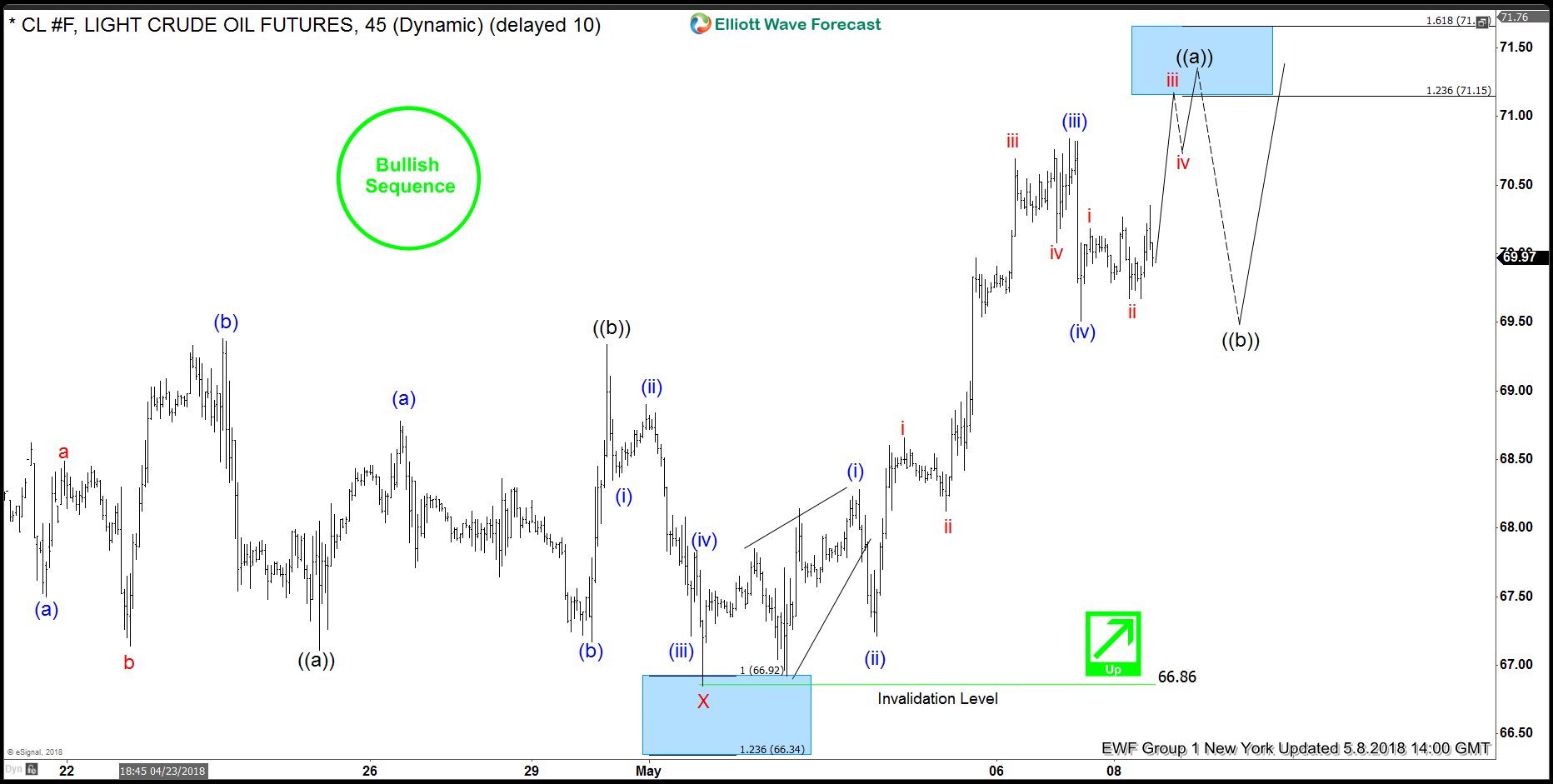

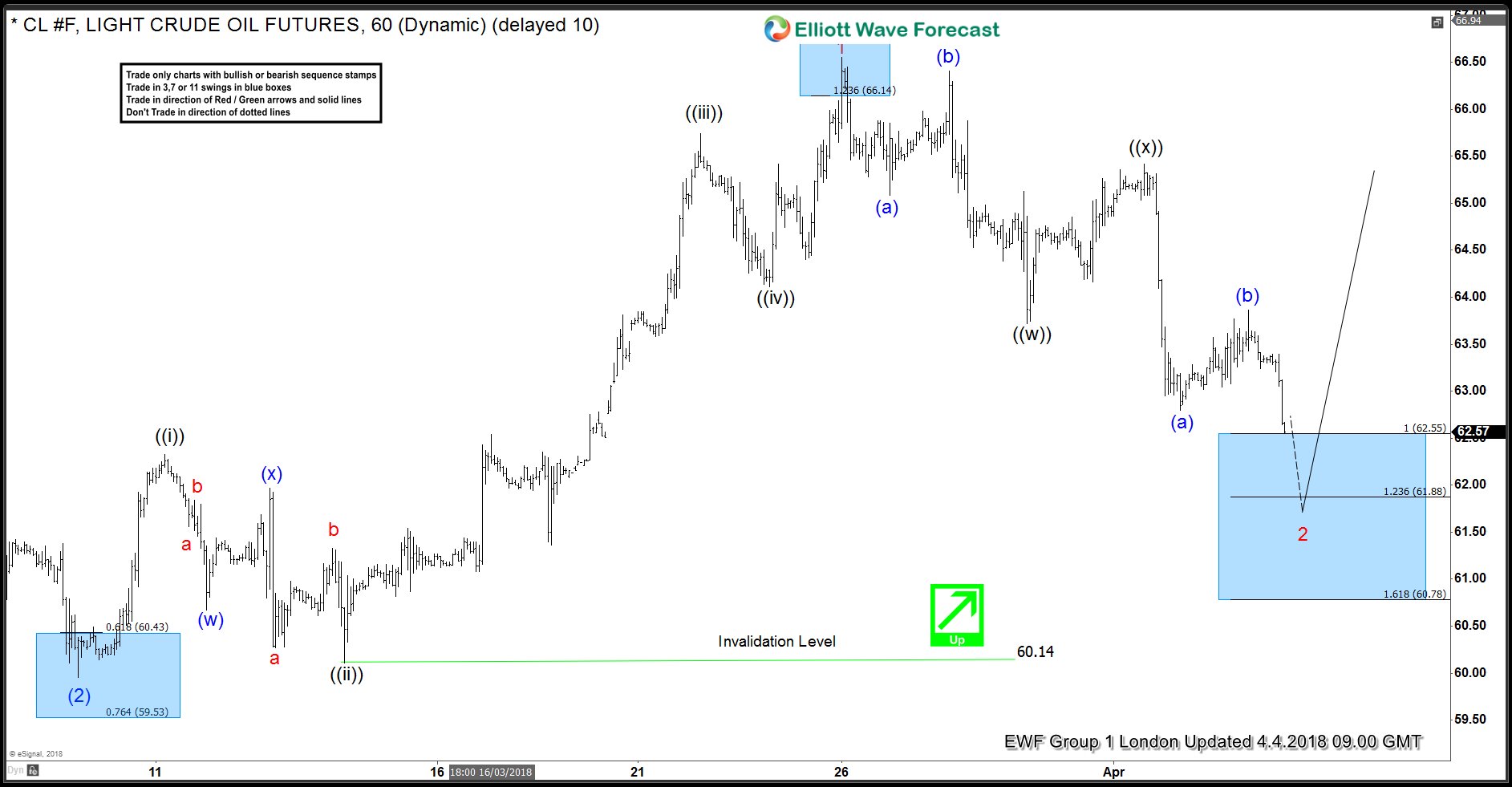

Oil Elliott Wave Analysis: Forecasting And Trading The Rally

Read MoreIn this blog, I want to share some short-term Elliott Wave charts of Crude Oil which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 05/02/18 calling for more upside after ending the correction to the cycle from 09/04/18 in an Elliott Wave Flat correction in […]

-

How US Decision on Iran Deal May Affect Crude Oil Price

Read MoreOn Tuesday at 2 PM Eastern Time, U.S President Donald Trump is expected to announce decision whether he will withdraw from the 2015 Iran nuclear deal. Trump has long been known to criticize the 2015 accord, known as JCPOA (Joint Comprehensive Plan of Action). The deal was originally signed by Iran, the Obama Administration., Russia, […]

-

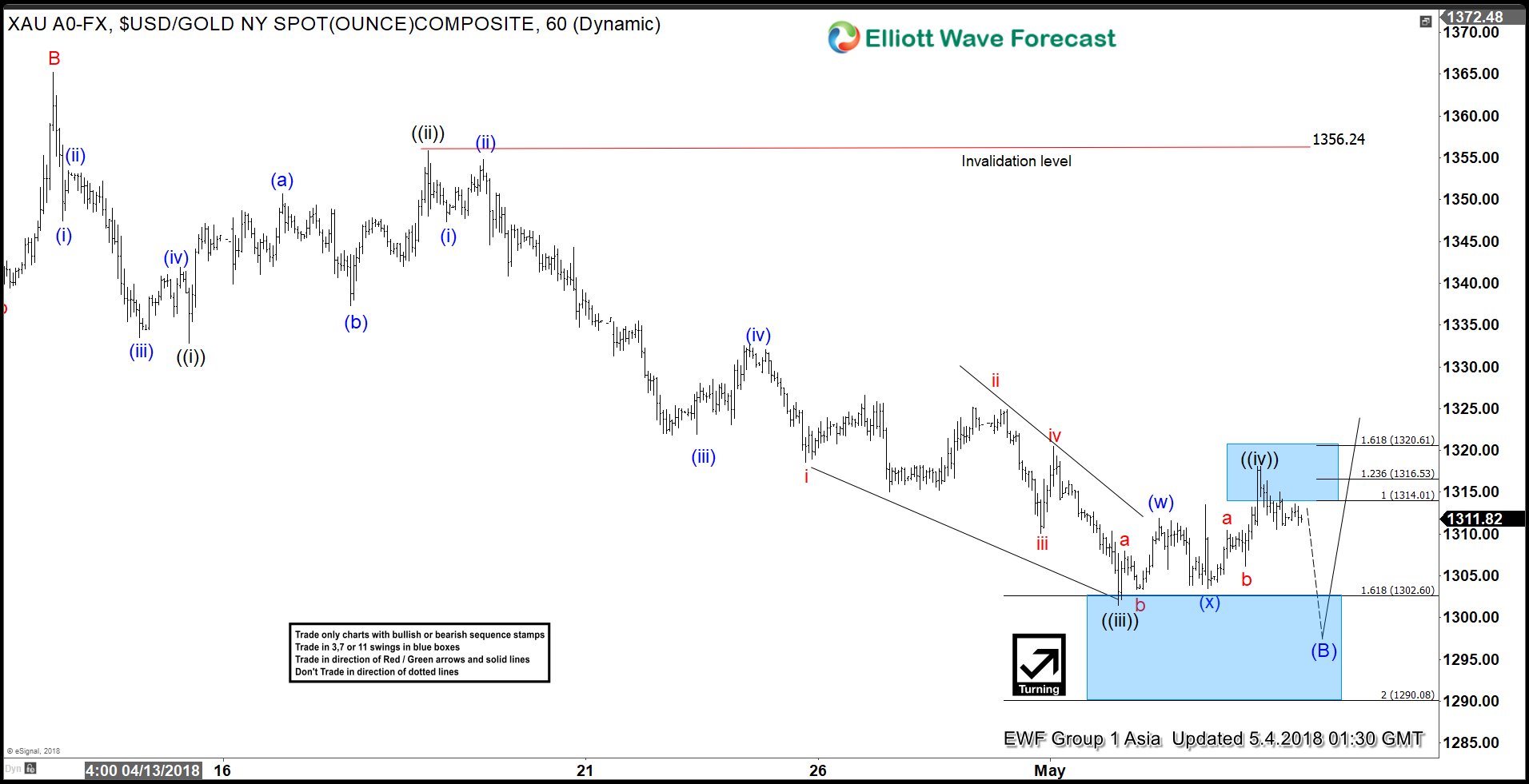

Elliott Wave View: Gold Entering Buying Areas

Read MoreGold short-term Elliott Wave view suggests that the rally to 4/11 high at 1365.24 ended Minor wave B. Below from there, the decline is unfolding as an impulse Elliott wave structure in Minor wave C of (B) lower. This structure forms a bigger FLAT Elliott Wave structure which starts from 1/25 peak. Internals of each leg to […]

-

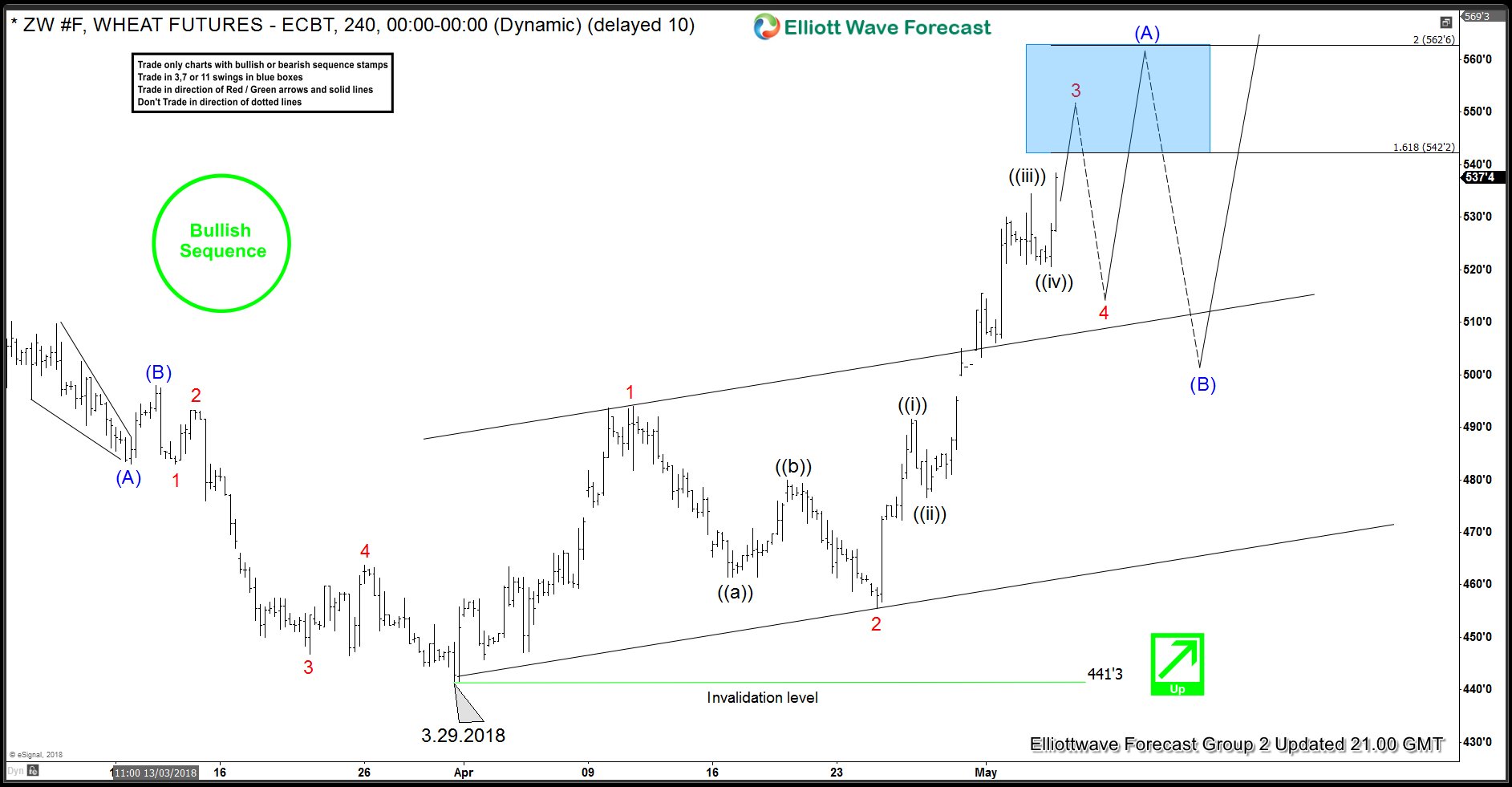

Wheat Futures Break Above March 2018 Peak. What’s Next?

Read MoreA couple of days ago, we saw ZW #F (Wheat Futures) breaking above 3.2.2018 peak with an impulsive looking rally. Aim of this blog is to take a closer look at the rally from 3.29.2018 low and also look at the implications of the break above 3.2.2018 peak. Wheat Futures: Impulsive Elliott Wave Rally From […]

-

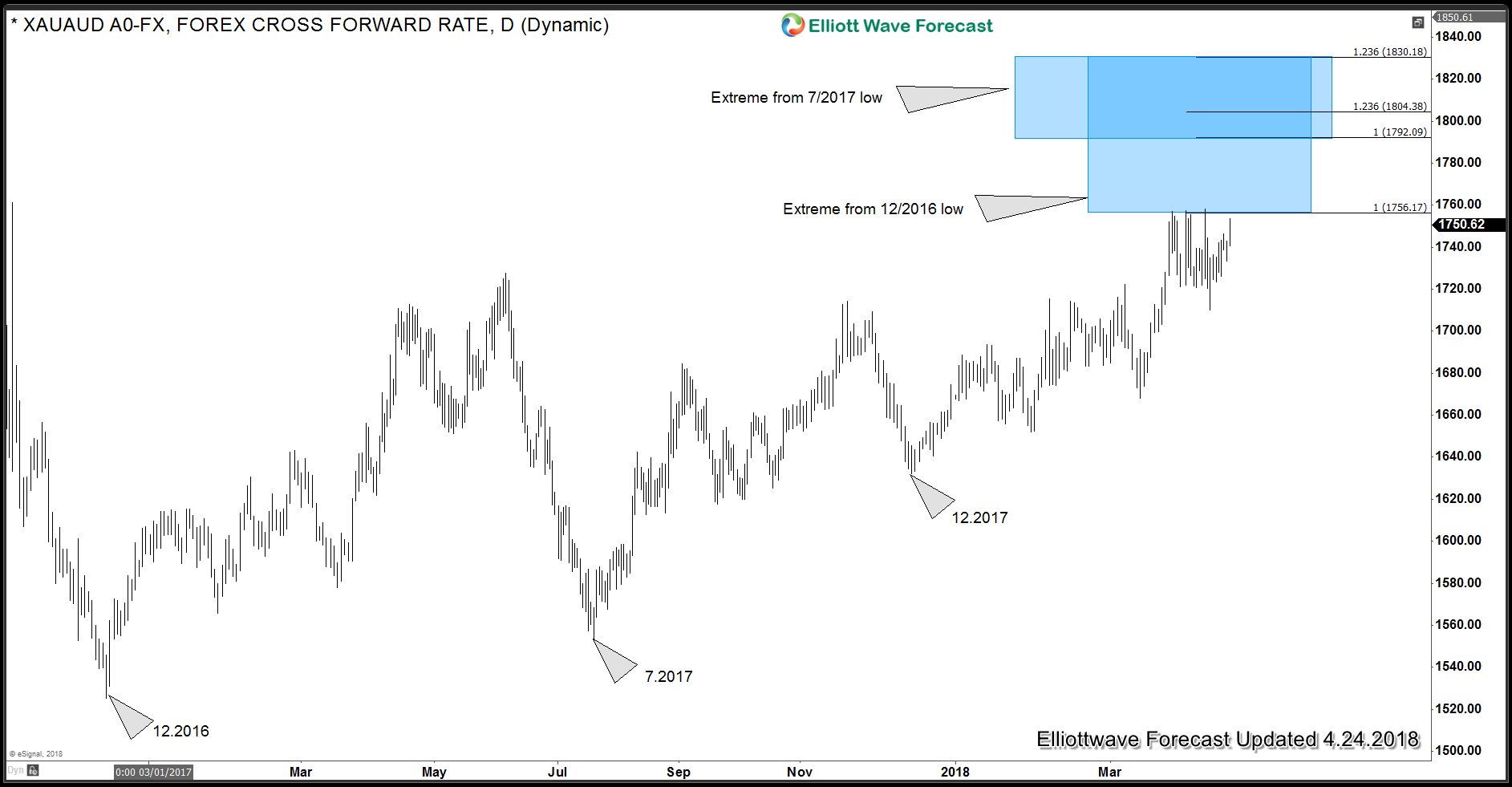

Gold versus Australian Dollar and British Pound

Read MoreIn this blog, we will take a look at Gold charts against US Dollar, AUD and GBP. Back in June 2017, we mentioned that XAUAUD should hold the low at December 2016 and turn higher. It did hold December 2016 lows and turned higher as expected. It has now reached the initial target at 1755 […]

-

OIL ( CL_F ) Forecasting the Rally After Double Three Pattern

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of OIL published in members area of the website. As our members know, we have been favouring the long side, suggesting everyone to avoid selling. Finally on April 11th , we got break of March 26th peak and commodity […]