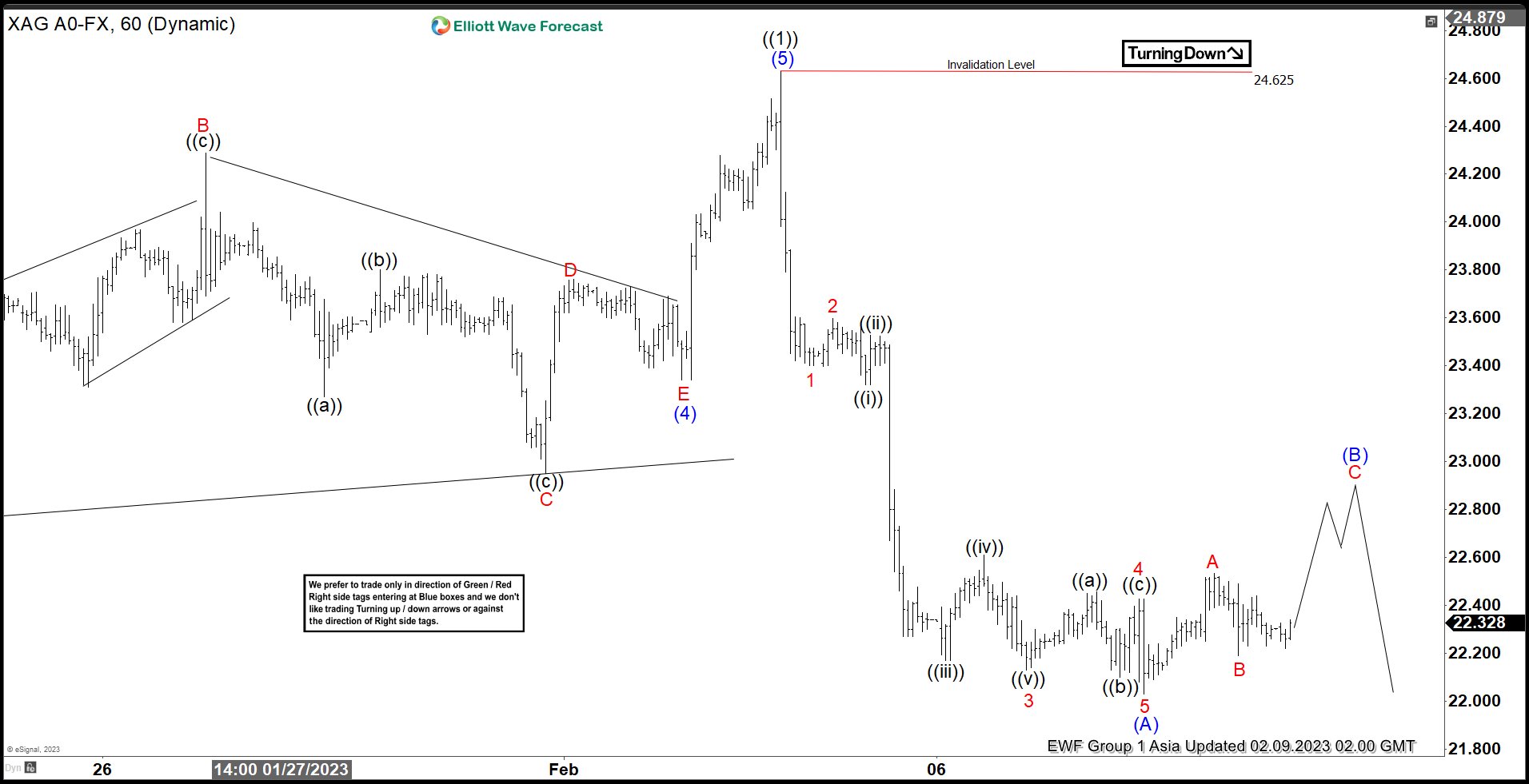

Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Silver Ended 5 Waves Elliott Wave Structure

Read MoreSilver (XAGUSD) ended cycle from 9.1.2022 low and now correcting that cycle before the rally resumes. This article and video look at the Elliott Wave path.

-

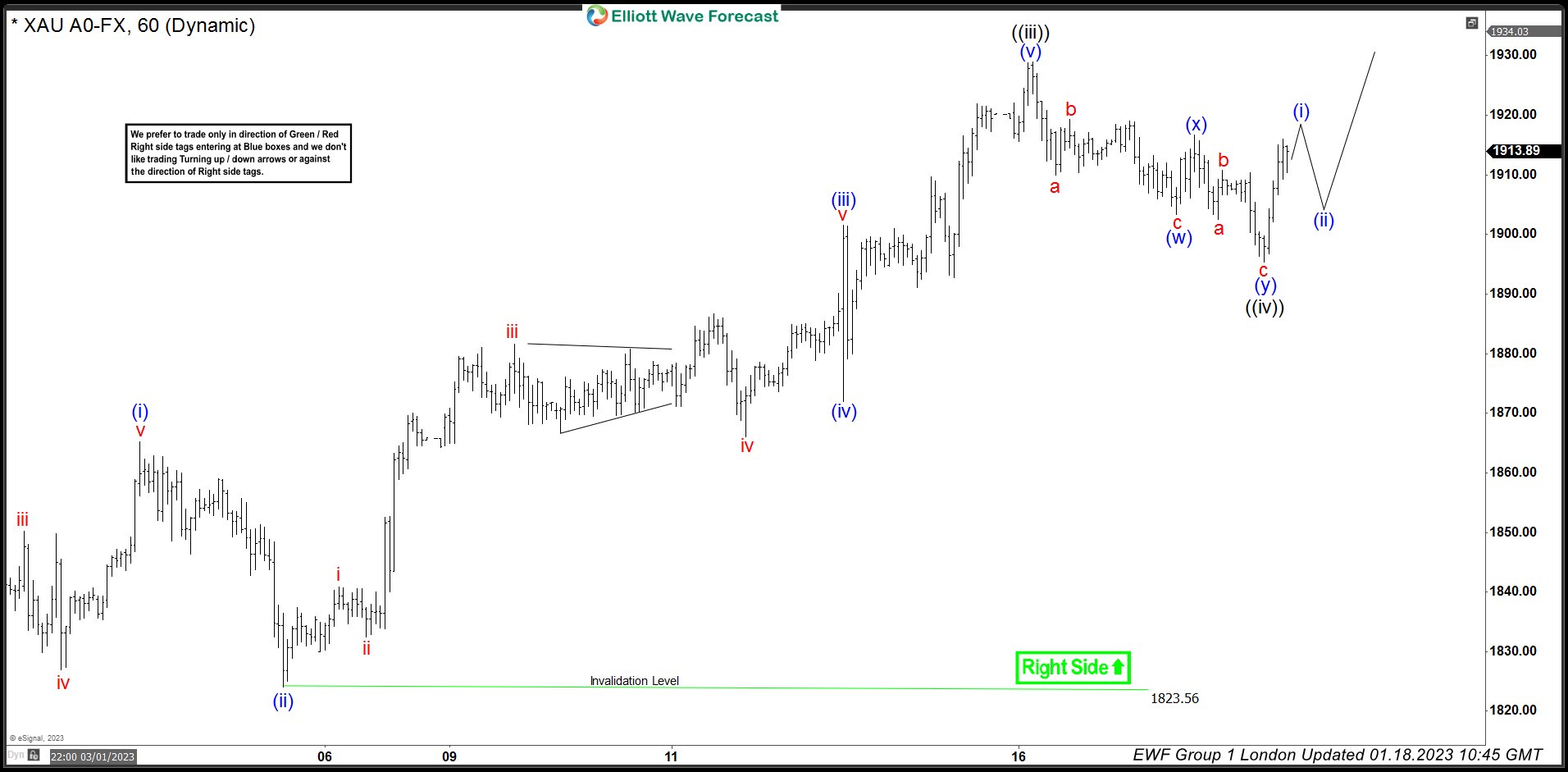

Gold (XAUUSD) Rallying in a Nesting Elliott Wave Impulse

Read MoreGold (XAUUSD) is rallying as a nesting impulse from 11.23.2022 low. This article and video look at the Elliott Wave path for the metal.

-

XAU/USD Forecasting the wave ((v)) higher

Read MoreHello Traders in this article we will see how we were forecasting XAU/USD to make the next leg higher within wave ((v)). Gold since it found support back from 09.28.2022 it has been in a bullish cycle. Since then it has been creating incomplete bullish sequences. Here at Elliott Wave Forecast we use incomplete sequences […]

-

Elliott Wave Outlook Suggests Oil (CL) Should Continue Higher

Read MoreOil shows a bullish sequence from 12.10.2022 low favoring more upside. This article and video look at the Elliott Wave path.

-

Copper (HG) Rallies in a Nesting Impulse According to Elliott Wave

Read MoreCopper rallies from 9.28.2022 low as a nesting impulse favoring more upside. This article and video look at the Elliott Wave path.

-

Natural Gas (NG): A Look at Elliott Wave Decline and Target Area

Read MoreNatural Gas (NG) has lost over 63% in value since the peak in August 2022. It has been a rather sharp decline with a sizeable recovery in the middle before the decline resumed again. Today, we will take a look at Elliott Wave structure of the decline from August 2022 peak, show some charts from […]