Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Lithium ETF (LIT) Should See More Downside To Reach A Blue Box

Read MoreThe Global X Lithium & Battery Tech ETF (LIT) invests in the full lithium cycle, from mining and refining the metal, through battery production. The Global X Lithium & Battery Tech ETF (LIT) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global […]

-

Platinum (PL) Ended Correction and Resumes Higher

Read MoreIn our last blog from December 2022, we wrote that Platinum is ready to rally in 2023 after a 3 waves pullback. Fast forward 3 months later, the pullback has likely completed. The metal can start to resume higher in months to come. Below we will look at the technical outlook using Elliott Wave. Platinum […]

-

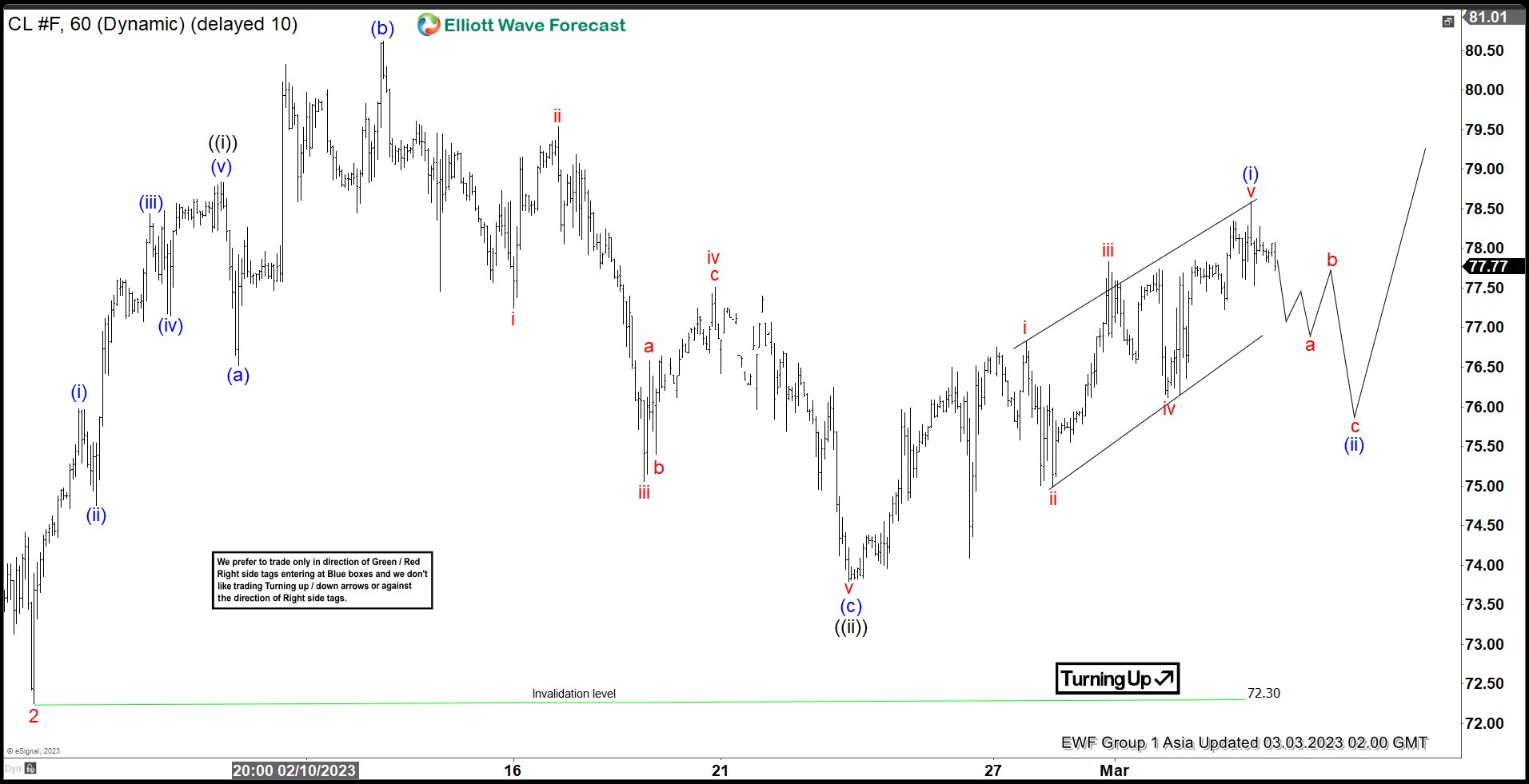

Elliott Wave View: Sideways Price Action in Oil (CL) May Resolve to the Upside

Read MoreOil (CL) shows rallies as an impulse from 12.9.2022 low favoring more upside. This article and video look at the Elliott Wave path.

-

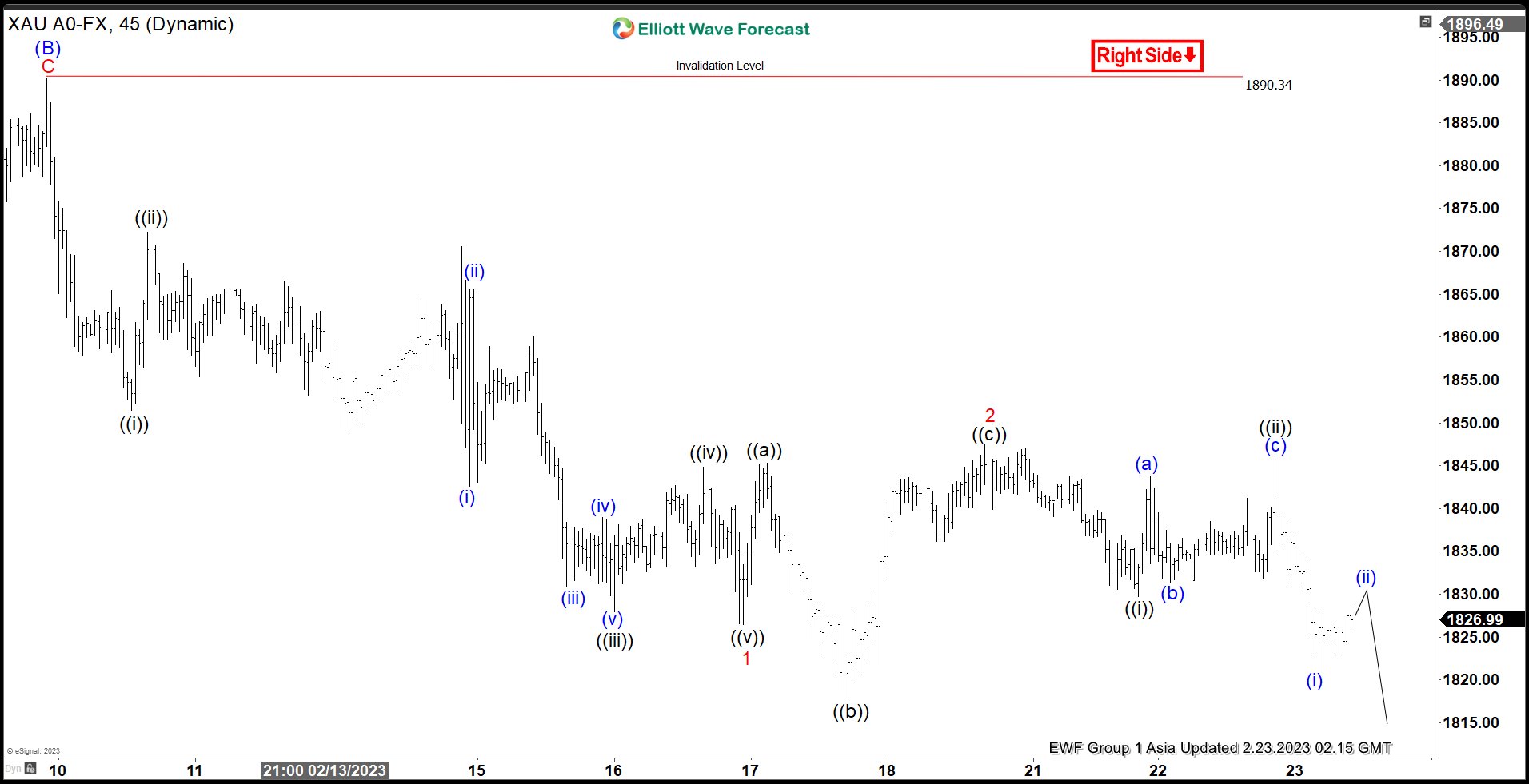

Elliott Wave Suggests Gold (XAUUSD) Still Has Scope to Extend Lower

Read MoreGold (XAUUSD) is correcting cycle from 9.28.2022 low and has scope to extend lower. This article and video look at the Elliott Wave path.

-

Elliott Wave Projects Oil Pullback to Find Buyers

Read MoreOil cycle from 12.10.2022 low is in progress as an impulse. Dips should find support in 3, 7, 11 swing. This article & video look at the Elliott Wave path.

-

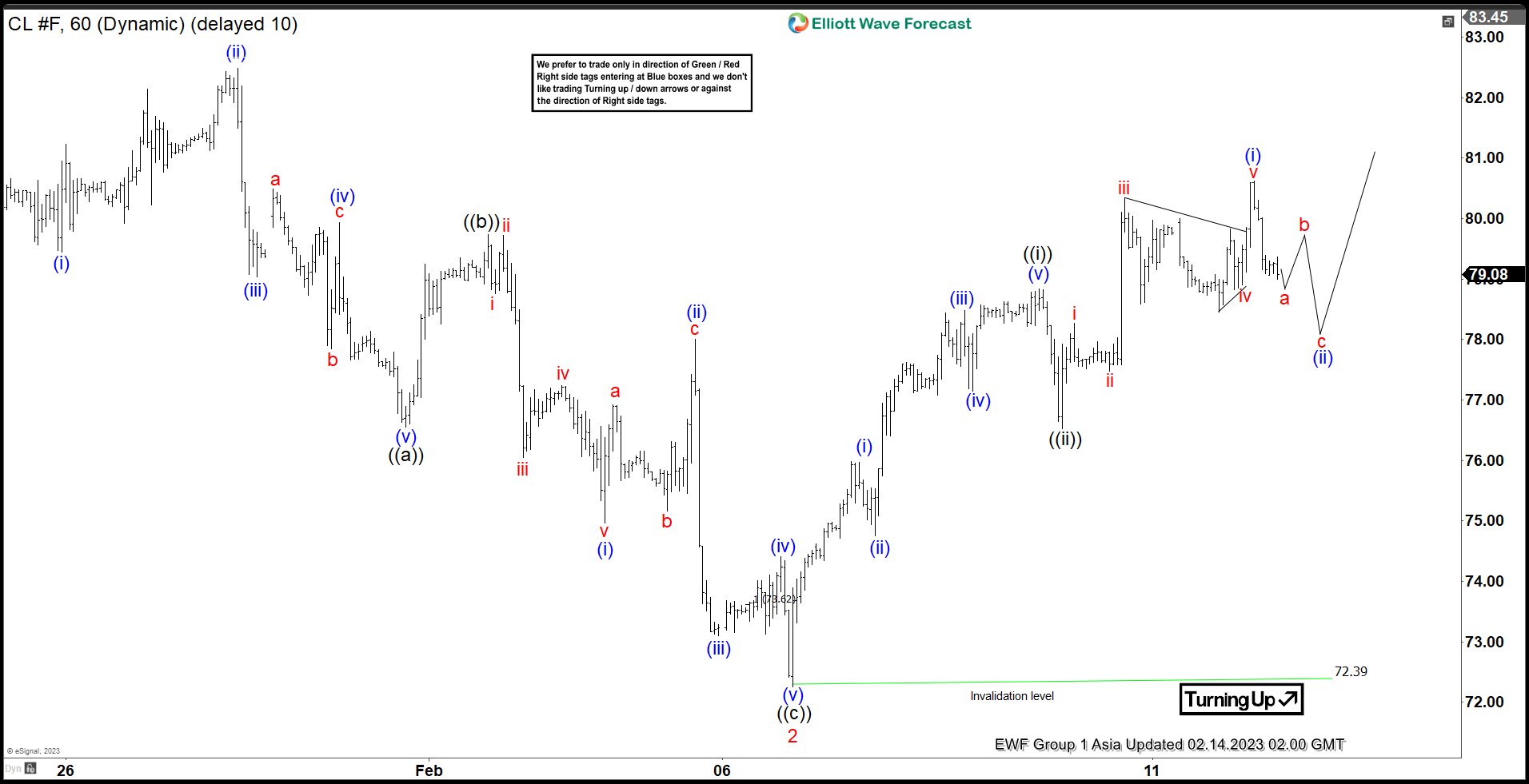

CL_F: Crude Oil Futures Found Support From Equal Legs Area

Read MoreHello Traders in this blog we will see how CL_F Crude Oil Futures found support from equal legs area and reacted higher within wave 2. Many traders are wondering whether Crude Oil will still trade lower or higher after it’s larger degree peak it made from March 7th, 2022. In this article we will only […]