Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

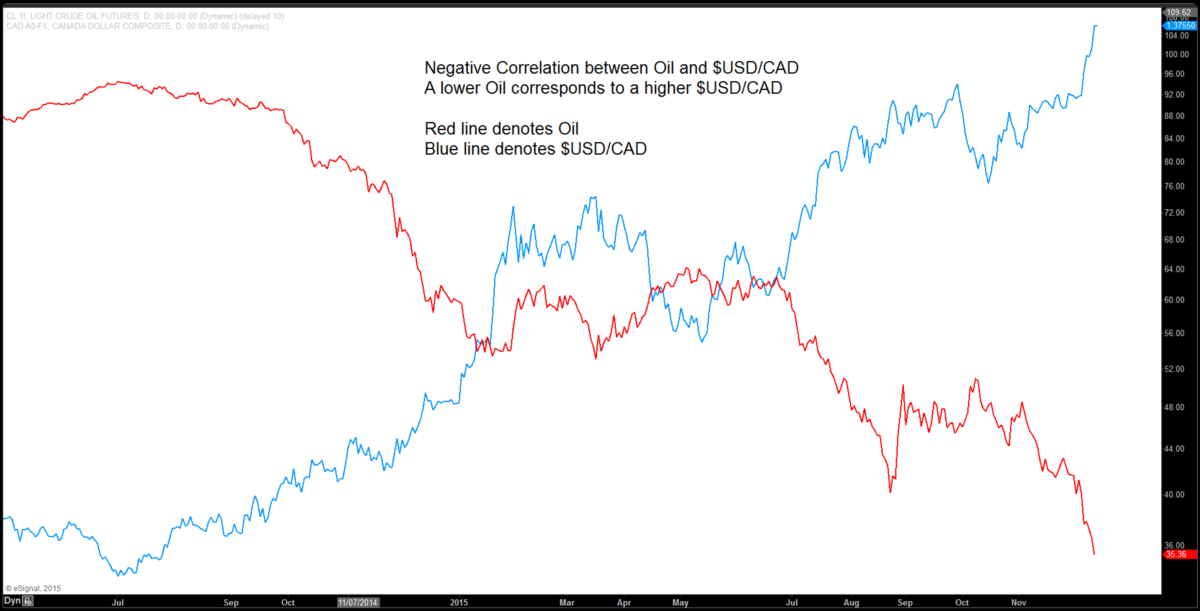

What OPEC decision means to Oil and $USDCAD

Read MoreCorrelation between Oil and $USDCAD One of the biggest trades in 2014 – 2015 is undeniably Oil and the correlated commodity currency Canadian dollar, or sometimes called Loonie. For some reasons, most Americans typically associate big crude oil exporters with Persian Gulf countries like Iraq, Kuwait, or Saudi Arabia. However, in reality, majority of crude oil consumed in the […]

-

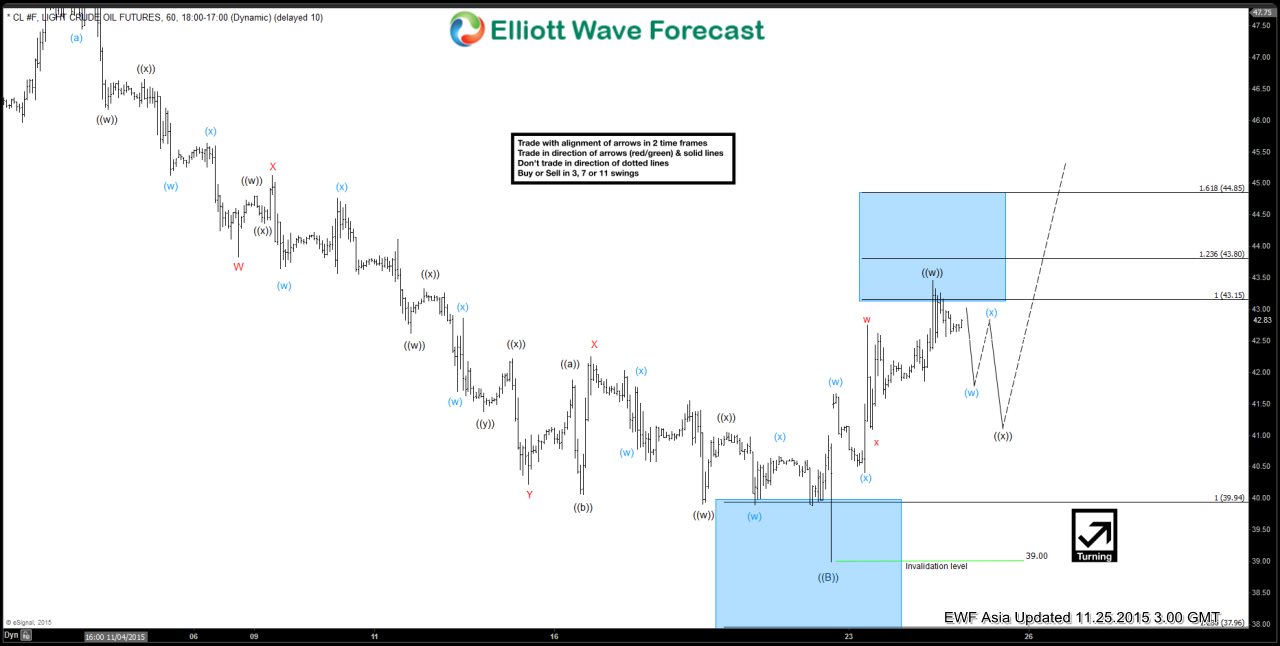

Oil Short Term Elliott Wave Update 11.25.2015

Read MoreShort term reading of the Elliott Wave cycle suggests the decline to 39 at 11/21 ended wave ((B)) and oil has turned higher in a double three structure where wave (w) ended at 41.66, wave (x) ended at 40.41, and wave (y) of ((w)) is proposed complete at 43.46. Wave ((x)) pullback is currently in progress to correct 11/21 cycle in […]

-

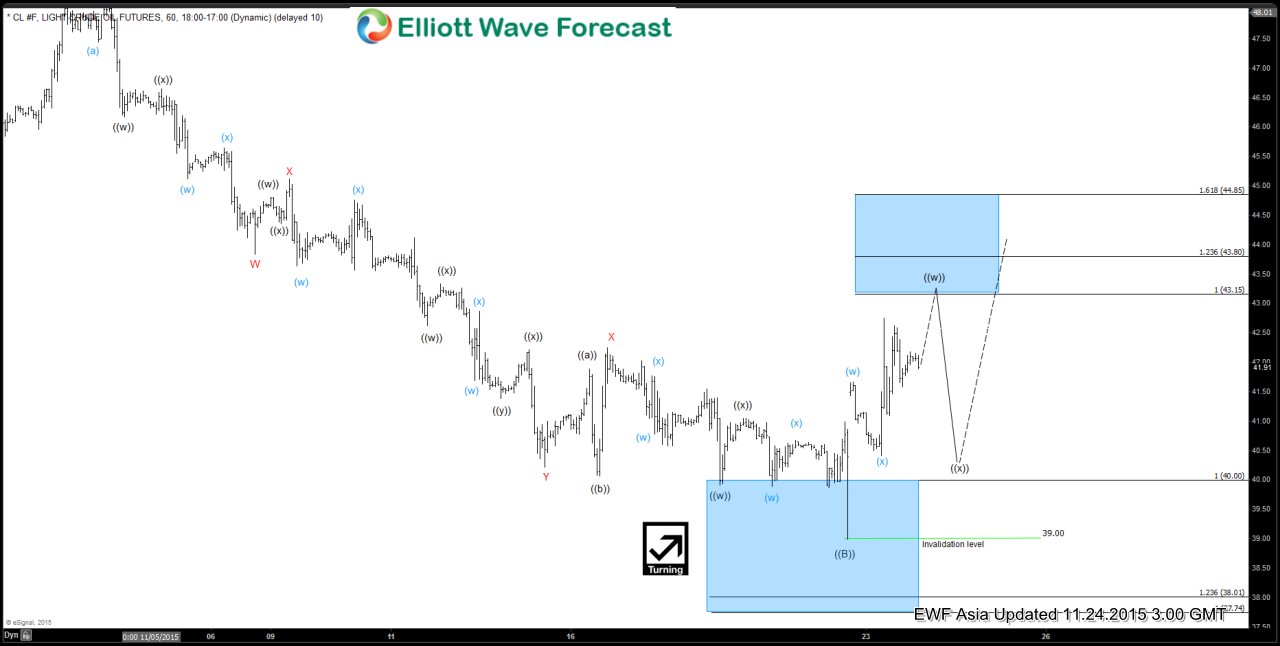

Oil Short Term Elliott Wave Analysis 11.24.2015

Read MoreShort term reading of the Elliott Wave cycle suggests the decline to 39 at 11/21 ended wave ((B)) and oil has turned higher in a double three structure where wave (w) ended at 41.66, wave (x) ended at 40.41, and wave (y) of ((w)) is in progress towards 43.15 – 43.8 to end the cycle from 11/21 low. Once […]

-

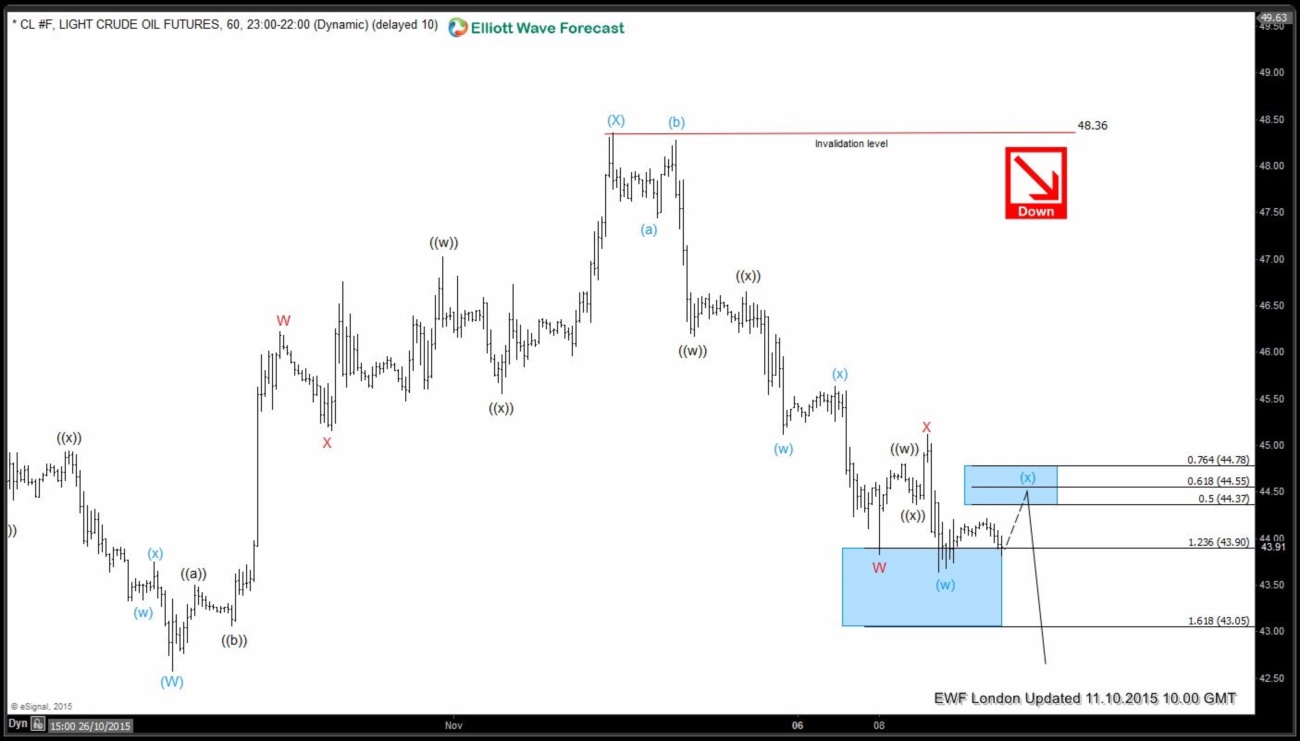

$OIL: Elliott Waves Forecasting the decline

Read MoreIn this blog we’re going to take a qucik look at the $OIL Elliott Wave chart from the 11.10.2015 to explain the structure and our view. We were forecasting the decline in $OIL from marked 50-76.4 fib ret zone: 44.37-77.78 toward h4 equal legs (W)-(X) : 40.13 area $OIL 11.10.2015 London As we can see […]

-

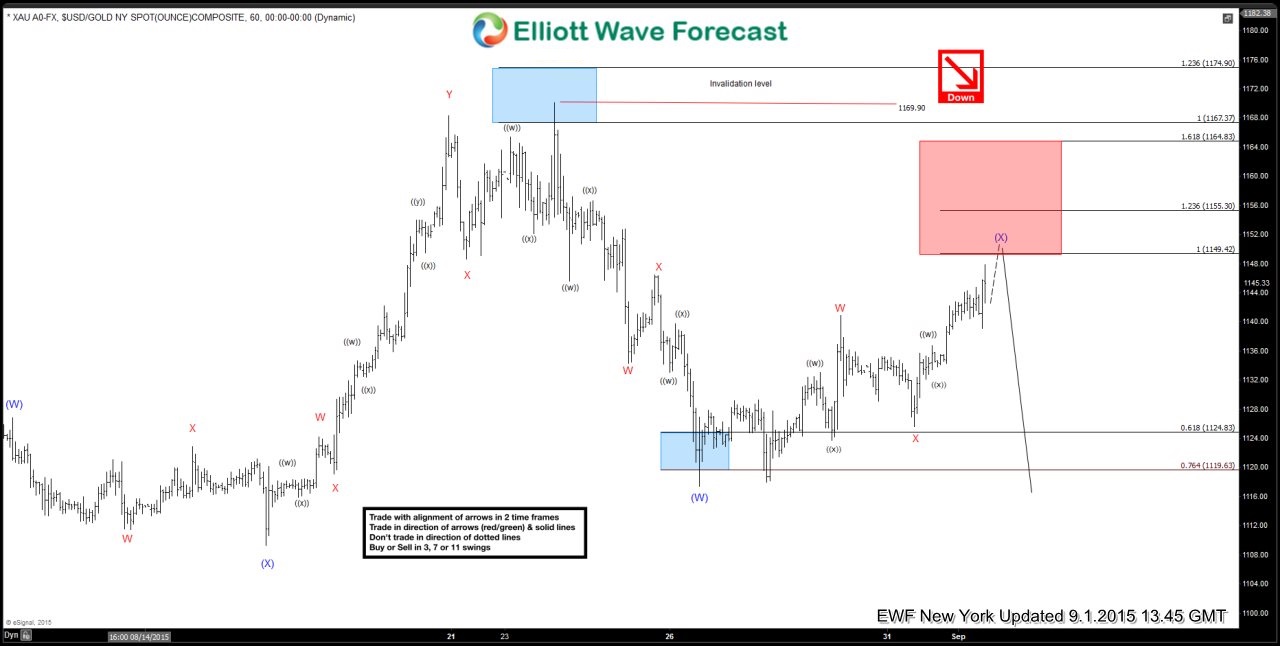

$GOLD (XAU/USD) Elliott Waves Forecasting the decline

Read MoreAt the beginning of September our Elliott Wave analysis of GOLD (XAU/USD) suggested that we were still in bearish cycle from the 1169.9 high. The price was about to complete (X) recovery and were expecting more downside toward new lows below the 1117.47 level. First target came at 0.618-0.764 (W)-(X) at 1114.8-1107.05. Let’s take a […]

-

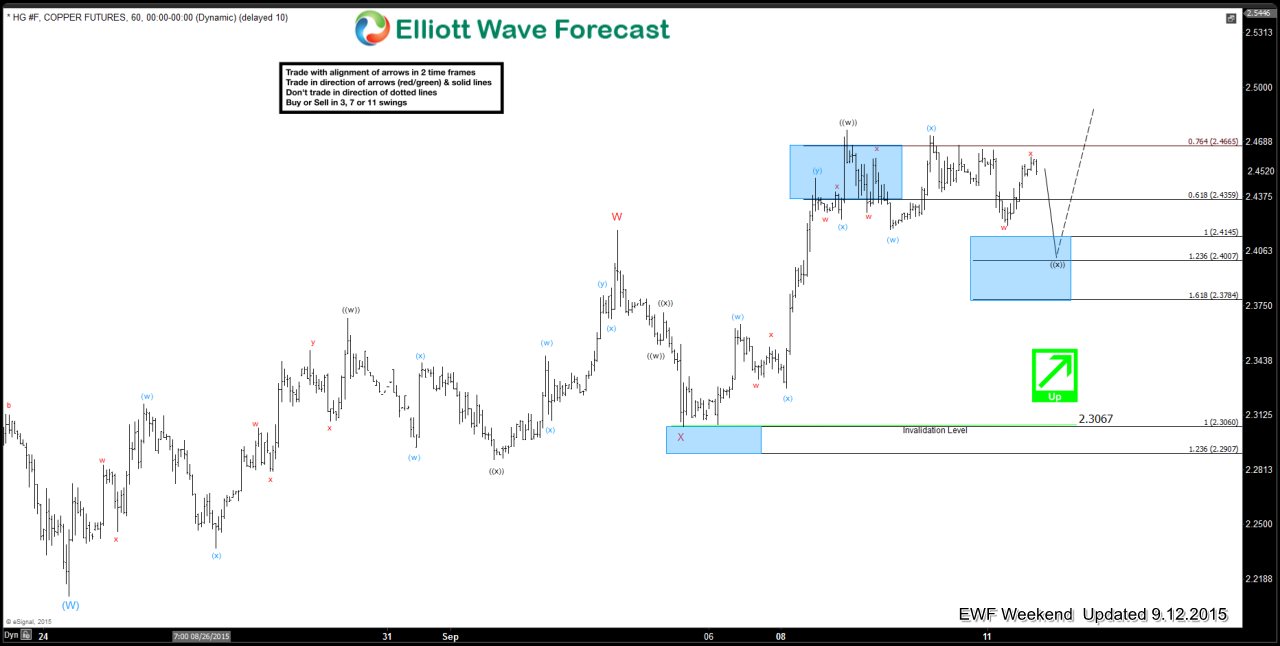

Copper Short Term Elliott Wave Update 9.12.2015

Read MoreRally from wave (W) low at 2.209 is unfolding in double corrective structure WXY where wave W ended at 2.418, wave X ended at 2.3053, and wave Y of (X) is in progress towards 2.516 – 2.64 area before turning lower at least in 3 waves. Short term, metal is still in wave ((x)) and […]