Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

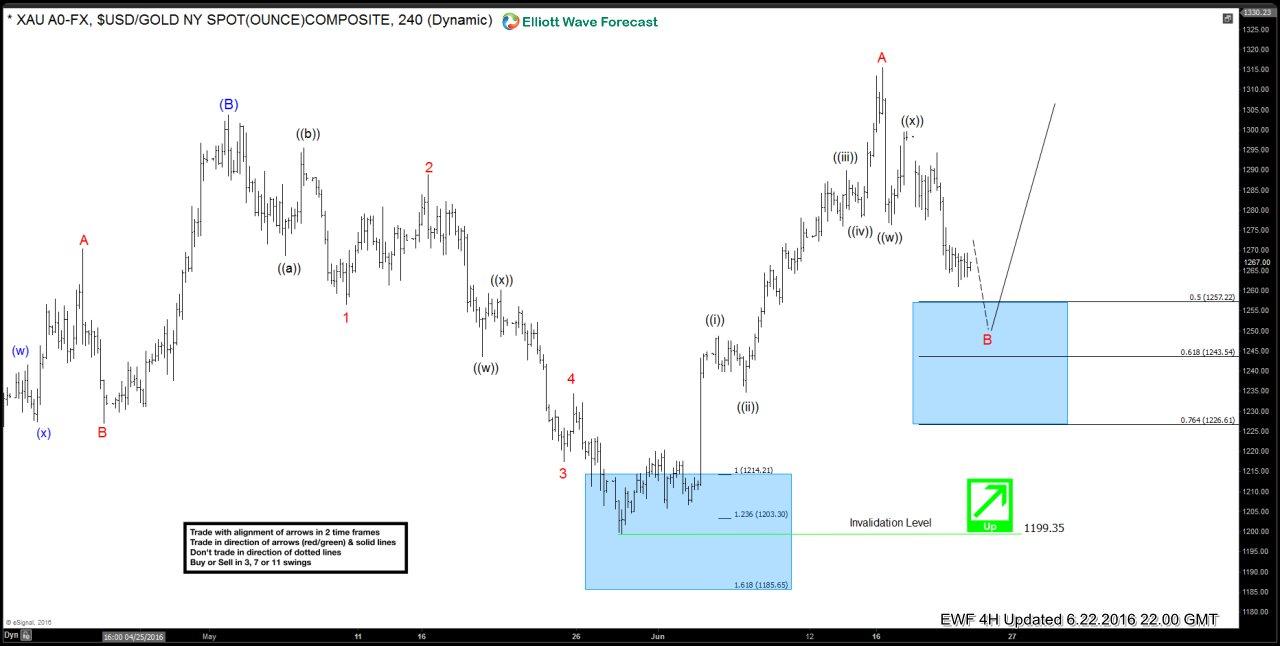

Is uncertainty Gold’s best friend?

Read MoreGold is enjoying a strong run in recent times due to the recent decision market shake Britain to leave the European Union. Healthy boost the yellow metal is exhibited by an increase roughly 24 % of its value since the beginning of this year. Gold prices rebounded as much as about 8 % to its […]

-

Oil $CL_F Short-term Elliott Wave Analysis 7.1.2016

Read MoreShort term Elliottwave structure suggests cycle from 6/9 peak remains alive as a double three where wave W ended at 45.83 and bounce to 50.54 ended wave X. Wave Y lower is in progress with the internal as a double three where wave ((w)) ended at 45.83 and wave ((x)) bounce ended at 50. Near term focus […]

-

Oil $CL_F Short-term Elliott Wave Analysis 6.30.2016

Read MoreShort term Elliottwave structure suggests cycle from 6/9 peak remains alive as a double three where wave W ended at 45.83 and bounce to 50.54 ended wave X. Wave Y lower is in progress with the internal as a double three where wave ((w)) ended at 45.83 and wave ((x)) bounce is proposed complete at 50. […]

-

Oil $CL_F Short-term Elliott Wave Analysis 6.29.2016

Read MoreShort term Elliottwave structure suggests cycle from 6/9 peak remains alive as a double three where wave W ended at 45.83 and bounce to 50.54 ended wave X. Wave Y lower is in progress with the internal as a double three where wave ((w)) ended at 45.83 and wave ((x)) bounce remains in progress as a […]

-

Oil $CL_F Short-term Elliott Wave Analysis 6.28.2016

Read MoreShort term Elliottwave structure suggests cycle from 6/9 peak remains alive as a double three where wave W ended at 45.83 and bounce to 50.54 ended wave X. Wave Y lower is in progress with the internal as a double three where wave ((w)) ended at 46.7 and wave ((x)) bounce ended at 48.45. Near term, […]

-

XAUAUD – Elliott Wave Update

Read MoreHere is a quick video update on XAUAUD (Gold-Australian dollar) structure to see what progress we have made since the last video update. Instrument made a new high above 1759.73 as expected and now has minimum number of swings in place to call the cycle from 4/19 and hence 4/1 lows completed. However, while above […]