The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

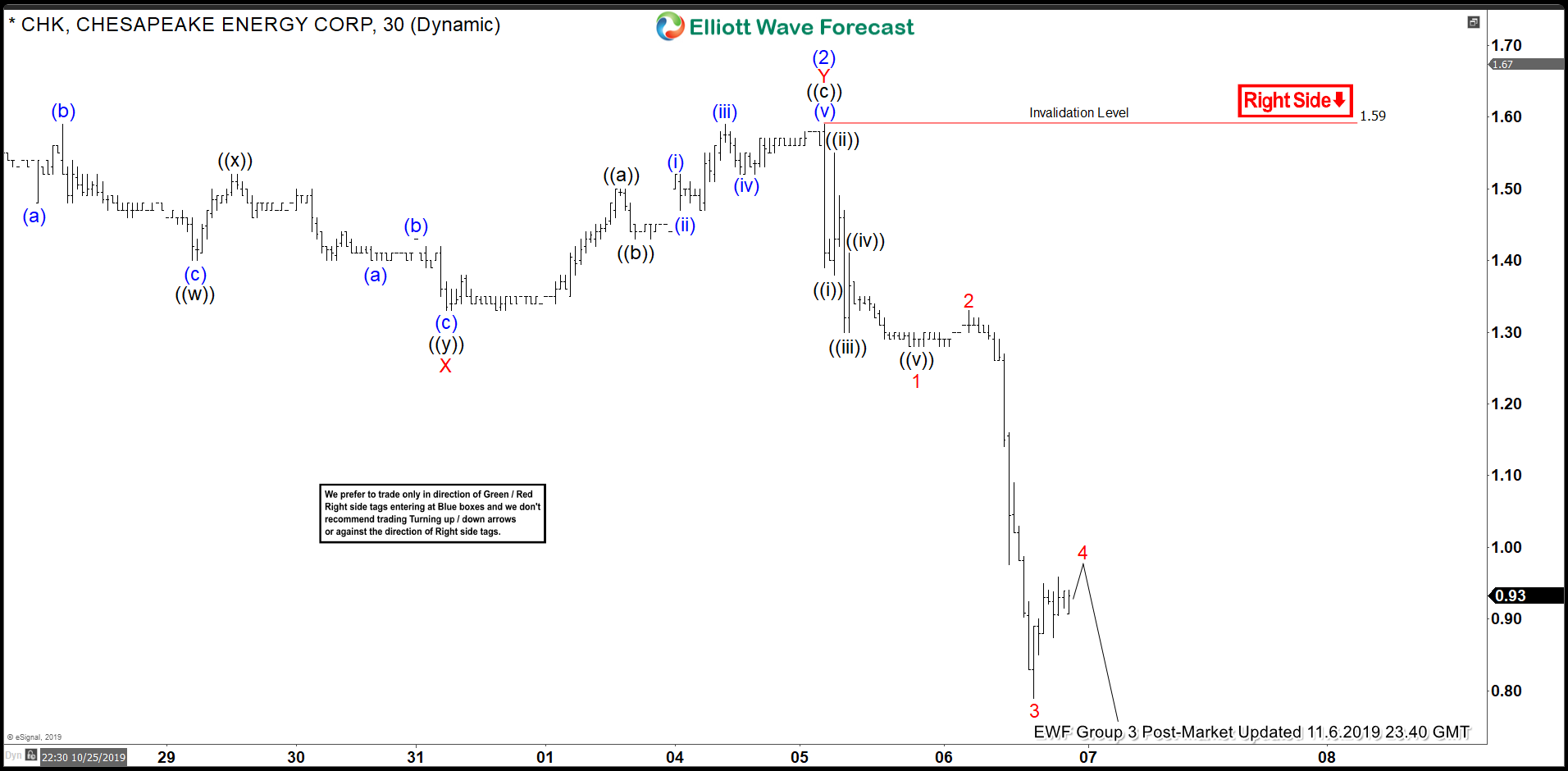

Elliott Wave View: Further Weakness in Chesapeake Energy Corp (CHK)

Read MoreShort Term Elliott Wave View on Chesapeake Energy Corp (ticker: CHK) shows 5 waves impulsive Elliott Wave decline from November 5 high. The bounce to $1.59 in the stock ended wave (2) as a double three Elliott Wave structure. On the chart below, we can see wave X of this double three ended at $1.33 and […]

-

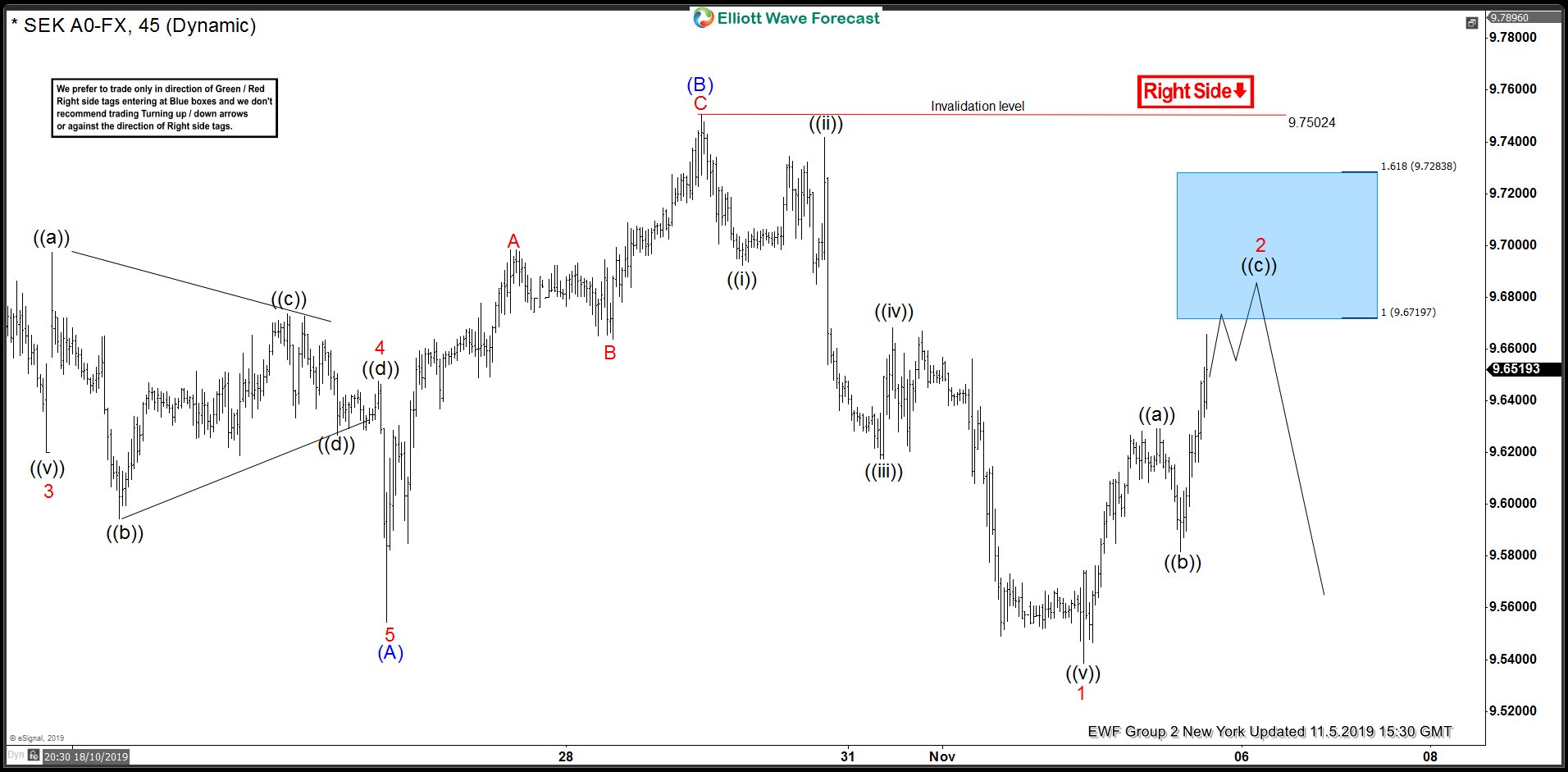

USDSEK Found Sellers At The Blue Box

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of USDSEK , published in members area of the website. As our members know, USDSEK has incomplete bearish sequences in the cycle from the 9.9632 (October 9th) peak. Consequently, we advised members to avoid buying the pair and keep […]

-

Elliott Wave View: Dow Jones Futures Ending 5 Waves Rally

Read MoreDow Jones Future (YM_F) rally from Oct 3 low is impulsive. The 5 waves rally should end soon & Index should pullback in 3 waves before the next leg higher.

-

Elliott Wave View: Bullish Outlook in Russell

Read MoreRussell is close to break above May 6, 2019 (1621.9). A break above will open up a bullish sequence. This article & video look at the Elliott Wave path.