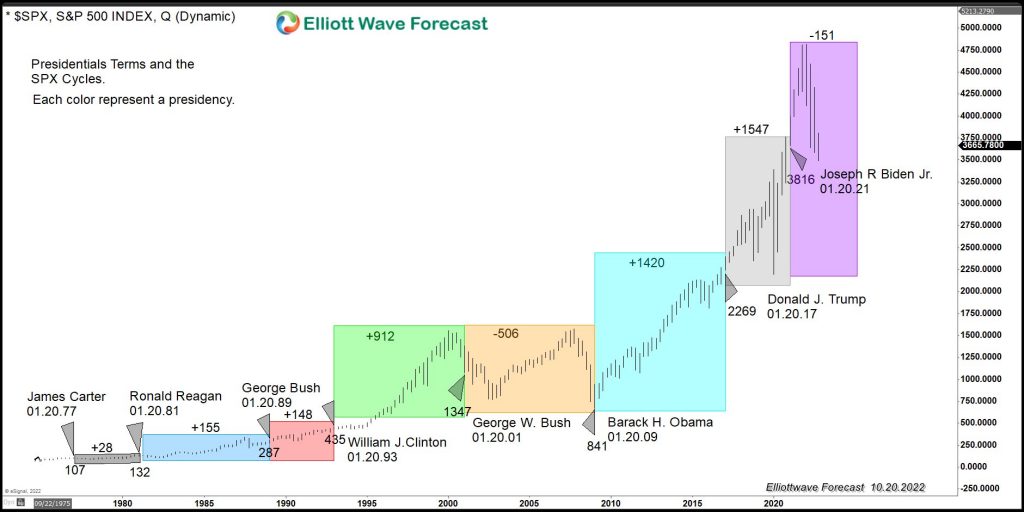

A lot has been said and written about both the Democrat and Republican economic plans for a better economy. We believe in free enterprise and limited regulation, allowing humans to create and expand at their own will for the better but there is a vast difference between the two parties regarding the economic agenda. Most […]

-

JPM Elliott Wave Bullish Structure

Read MoreThe Elliott Wave view for JPMorgan Chase (NYSE: JPM) suggests the rally from February 2016 low (52.5) to 03/01/2017 peak (93.98) have ended wave (3). The pullback from there unfolded as zigzag ABC structure which ended wave (4) at 06/01/2017 low (81.79). Up from there, the stock rallied in another zigzag structure before ending that short term cycle after reaching […]

-

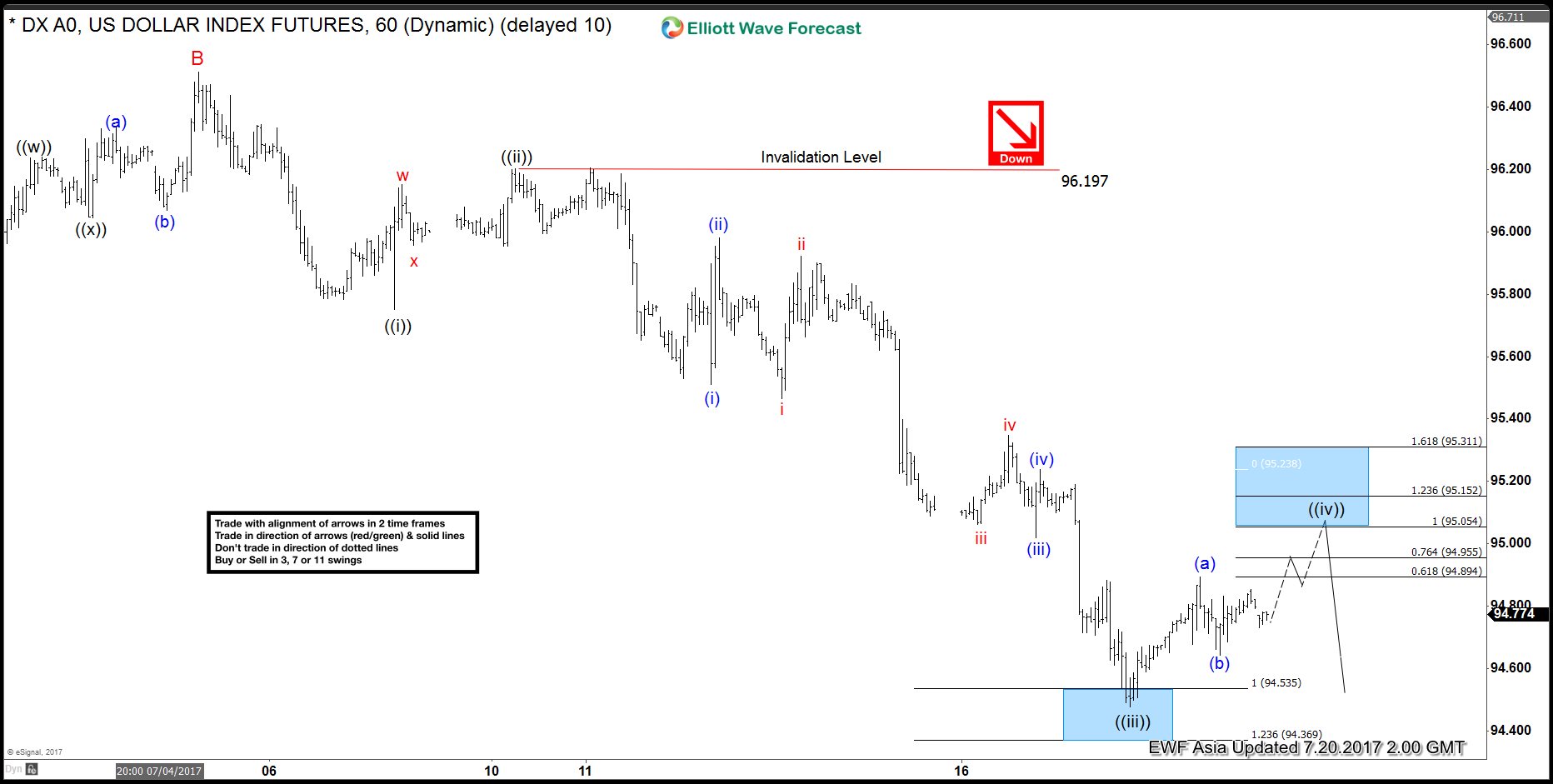

DXY Elliott Wave View : Bounce in progress

Read MoreShort term DXY (USD Index) Elliott Wave view suggests the decline from 6/20 peak (97.87) is unfolding as a Zigzag Elliott Wave structure. Down from 97.87 high, decline to 95.47 ended Minor wave A, and bounce to 96.51 high ended Minor wave B. Wave C is unfolding as an Elliott wave Impulse structure with extension where Minute wave ((i)) ended […]

-

SPX Elliott wave view: Showing impulse

Read MoreShort term SPX Elliott Wave view suggests the rally from 5/18 low (2352.7) to 6/19 peak (2453.8) ended Minor wave 3. The pullback from 2453.8 to 2405.70 on 6/29 low ended Minor wave 4. Up from there, the rally is unfolding as an impulse Elliott Wave structure with extension. This 5 waves move could be Minute wave ((a)) of […]

-

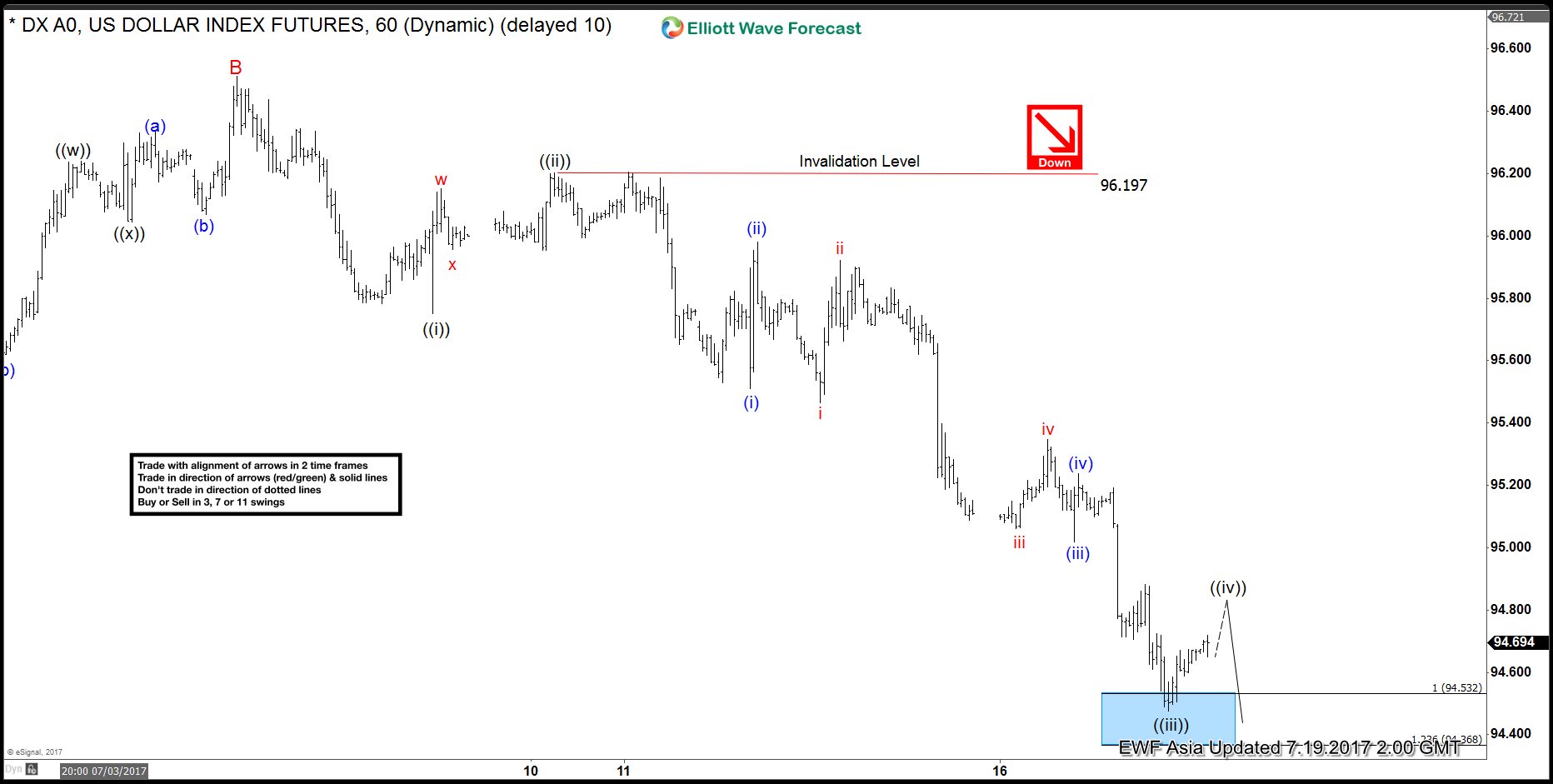

DXY Elliott Wave View 7.19.2017

Read MoreShort term DXY (USD Index) Elliott Wave view suggests the decline from 6/20 peak (97.87) is unfolding as a Zigzag Elliott Wave structure. Down from 97.87 high, decline to 95.47 ended Minor wave A, and bounce to 96.51 high ended Minor wave B. Wave C is unfolding as an Elliott wave Impulse structure with extension where Minute wave ((i)) ended […]