The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Apple (AAPL) Ending Wave 5

Read MoreShort-term Elliott Wave view in Apple (ticker: AAPL) suggests that the pullback to 256.31 on December 3, 2019 low ended wave (4). The stock has resumed higher within wave (5) and the internal is unfolding as a 5 waves Elliott wave impulsive structure. Up from 256.31, wave ((i)) ended at 263.31, and wave ((ii) pullback […]

-

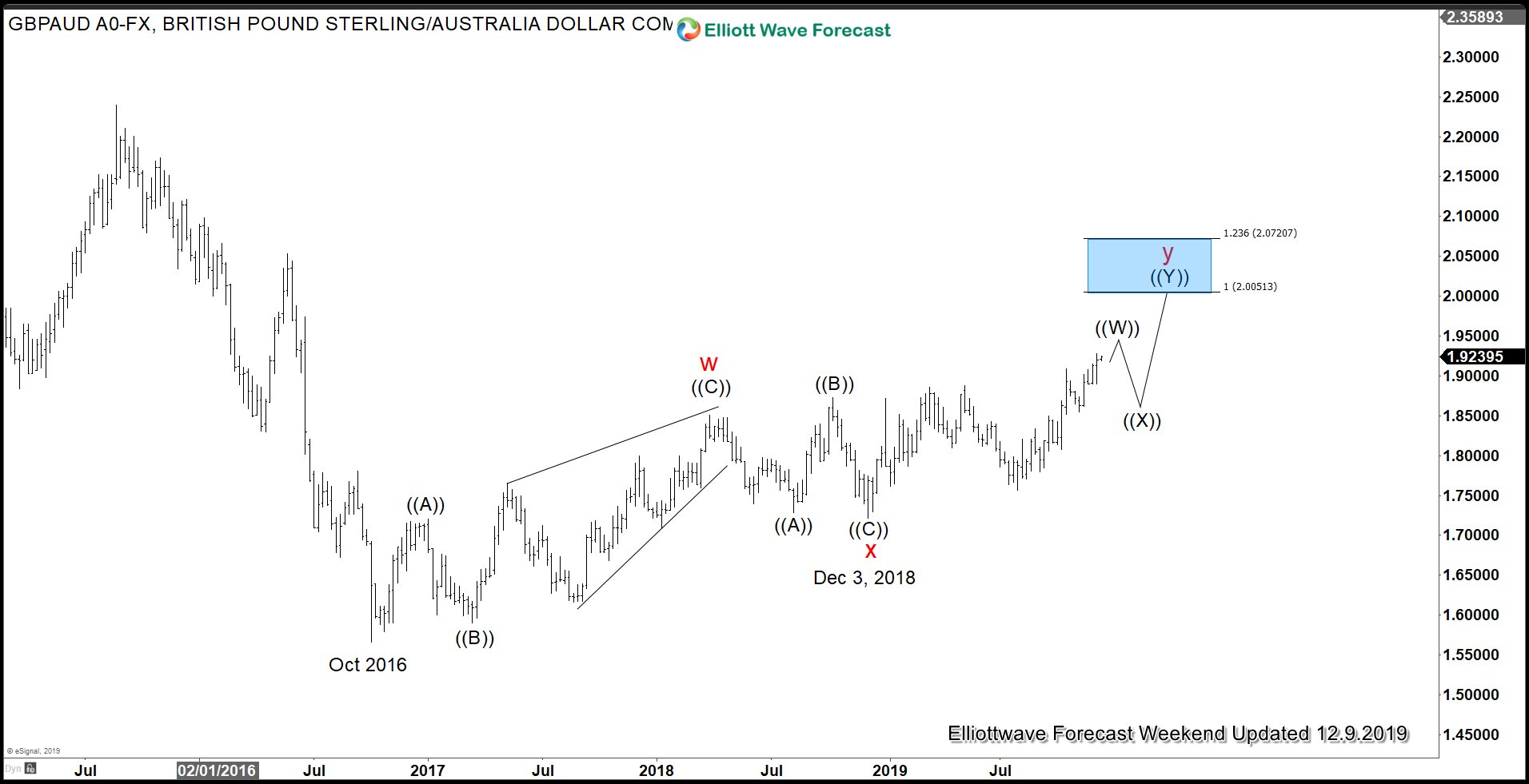

Pound Sterling Maintains Strength as Tories Projected to Win

Read MorePound Sterling remains strong as the U.K. will go to poll this coming Thursday December 12. The general election normally should be held every five years. However, this election will be the third time since 2015 as it’s necessary to break the country’s Brexit impasse. It will determine whether the U.K. will quit the European […]

-

COPPER ( $HG_F ) Forecasting The Rally After Double Three Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of COPPER ( $HG_F) published in members area of the Elliottwave-Forecast . As our members know, COPPER recently corrected the short term cycle from the 2.6132 (November 14th ) low. Pull back unfolded as Elliott Wave Double […]

-

U.S. Stock Market Surged as November Payroll Smashed Expectation

Read MoreU.S. stock market surged as November Nonfarm Payroll came out strong at 266,000. Unemployment rate also fell to 3.5%, which is at 50-year low since 1969. The result smashed the consensus expectation of 185,000. Stocks leaped higher after the blockbuster number as the US economy is firing on all cylinder. There was initially some concern […]