The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

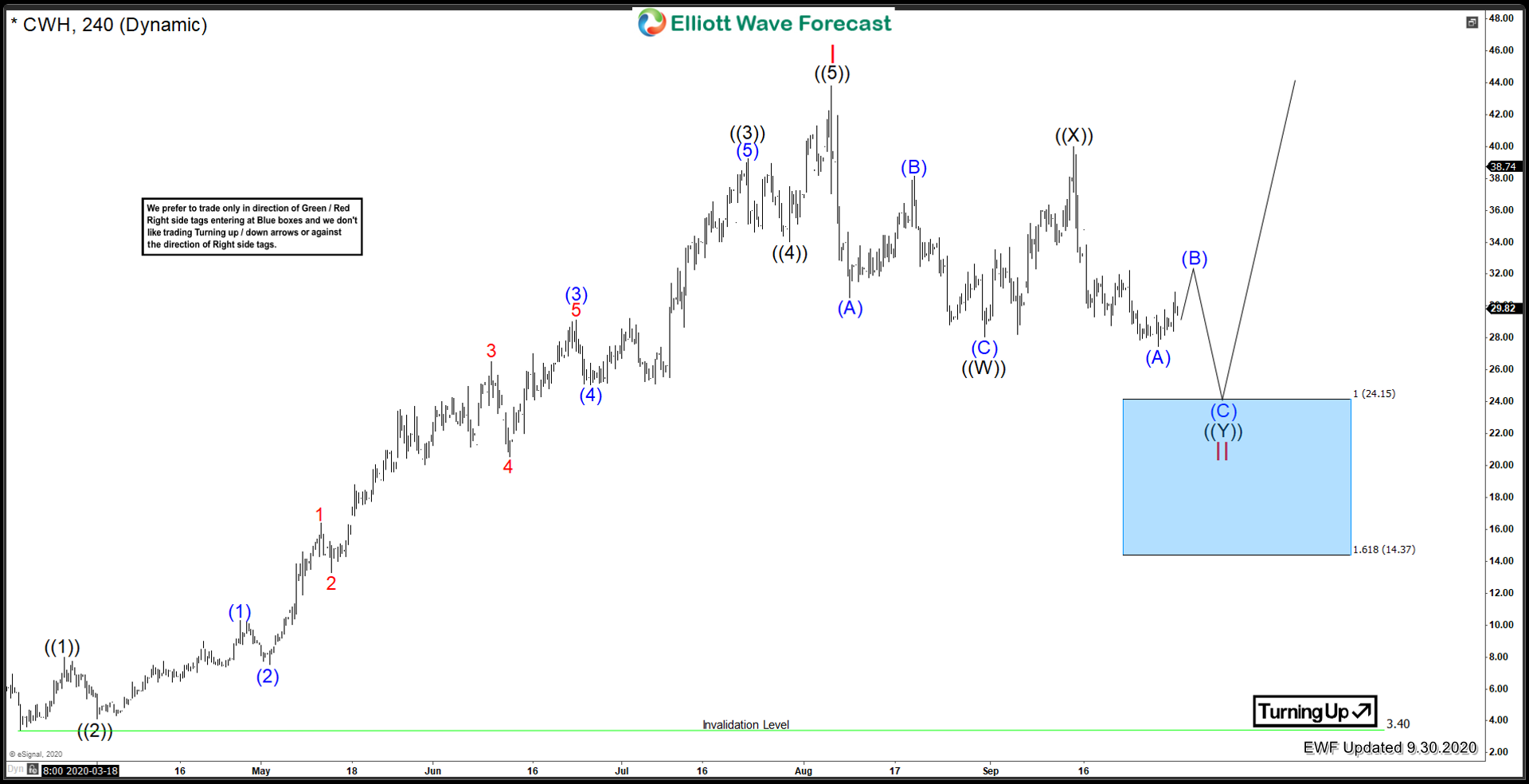

Camping World Holdings ($CWH) Bullish Setup Taking Shape

Read MoreWhen COVID-19 took over the world, the last sector in the world that I thought would surge as much as it did, is CAMPING! It is important to realize, the Marketplace decides what is hot, and what is not. To be a successful trader, we need to let go of all emotional reason, and focus […]

-

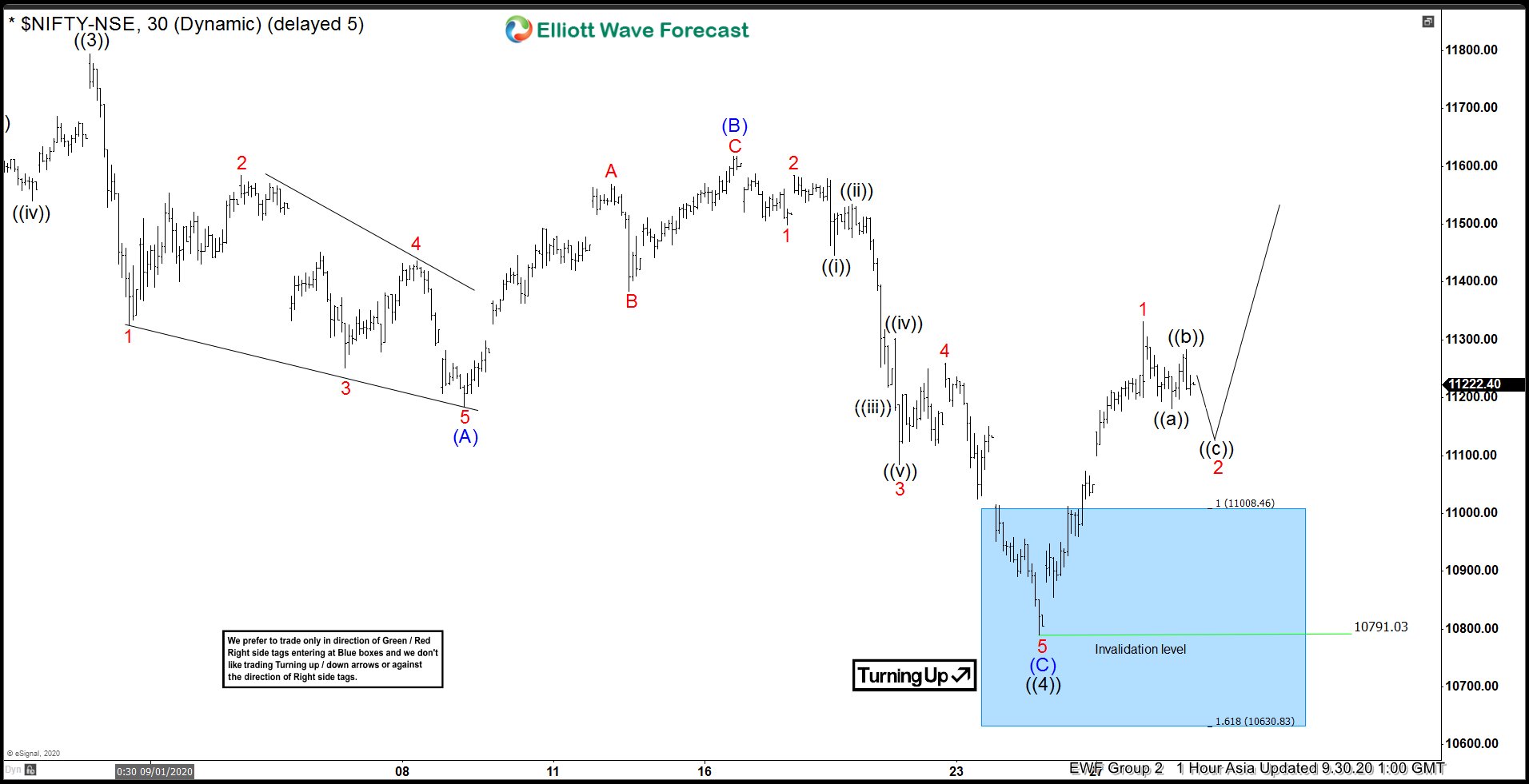

Elliott Wave View: Nifty Found Support for Next Leg Higher

Read MoreNifty found support after 3 waves pullback & can see further upside to end 5 waves up from March low. This article and video look at the Elliott wave path.

-

AUG (Gold/Silver Ratio) Showing A Five Waves From 03.18.2020

Read MoreGold to Silver Ratio ( AUG) is showing 5 waves decline from the 18 March 2020 peak. This article & Video explains the Elliott wave path.

-

Nifty – Forecasting The Rally From Elliott Wave Blue Box

Read MoreNifty saw a high of 11794.25 at the end of August and then turned lower, we told members the decline should be corrective and present another opportunity for the buyers to enter the market. In this article, we will look at how the decline unfolded and also view the blue box area that we highlighted […]