The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

IBM: Below 06.08.2020 Peak Is Holding The Indices

Read MoreIBM has been trading within a corrective sequence lower since the peak on 03.11.2013. The decline is a clear 3-7-11 sequence, which comes with a lot of overlapping and choppy price action. We do believe a double correction (WXY) is taking place. This is a combination of either two Zig Zags or two WXY which […]

-

EME: The March 23, 2020 Cycle And The US General Election Results

Read MoreAt EWF, we believe the market works as a whole. Every instrument, symbol, or ETF is therefore related. Many traders do not track as many markets as we do, but through analyzing hundreds of charts every day, we can see a clear relationship between these different instrument. This time, we will take a look at […]

-

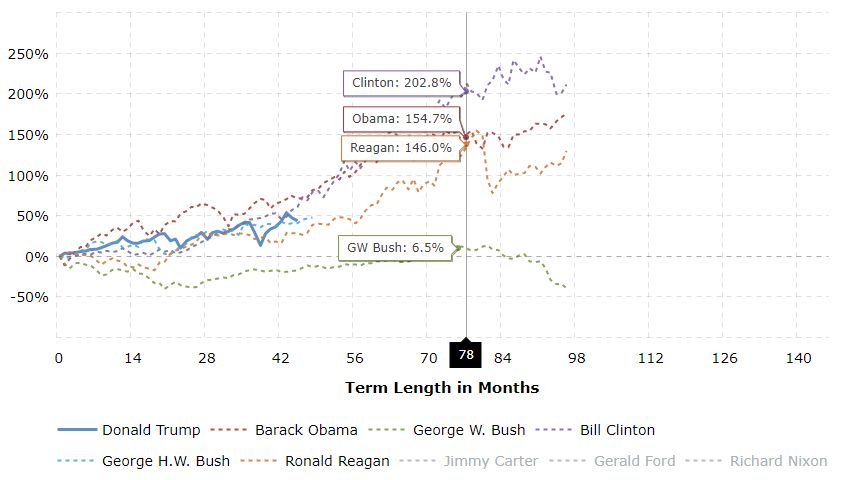

SP500 and DXY Performance in US Election. What to expect this year?

Read MoreEvery 4 years the elections arrive in the United States, the performance of the most important health indicator of the financial markets, such as SP500, is reviewed again. In recent years the SP500 has been well above other indices worldwide like the DAX or the FTSE. That leads us to think about the importance of […]

-

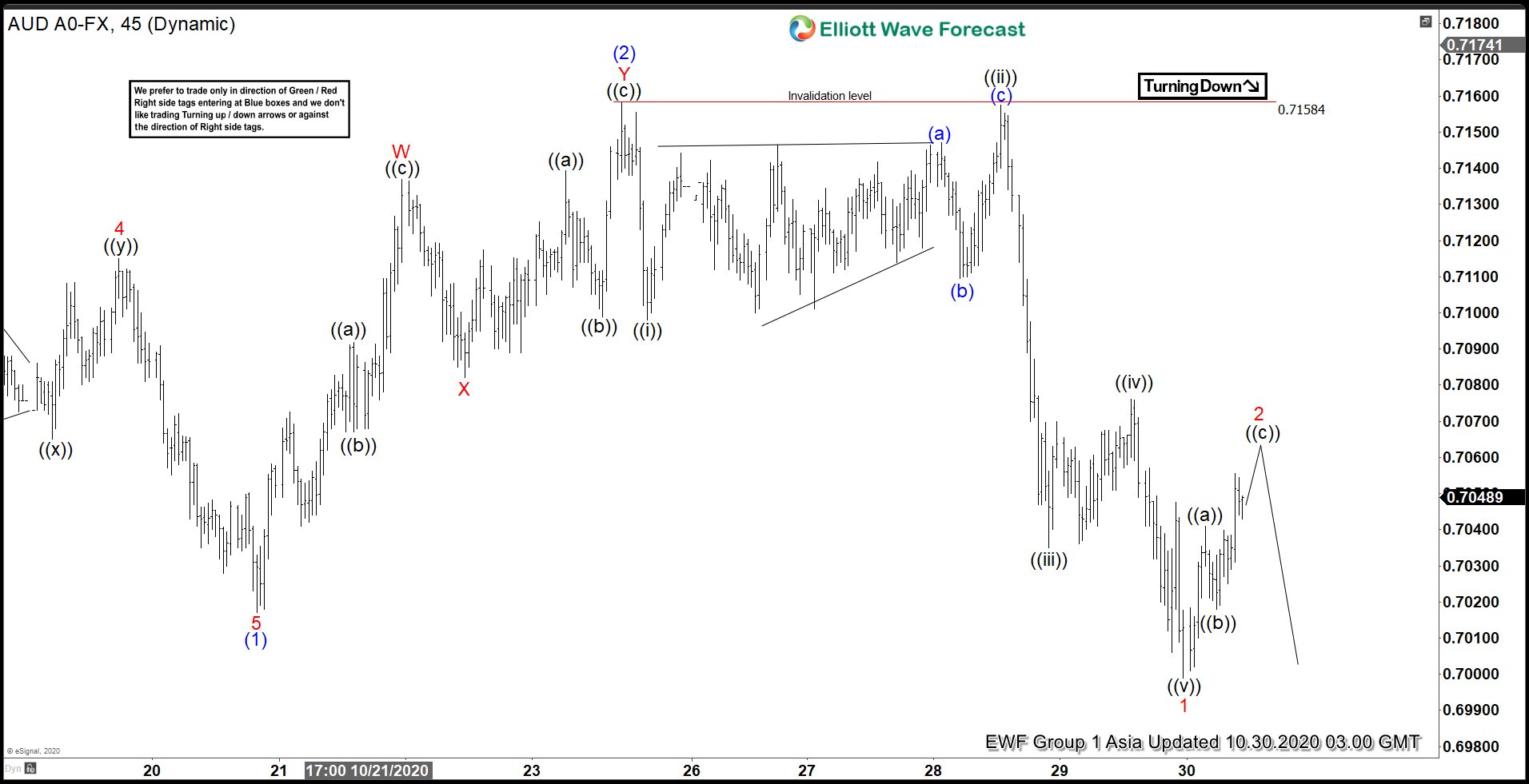

Elliott Wave View: Further Weakness in AUDUSD

Read MoreAUDUSD shows incomplete sequence from September 1, 2020 high and pair can see further weakness. This article and video look at the Elliott Wave path.