The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Bitcoin Has Started the Next Leg Higher

Read MoreBitcoin (BTCUSD) rallies impulsively from September 21 low looking for more upside. This article and video look at the Elliott Wave path.

-

Best Pharmaceutical Stocks to Buy in 2024

Read MoreThe world around us needs pharmaceuticals to survive and function on a normal basis. The pharmaceutical industry is part of the wider healthcare sector, and these companies are active all year round, no matter the global situation. The global pharmaceutical market has experienced significant growth in recent years. As of end-2020, the total global pharmaceutical […]

-

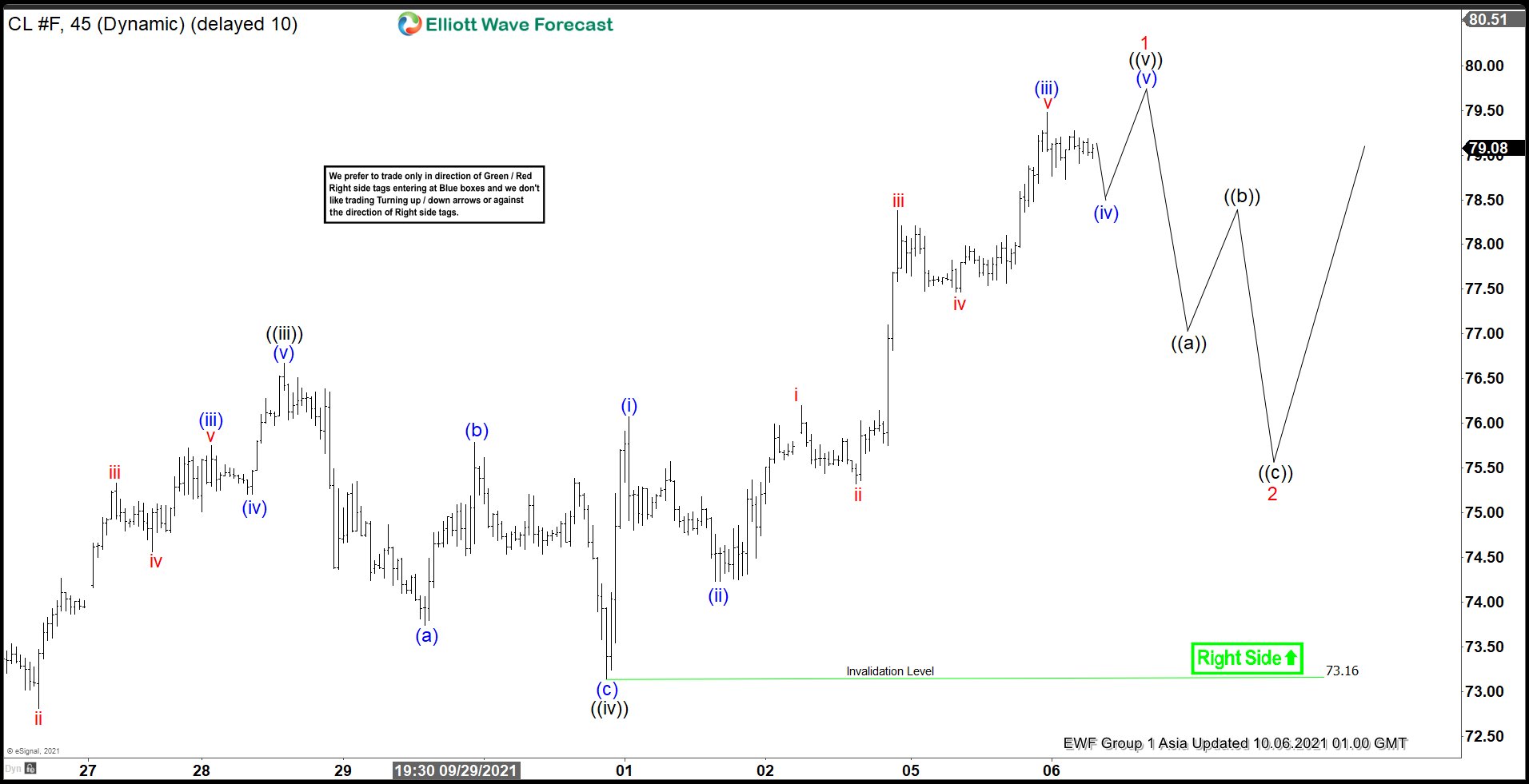

Elliott Wave View: Oil Near Correction within Bullish Market

Read MoreOil (CL_F) is close to ending cycle from September 9 low and can see larger pullback. This article and video look at the Elliott Wave path.

-

Bit Digital ($BTBT) Priming a wave 3 breakout

Read MoreThe last time I analyzed Bit Digital was in August 2021 (article can be read here). At the time, I had called the low in Red II, and was looking for an impulsive leg up to take place. Bit Digital is one of the worlds largest bitcoin miners. Before moving their operations to North America, […]