The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Chevron Corp ($CVX) Continues to Move Higher

Read MoreThe last time I covered Chevron was back in November 2021. And I was expecting a larger cycle to complete before pulling back against March 2020 low. Lets take a look at the view I was presenting back then and compare to what the market gave us. Chevron Elliottwave View November 2021: At the time, […]

-

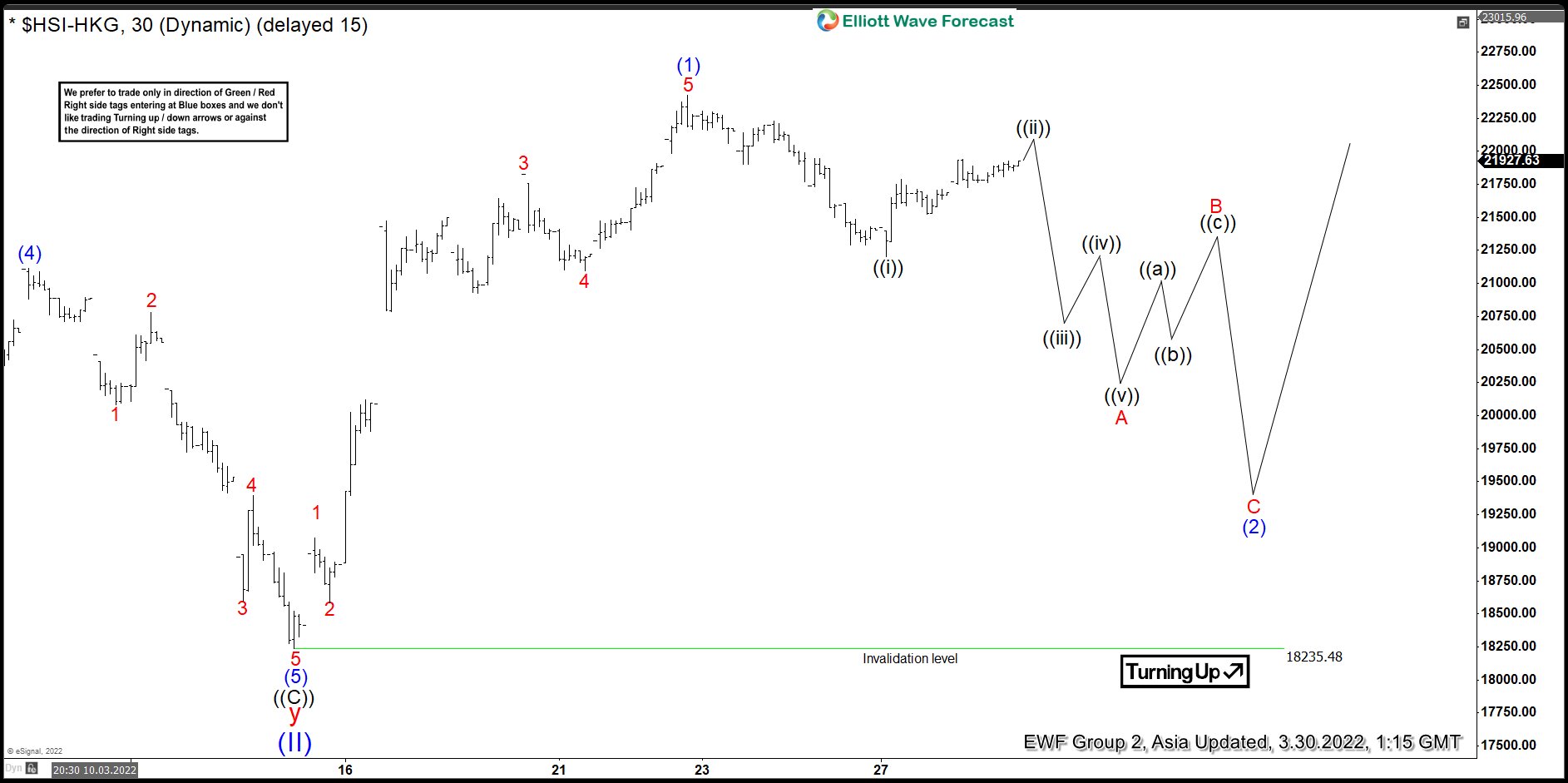

Elliott Wave View: Hangseng Index Pullback Should Find Support

Read MoreHangseng Index rallies as a 5 waves impulse from March 15, 2022 low. While dips stay above there, expect the Index to extend higher.

-

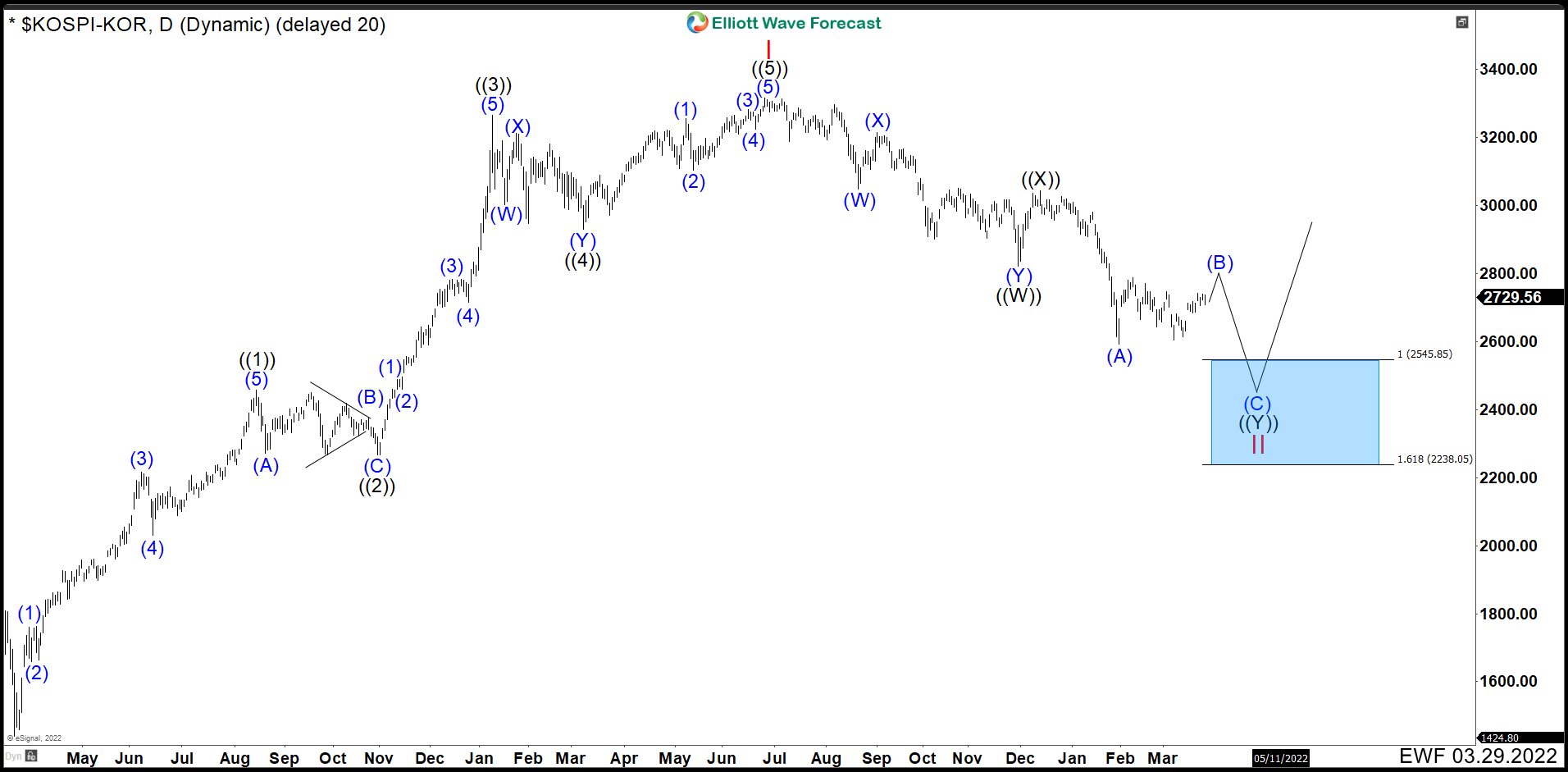

South Korean Stock Index (KOSPI) Is Near To Find Support

Read MoreThe Korea Composite Stock Price Index (KOSPI) is the index of all common stocks traded on the Korea Exchange. It is the representative stock market index of South Korea, like the S&P 500 in the United States. KOSPI Daily Chart March 2022 Since March 2020 low, KOSPI began to develop and impulse structure as we can see in the chart. Wave ((1)) ended at […]

-

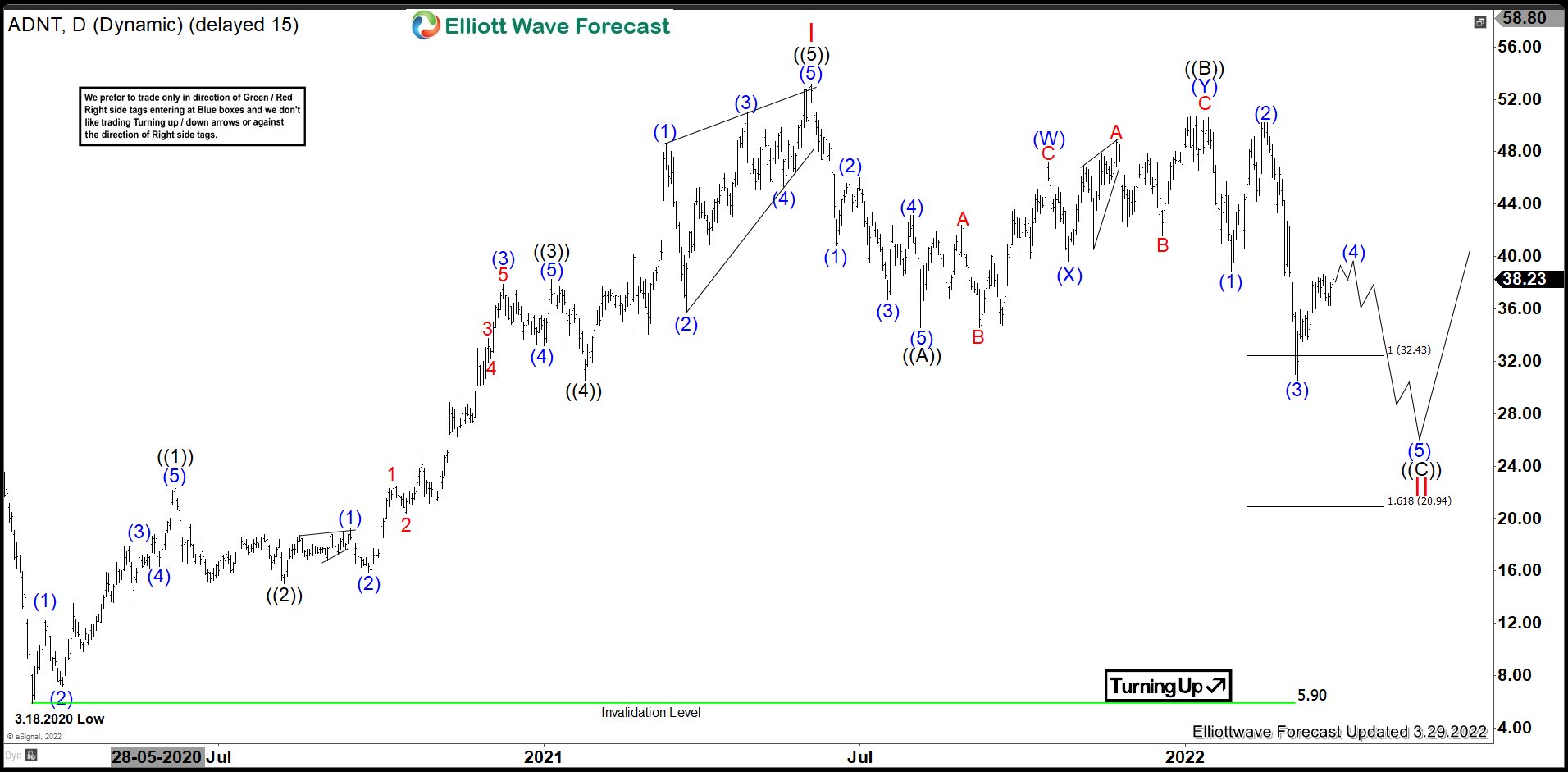

ADNT : Should Pullback Before Resume Rally

Read MoreAdient Plc (ADNT) designs, develops, manufactures & markets a wide range of seating systems & components for passenger cars, commercial vehicles & light trucks & serves globally. The company is based in Dublin, Ireland. It comes under Consumer Cyclicals sector as Auto Parts Industry & trades under “ADNT” ticker at NYSE. Since October-2016, ADNT made an […]