The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

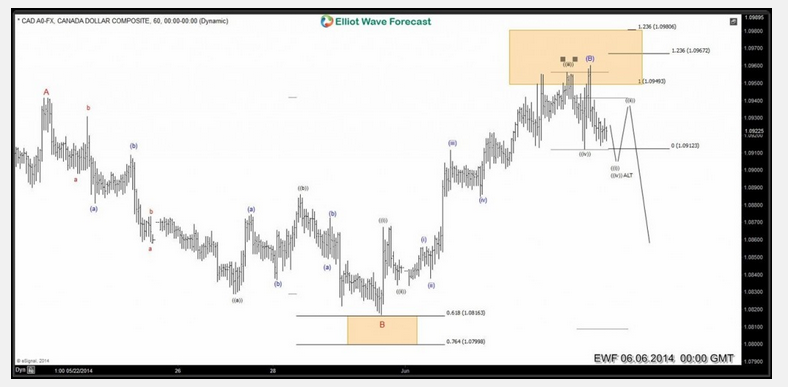

$USDCAD: Elliott Wave Analysis & Turn Lower

Read MoreFor the whole month of May we been telling our members to SELL the rallies for USDCAD as that is what our preferred Elliott Wave Analysis was calling for. When June came along our view did not change. We continued telling our members to only look to sell USDCAD based on the idea of Elliottwave […]

-

$EURGBP 1 Hour Elliott Wave Analysis 6.25.2014

Read MorePreferred Elliottwave view suggests drop from 0.8130 to 0.7956 was a WXY structure and complete wave A. Wave B is also taking the form of a 7 swing or WXY structure when rally to 0.8025 completed wave (( w )) , dip to 0.7965 completed wave (( x )) and wave (( y )) is now […]

-

$IBEX (IBC-MAC) 1 Hour Elliott Wave Analysis 6.24.2014

Read MoreIndex has almost reached the equal legs up from 5.16.2014 marked as red wave X on the chart. Break of rising 1 hour trend line or a similar break in RSI trend line would add more conviction to the view that cycle is over and a pull back lower in wave ( X ) has […]

-

$IBEX (IBC-MAC) 1 Hour Elliott Wave Analysis 6.23.2014

Read MoreIndex has almost reached the equal legs up from 5.16.2014 marked as red wave X on the chart. Break of rising 1 hour trend line or a similar break in RSI trend line would add more conviction to the view that cycle is over and a pull back lower in wave ( X ) has […]