The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

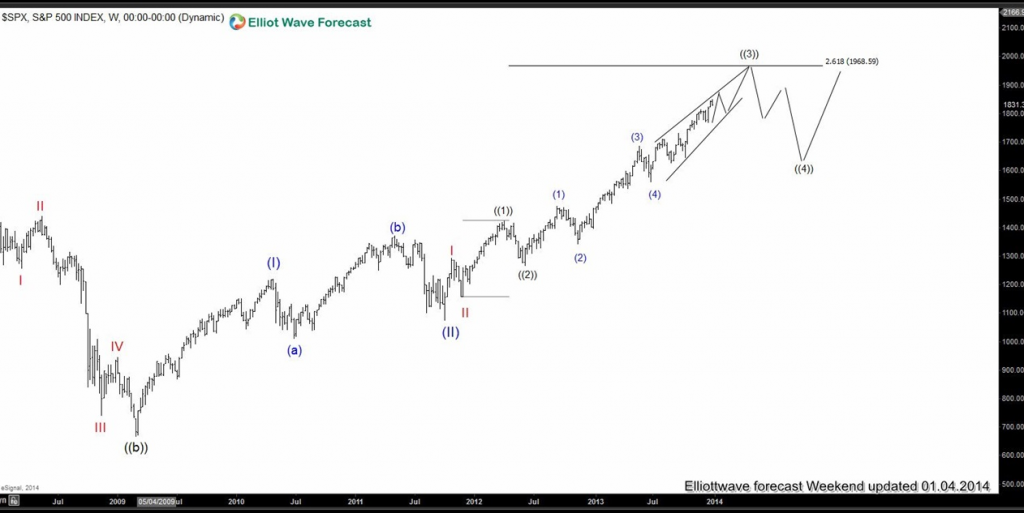

2014 : The Year in Review

Read MoreThe year 2014 has come to an end and EWF had an outstanding year forecasting the markets for our members. We have no doubt that 2015 will be another outstanding year. We at EWF understand that nobody can forecast the markets with 100% accuracy and we will never say that we are always right in […]

-

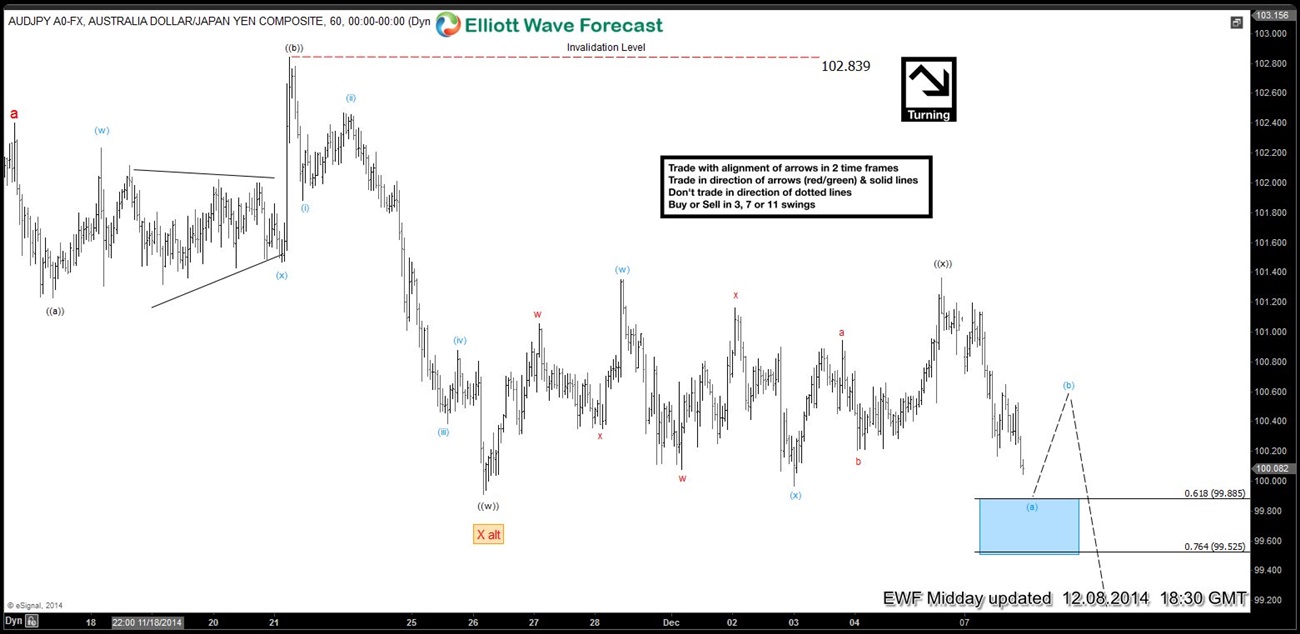

AUDJPY Elliott Wave Setup Video

Read MoreAUDJPY 12.8.2014 AUDJPY looks like is the 1st Yen pair to end the cycle from Mid-October low among Indices and Yen pairs. Today pair broke below 99.91 area so while below 101.36, pair has scope to test 98.86 – 98.31 area to end the cycle from 102.40 high. After that we would expect a bounce at least […]

-

AUDJPY Short-term Elliott Wave Analysis 12.8.2014

Read MorePreferred Elliott Wave view suggests price action between 102.40 (11.16) – 99.91 (11.26) was a FLAT structure and completed wave (( w)). FLAT is a 3-3-5 structure in Elliott Wave Theory and this one in particular was an Expanded FLAT. You can learn more about 3 types of FLAT structures here We have seen a 3 […]

-

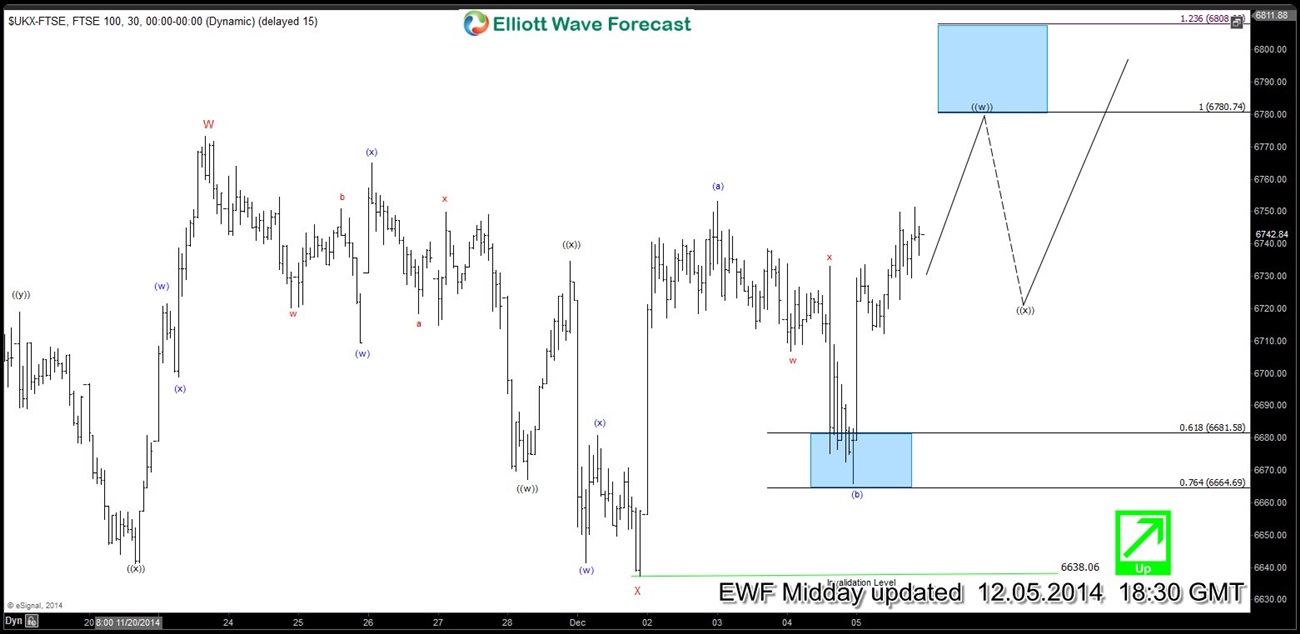

$FTSE Short-term Elliott Wave Analysis 12.5.2014

Read MoreIn our previous chart of the day updates posted on December 1 and December 2 , we were expecting the Index to rally and find buyers in the dips. Index pulled back in wave (b) as per preferred Elliott wave view and we think it’s over at 6665. Near-term focus is on 6780 – 6807 […]