The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

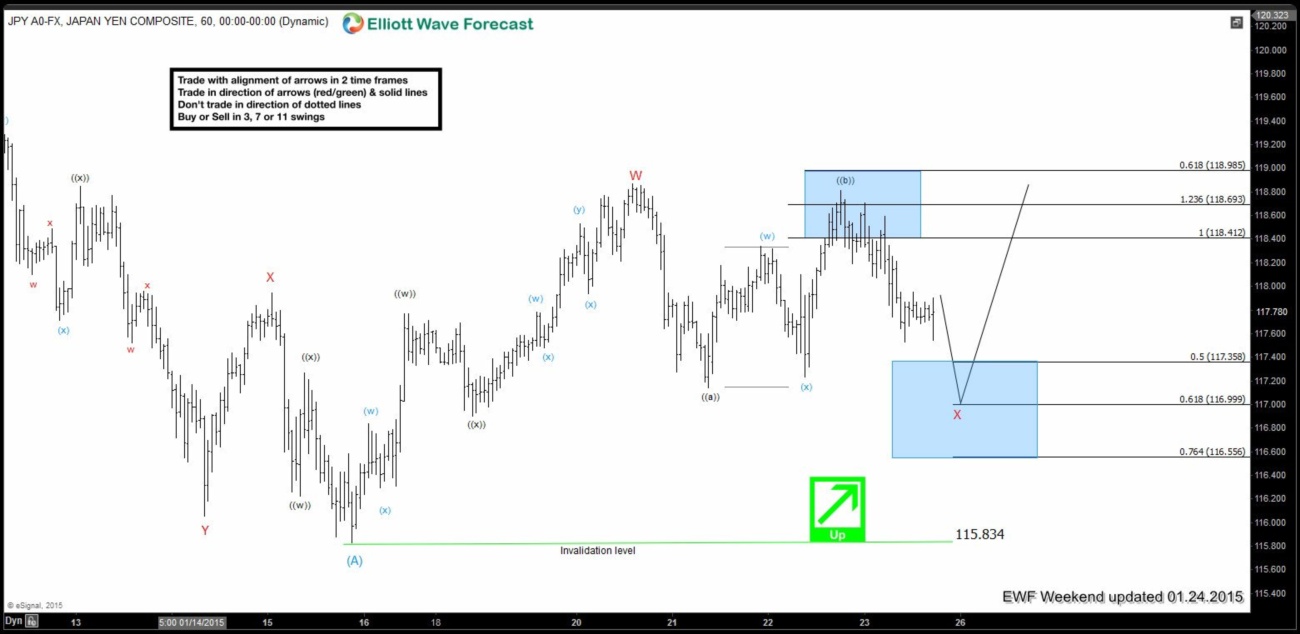

USDJPY Short-term Elliott Wave Analysis 1.24.2015

Read MorePreferred Elliott Wave view is the dips in the pair should hold above 115.82 low for continuation higher. We think wave “W” ended at 118.83, wave “X” pull back is in progress & could test 116.99 – 116.56 area before pair turns higher in the next leg. We don’t like selling the pair as there is no […]

-

USDJPY Elliott Wave Video

Read MorePreferred Elliott Wave view is the dips in the pair should hold above 115.82 low for continuation higher. We think wave “W” ended at 118.83 and dip to 117.14 completed wave “X”. Expect a test of 118.69 to complete wave (w) before we get a pull back in wave (x) and higher again. If 118.69 is […]

-

EURUSD – Pre ECB Technical Analysis and Trade Plan

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily from 12:30 PM EST (5:30 PM BST), join Dan there for more insight into these proven methods of trading. EURUSD […]

-

NZDUSD Short-term Elliott Wave Analysis 1.21.2015

Read MorePair remains bearish while below 0.7891 & now the X high at 0.7710. We expect wave (( w )) of Y to end in 0.7542 -0.7503 area followed by a bounce in wave (( x )) and then lower again toward 0.7438 – 0.7374 area to complete 7 swings down from 0.7891 high. After that there […]