The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

EURGBP Short-term Elliott Wave Analysis 2.26.2015

Read MorePreferred Elliott Wave view suggests pair is doing a WXY structure down from 2/2 high. We have seen the end of 6th swing i.e. wave (( x )) of Y at 0.7348. A bounce in wave (x) is now expected to hold below this level for continuation lower toward 0.7221 – 0.7169 area to end […]

-

EURGBP Elliott Wave Video 2.26.2015

Read MorePreferred Elliott Wave view suggests pair is doing a WXY structure down from 2/2 high. We have seen the end of 6th swing i.e. wave (( x )) of Y at 0.7348. A bounce in wave (x) is now expected to hold below this level for continuation lower toward 0.7148 – 0.7233 area to end […]

-

How to trade with Elliott Wave Forecast- follow the chart arrows

Read MoreOur new clients usually need at least 2 weeks to get familiar with EWF Services and trading system before they start enjoying the profit in trading. Every day we receive questions like: “How to trade with Elliott Wave” or “Which pair is best to trade at this moment?” or “Chart of Gold is calling for […]

-

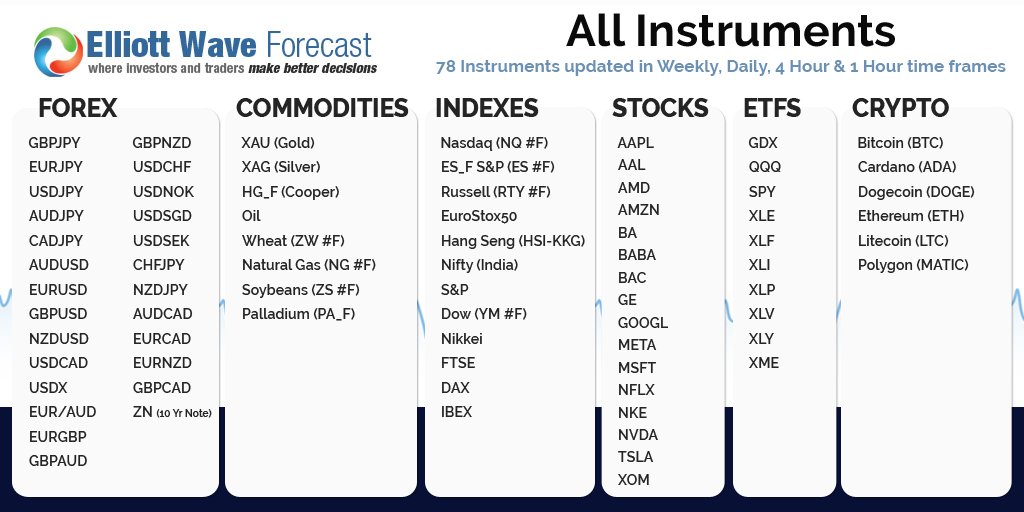

How to get the best of Free 14 day Trial

Read MoreBy signing up for Free 14 days Trial, you have taken the first step toward becoming a successful trader. We cover 78 instruments in total which are devided into 3 groups as listed below: Group 1: USD group : AUDUSD, EURUSD, NZDUSD, GBPUSD, USDCAD, USDX,ZN_F Yen group : GBPJPY, EURJPY , USDJPY, AUDJPY, CADJPY Crosses : […]