The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

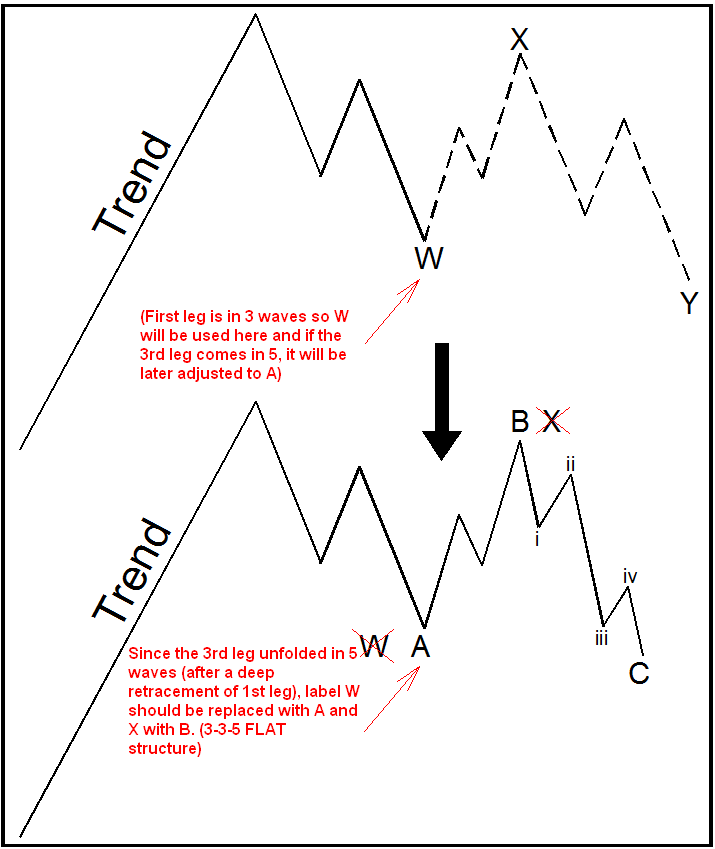

Elliott Wave Pattern Labeling: A Step-by-Step Guide for Traders

Read MoreThe patterns that usually occur in the market can be subdivided in two main categories: Impulsive pattern and corrective pattern. The main difference between these two groups is in Impulsive pattern the move in the market is sharp and without overlap but in corrective pattern, we see sideway and overlapping price actions. Labeling the impulsive […]

-

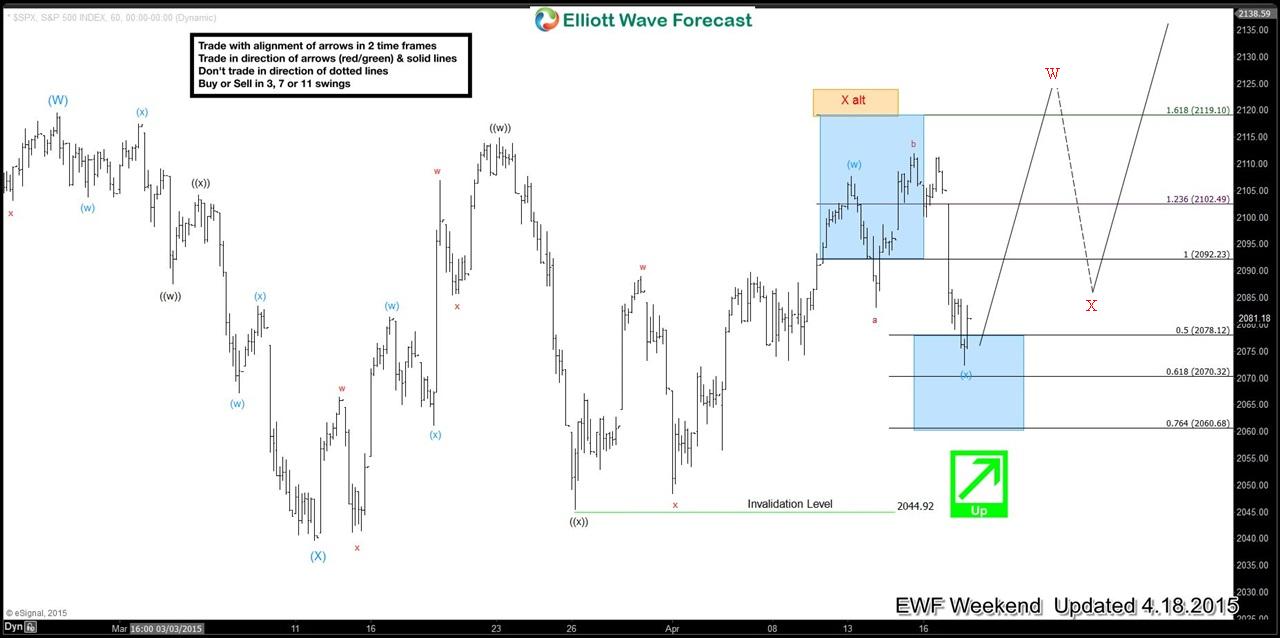

$SPX Short-term Elliott Wave update 4.21.2015

Read MorePreferred Elliott wave view suggests a cycle from (x) low has ended and a pull back in wave “b” is in progress. 2091 – 2086 is the ideal area to complete this pull back and then we expect the rally to resume. Green arrow indicates the trend is up and also the line going toward “b” […]

-

$SPX Elliott Wave Analysis 4.20.2015

Read MoreSPX500 dropped sharply on Friday in 5 waves. A 5 wave move doesn’t always mean that trend has reversed as a 5 wave move could be part of an Elliott Wave FLAT correction as well which we think was the case here as our bullish pivot at 3/26 (2044.92) low never gave up. As this […]

-

Educational Series – Zig-Zag Elliott Wave Structure

Read MoreIn this educational video, we will talk about the Elliottwave zigzag structure. Zigzag is a corrective 3 wave move labelled as an ABC. Zigzag is a 5-3-5 Elliott wave structure but zigzag can also be the internal structure of a double three WXY or an internal structure of a triple three WXYZ. What are some of the […]