The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

NZDUSD: EWF forecasting the decline & selling the rallies

Read MoreFor the last few months EWF members knew that NZDUSD has been in bearish cycle, which has given us a lot of nice selling opportunities. Suggested strategy was selling rallies in 3,7 or 11 swings. Let’s take a quick look at H1 Elliott Wave charts from the 25. May 2015 to see how we were guiding […]

-

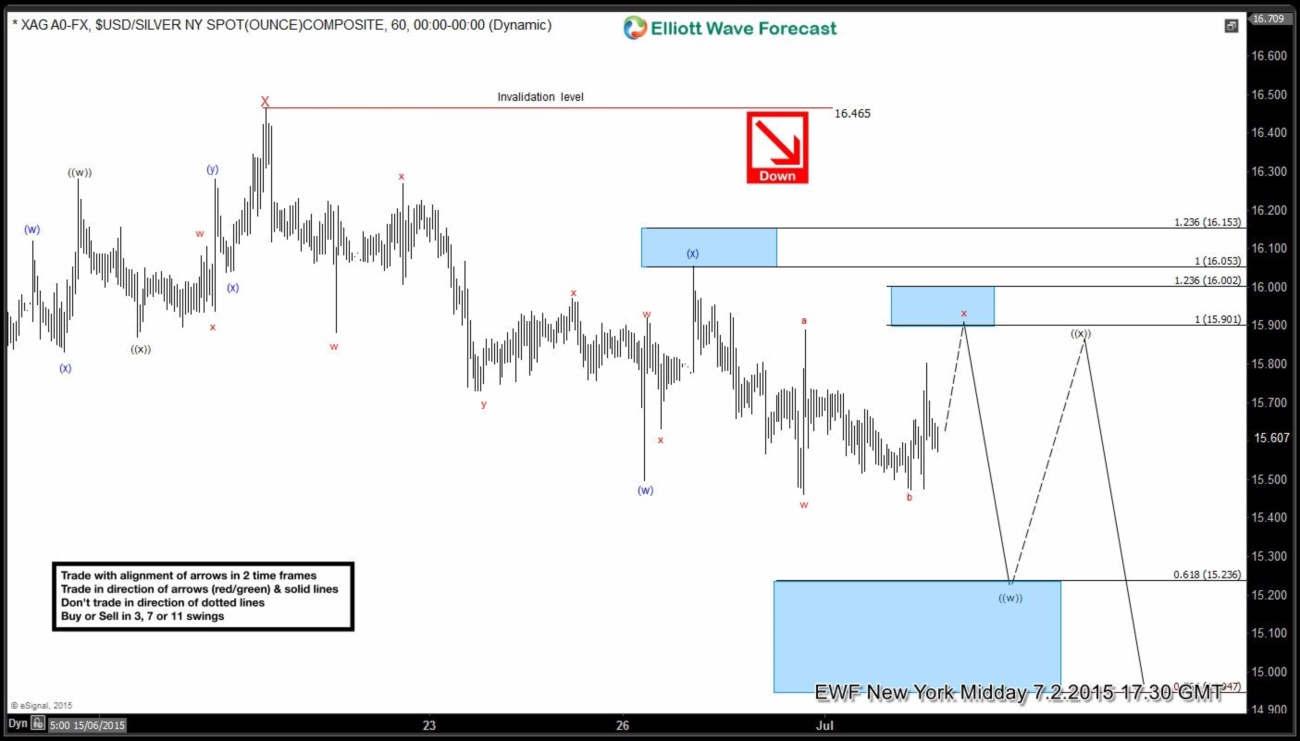

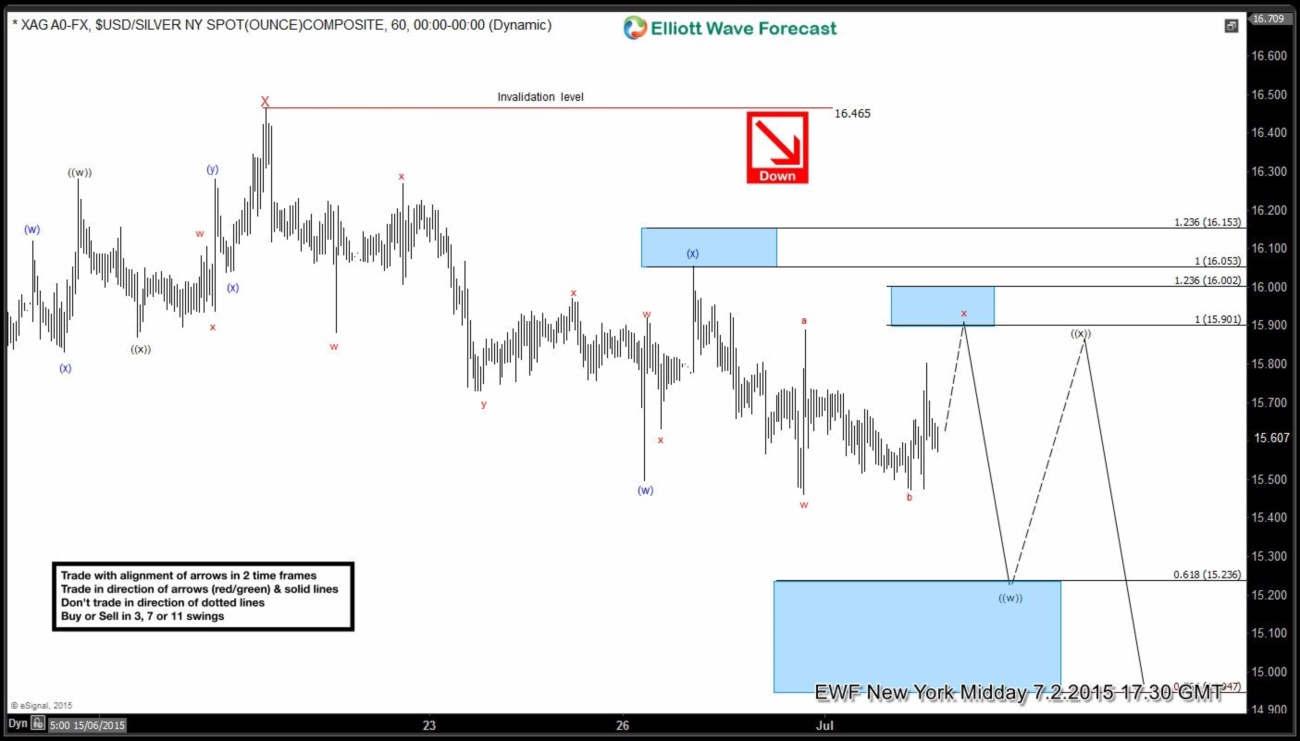

Silver (XAG) Short Term Elliott Wave Update 7.3.2015

Read MoreDecline from wave X at 16.46 is unfolding in double correction (w)-(x)-(y) where wave (w) ended at 15.5, wave (x) ended at 16.05, and wave (y) is in progress towards 14.95 – 15.2. Revised short term Elliott Wave view suggests the internal of wave (y) is taking the form of a double corrective structure w-x-y where […]

-

Silver (XAG) Short Term Elliott Wave Update 7.3.2015

Read MoreDecline from wave X at 16.46 is unfolding in double correction (w)-(x)-(y) where wave (w) ended at 15.5, wave (x) ended at 16.05, and wave (y) is in progress towards 14.95 – 15.2. Revised short term Elliott Wave view suggests the internal of wave (y) is taking the form of a double corrective structure w-x-y where […]

-

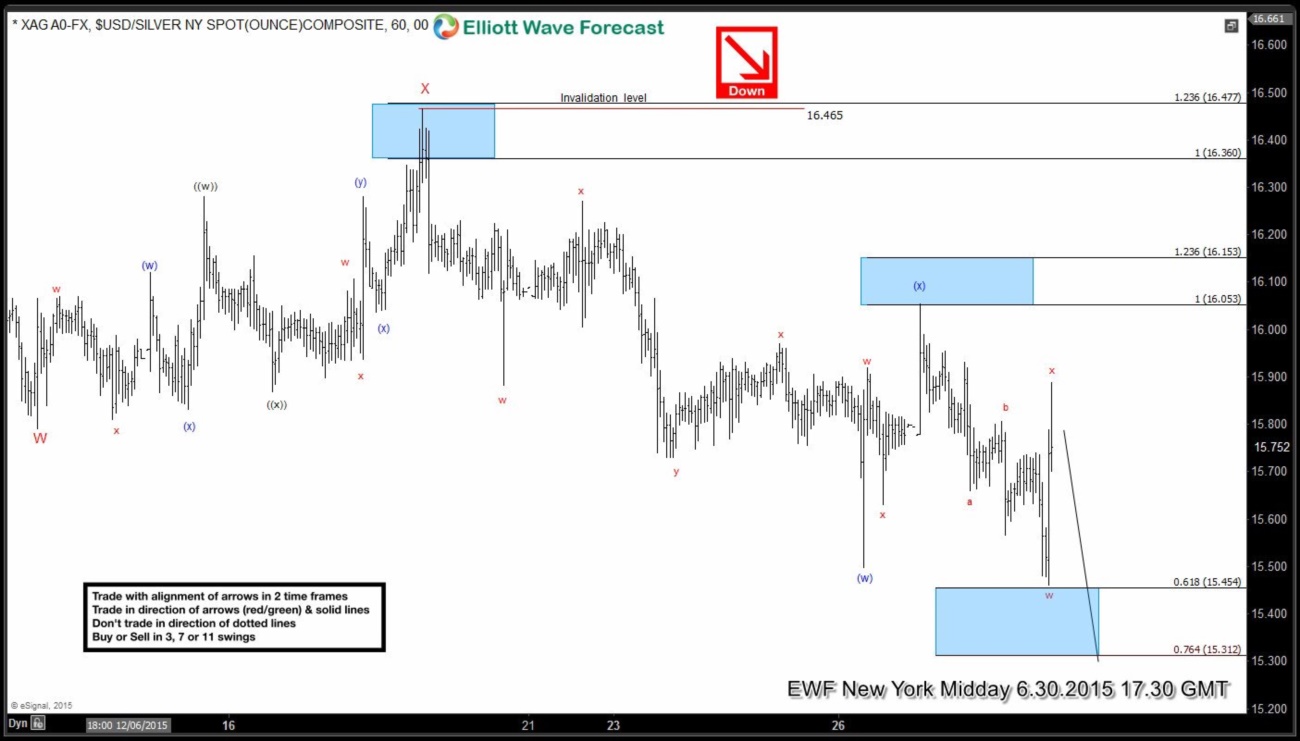

Silver (XAG) Short Term Elliott Wave Update 7.1.2015

Read MoreDecline from wave X at 16.46 is unfolding in double correction (w)-(x)-(y) where wave (w) ended at 15.5, wave (x) ended at 16.05, and wave (y) is in progress towards 14.85 – 15.08. In our Chart of The Day 6.30.2015, we said the internal of wave (y) is also taking the form of a double corrective […]