The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Russell 2000 $RUT Short-term Elliott Wave Analysis 5.18.2016

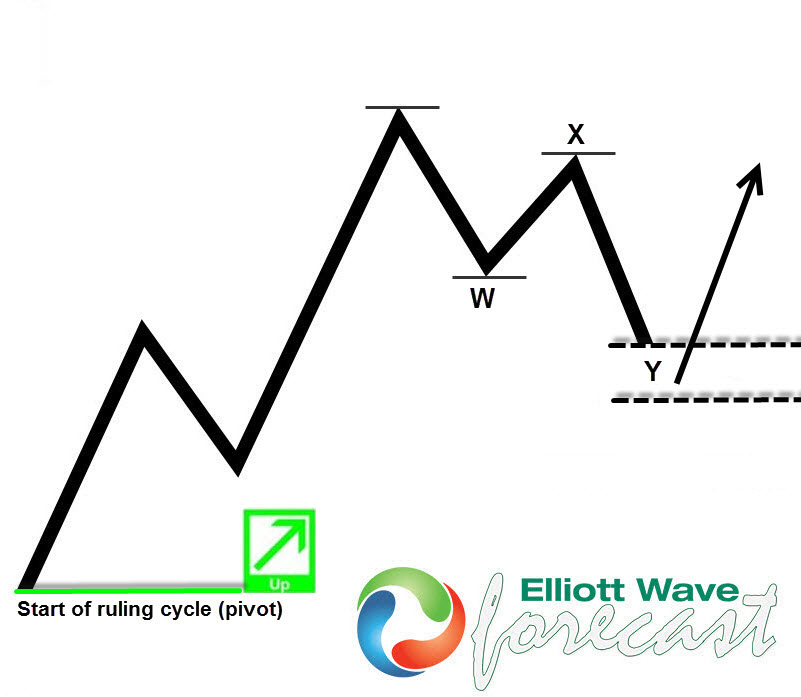

Read MoreShort term Elliottwave structure suggests wave “b” is proposed over at 1156.07. Decline from there is unfolding as a double three structure where wave (W) ended at 1101.57 and wave (X) bounce ended at 1129.08. Secondary high wave ((x)) is also proposed complete at 1119.68. Decline from there is proposed to be unfolding in a zigzag where wave […]

-

A Lesson from the Maze

Read MoreHave you ever played a maze when you were a kid? In Hong Kong Disneyland, there’s a maze located at the garden outside the hotel which has a shape of a Mickey Mouse head if seen from a distance above. The height of the bushes is designed so that little children’s sight would be blocked when they go inside […]

-

New to Elliott Wave? This is the first thing you should learn

Read MoreHello fellow traders, welcome to Elliott Wave Forecast. In this technical blog we’re going to get through some basic stuff of Elliott Wave Theory in order to help you get started with it. Many of you probably already know that Elliott Wave is the most powerful form of Technical Analysis used to forecast financial market […]

-

Russell 2000 $RUT Short-term Elliott Wave Analysis 5.17.2016

Read MoreShort term Elliottwave structure suggests wave “b” is proposed over at 1156.07. Decline from there is unfolding as a double three structure where wave (W) ended at 1101.57 and wave (X) bounce ended at 1129.08. Secondary high wave ((x)) is also proposed complete at 1119.68. While pair stays below below 1129.08, expect the Index to resume the decline either to new […]