-

Trading with Elliott Waves using Fibonacci retracement levels

Read MoreOne of the ways to determinate end of corrections(potential reversal areas) is by using Fibonacci retracement levels in your analysis approach . In this blog, we’re going to explain some basic things about Fibonacci retracements. Fibonacci retracement is a popular tool among Elliott Wave practitioners and is based on the key founded by mathematician Leonardo Fibonacci. The most important […]

-

AUDUSD Short-term Elliott Wave Analysis 3.10.2015

Read MoreBest reading of Elliott wave cycles suggests decline from 0.7914 ((X)) high is taking the form of a triple three structure. Triple three is an 11 swing structure labelled here as ((w))-((x))-((y))-((z)). Drop to 0.7748 completed wave ((w)), recovery to 0.7860 was wave ((x)), dip to 0.7696 was wave ((y)) and 2nd wave ((x)) is considered completed […]

-

Dynamics of a WXY Elliott Wave Structure

Read MoreIn this educational video, we are going to take a look at (W)-(X)-(Y) Elliott wave structure which is one of the most important structures in the market. It is a 7 swing Elliot Wave structure and is commonly known as a double zig-zag but we would like to point out that every (W)-(X)-(Y) structure is […]

-

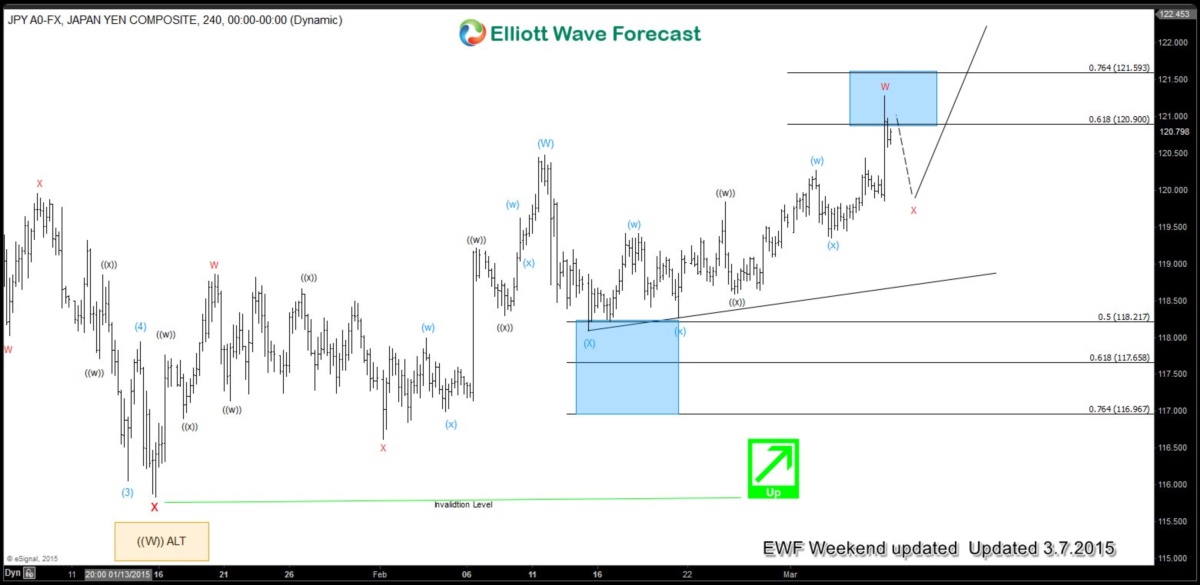

USDJPY Mid-term Elliott Wave Cycles remain bullish

Read MoreUSDJPY pair made a sharp move to the upside after US Non-Farm payrolls report last Friday. Financial media would make traders think that up move happened because of NFP whereas in reality, the move had nothing to do with NFP. It was a very technical move and we forecasted this before the move happened. Let’s […]