The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Gold Forecast through Gold-to-Silver Ratio

Read MoreIn this article, we will attempt to do short term and medium term Gold forecast through the chart of Gold-to-Silver ratio. The aftermath of Donald Trump’s election initially saw Gold rallying 5% on Nov 9, only to be completely reversed. Since then, we saw U.S. Dollar’s rally accelerated against other major currencies. USD Index made […]

-

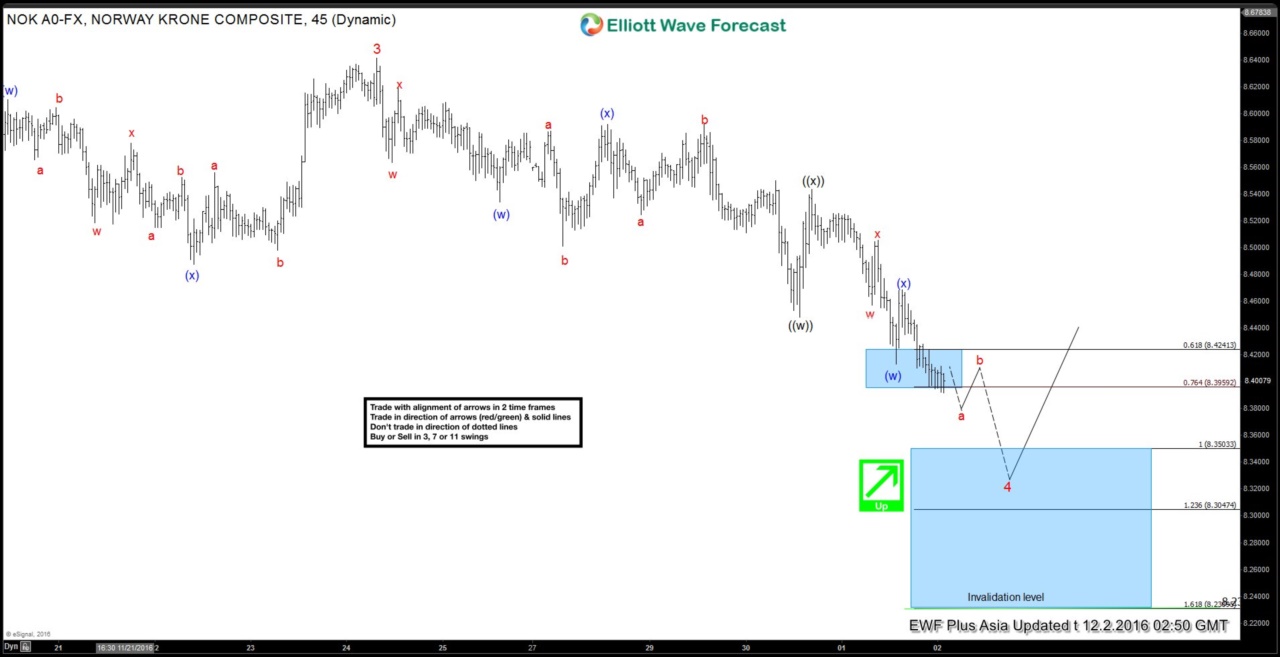

USDNOK Short-term Elliott Wave Analysis 12.2.2016

Read MoreRevised USDNOK short Term Elliott wave cycles suggests that rally to 8.641 ended wave 3 and wave 4 pullback is unfolding as a double three where wave ((w)) ended at 8.447, wave ((x)) ended at 8.543 and wave ((y)) of 4 is in progress towards 8.304 – 8.35 area. Near term, while pullbacks stay below wave ((x)) at […]

-

Don’t rush buying MasterCard (MA)

Read MoreMasterCard shares (NYSE: MA) failed to break above the all-time highs made last month even with the “Trump Rally” which started 3 weeks ago pushing the stock market strongly to the upside , this doesn’t seems to had any impact on MasterCard so with investors looking to cash-out before Christmas and some stocks reaching extremes like American Express that […]

-

NZDJPY Elliott Waves forecasting the rally & buying the dips

Read MoreHello fellow traders, in this technical blog we’re going to take a quick look at the past Elliott Wave charts of NZDJPY to see how we guided our members through this instrument. The chart below is $NZDJPY daily update from 11.07.2016 It’s suggesting we’re in the potential pull back X red from the 76.90-78.01 area, […]