The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

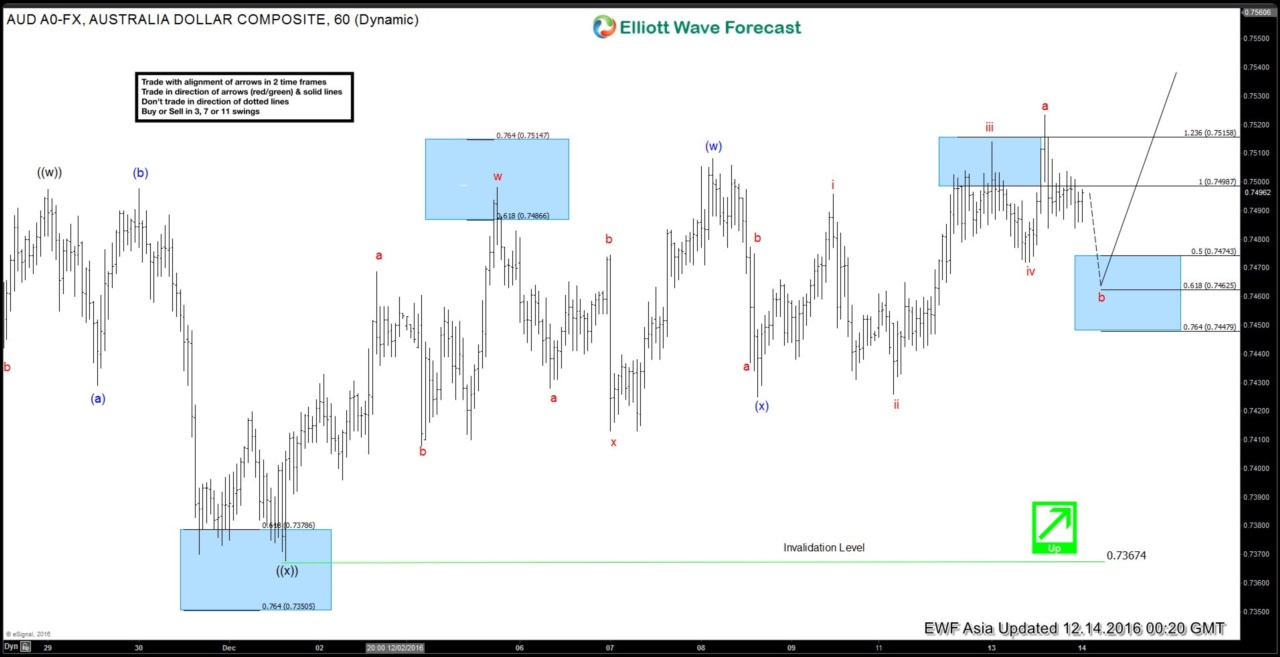

AUDUSD Elliott Wave Forecast 12.14.2016

Read MoreShort Term AUDUSD Elliott wave forecast suggests that the decline to 0.7306 on 11/21 low ended wave (X). Up from there, pair is showing a 5 swing sequence from 11/21 low and suggest more upside. Rally from 11/21 low is unfolding as a double three structure where wave ((w)) ended at 0.749 and wave ((x)) ended […]

-

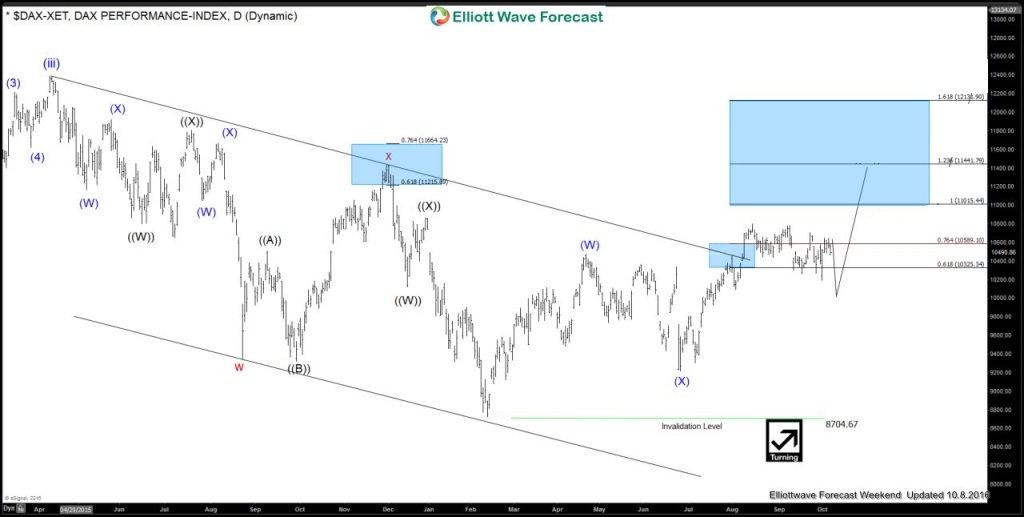

Forecasting the rally in DAX Index

Read MoreIn this technical blog, we will take a look at some charts of DAX Stock Index presented to clients of Elliottwave-Forecast.com over the last few weeks. For the last few months EWF members knew that Global Indices had been in a bullish cycle and it offered some nice buying opportunities in the dips in 3, 7 or […]

-

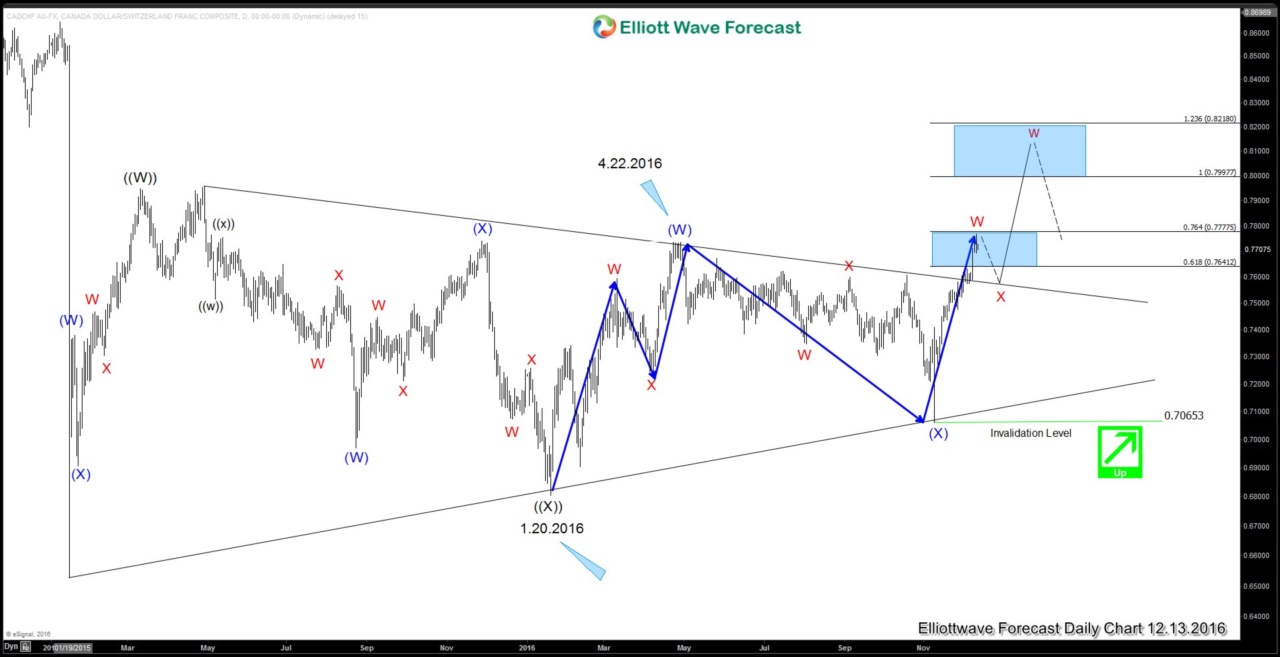

CL_F rally will benefit Canadian Dollar

Read MoreIn November 30, the OPEC members agreed to cut oil production by 1.2 million barrels causing a 9.3% rally in CL_F. Since then, U.S. crude futures continued to rally and took out the previous high of the year made on October 18 at $50.78. We’ve suggested that from technical point of view, CL_F is showing […]

-

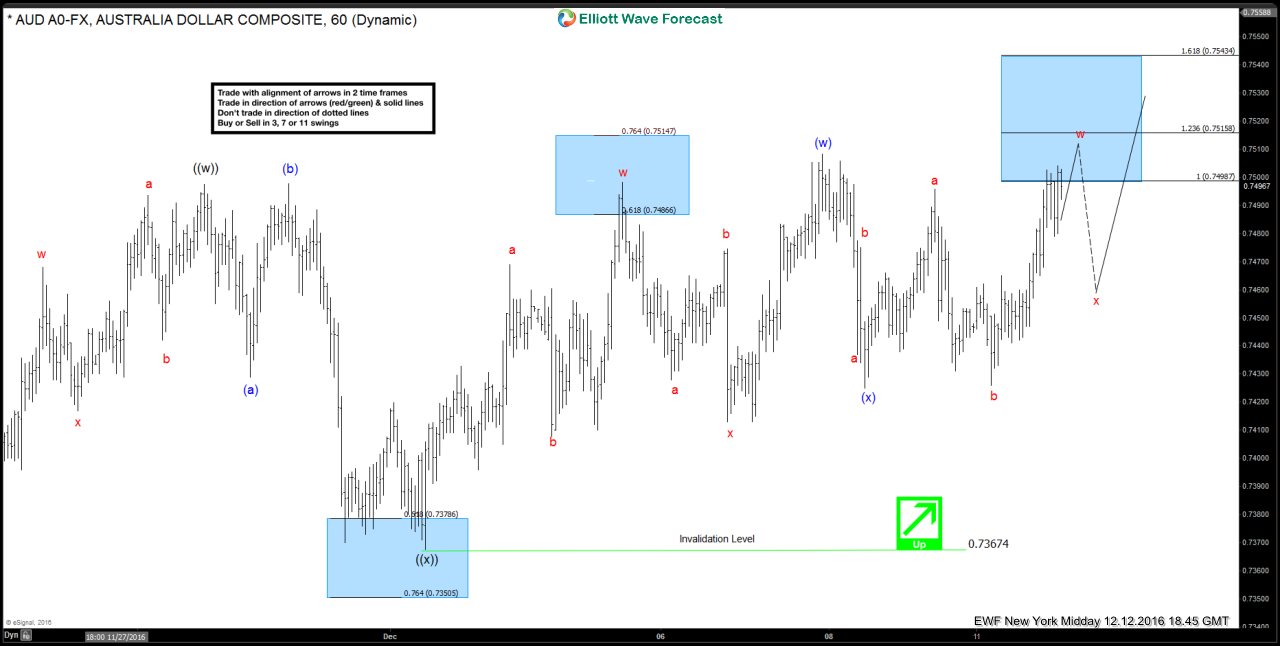

AUDUSD Elliott Wave Forecast 12.13.2016

Read MoreShort Term AUDUSD Elliott wave forecast suggests that the decline to 0.7306 on 11/21 low ended wave (X). Up from there, pair is showing a 5 swing sequence from 11/21 low and suggest more upside. Rally from 11/21 low is unfolding as a double three structure where wave ((w)) ended at 0.749 and wave ((x)) ended […]