The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

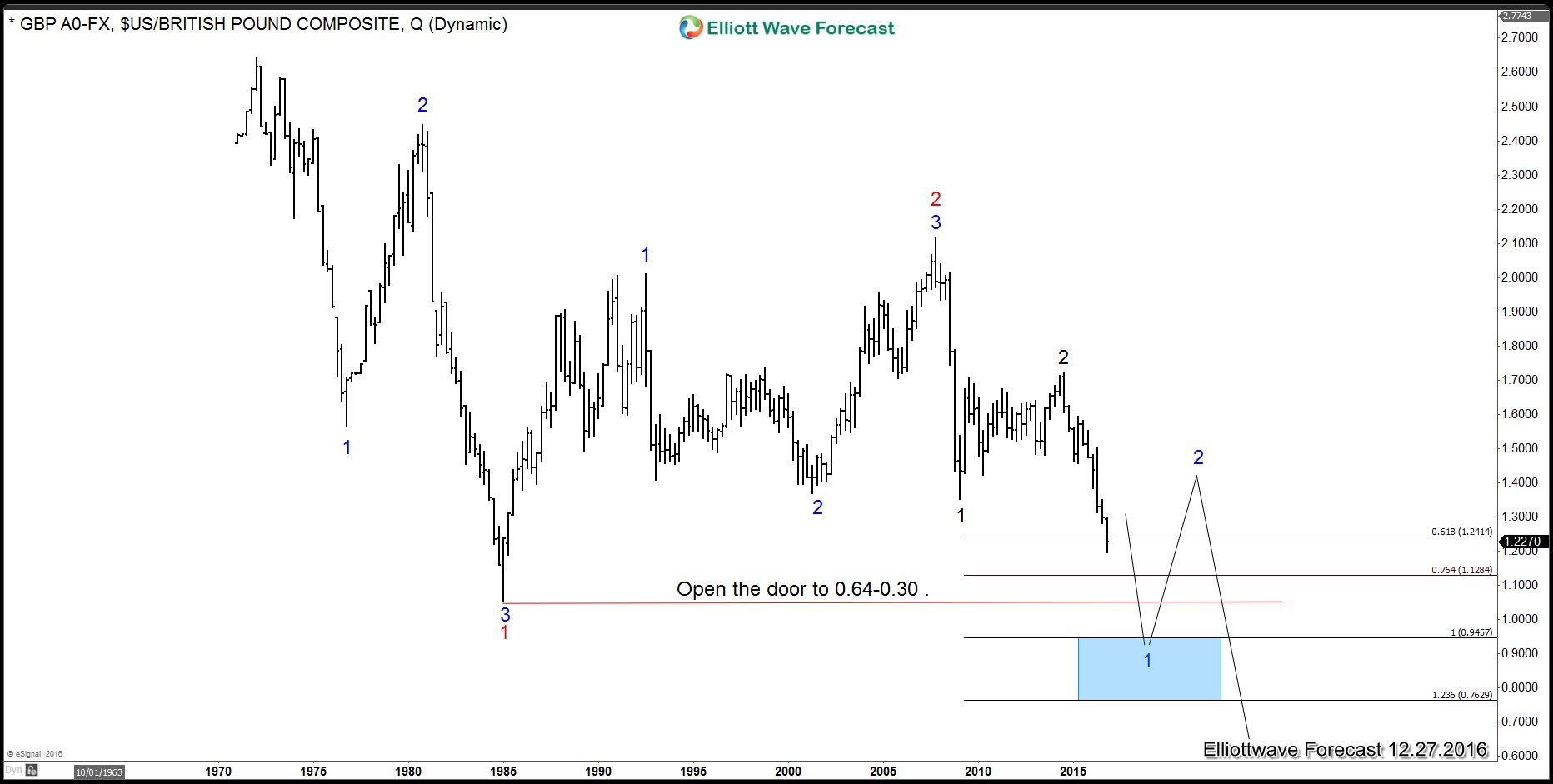

GBPUSD Can a dip into the $0.60-$0.30 area happen?

Read MoreThe GBPUSD has been declining since the late 1960’s. The currency instrument did see a three wave decline into the 1985 low. This low represents either a pause into the longer term decline sequence or the beginning of a new bullish sequence. From the 1985 lows the currency rallied for 22 years based in Elliott wave hedging, which […]

-

CL_F Elliott Wave Forecast 12.27.2016

Read MoreCL_F (Oil) is showing an incomplete 5 swing sequence from 2/8 low ($26.02), favoring for more upside. The latest rally up from 11/14 low ($42.2) is proposed to be unfolding as a triple three where wave W ended at $49.2, wave X ended at $44.82, wave Y ended at $54.51, and second wave X ended […]

-

CVR Energy Bullish Reversal ( CVI )

Read MoreCVR Energy Presentation & News CVR Energy ( NYSE:CVI ) is a diversified holding company primarily engaged in the petroleum refining and nitrogen fertilizer manufacturing industries through its holdings in two limited partnerships, CVR Refining ( NYSE:CVRR ) and CVR Partners ( NYSE:UAN ). The largest shareholder of CVR Energy is Carl Icahn, who, through Icahn Enterprises, […]

-

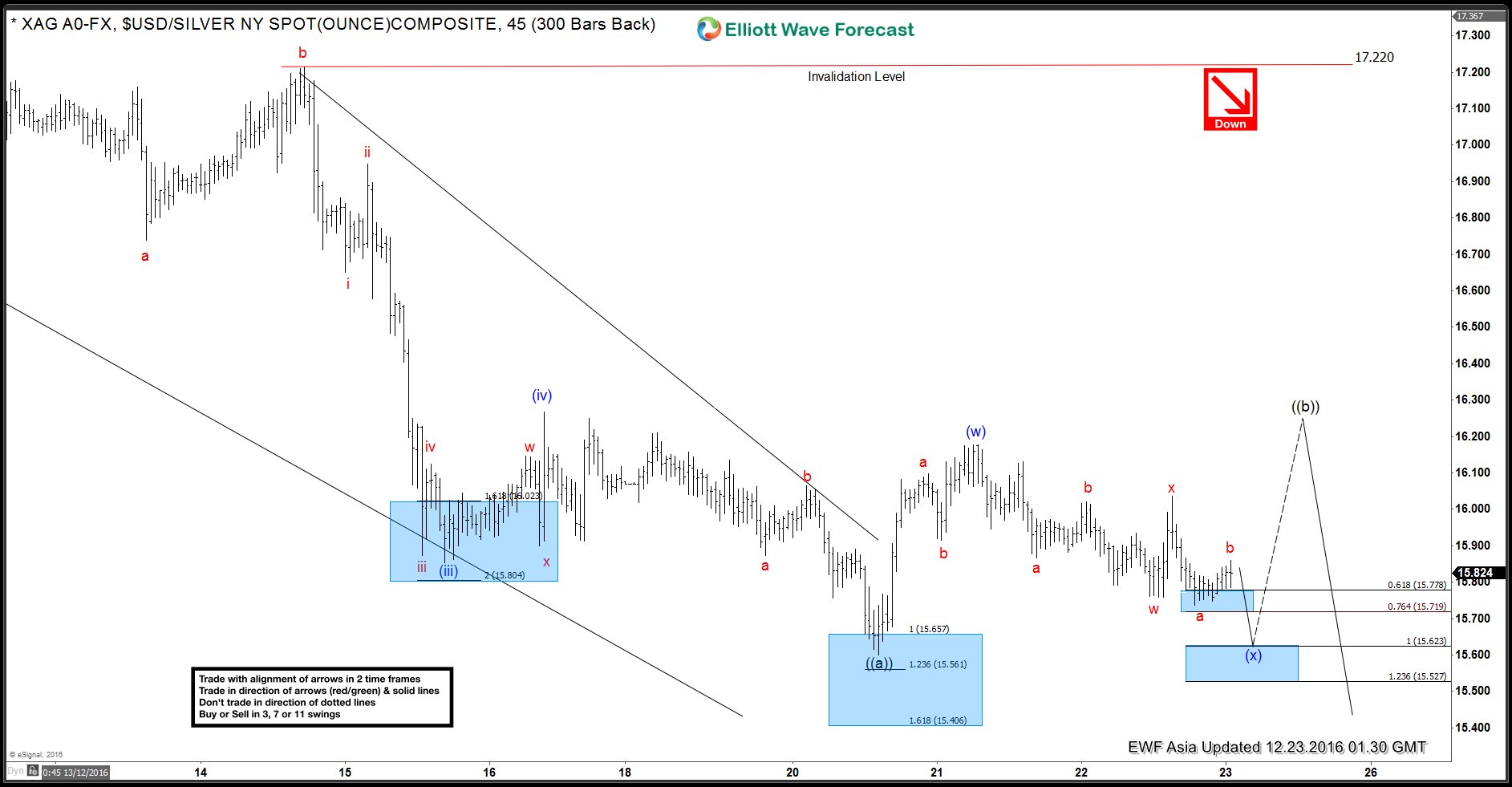

XAG Elliott Wave Forecast 12.23.2016

Read MoreXAG (Silver) is showing an incomplete Elliott Wave sequence from 11.9.2016 peak. There are 5 swings down from 11.9.2016 peak which makes short-term sequence bearish against 12.7.2016 (17.25) peak. Decline from 18.99 – 16.14 was a 3 wave move labelled wave W followed by a 3 wave bounce to 17.25 that completed wave X. Cycle […]