The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

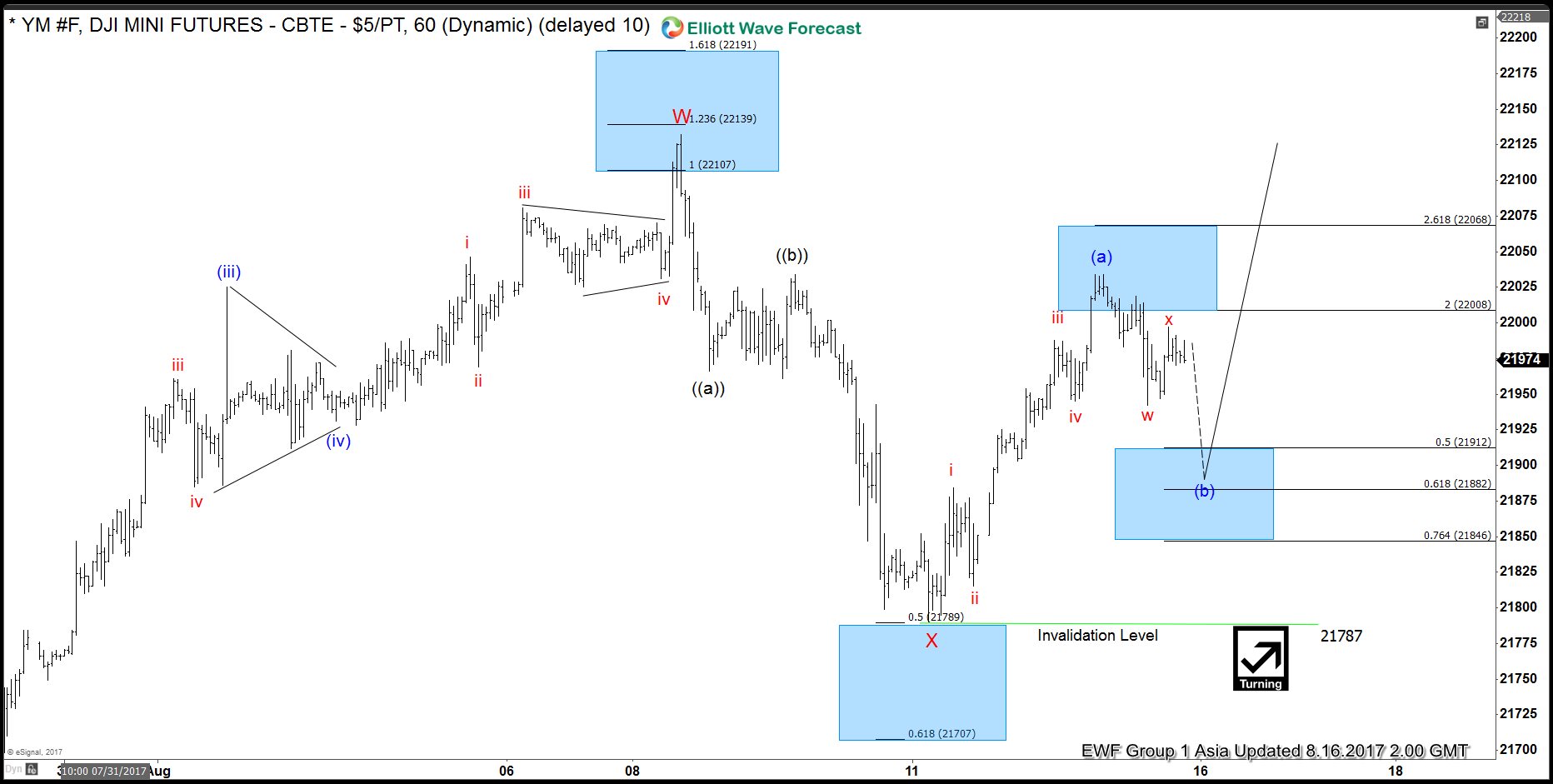

Dow Futures Elliott Wave View 8.17.2017

Read MoreShort term Dow Futures (YM_F) Elliott Wave view suggests that rally from 6/29 low is unfolding as a a double three Elliott wave structure. Up from 6/29 low (21138), Minor wave W ended at 22132 and pullback to 21790 ended Minor wave X. Rally from there is unfolding as an impulse Elliott wave structure. Up from 21790, […]

-

NASDAQ:GOOGL Awaiting New Highs with the new Google Android 8.0 OS Version

Read MoreBefore we get into the subject, Alphabet, Inc. is a holding company and engages in acquisition & operation of different companies and operates through the Google and Other Bets segments. The Google segment includes Internet products such as the Google Search engine, Google Ads, Google Commerce, Google Maps, YouTube, Apps, Cloud, Android, Chrome, Google Play […]

-

Dow Futures Elliott Wave View: 3 waves pullback

Read MoreShort term Dow Futures (YM_F) Elliott Wave view suggests that rally from 6/29 low is unfolding as a a double three Elliott wave structure. Up from 6/29 low (21138), Minor wave W ended at 22132 and pullback to 21790 ended Minor wave X. Rally from there is unfolding as an impulse Elliott wave structure. Up from 21790, […]

-

SPX forecasting the rally and buying the dips

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave chart of SPX published in members area of www.elliottwave-forecast.com. In further text we’re going to explain the Elliott Wave count nad trading strategy. SPX Elliott Wave 1 Hour Chart 06.27.2017 As our members know, we were pointing […]