The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

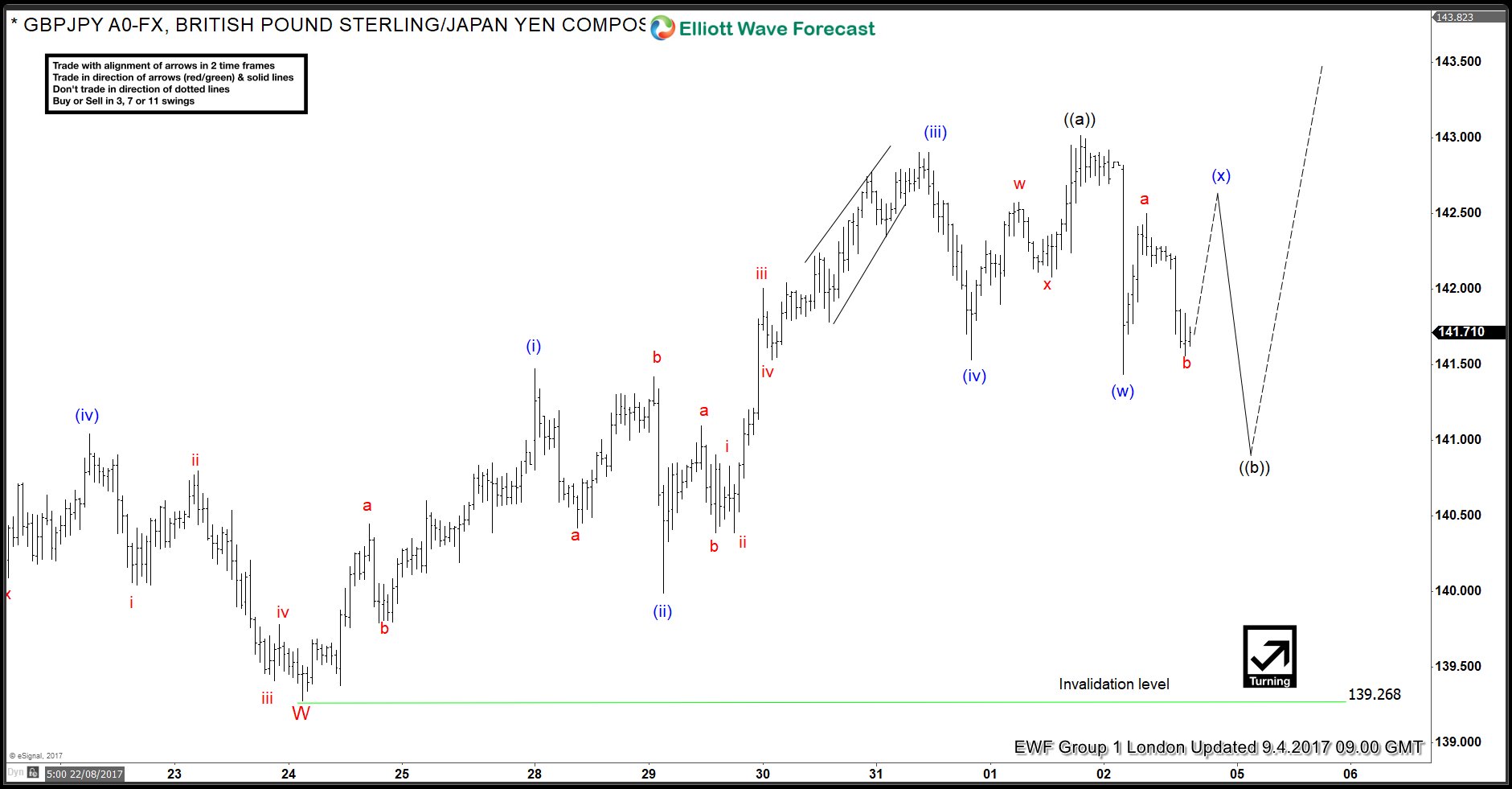

GBPJPY Elliott Wave View: 9.4.2017

Read MoreGBPJPY Short Term Elliott Wave suggests that the decline to 8/23 low at 139.26 ended Minor wave W. Up from there, the rally is unfolding as an Diagonal structure . Which we are viewing as part of Minute wave ((a)) of an Elliott wave zigzag structure. Where Minutte wave (i) ended at 141.40 and Minutte wave (ii) ended at 139.99 […]

-

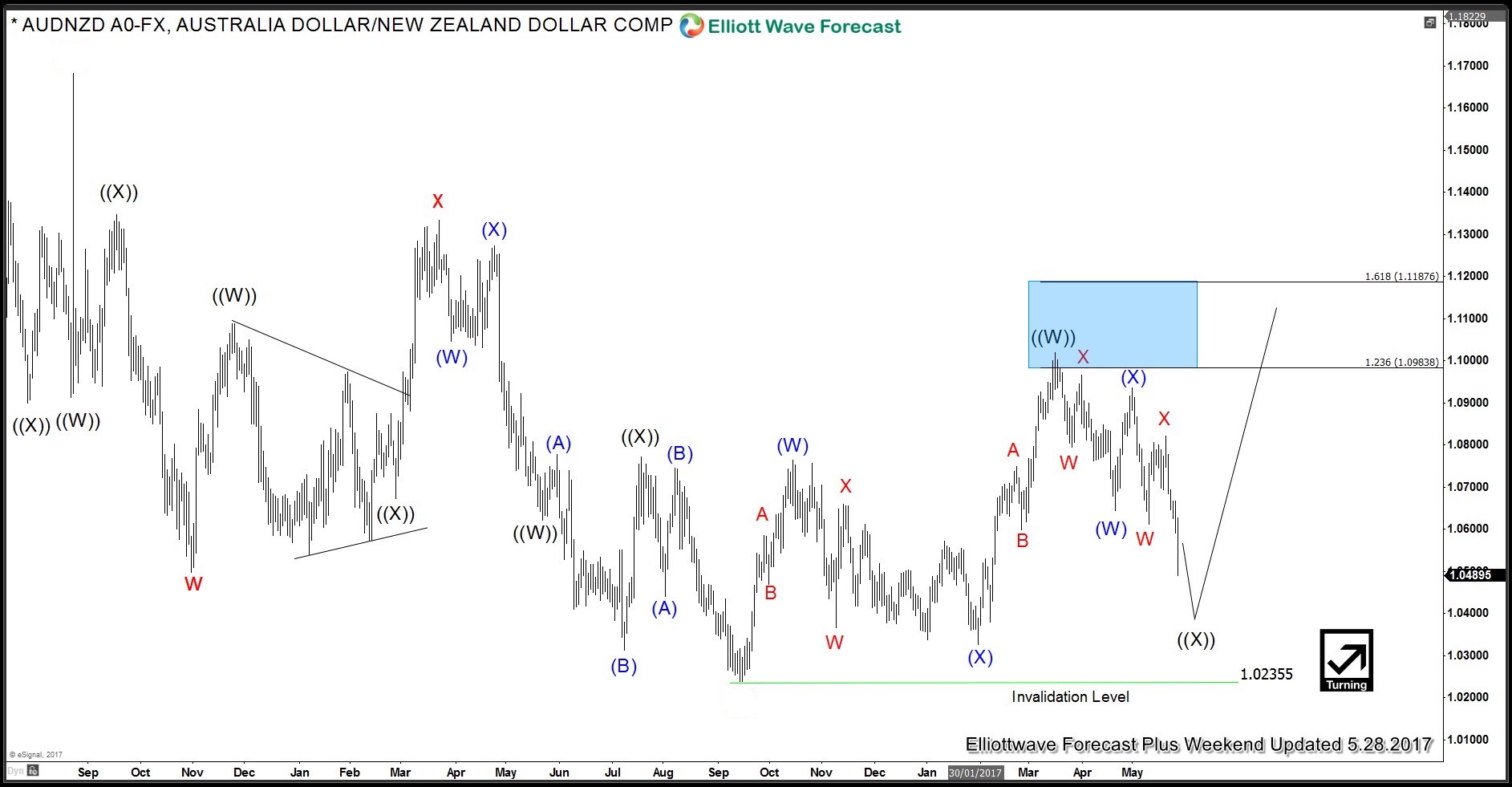

AUDNZD Live Trade reaches target for 455 pips profit

Read MoreIn May 17th Live Trading Room, we issued a trading idea for AUDNZD . The trade was to buy AUDNZD at 1.0565 and the entry was filled on May 25th. Below is the trading journal we presented to members on May 17th Live Trading Room We subsequently put a limit target of 1.102 and the pair […]

-

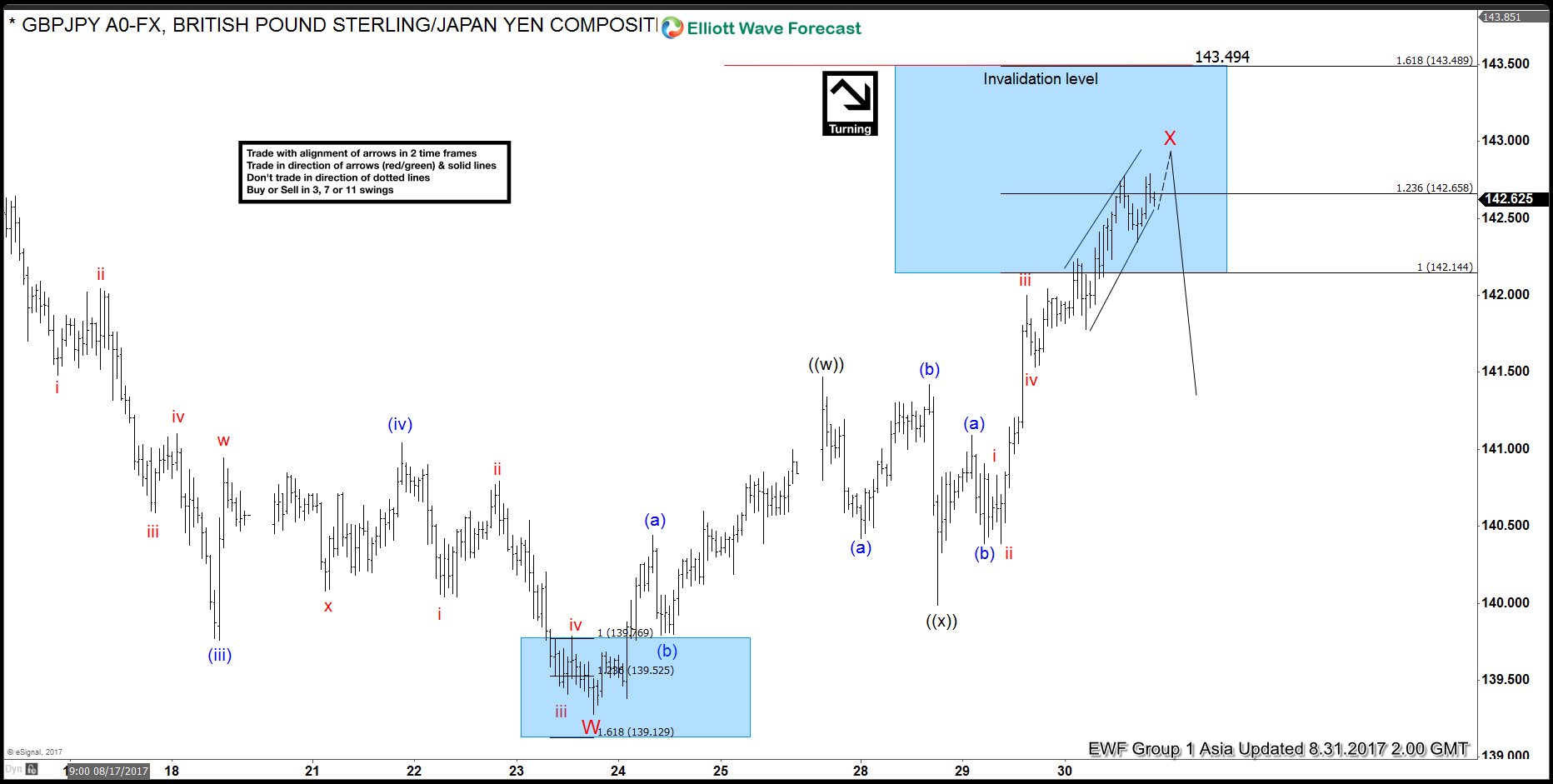

GBPJPY Elliott Wave View: Ending correction

Read MoreGBPJPY Short Term Elliott Wave suggests that the decline to 8/23 low at 139.27 ended Minor wave W. Minor wave X bounce is currently unfolding as a double three Elliott Wave Structure. Minute wave ((w)) of X ended at 141.47, Minute wave ((x)) of X ended at 139.98, and Minute wave ((y)) of X is subdivided into a […]

-

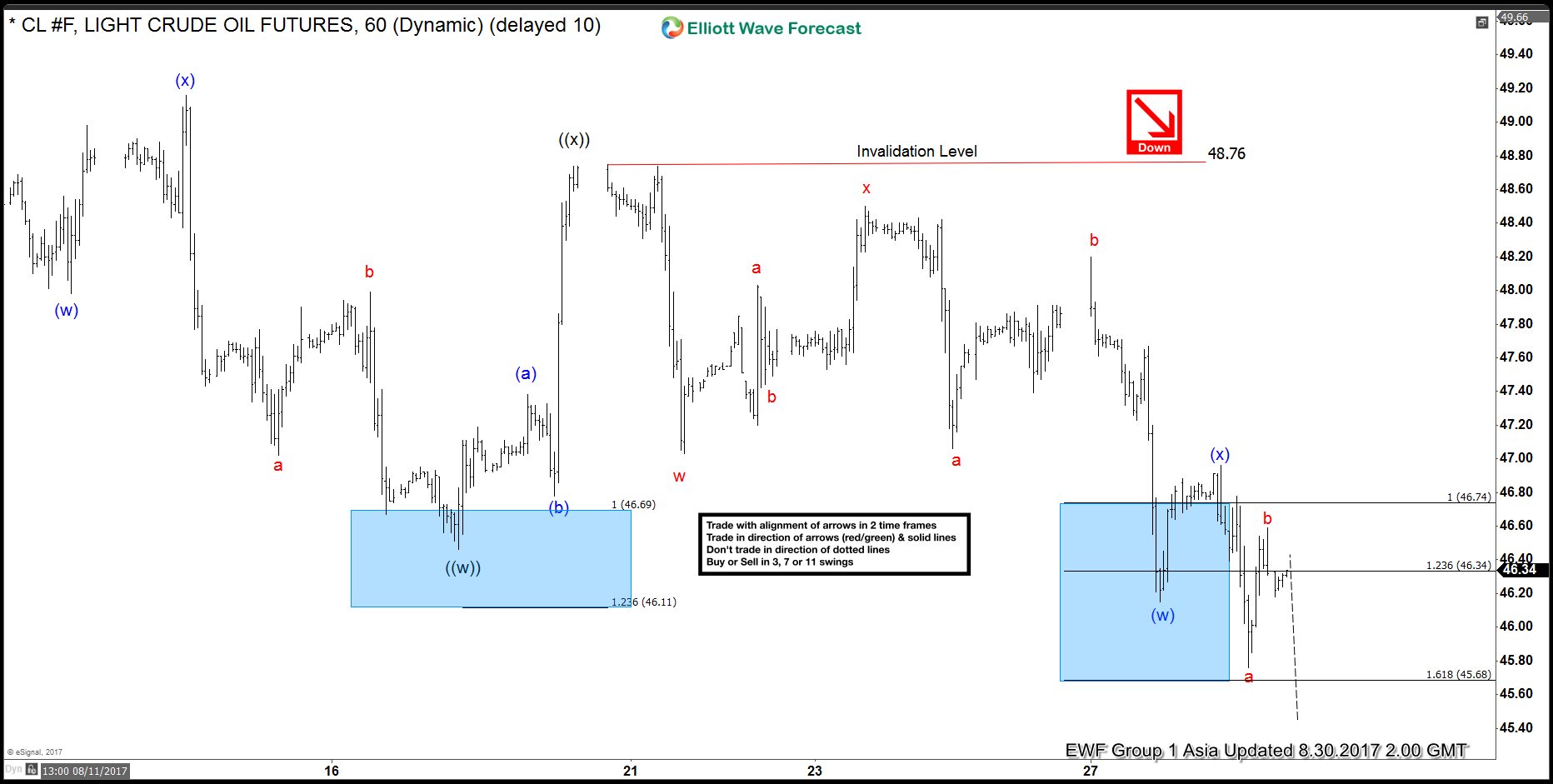

CL_F Oil Elliott Wave View: Pullback in progress

Read MoreOil Short Term Elliott Wave suggests that the decline from 8/1 peak is unfolding as a double three Elliott Wave Structure where Minute wave ((w)) ended at 46.46 and Minute wave ((x)) ended at 48.76. Oil has since made a new low below Minute wave ((w)) at 46.46 suggesting the next leg lower has started. Wave […]