The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

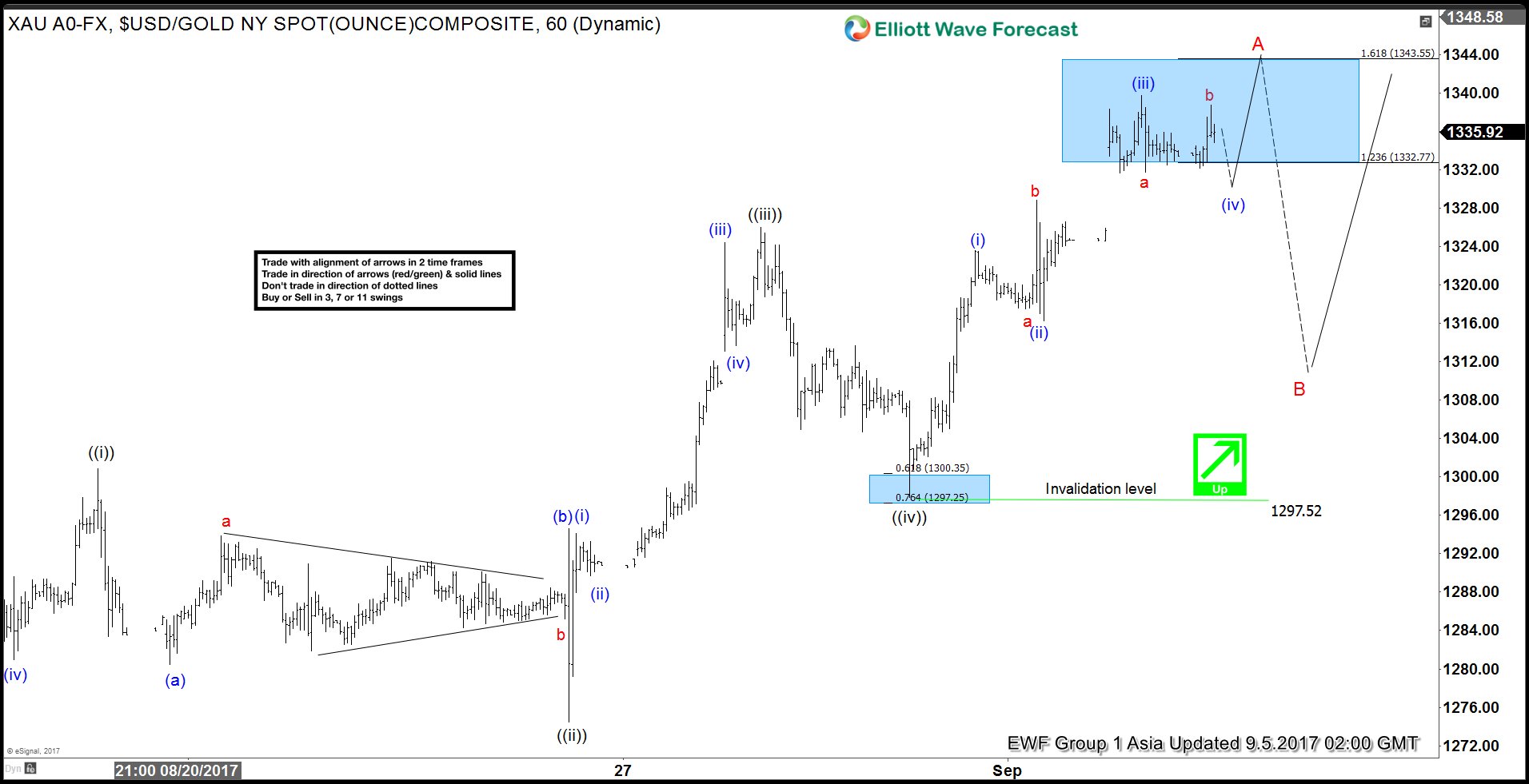

Gold Elliott Wave View: 5 Waves Up

Read MoreShort Term Gold Elliott Wave suggests that the rally from 8/15 low is unfolding as a zigzag. The first leg Minor wave A is subdivided as an impulse. Minute wave ((i)) of A ended at 1300.83, Minute wave ((ii)) of A ended at 1274.45, Minute wave ((iii)) of A ended at 1326, and Minute wave ((iv)) […]

-

North Korea Nuclear test poses little threat to Indices rally

Read MoreGeopolitical tensions intensified after North Korea conducted its sixth and most powerful nuclear test on Sunday, 3rd September 2017 detonating what it said was a hydrogen bomb meant for intercontinental ballistic missile. The United States warned it could launch a “massive” military response if it or its allies were threatened. Most of the Stock Markets […]

-

Under Armour UAA Weekly Elliott Wave Outlook

Read MoreUnder Armour (NYSE: UAA) is one of the leading sporstwear companies around the world. However it’s stock has been struggling in the recent 2 years as it lost %68 since September 2015. In our previous article, we pointed out to the current correction taking place which could turn out to be 3 waves flat structure. […]

-

Cleveland Cliffs (NYSE:CLF) Daily Elliott Wave Outlook

Read MoreCleveland-Cliffs (NYSE: CLF) formerly known as Cliffs Natural Resources is a mining and natural resources company with a focus on iron ore. Let’s jump directly to the daily chart presented below showing the cycle from 01/12/2016 low which was a significant bottom for the stock. Up from there, CLF rallied in 7 swings structure forming a double three structure that ended […]