The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

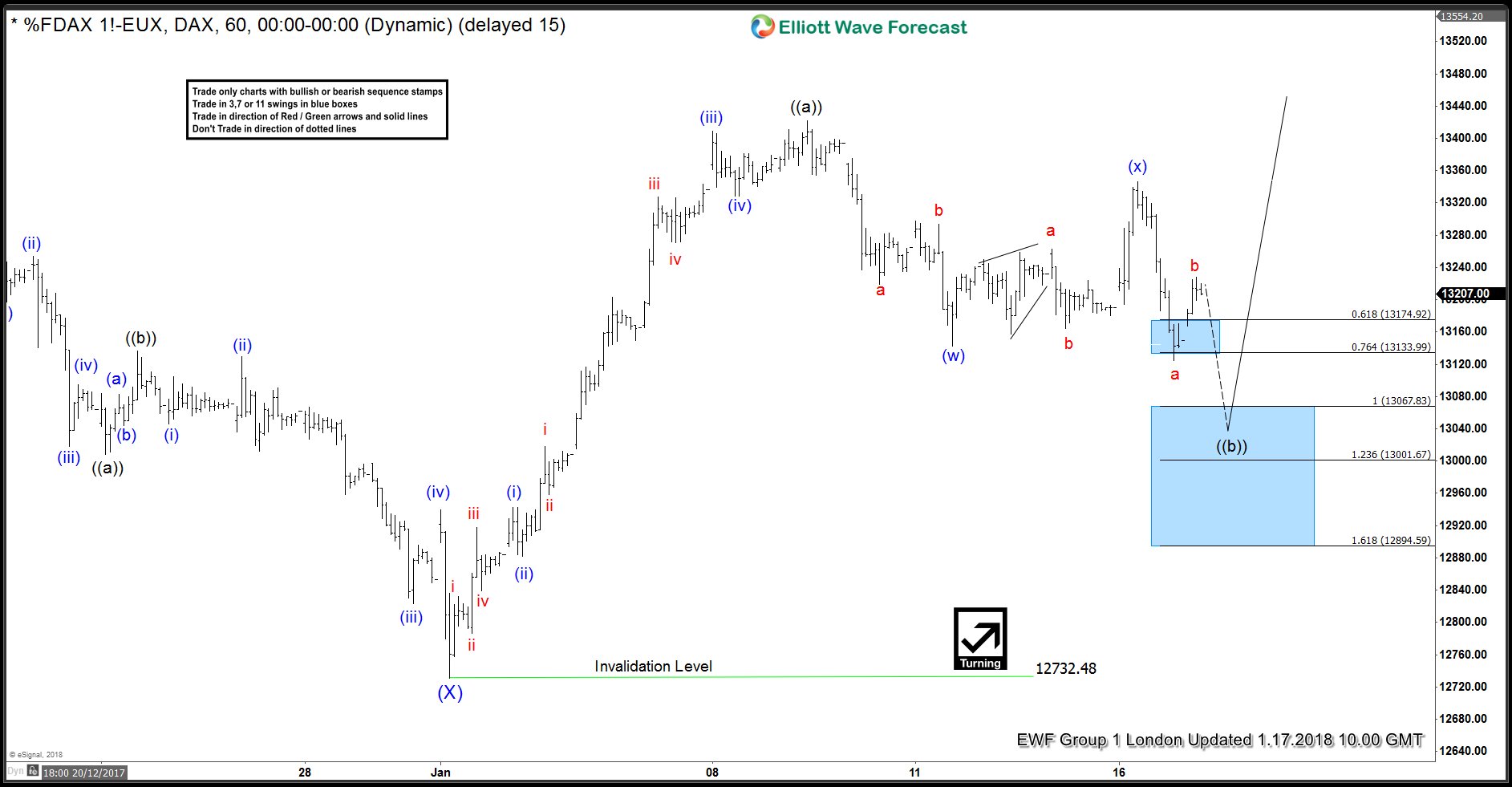

DAX Elliott Wave View: Doing Double Correction

Read MoreDAX Short Term Elliott Wave view suggests that Intermediate wave (X) ended at 12732.48 on 1/02 low. A rally from there is unfolding as a 5 waves impulsive Elliott Wave structure where Minutte wave (i) ended at 12943. Minutte wave (ii) ended at 12881.5, Minutte wave (iii) ended at 13408.5. Minutte wave (iv) ended at 13328.5, and Minutte wave (v) of […]

-

OIL (CL #F) Showing Impulsive Sequence

Read MoreOIL (CL #F) Short-term Elliott Wave view suggests that the rally from 55.82 December 07 low is unfolding as an impulse Elliott Wave structure with extension in 3rd swing higher, where each leg has internal oscillations of 5 waves thus favoring it to be an impulse. These 5 waves move higher should end the Intermediate wave (A) higher in an Impulse sequence. Afterwards, the […]

-

Elliott Wave Analysis: SPX Extending Higher

Read MoreSPX Short Term Elliott Wave view suggests that rally from 12/2/2017 low is unfolding as 5 waves impulsive Elliott Wave structure where Minute wave ((i)) ended at 2694.97, Minute wave ((ii)) ended at 2673.61, Minute wave ((iii)) ended at 2759.14, and Minute wave ((iv)) ended at 2736.06. Internal of Minute wave ((v)) is unfolding also as 5 waves […]

-

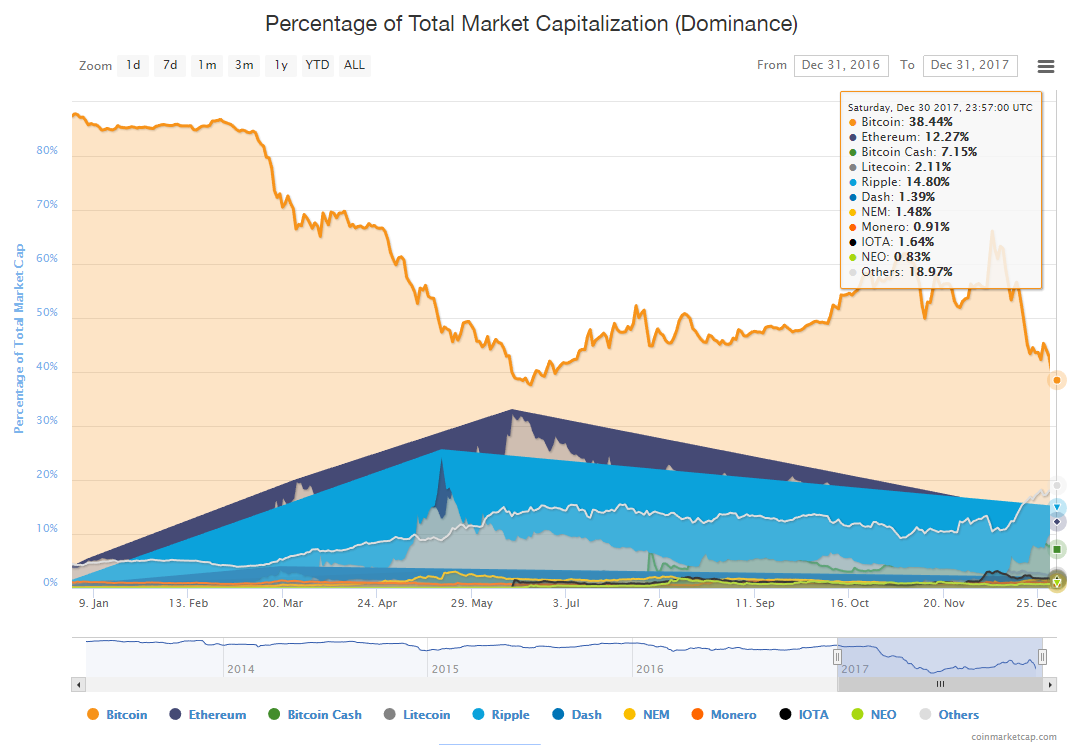

The Rise of Cryptocurrencies

Read More2017 was the mania year of cryptocurrencies without a doubt, ICOs (Initial coin offering) exploded in 2017 raising more then $3.5 billion in cryptocurrency and currently there are more then 1,400 new coin in the market compared to six years ago as bitcoin was the only cryptocurrency people talked about. The cryptocurrency market continued its growth in 2017 […]