The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

NZDJPY Elliott Wave View: Down 400 Pips, Is The Decline Over?

Read MoreNZDJPY decline from 7.27.2017 (83.91) is so far in 5 swings which is an incomplete bearish sequence. In Elliott wave terms, decline is taking the form of a double three (WXY) structure where wave (A) of ((W)) ended at 78.09, wave (B) of ((W)) ended at 82.75 and wave ((W)) completed at 76.09. Rally to […]

-

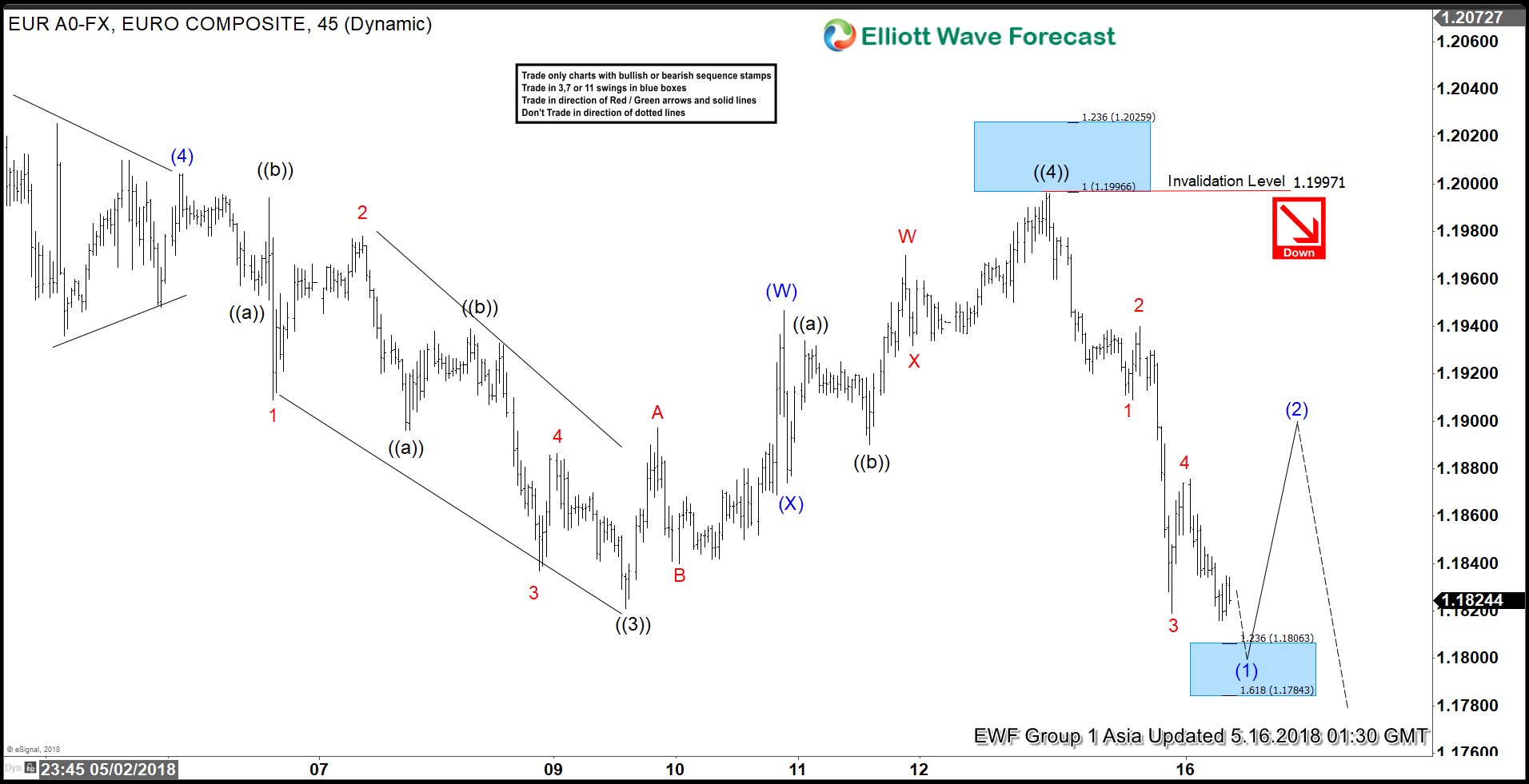

EURUSD Elliott Wave Analysis: Strength Can Be Temporary

Read MoreEURUSD Short Term Elliott Wave view suggests that the decline to 1.1821 on 5/09/2018 low ended Primary wave ((3)). The move lower came from 4/17/2018 peak as a 5 waves impulse structure. Above from 1.1821, pair ended the correction of cycle from 4/17/2018 high in Primary wave ((4)) at 1.1997. The internals of that rally […]

-

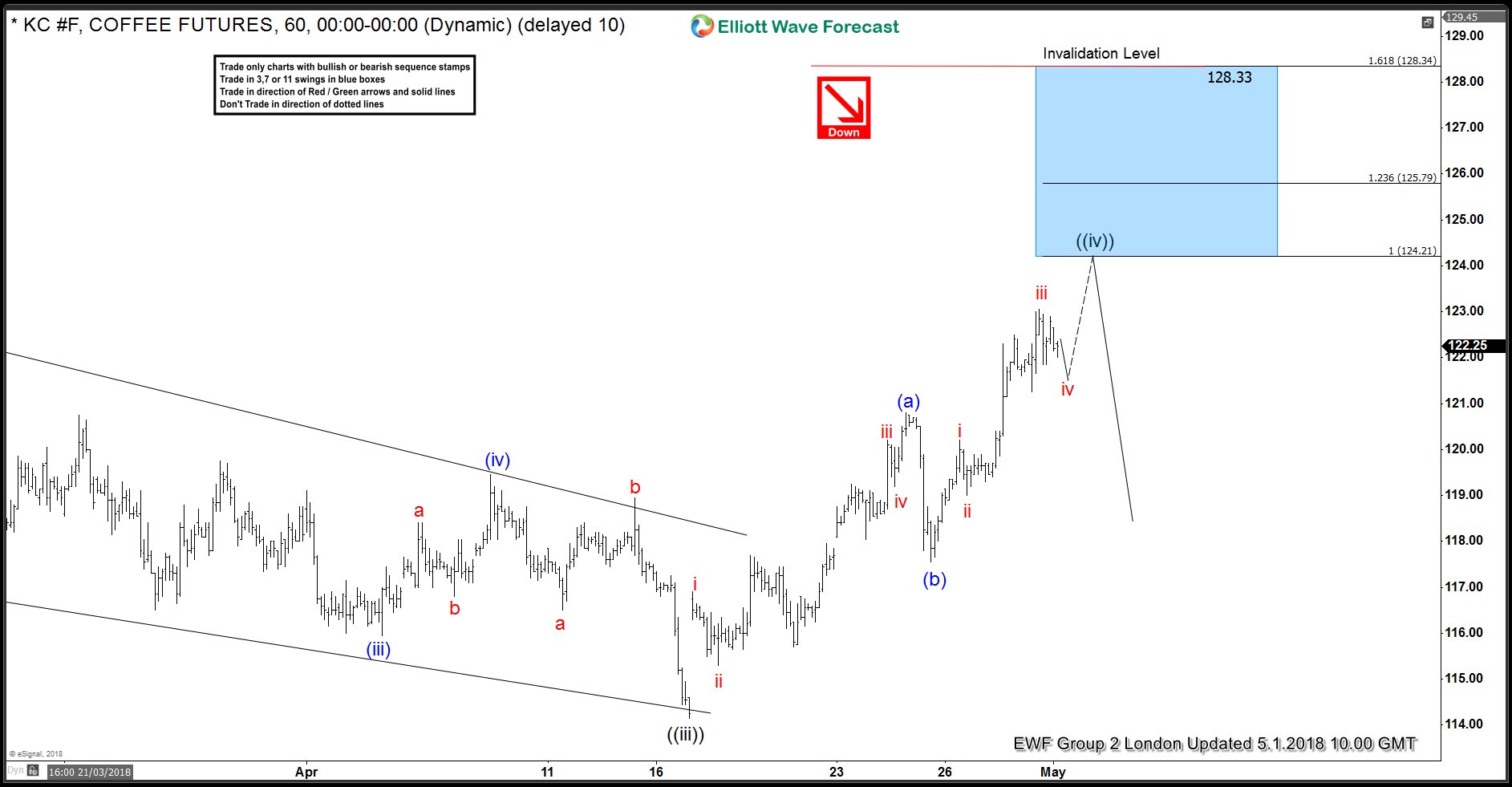

COFFEE Futures (KC#F) Selling The Bounce

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of COFFEE Futures (KC#F) . In further text we’re going to explain the Elliott Wave structure, forecast and trading strategy. As our members know, KC#F has had incomplete bearish sequences in H4 cycle according to Sequence Report. Consequently […]

-

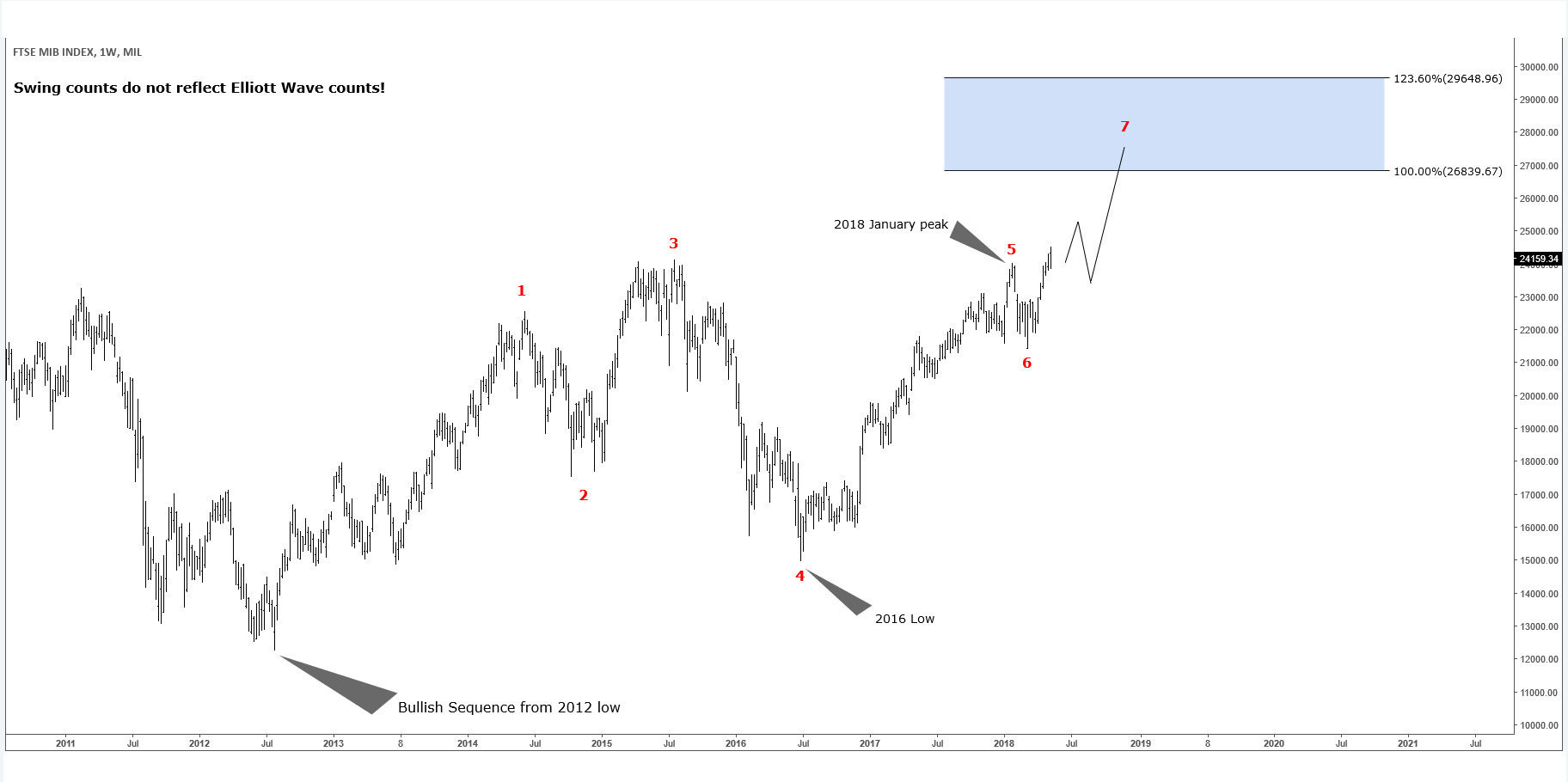

FTSE MIB Index – Bullish Extension Higher Started

Read MoreIn this blog, we will have a look at a European index called FTSE MIB. It is the stock market index for the Borsa Italiana. Which is traded in Italy. It has a market capitalization of around 4 Trillion €. The index consists of the 40 most-traded stocks in Italy. This index has a very interesting swing structure. Having a […]