The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

USDX Elliott Wave View: Ending Diagonal In Progress

Read MoreUSDX short-term Elliott Wave view suggests that the rally from 5/14 low 92.24 is extending higher as Elliott Wave Ending diagonal structure within Intermediate wave (5). Keep in mind that Ending Diagonal usually appears in sub-division of wave (5) of impulse or wave C of Zigzag or Flat. In Ending Diagonal, the internal distribution of […]

-

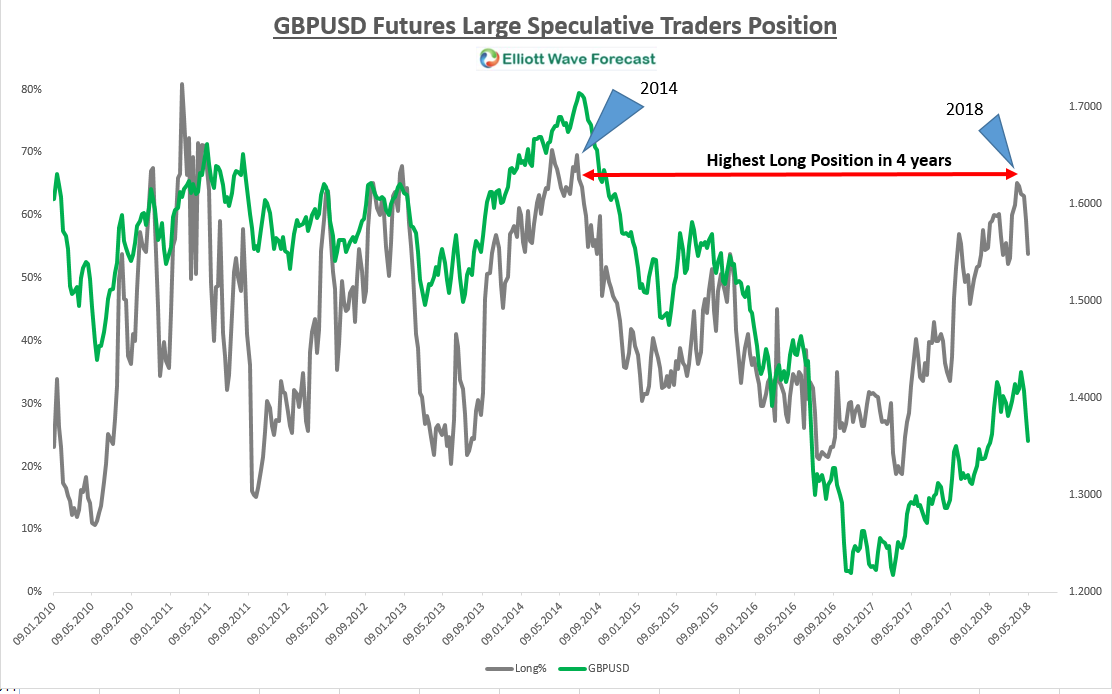

Sentiment Extreme Drags GBPUSD Lower

Read MoreIn this blog, I want to discuss the retreat in the COT Sentiment Net long position in the GBPUSD and what effects it can take. First off let me start explaining what the COT report is all about. The Commitments of Traders Report, short COT is a weekly market report which is issued by the Commodity Futures […]

-

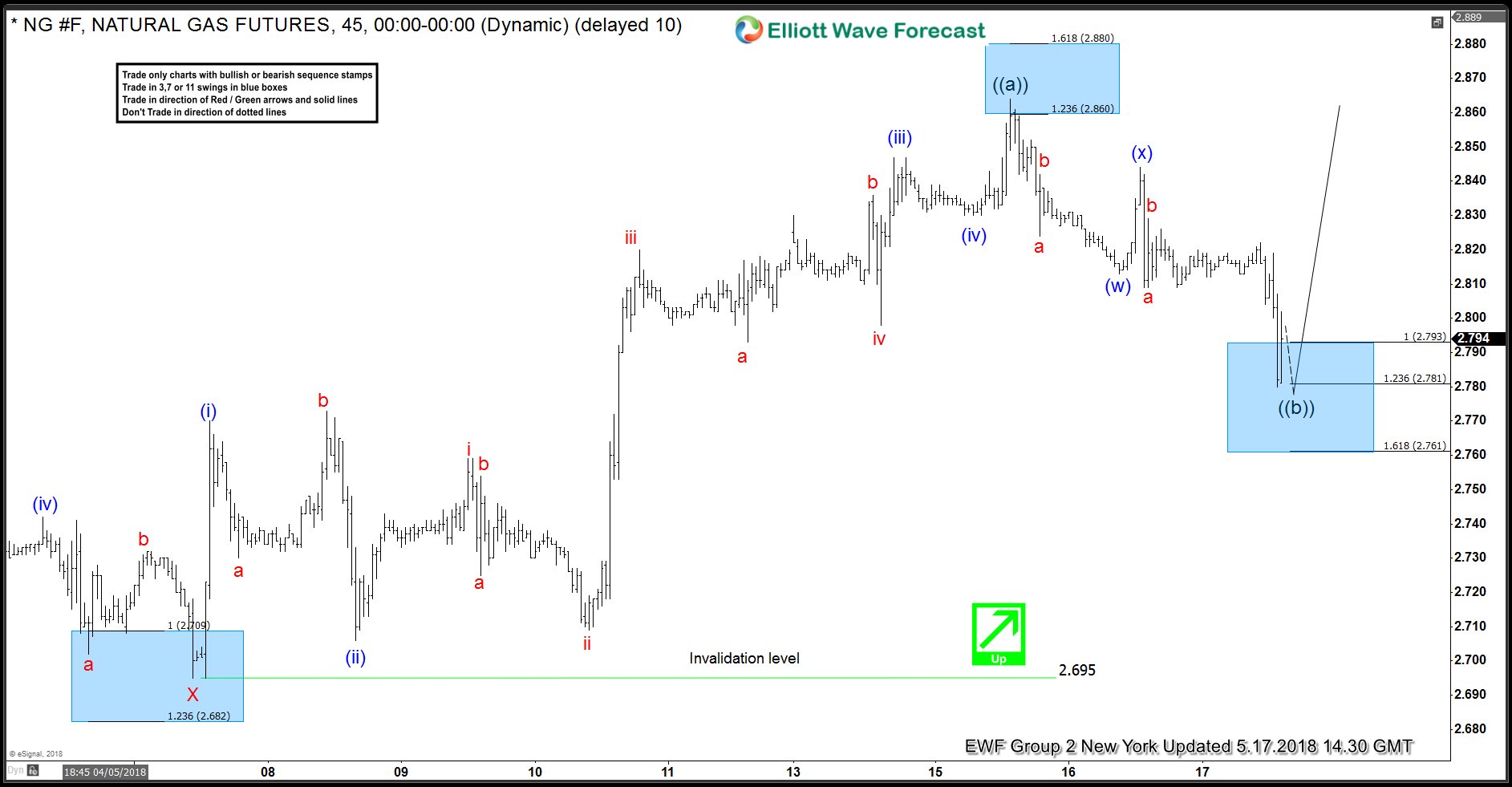

Natural Gas ( NG #F) Buying The Dips

Read MoreHello fellow traders. Another trading opportunity we have had lately is Natural Gas (NG #F). In this technical blog we’re going to take a quick look at the past Elliott Wave charts of NG #F published in members area of the website. In further text we’re going to explain the forecast and trading setup. Natural […]

-

The Hang Seng Index Larger Bullish Cycles

Read MoreThe Hang Seng Index Larger Bullish Cycles. Firstly the Hang Seng index larger bullish cycles has been trending higher with other world indices. In April 2003 it put in a huge degree pullback low. From there the index rallied with other world indices again until October 2007. It then corrected the rally as did most […]