The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Soybean Hit 9 Year Low Due to Trade War

Read MoreEarly this week the price of Soybean futures (ZS_F) plunged to a new low in more than 9 years due to the tit-for-tat trade war between U.S. and China. Soybean Futures started to drop on Friday last week after Trump administration decided to go ahead with 25% tariff on $50 billion worth of goods from […]

-

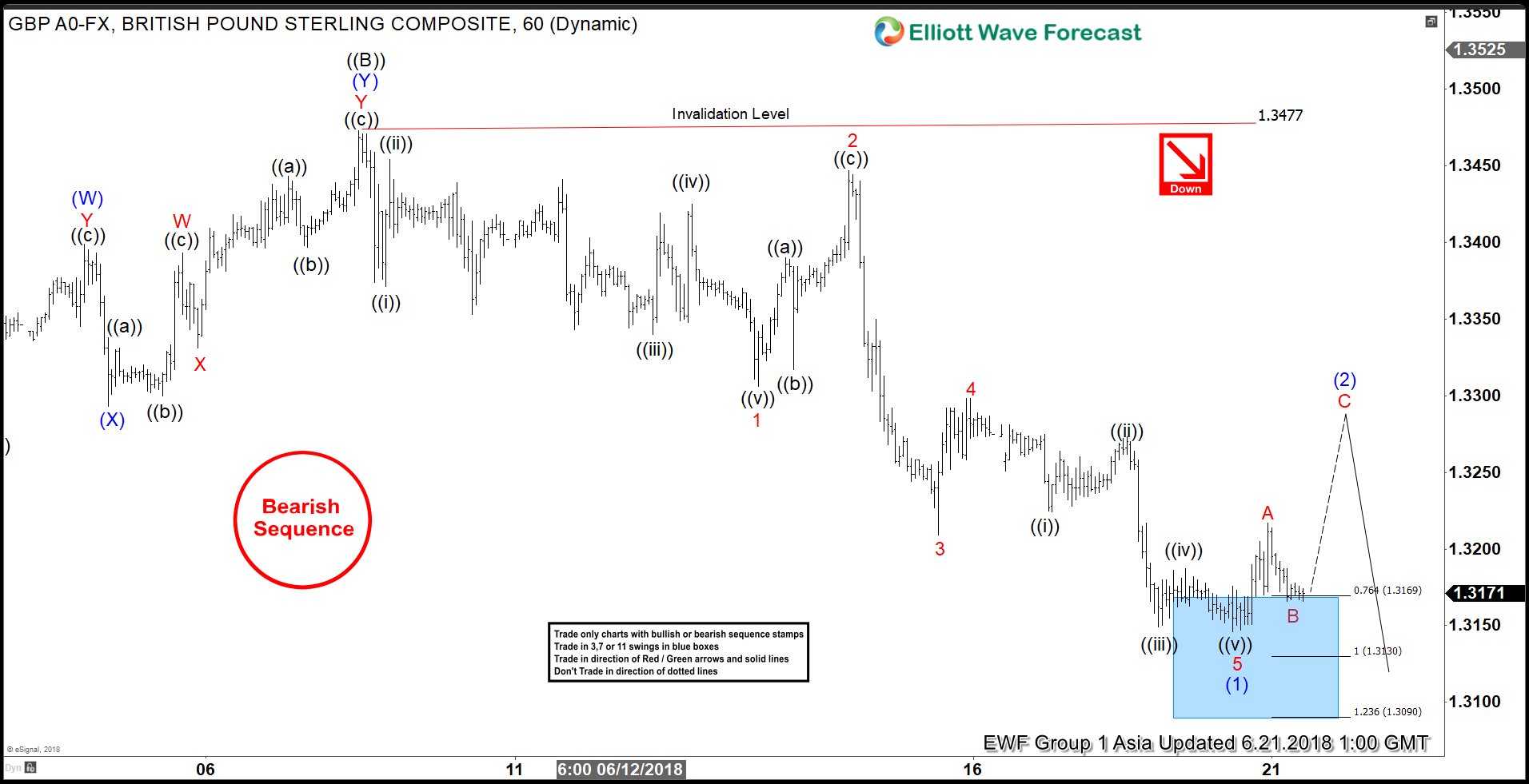

Elliott Wave Analysis: GBPUSD Showing Incomplete Sequence

Read MoreGBPUSD short-term Elliott Wave view suggests that the recovery to 1.3473 on 6/07/2018 peak ended primary wave ((B)) bounce as double three structure. Below from there, the pair has managed to break below the previous low on 5/29 (1.3203) to confirm the next extension lower in primary wave ((C)) has started. With this break lower, […]

-

(PA_F) Palladium Buying Opportunity Ahead?

Read MorePalladium ended a cycle from January 2016 low (452.63) and the pull back should be a Palladium Buying Opportunity. Rally from January 2016 low can be counted as an Elliott Wave Impulse when rally to 776 completed wave ((1)), dip to 652.15 low completed wave ((2)), rally to 1023.95)completed wave ((3)), dip to 973.60 low […]

-

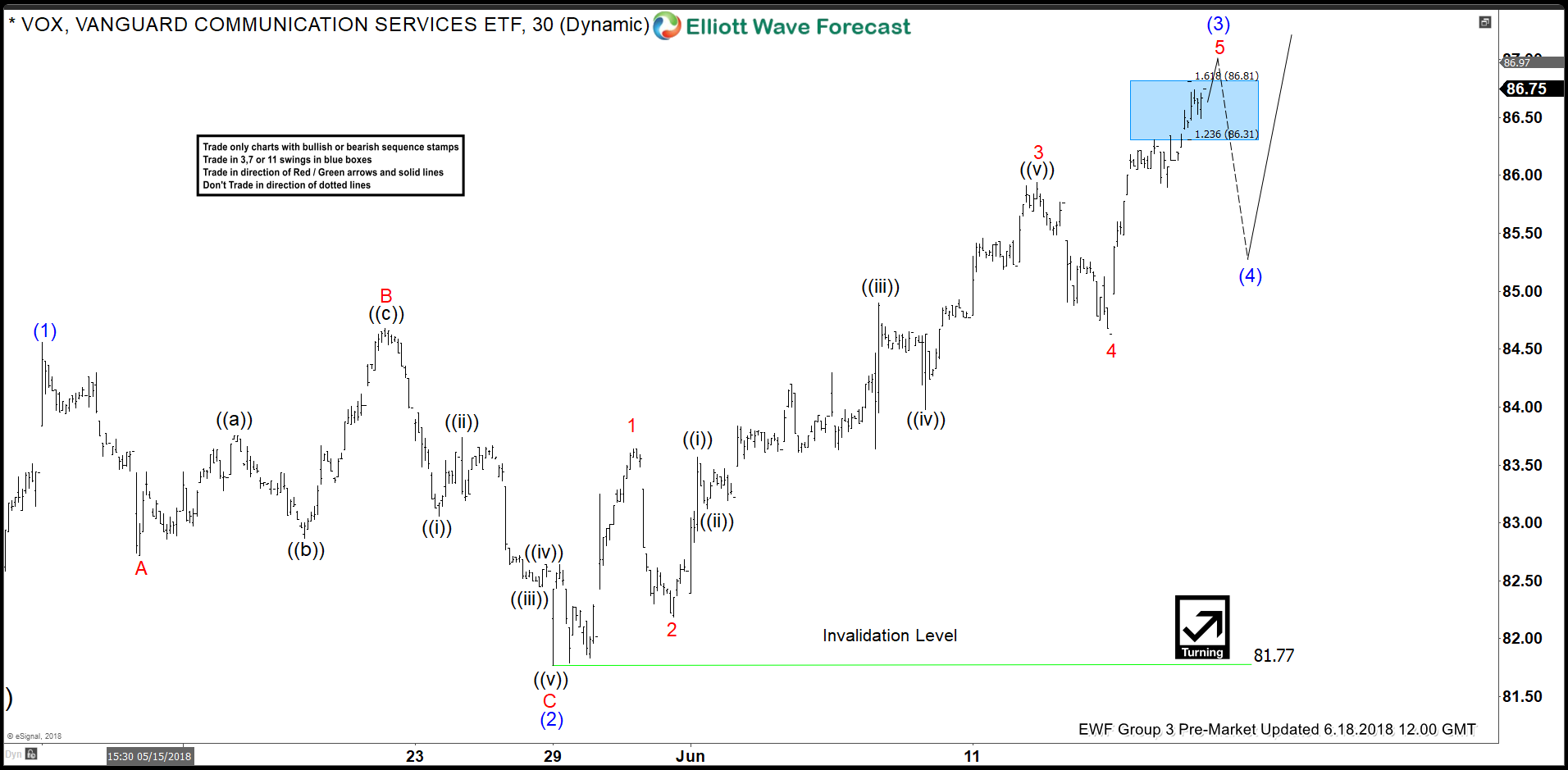

VOX Elliott Wave View: Extending Higher As Impulse

Read MoreVanguard communication services ticker symbol: VOX short-term Elliott Wave view suggests that the rally to 84.50 on 5/11 peak ended intermediate wave (1) as an impulse. Down from there, the pullback to 81.78 on 5/29 low ended intermediate wave (2) pullback as expanded Flat. The internals of a Flat correction ended Minor wave A at […]