The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Yen Surged as Safe Haven On Demand Amidst Trade War Escalation

Read MoreLast week’s tweet by president Trump to slap a new round of tariffs to Chinese goods has sparked risk aversion in the market. Trump announced that he is imposing an additional 10% tariff on $300 billion of Chinese imports beginning on September 1. Trump said the additional tariff is due to China being slow to […]

-

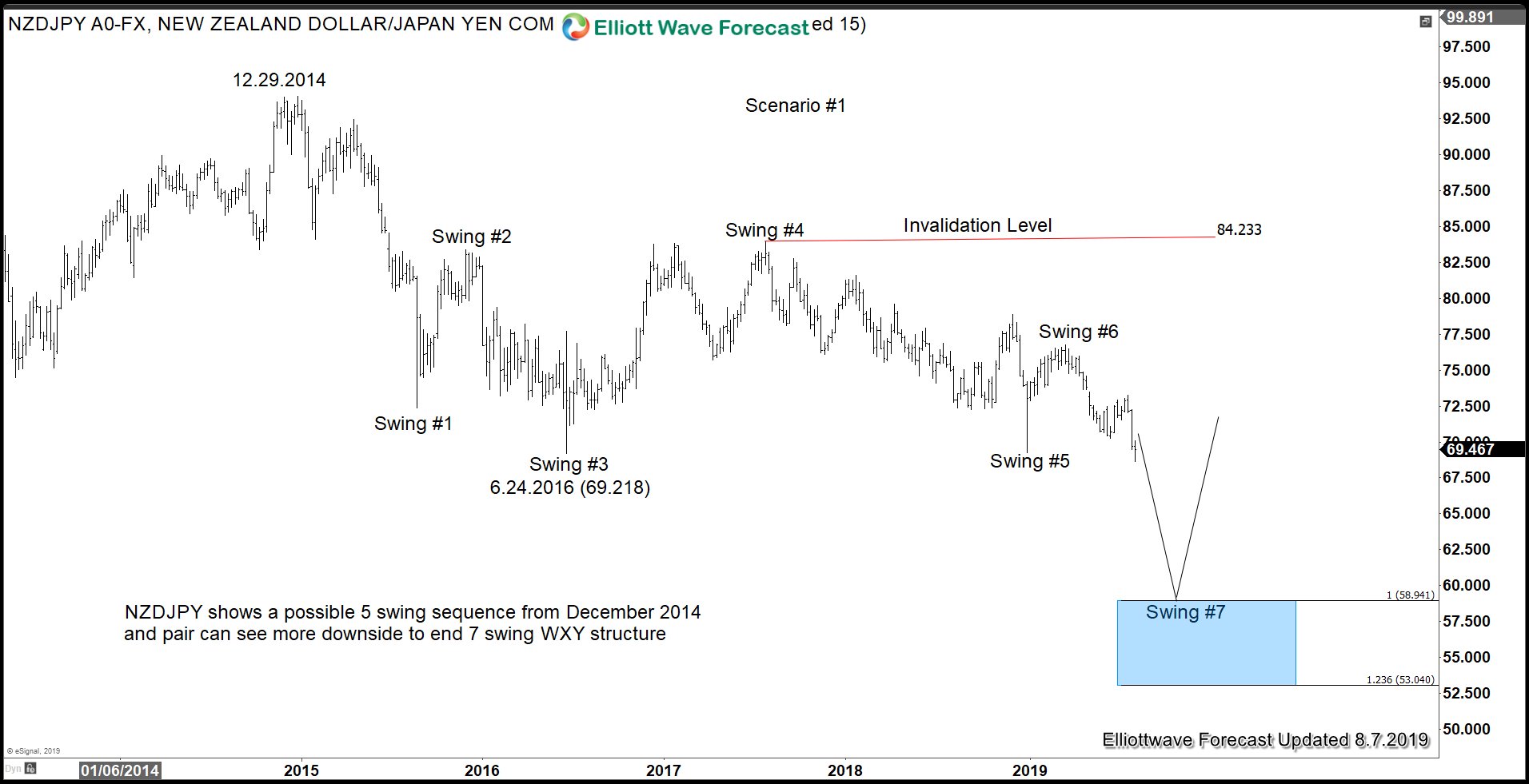

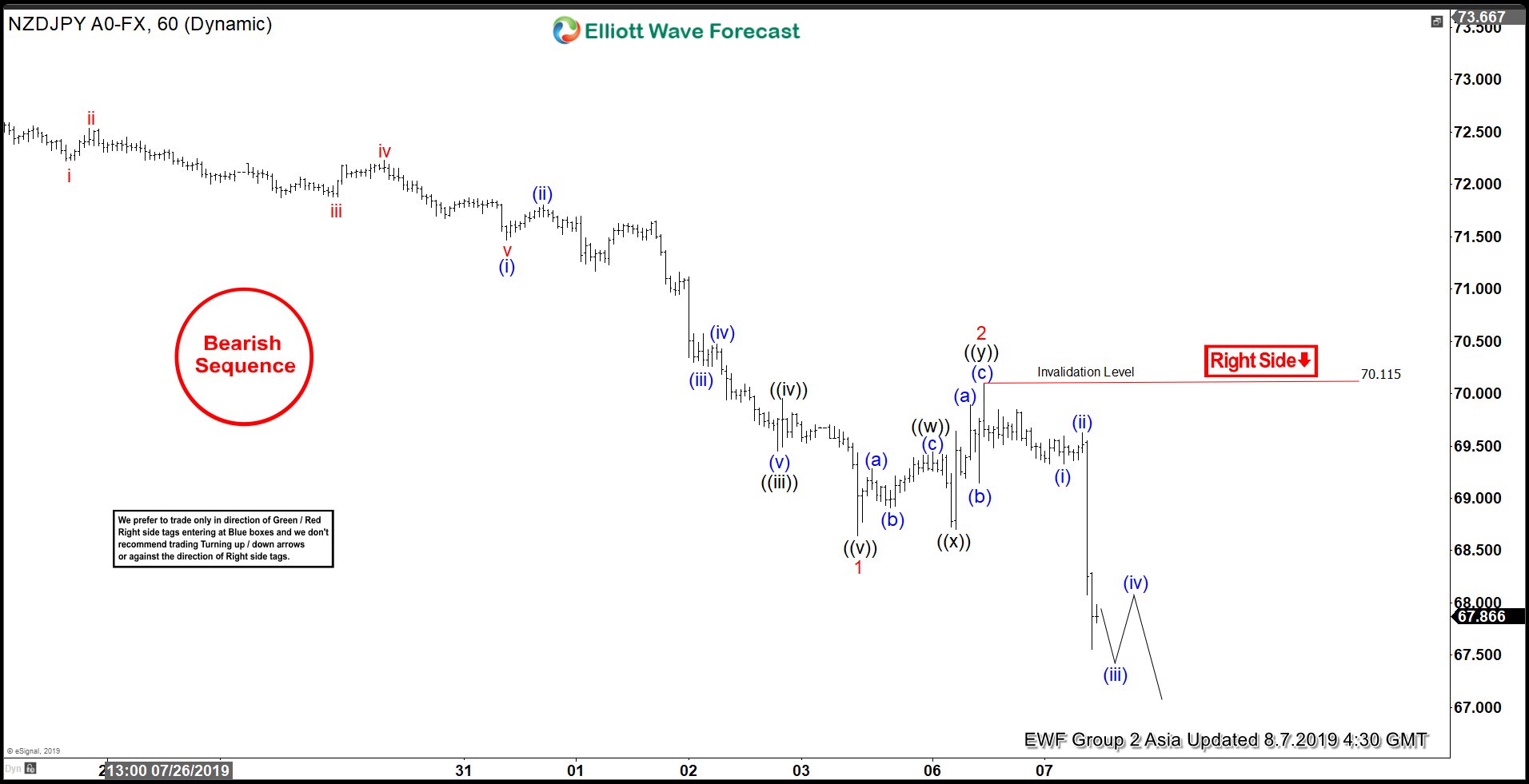

Elliott Wave View: NZDJPY Plunges after RBNZ 50 bp Rate Cut

Read MoreNZDJPY extends lower after the 50 bp rate cut by RBNZ. Elliott wave view suggests the pair shows incomplete bearish sequence favoring more downside.

-

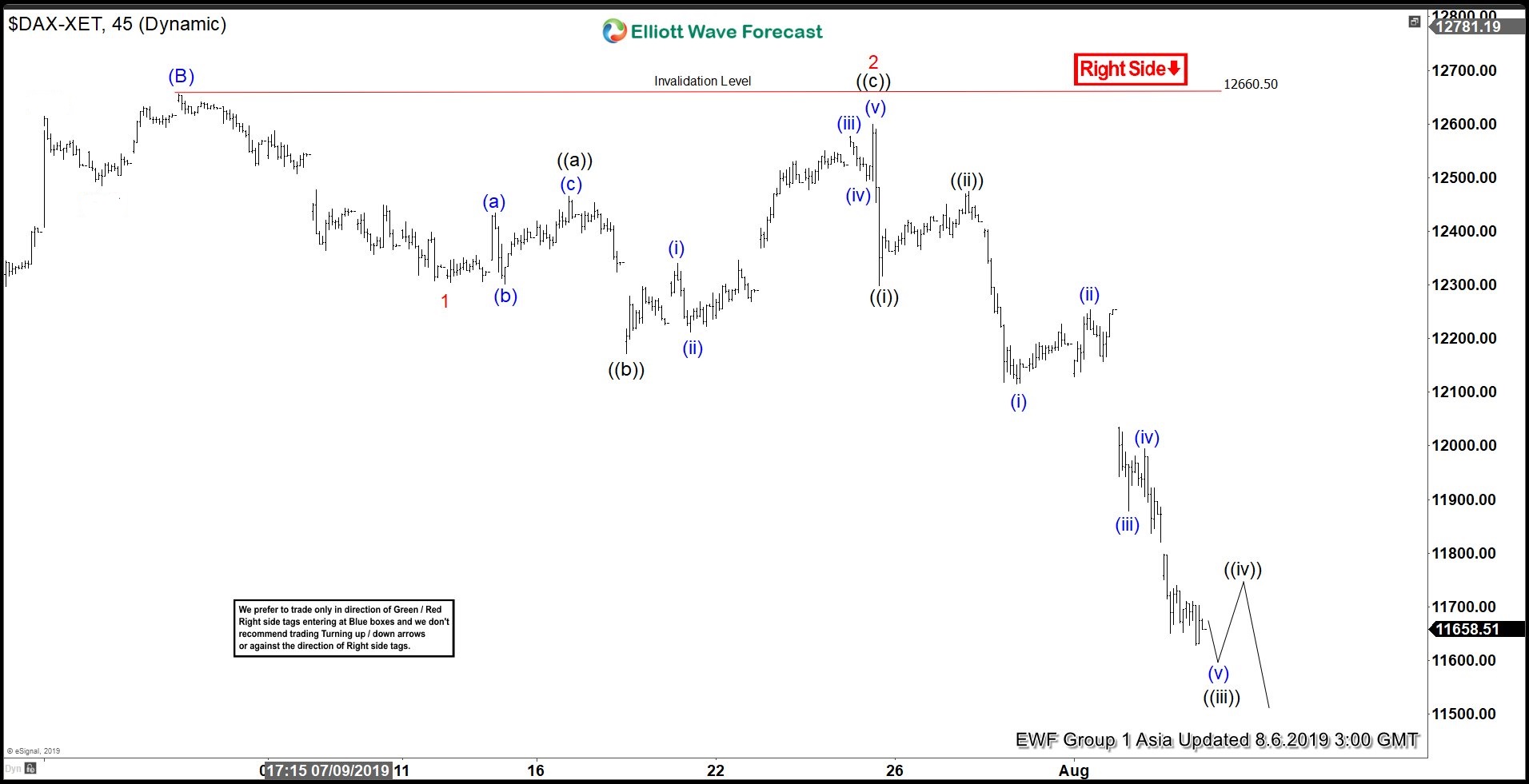

Elliottwave View: Decline in DAX a correction or a new bearish market?

Read MoreDecline in DAX from July 4 high (12660.5) is impulsive. Index should see further downside in the near term. This article talks about Elliott Wave path.

-

Elliott Wave View: Gold Resumes Wave 5 Rally

Read MoreGold has resumed higher in wave 5. The rally from Aug 1 is impulsive and while dips stay above there, the metal can extend higher.