The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

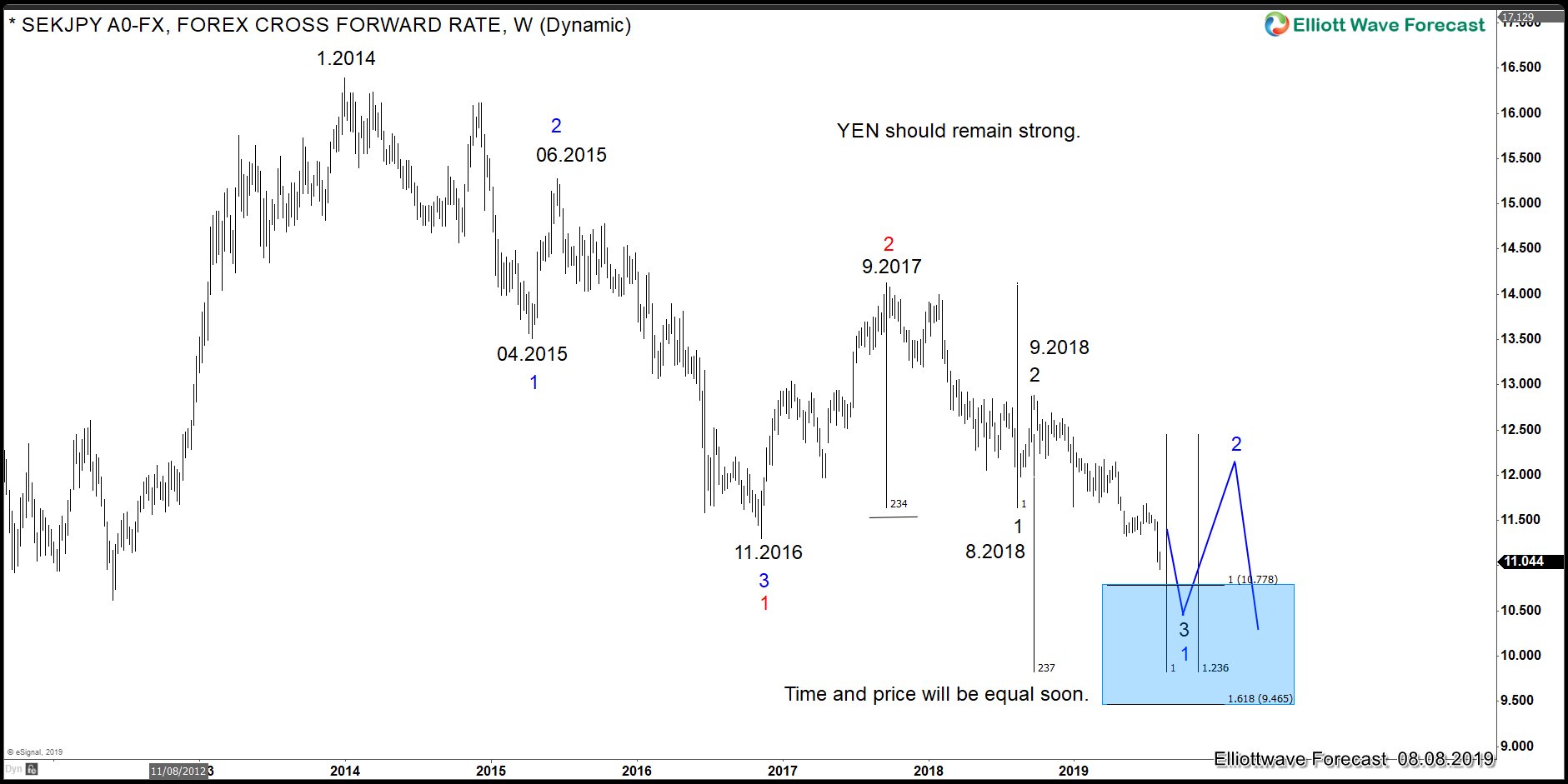

SEKJPY Elliott Wave View: Pair Is Showing The Map For The YEN Group

Read MoreHello fellow traders. The YEN group has been selling lately across the board and the path has become more clear with the SEKJPY breaking its 2016 lows. We at Elliott Wave Forecast trade the Market different than most other market participants. We track over 100 instruments across the world. That allows us to locate the […]

-

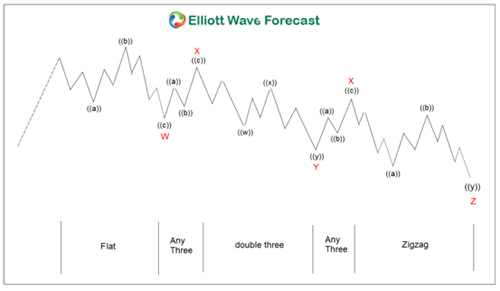

Mastering Triple Three Corrections in Elliott Wave Theory

Read MoreFirstly, triple three corrections are a sideways combination of three corrective patterns in Elliott Wave Theory. These corrections are one of the five types of corrective patterns that correct the completed cycle of the prevailing trend. Zigzags (5-3-5), Flats (3-3-5), Triangles (3-3-3-3-3), Double threes which are a combination of two corrective patterns previously mentioned. Then lastly […]

-

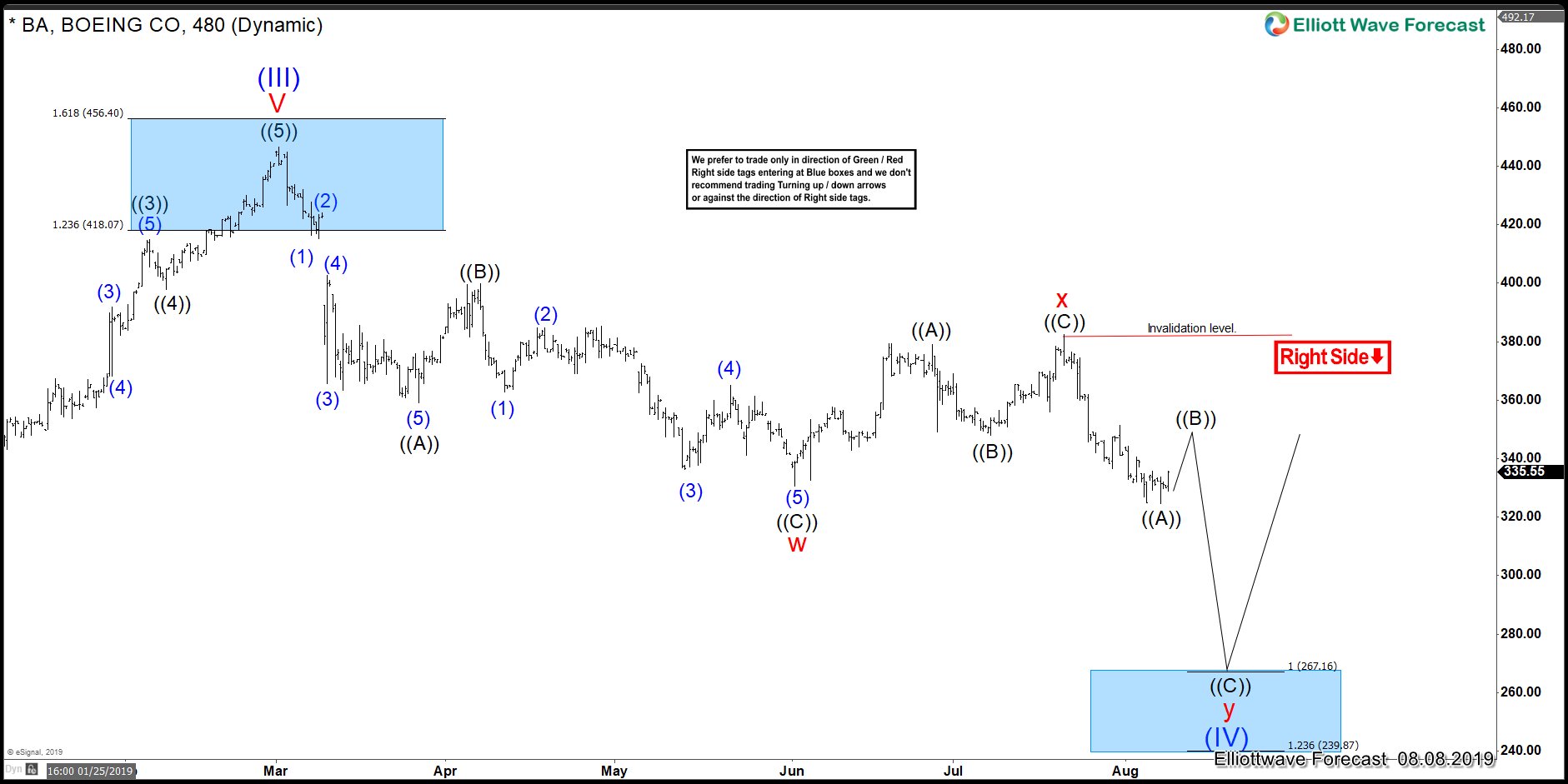

Boeing Elliott Wave Analysis: Stock Will Dictate Path For World Indices

Read MoreHello Traders. In this previous Boeing blog, we discussed the path for the Boeing stock. Now, let have a look at the latest 4 Hour chart. We can see that soon the stock will be reaching the $267.00 area. That area in the following chart is the 100% extension from 3.1.2019 peak. The Instrument has […]

-

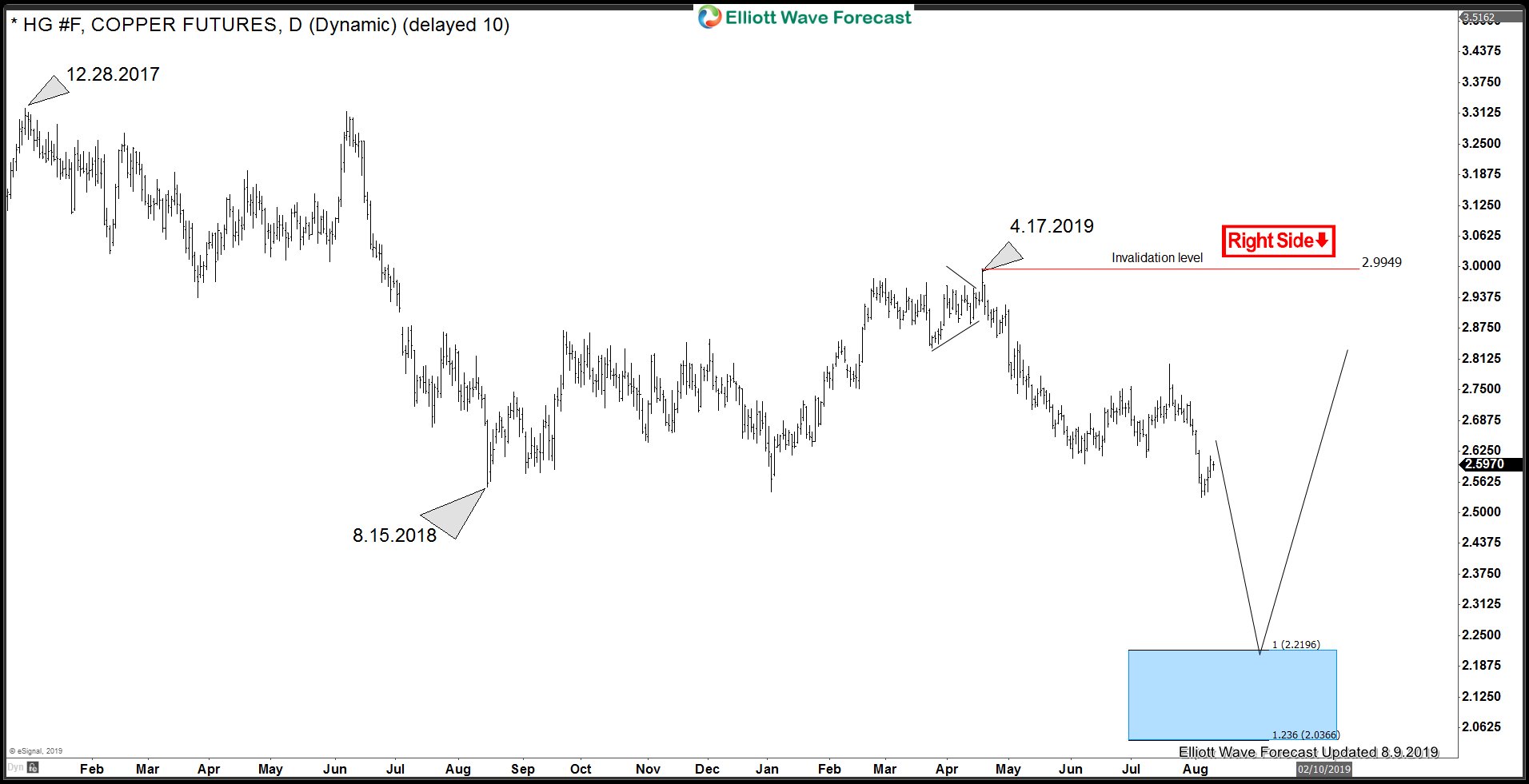

HG_F (Copper) Incomplete Elliott Wave Sequence and Next Opportunity

Read MoreIn this blog, we will take a look at how HG_F (Copper) rally from June low failed in a blue box and resulted in new lows. We will also look at the sequence from December 2017 peak and talk about the next Trading opportunity and targets for the sequence from December 2017 peak. HG_F (Copper) […]