The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

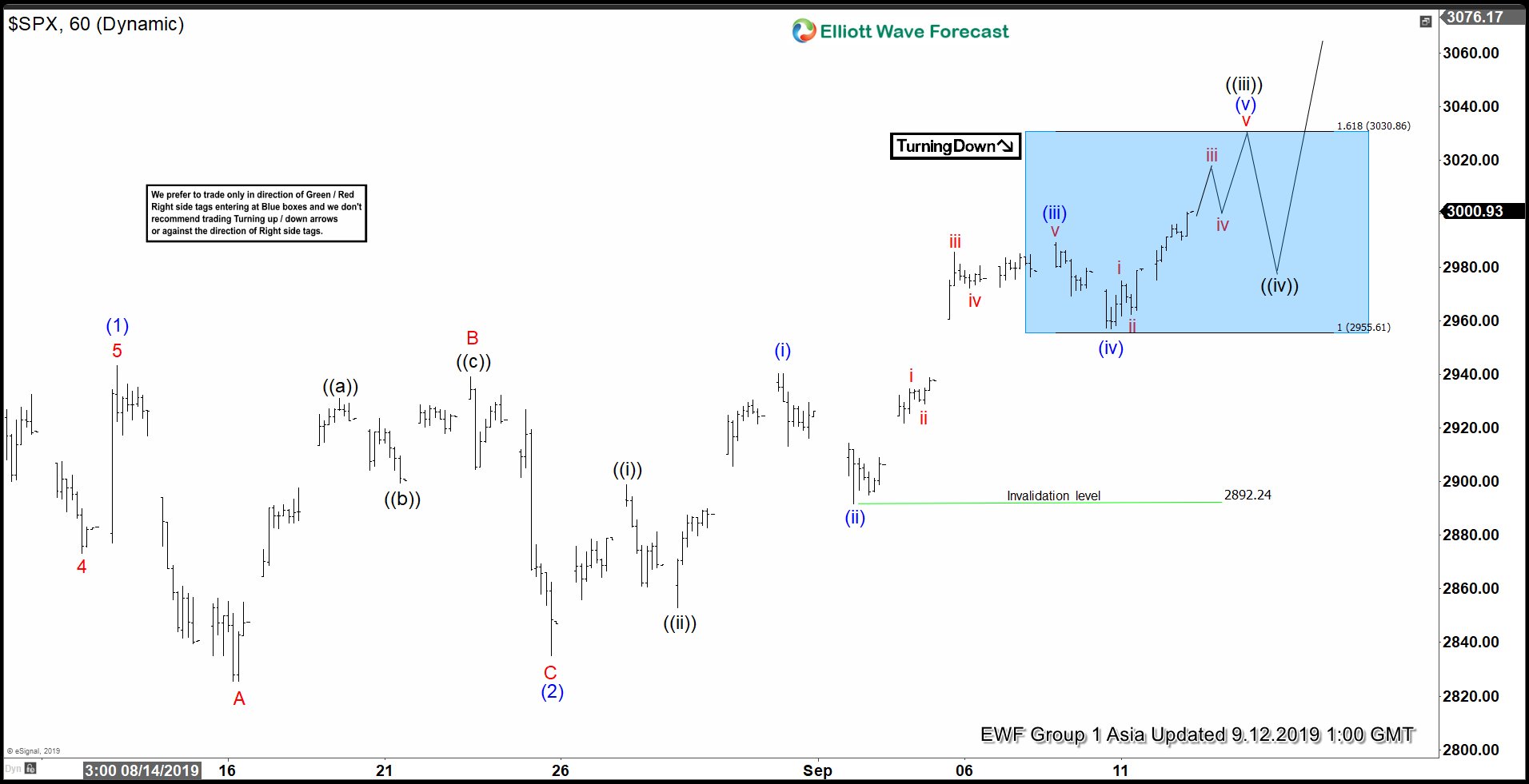

Elliott Wave View: S&P 500 (SPX) New All-Time High Imminent

Read MoreShort term Elliott Wave view suggests the rally in S&P 500 (SPX) from August 6, 2019 low is unfolding as an impulse Elliott Wave structure. In the chart below, we can see wave (1) ended at 2943.31 and wave (2) pullback ended at 2834.97. Internal subdivision of wave (2) unfolded as a running Flat. Wave A […]

-

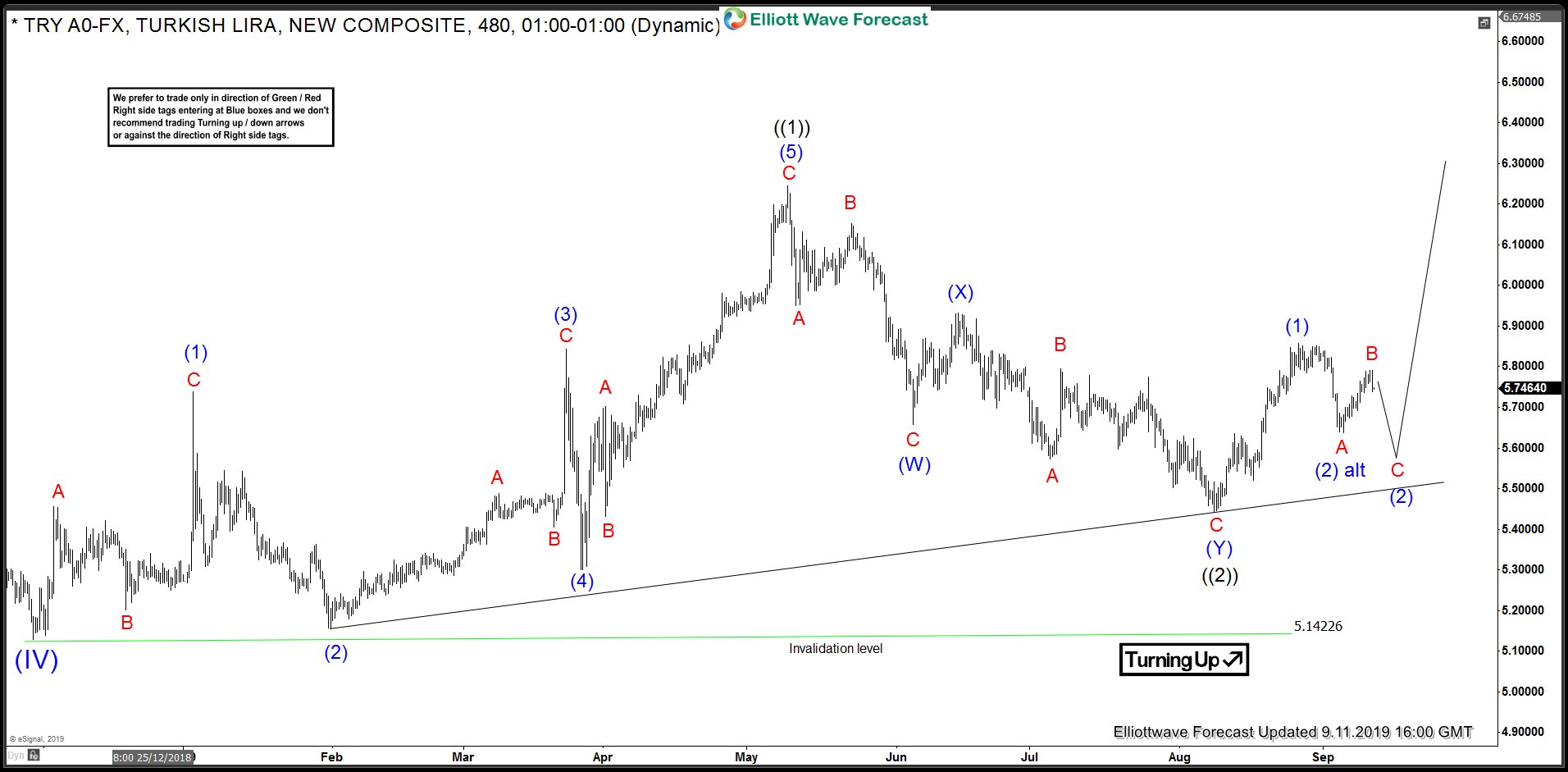

USDTRY Elliott Wave View: Double Three Structure Ended from May

Read MoreWe looked at USDTRY back in June and told the readers that preferred Elliott wave view suggested that cycle from 11/29/2018 low (5.129) ended at 5/9/2019 (6.199) as 11 swings diagonal structure that we labelled as wave (( 1)) and we expected a wave (( 2 )) pull back to unfold as a double three Elliott […]

-

Netflix Selling Elliott Wave Blue Box At The Extreme Areas

Read MoreIn this blog, we take a look at the 1 hour Elliott Wave charts performance of Netflix, which our members took advantage at the blue box extreme areas.

-

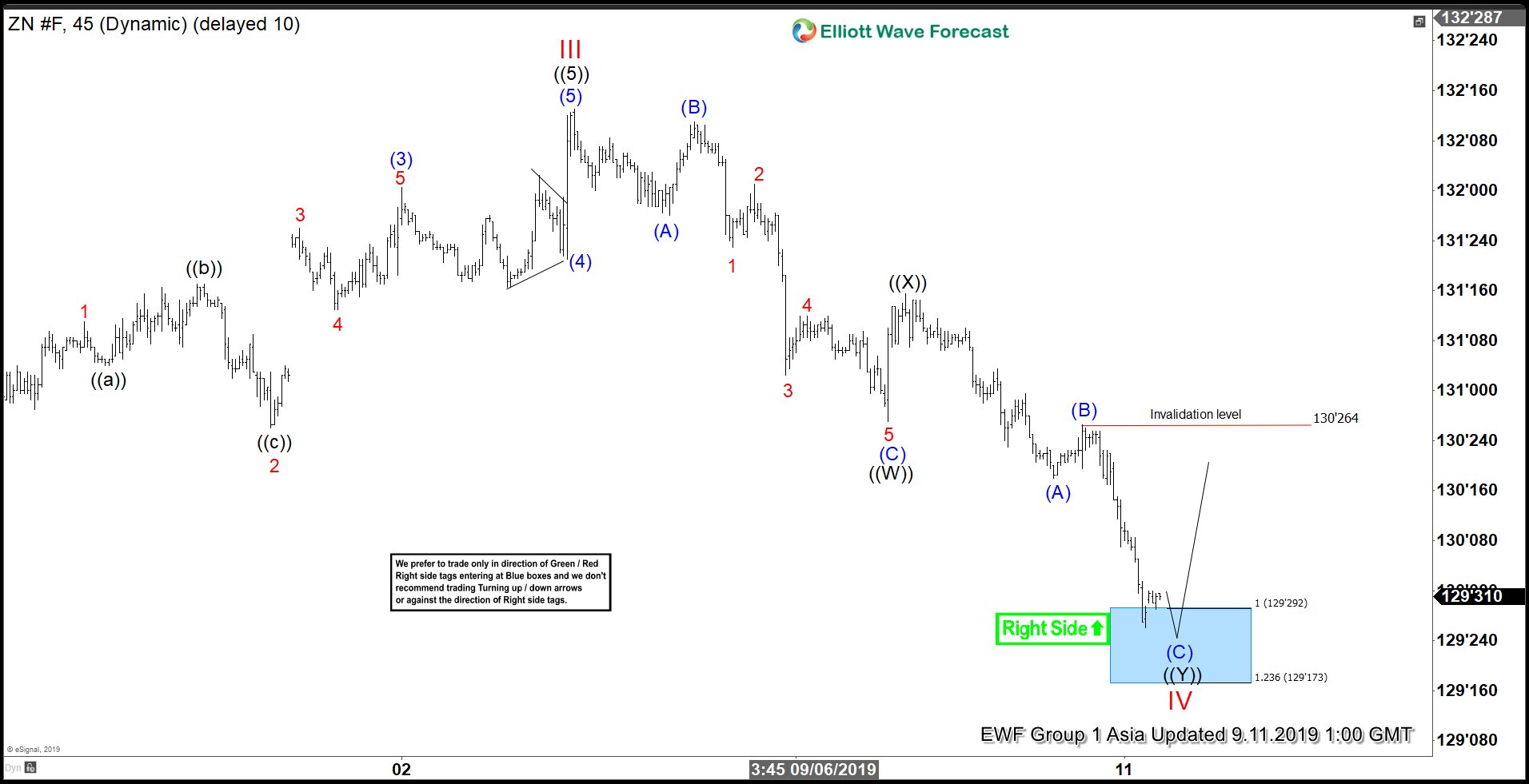

Elliott Wave View: 10 Year Treasury Notes (ZN_F) at Support Area

Read More10 Year Treasury Note (ZN_F) has reached support area in 7 swing where it can find buyers and bounce in 3 waves at least soon.