The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Palladium Bouncing From Elliott Wave Blue Box Area

Read MoreIn this blog, we take a look at the 1 hour Elliott Wave charts performance of Palladium, which our members took advantage at the blue box extreme areas.

-

Elliott Wave View: SPY Can See Further Strength in Short Term

Read MoreSPY broke above July 27 peak and showing incomplete short term sequence from June 3 low. This video talks about the short term Elliott Wave path.

-

USDSGD Buying Elliott Wave Blue Boxes At Extreme Areas

Read MoreIn this blog, we take a look at the 1 hour Elliott Wave charts performance of USDSGD, which our members took advantage at the blue box extreme areas.

-

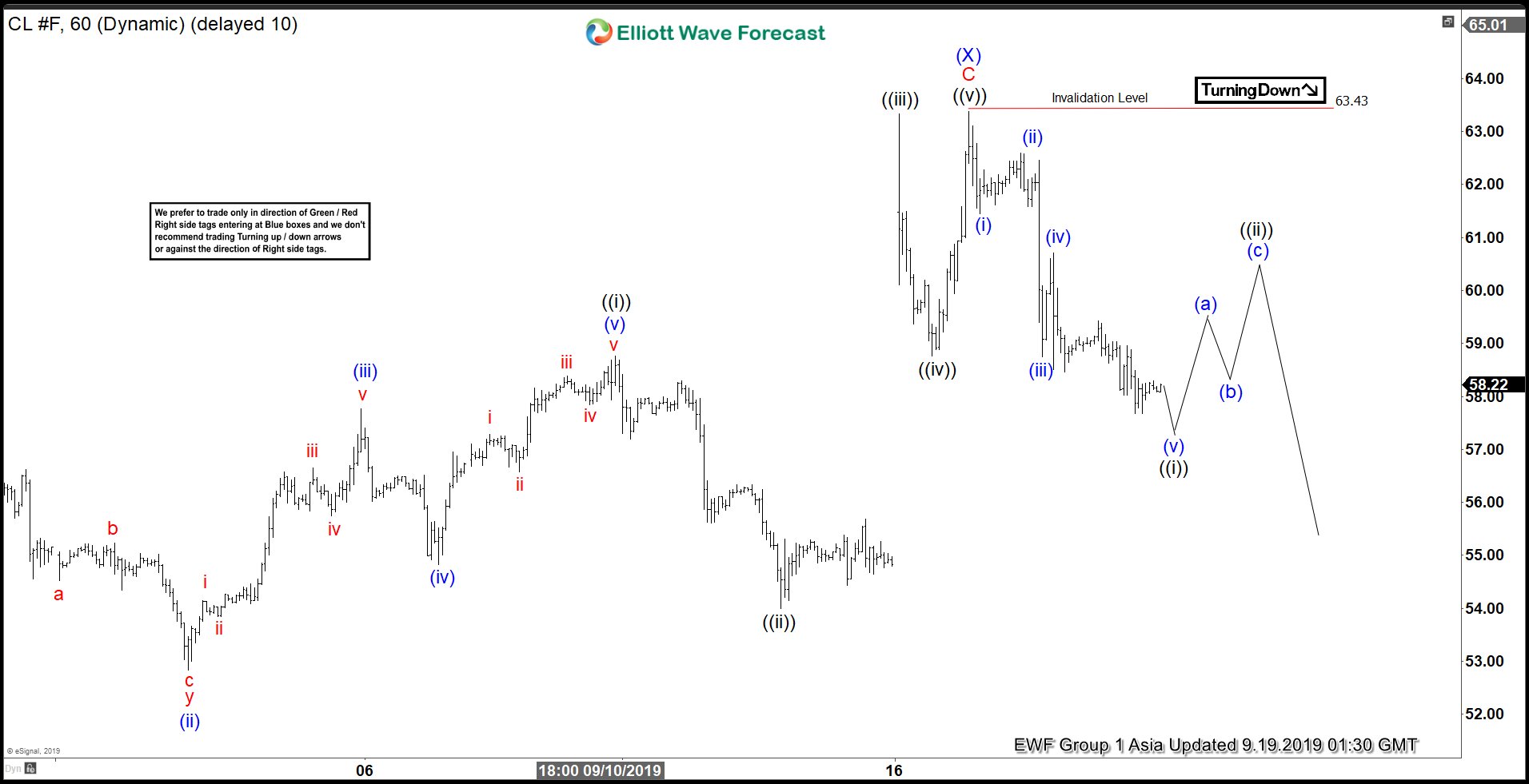

Elliott Wave View: Oil (CL_F) Outlook After Saudi Arabia’s Oil Refinery Attack

Read MoreAfter the 18% gap on the news of Saudi Arabia’s oil refinery attack, Oil has retraced. This video looks at the Elliott Wave path.